Yield-Bearing Stablecoin Landscape Report

This article is part of the Redstone “Yield Bearing Assets & Stablecoins Report 2025”, where Stablewatch is a co-author.

The architecture of the digital asset economy is on the cusp of a fundamental transformation, catalyzed by the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. A landmark piece of legislation, the Act creates a deliberate divide of the stablecoin market into two distinct classes: federally regulated, non-yielding “Payment Stablecoins” for pure utility, and a separate, innovative class of “Yield-Bearing Stablecoins” (YBS), defined as investment assets. Our central thesis is that this separation, while creating regulatory clarity for payment rails, simultaneously introduces a new and complex investment landscape that the market is currently ill-equipped to navigate.

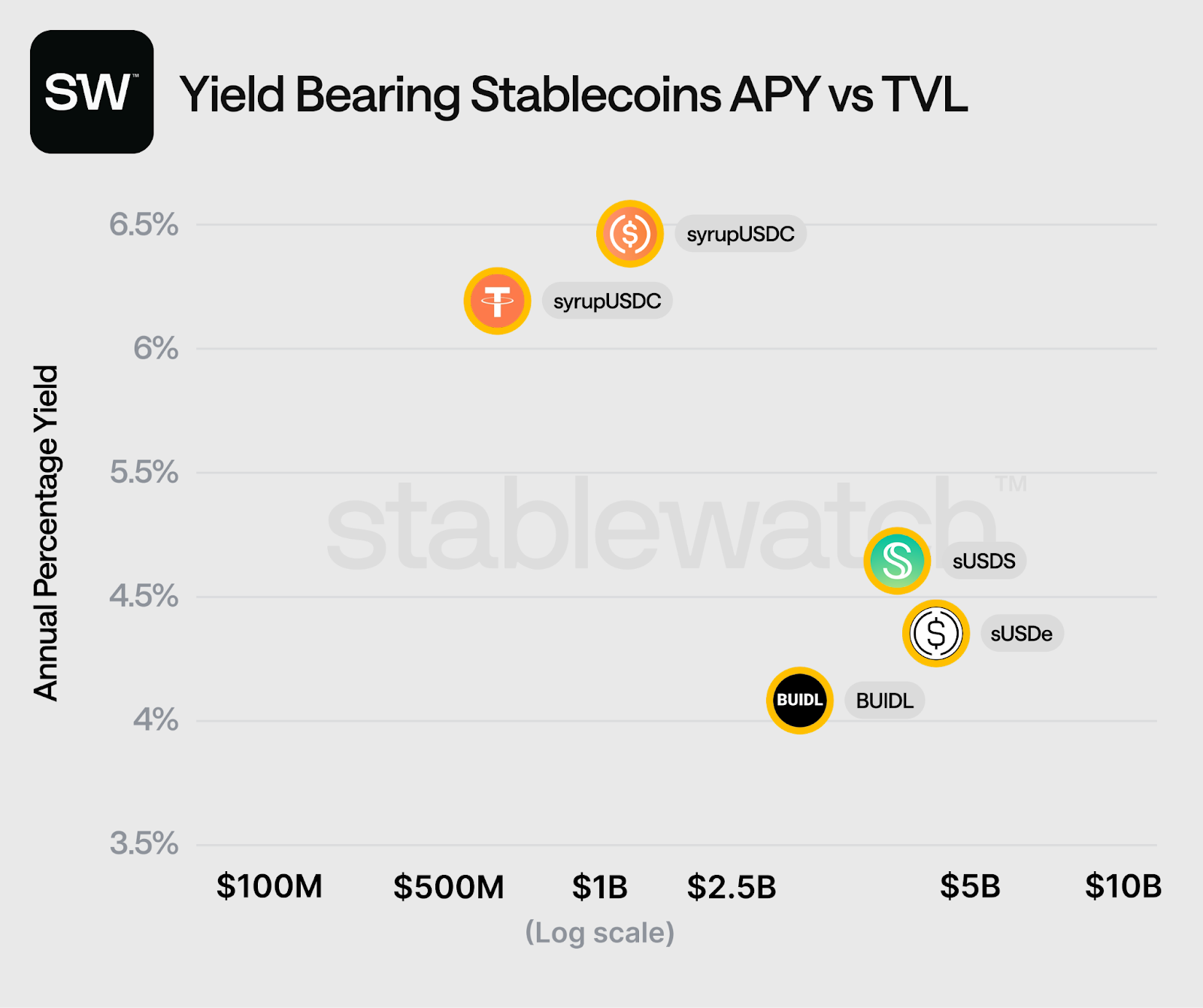

The core problem we want to address here is the dangerously broad nature of the “YBS” label. A monolithic term masking a vast and non-uniform spectrum of risk. A tokenized U.S. Treasury bill and a delta-neutral synthetic dollar may both be called Yield-Bearing Stablecoins, yet they share virtually no overlap in their underlying mechanisms, collateral, or risk profiles. For investors, protocols, and risk managers, comparing them based on headline APY alone is a critical error, akin to evaluating a corporate bond and a quantitative arbitrage strategy on the same scale. Everyday we can see more and more reasons for a more sophisticated framework to deconstruct and differentiate these assets.

To solve this, Stablewatch has created a qualitative framework for categorizing and analyzing the YBS landscape. Deconstructing the ecosystem, this report defines the core models and discusses the primary opportunities and risk vectors for each category, providing an essential foundation for sophisticated, risk-aware investment. We move beyond surface-level metrics to examine the fundamental differentiator: the source and nature of the yield itself.

The following analysis systematically maps the YBS world into three primary families. First, RWA-Backed YBS, are “pass-through” models that import yield from offchain traditional finance assets like T-bills. Second, Onchain Native YBS, are DeFi protocols that generate yield from crypto-native economic activity such as lending and derivatives. A final category, Actively Managed YBS, comprises advanced strategy models that derive yield from complex algorithms or direct human management, representing the frontier of financial engineering.

We focus here on these three large buckets, to bring clarity to the users. While we believe this split can be helpful, it's not perfect, as many YBS share characteristics of overlapping categories, and a unique set of risks. On https://app.stablewatch.io/ you can explore finer categorization together with key risk highlights for each YBS. In what follows, we will describe broader characteristics of each of the main categories, highlighting notable examples, opportunities, and risks. Before concluding, we also highlight the evolving stablecoin value capture model, featuring Hyperliquid's USDH.

Main Sectors of YBS

Post-GENIUS Act, the stablecoin market requires a new mental model. A formerly monolithic landscape, where yield was an occasional feature, has been deliberately fractured. We must now move from a singular understanding of “stablecoins” to a nuanced view of a spectrum, where assets are defined by their position along a continuum of risk and return. A new reality demands a framework that looks beyond the peg and interrogates the very source of an asset’s yield, as its origins are the fundamental determinant of its risk profile and economic function.

At the highest level of this new framework sits Category 1: RWA-Backed YBS. These instruments are best understood as “pass-through” vehicles for traditional financial (TradFi) yield. Their core mechanism involves importing yield generated by offchain, institutional-grade assets — primarily U.S. Treasury bills — and distributing it to onchain token holders. These assets represent the most conservative end of the YBS spectrum, functioning as a bridge between the established world of TradFi and the nascent onchain economy, offering familiar, credit-risk-minimized returns.

Occupying the middle ground is Category 2: Onchain Native YBS. As the engines of the decentralized economy, these assets generate their yield from crypto-native sources. Their returns are not imported from the outside world but are a function of intrinsic onchain activities. Revenue from decentralized lending protocols, yield from liquid staking derivatives, or profits derived from sophisticated, market-neutral hedging strategies on perpetual futures markets are all included. These instruments offer a return profile that is less correlated with traditional markets, representing a new, autonomous vector for capital appreciation.

At the far end of the risk and complexity spectrum lies Category 3: Actively Managed YBS. Functioning as the active strategies of the onchain world, their yield is not a passive function of an underlying asset but is generated by complex, often opaque, and actively managed processes. Included in this category are everything from algorithmic strategies that deploy capital across a range of DeFi protocols to onchain credit funds managed by human portfolio managers who underwrite loans to institutional borrowers. These assets offer the potential for the highest alpha but also introduce a host of new, complex risks, including model risk and manager risk, that are not present in the other categories.

Bridging TradFi

To understand the core mechanism of RWA-Backed YBS we have to begin with the enabling legal and financial architecture. Usually, issuers establish bankruptcy-remote Special Purpose Vehicles (SPVs) in legally favorable jurisdictions, creating a distinct entity whose sole purpose is to hold the underlying assets. Such a structure is critical for isolating the collateral from the operational risks of the issuing company, providing a foundational layer of security for the token holders.

Capital flows methodically, bridging the onchain and offchain worlds. An investor commences the process by subscribing to the offering, typically by sending a large-denomination Payment Stablecoin like USDC to the issuer's designated address. The SPV then takes this digital capital and executes purchases of offchain, institutional-grade, yield-bearing assets, with the dominant choice being short-term U.S. Treasury Bills or shares in T-bill-backed Money Market Funds (MMFs). Upon confirmation of the asset purchase, the issuer mints a corresponding amount of their new onchain YBS token, representing a 1:1 claim on the underlying real-world collateral.

The market landscape for RWA-backed YBS is expanding rapidly, led by a cohort of pioneering issuers. Key players include Ondo Finance, with its OUSG and USDY products catering to different investor types; Superstate, with its USTB token; and Mountain Protocol, with its rebasing USDM. These protocols, while sharing a common reliance on offchain collateral, differentiate themselves through their legal structures, target audiences, and yield distribution mechanisms.

A critical component of this model, and a primary source of its unique risk profile, is the custody of the underlying assets. Unlike crypto-native assets held by smart contracts, RWA collateral is held by traditional, regulated financial institutions such as BNY Mellon. A reliance on offchain, centralized custodians introduces traditional counterparty risk into the DeFi ecosystem — a trade-off made to access the stability and deep liquidity of traditional financial markets.

This category is further divided by the technical mechanism used to distribute T-bill yield to holders. The first method is through rebasing tokens, such as Mountain Protocol's USDM, which maintain a permanent $1.00 price peg. Yield is delivered by algorithmically increasing the balance of tokens in a holder's wallet on a daily basis. The primary drawback of this approach is a lack of composability with the majority of DeFi protocols, which are not designed to handle assets with dynamically changing balances.

A second, and more common, method is through appreciating or accrual tokens, exemplified by Ondo's OUSG. In this model, the number of tokens in a holder's wallet remains fixed. Instead, the token's Net Asset Value (NAV), or its redemption value, steadily increases over time as yield from the underlying assets accrues. Natively composable with all existing DeFi infrastructure, this approach behaves like any other standard ERC20 token, making it ideal for use as collateral in lending markets and other applications.

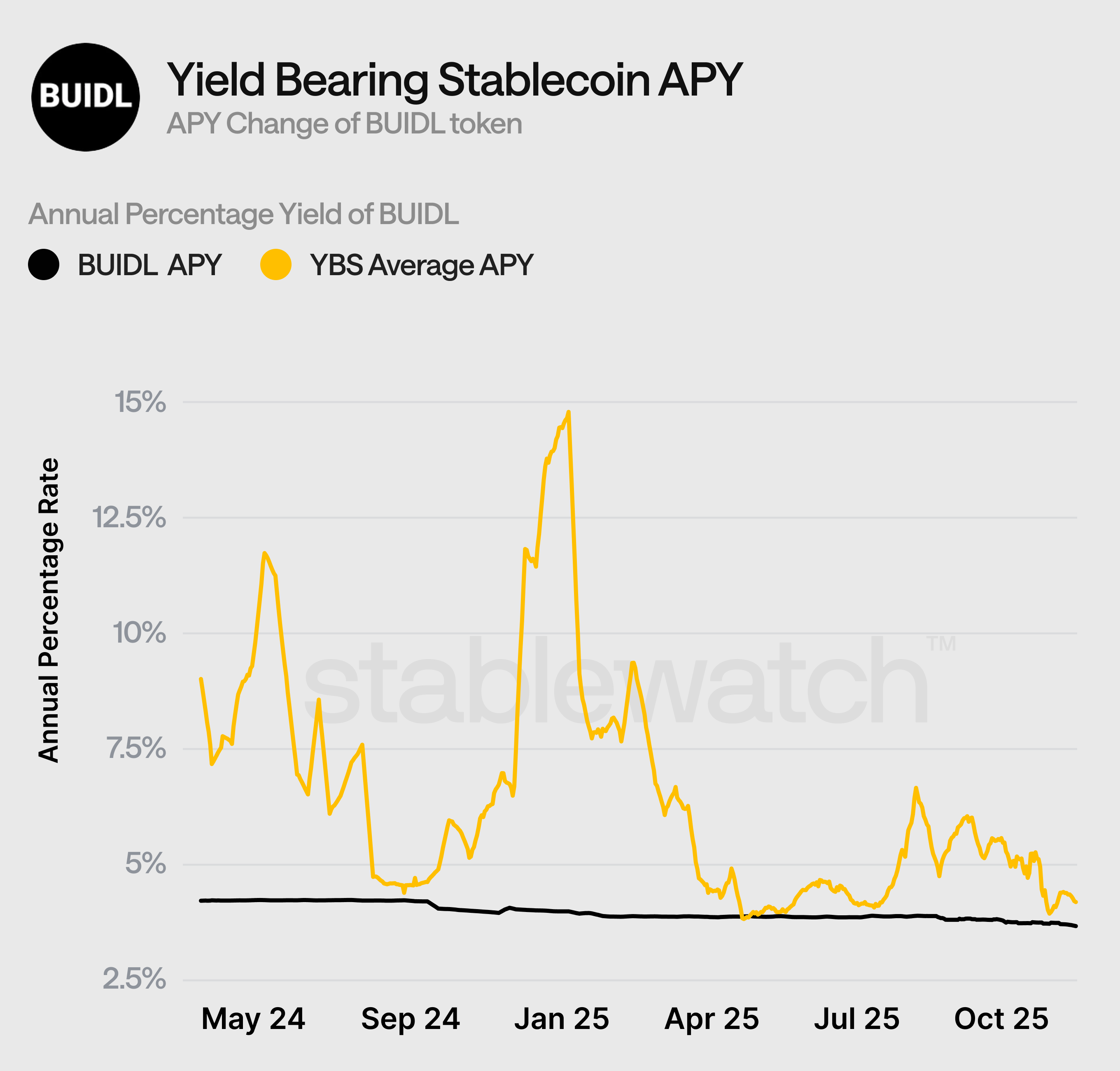

As a key highlight in this group, BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) launched in March 2024 established an institutional-grade primitive for the entire category. It is crucial to understand that BUIDL is a tokenized share of an existing BlackRock Money Market Fund. It serves as the foundational layer, the wholesale asset upon which other, more retail-facing products are built.

BUIDL functions as an institutional bridge, designed exclusively for Qualified Investors who pass a stringent KYC/AML process. With a $5 million minimum investment, it is a permissioned DeFi primitive that operates on a whitelist basis, restricting who can hold or transfer the token. Its primary innovation is not the yield itself, but the escape from traditional financial settlement times, allowing for 24/7 peer-to-peer transfers between whitelisted participants.

A sophisticated B2B2C supply chain has emerged as one of the most significant developments in this space. Protocols like Ondo Finance do not source their own T-bills; instead, they act as distributors and accessibility layers, investing their assets directly into BlackRock's BUIDL. Ondo is, therefore, one of the largest institutional holders of BUIDL, effectively creating a retail-friendly wrapper around an institutional product.

RWA-backed YBS tap into the deep, stable yields of the $140T+ global bond market, offering a familiar and relatively low-risk return profile that is attractive to both crypto-native and traditional investors. They also serve as a trusted and easily understandable entry point for TradFi institutions looking to enter the digital asset space, backed by the credibility of major asset managers like BlackRock.

However, the risk profile of this category, while different from crypto-native assets, is no less significant. The primary vector is Counterparty and Custodial Risk. An entire structure is predicated on the solvency and operational integrity of the offchain banks, custodians, and SPV administrators. A failure at any point in this offchain dependency chain could result in a partial or total loss of the underlying collateral.

Furthermore, these instruments carry significant Regulatory Risk. Many, like BUIDL, are explicitly structured as registered securities and are subject to the full scope of securities law. A level of regulatory friction and a set of compliance obligations are thus introduced that are foreign to the permissionless ethos of standard DeFi.

Another critical vector is Transparency Risk. While issuers provide regular attestations and reports on their offchain reserves, this is a significant step down from the real-time, verifiable transparency of onchain collateral. Investors must trust these periodic disclosures rather than being able to verify the backing of their assets independently and at any time.

Finally, these assets are subject to Liquidity Risk. A promise of "instant" redemption to USDC is often dependent on a single, counterparty-funded smart contract. As seen in a 23-hour period of limited availability for the BUIDL-Circle redemption facility in March 2025, a failure of this single point of liquidity forces all redemptions to fall back to the T+1 or T+2 settlement timelines of the traditional financial system, re-introducing the very friction that DeFi aims to eliminate.

Crypto-Native Yields

In direct contrast to the TradFi-bridged models, the second category of YBS derives its economic power from within, generating yield through purely crypto-native activities. Unlike their RWA-backed counterparts, the yield is not imported from an external financial system but is an intrinsic product of onchain mechanics, leverage demand, and protocol-generated fees. A return profile is thus created that is fundamentally uncorrelated with traditional financial markets, offering a powerful tool for portfolio diversification.

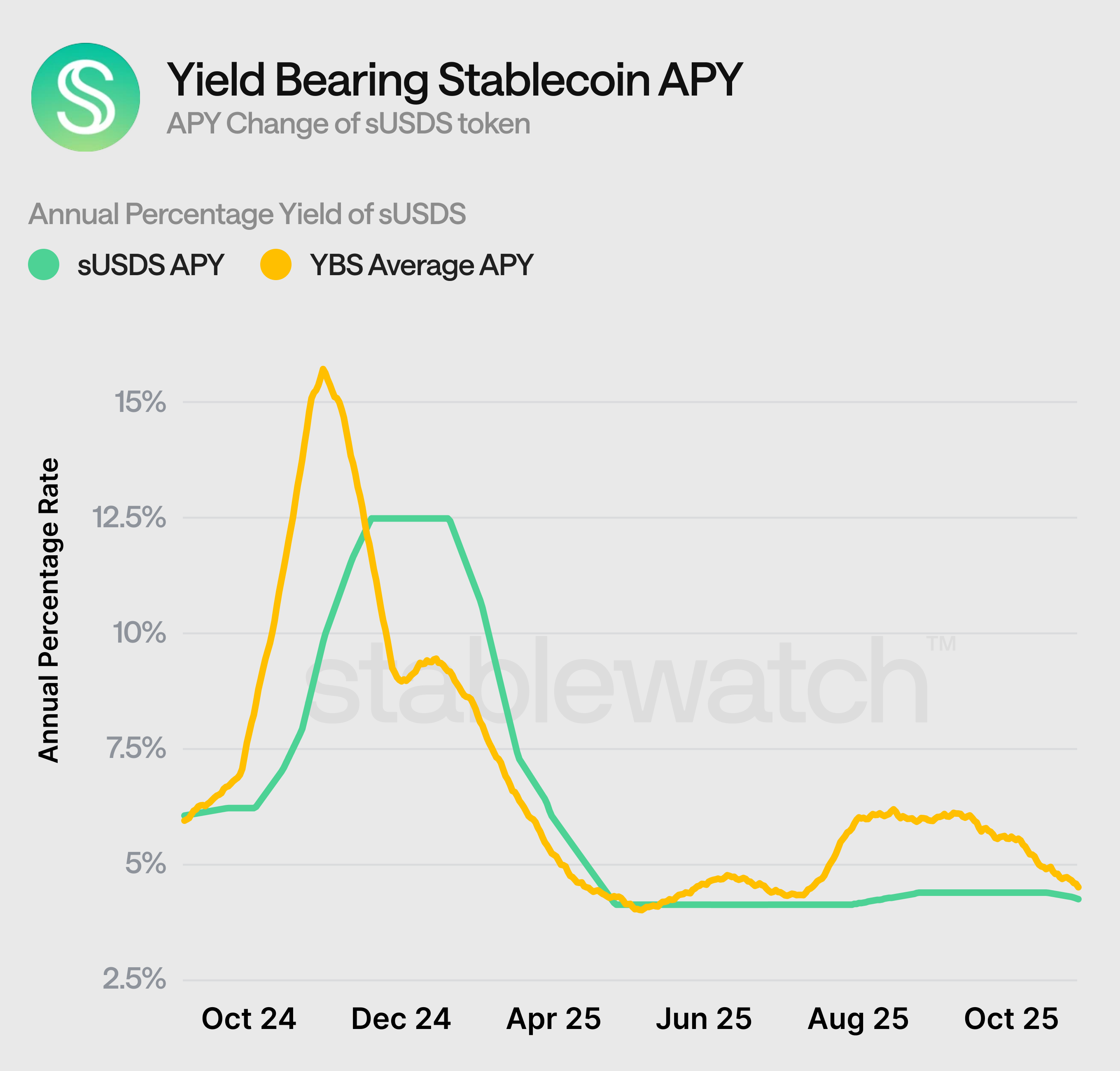

A first major sub-category here is the YBS Wrapper, best exemplified by sUSDS from Sky Protocol (formerly MakerDAO). An elegant mechanism in its simplicity, a user deposits a standard, non-yield-bearing stablecoin like USDS into a smart contract (in this case, the Sky Savings Rate module) and receives an accrual token, sUSDS, in return. The yield passed to sUSDS holders is generated by the entire Sky Protocol ecosystem, primarily from the stability fees paid by borrowers and, critically, from the yield generated by the protocol's own multi-billion-dollar balance sheet of RWA investments.

A second sub-category is the Crypto-Backed or Collateralized Debt Position (CDP) model. In this structure, users mint a stablecoin against a deposit of crypto-native collateral, most commonly a Liquid Staking Token (LST) like stETH. Yield is generated from the underlying staking rewards of the collateral, which is then passed through to the holder of the stablecoin, often via a rebasing or accrual mechanism.

A third and most complex sub-category is the Delta-Neutral strategy. Maintaining its peg, this mechanism generates yield not through collateralization but through a sophisticated "cash-and-carry" trade. The protocol simultaneously holds a spot long position in a crypto asset (like ETH) and a corresponding short position in that same asset's perpetual future. A market-neutral position is thus created, and the yield is harvested from the funding rate typically paid by long positions to short positions in perpetual futures markets.

The market for onchain native YBS is vibrant and diverse, populated by a range of innovative protocols. Key assets include Sky's sUSDS, which represents the protocol revenue distribution model, or OpenEden's TBILL, which tokenizes T-bills but does so in a more DeFi-native manner than many of its RWA-focused competitors.

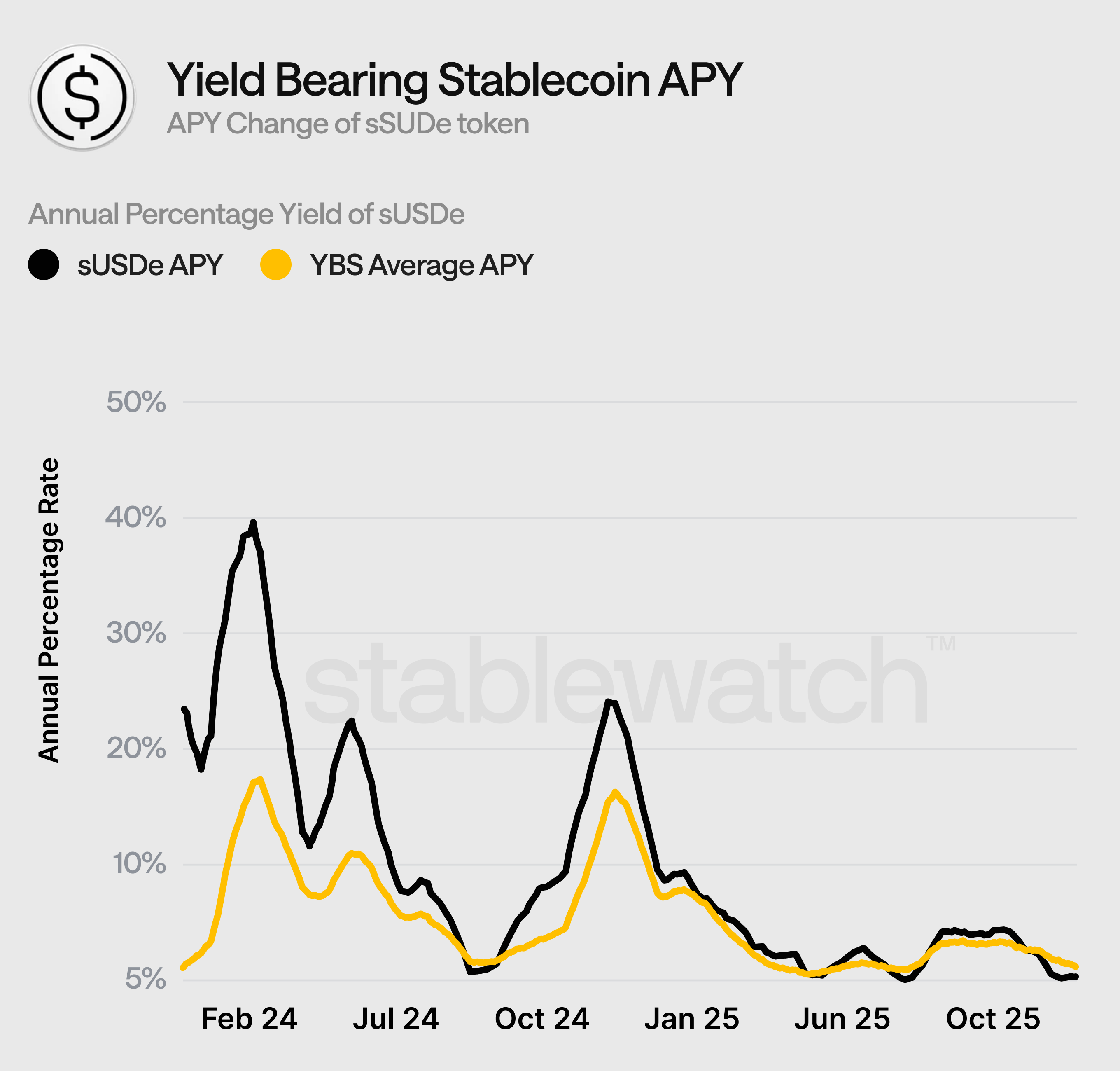

A spotlight on Ethena's sUSDe provides the flagship example of a delta-neutral YBS. Ethena has marketed its synthetic dollar, USDe, and its staked counterpart, sUSDe, as the "Internet Bond" — a permissionless, dollar-denominated savings instrument for the digital economy. Its existence and yield are a pure function of crypto market structure.

The sUSDe yield mechanism is a composite of two distinct, crypto-native sources. The first is the baseline yield generated by the Liquid Staking Token (LST) collateral that backs the protocol, such as stETH. A second, and more volatile, component is the funding rate harvested from the short perpetual futures positions that the protocol maintains on centralized exchanges to hedge its exposure and maintain its peg.

A composite yield is what makes Ethena's sUSDe fundamentally different from and uncorrelated with the T-bill rates that anchor RWA-backed YBS. A new, crypto-native asset with a unique risk/return profile, driven entirely by onchain staking economics and the leverage appetite within derivatives markets, is the outcome. A powerful diversification tool is thus created, but a set of novel and complex risks are also introduced.

The primary value proposition of onchain Native YBS lies in this very lack of correlation with traditional financial markets, offering a source of yield that is insulated from the monetary policy of central banks. Furthermore, many of these assets offer the promise of full onchain transparency, where reserves and mechanisms can be audited in real-time by anyone, a stark contrast to the opaque, attestation-based world of RWA. Such transparency, combined with their native composability, allows for deep and efficient integration within the broader DeFi ecosystem.

The risk profile of this category begins with Smart Contract Risk as its foundational vector. An entire system is reliant on the security and integrity of the underlying code. A bug or exploit in the smart contracts can, and often does, lead to a total loss of funds, a risk that is ever-present in the DeFi space.

Beyond the code itself lies Economic Model Risk, which is arguably the most significant and least understood vulnerability. For a protocol like Ethena, this risk is embodied by the prospect of sustained negative funding rates, a market condition where the structural demand for leverage flips, and shorts must pay longs. In such a scenario, the protocol's backing would begin to erode, a risk that is only partially mitigated by the cushion provided by the underlying LST yield.

Next is Collateral Risk. The stability of these protocols is often dependent on the stability of the crypto-assets used as backing. For CDPs, the risk is that of the collateral (e.g., an LST) de-pegging from its underlying asset. For a delta-neutral protocol, there is the risk of a sudden, volatile price crash in the spot collateral that is not matched by a corresponding move in the perpetual futures, a situation that could lead to liquidations.

Finally, for delta-neutral models specifically, there is Exchange Counterparty Risk. These protocols often rely on centralized exchanges like Binance and Bybit to execute their short hedges. A dependency on the operational integrity and solvency of these third-party platforms is thus introduced, exposing the protocol to the risk of an exchange failure, a seizure of funds, or an operational halt — a classic "FTX scenario".

Actively Managed Strategies

A third category represents the frontier of onchain financial engineering, encompassing the "black boxes" of the Yield-Bearing Stablecoin world. Here, yield is not a passive pass-through of an underlying asset's return but is actively generated by dynamic and often opaque strategies. These models are defined by their reliance on active management, whether by a human or an algorithm, to navigate market conditions and produce alpha.

A first sub-model is the Algorithmic Strategy, which involves automated systems that deploy capital across a range of DeFi protocols and investment vehicles. These strategies are based on pre-defined logic, executing complex transactions to harvest yield from market inefficiencies, liquidity provision, or other exotic sources. They are, in effect, autonomous onchain hedge funds.

A second, and more prevalent, sub-model is the Managed Strategy. Explicitly, this approach re-introduces human decision-making into the yield generation process. It relies on experienced portfolio managers or credit underwriters to make active, discretionary decisions about where and how to deploy capital onchain. A traditional, actively-managed fund structure is thus effectively put onto the blockchain.

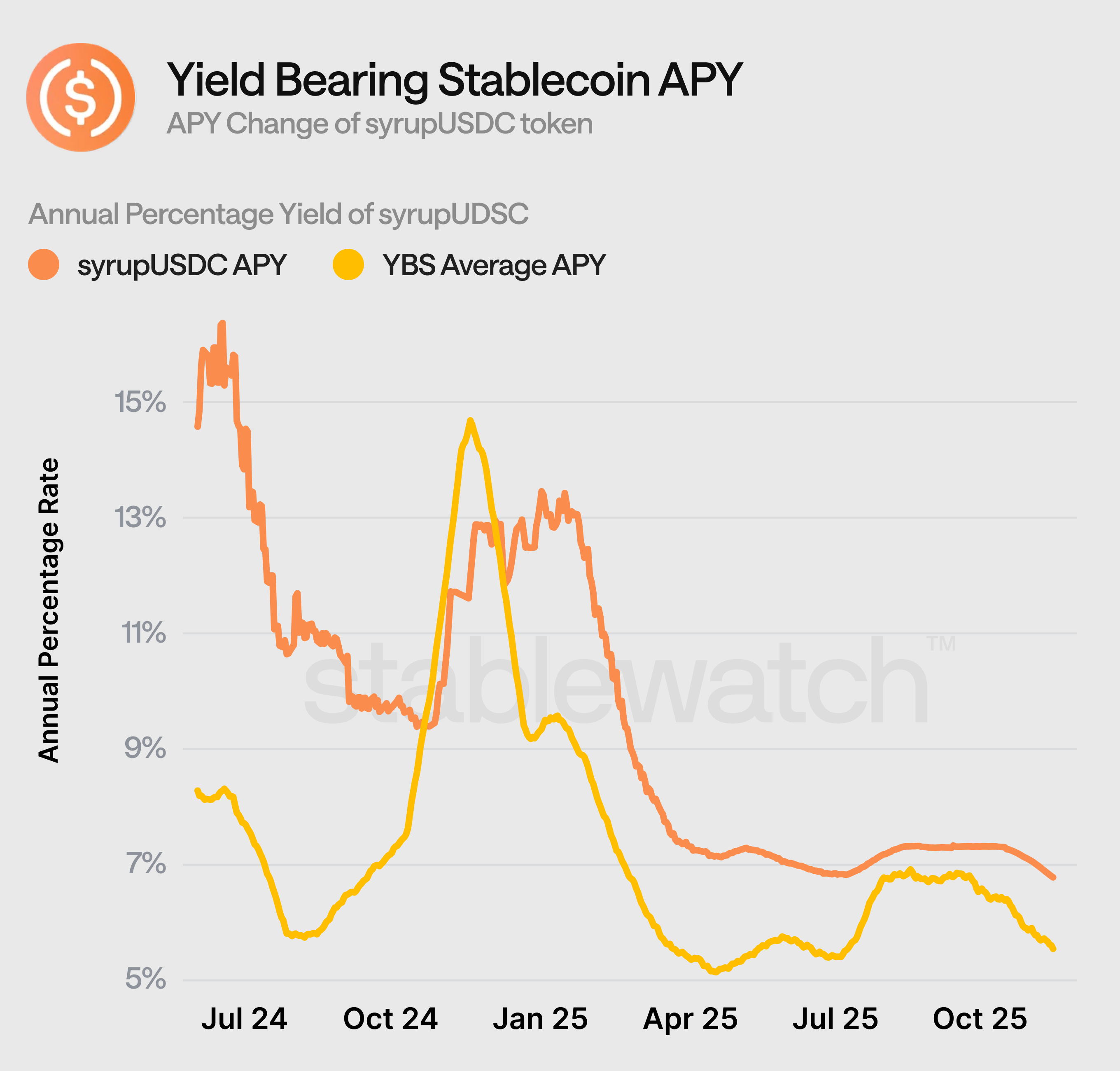

The market for these advanced models is still nascent but is populated by a number of innovative protocols. The most prominent example of the "Managed Strategy" is Maple Finance, with its syrupUSDC and syrupUSDT tokens. Maple has established itself as a decentralized credit market, or onchain asset manager, that facilitates undercollateralized loans to institutional borrowers.

A spotlight on Maple's syrupUSDC reveals how this model functions in practice. The token is an accrual-style asset that represents a user's deposit into Maple's lending pools. Yield for syrupUSDC holders is generated from the interest paid on the undercollateralized and overcollateralized loans that the protocol issues to institutional borrowers, such as crypto-native market makers and hedge funds.

The key mechanism, and the primary source of its unique risk profile, is the role of Pool Delegates. Not algorithms, these are human fund managers, vetted and approved by the Maple team, who act as onchain credit underwriters. They are responsible for sourcing and vetting borrowers, performing traditional offchain due diligence, negotiating loan terms, and actively managing the loan book, including the handling of any defaults.

A primary value proposition of this category is the potential for significant alpha generation. By moving beyond the passive yields of T-bills or staking, these active strategies can access higher-return opportunities, such as onchain private credit and other exotic sources of yield that are not available to the broader market. A glimpse into a future where the role of the active fund manager is disintermediated and brought onchain.

The risk profile of this category, however, is commensurately higher and more complex. The first vector is Model Risk, which is particularly acute for algorithmic strategies. The "black box" nature of these systems means that their underlying logic can be fragile, over-optimized for past market conditions, or susceptible to unforeseen exploits, leading to catastrophic failure.

For the managed strategies, the primary vector is Centralization and Manager Risk. The yield, and the safety of the principal, is entirely dependent on the skill, diligence, and integrity of the human Pool Delegate or similar actor. A poor underwriting decision, a failure in risk management, or a simple error in judgment can lead to substantial capital losses for the lenders. Explicitly, this model re-introduces human risk into the heart of a DeFi protocol.

Complexity Risk is a direct result of these two. The intricate nature of these strategies, whether algorithmic or human-managed, makes a comprehensive risk assessment exceedingly difficult for the average user. The sources of yield are often multifaceted, the risk exposures are dynamic, and the potential points of failure are numerous and often hidden from view.

The $36 million default of Orthogonal Trading on Maple Finance in late 2022 serves as the quintessential case study for the risks of this category. An event not caused by a smart contract failure, the Maple protocol itself worked flawlessly. The failure was entirely human: the M11 Pool Delegate, who had underwritten the loan to Orthogonal, failed in its credit assessment and risk management, exposing the pool to a borrower who was fatally overexposed to the bankrupt FTX exchange. A deposit in syrupUSDC is therefore not a bet on the code of a protocol, but primarily a bet on the underwriting skill of a human manager.

Stablecoin Value Capture Heating Up

The next evolutionary steps in the YBS landscape move beyond the asset itself to the underlying infrastructure. The future of stablecoins, particularly for high-throughput payment and trading applications, lies not in deploying them as applications on general-purpose networks, but in making them the native, foundational asset of a purpose-built blockchain. Inherent frictions of general-purpose chains, such as volatile gas fees and probabilistic finality, which are antithetical to the needs of a global-scale value transfer layer, are sought to be solved by this approach.

A full exploration of the Stablecoin Chains thesis is available in Stablewatch's dedicated report on the subject: https://app.stablewatch.io/blog/stablecoin-chains, here we briefly expand it by discussing Hyperliquid’s USDH value capture approach.

Hyperliquid has executed a unique flipped-playbook for its go-to-market strategy. Instead of building a general-purpose L1 and hoping for developers and users to arrive, Hyperliquid first built a single, high-performance product: a decentralized perpetuals exchange that achieved an overwhelming product-market fit. Only after proving the value of its underlying infrastructure and capturing a massive user base did it open up its custom-built L1, HyperEVM, for other developers to build on. A product-first strategy that effectively de-risked the launch of the L1.

Hyperliquid's USDH provides a prime example of the Stablecoin Chain thesis in action and serves as a perfect case study for a platform-specific YBS. The project embodies this new paradigm, where the stablecoin is not just an asset on the platform but is the very lifeblood of its economy, deeply and symbiotically integrated with the chain's core function.

Cleverly, this model circumvents the GENIUS Act's prohibition on yield for Payment Stablecoins. The USDH token itself is designed to be a non-yield-bearing instrument, fully compliant with the regulatory definition of a payment tool. However, the billion-dollar-plus in RWA reserves that will back the USDH supply are still generating tens of millions of dollars in annual yield, a yield not passed on to the USDH holder.

Instead, in a brilliant stroke of economic engineering, the yield is captured by the Hyperliquid ecosystem itself. As part of a competitive bidding process to become the issuer of USDH, established stablecoin issuers like Paxos and Agora validated the model by pledging to return 95-100% of the net reserve yield back to the Hyperliquid protocol. While the winner was ultimately an ecosystem-native team, Native Markets, their proposal followed the same principle, pledging to direct a majority of the yield back to the Hyperliquid ecosystem to support its growth and its native token. A powerful, DeFi-native, and community-centric model that solves the yield capture problem, aligning the incentives of the stablecoin with the long-term health and value accrual of the underlying L1 platform is the result.

Conclusion

The primary consequence of the 2025 GENIUS Act is the successful bifurcation of the stablecoin market. It has clarified the role of "Payment Stablecoins" as pure, non-yielding utility instruments, and in doing so, has forced all yield-seeking activity into a separate, vibrant, but dangerously broad YBS ecosystem. The core thesis of this report is that the "YBS" label, in its current form, is an insufficient and misleading abstraction, masking a vast spectrum of risk that the market is only beginning to comprehend.

The evolving YBS landscape presents investors and protocols with a classic apples-to-oranges risk comparison problem. The qualitative framework outlined in this report demonstrates that the risks inherent in each category are non-obvious, non-standardized, and fundamentally opaque. A decision to allocate capital is no longer a simple matter of comparing headline APYs, but a complex exercise in comparative risk assessment. Is the custodial and centralization risk of an RWA-backed asset like OUSG preferable to the market and counterparty risk of a delta-neutral protocol like sUSDe? Or is the human manager risk of a private credit fund like syrupUSDC a more palatable trade-off? There are no easy answers.

Future growth, and indeed the long-term viability, of the YBS market is entirely dependent on the development of a more nuanced, risk-aware understanding of these new financial primitives. The current approach of using simplistic, quantitative metrics like TVL and APY is completely blind to the disparate, qualitative risk vectors that truly define these assets. For the market to mature and for institutional capital to enter at scale, a new layer of analytical infrastructure is required.

Such is the core mission of Stablewatch. Our purpose is to provide the expert frameworks, data-driven analysis, and sophisticated insights necessary for investors, developers, and risk managers to safely and effectively navigate this new, multi-trillion-dollar opportunity. The GENIUS Act is not just a regulatory event; it is the starting gun for a new era of onchain financial innovation. The models are new, the risks are complex, and they demand a new and more rigorous mode of analysis.

We invite you to leverage this analysis today. The https://app.stablewatch.io/ v2 dashboard is live and designed to support your investments in this quickly evolving market.

About Piotr Kabaciński

Piotr is a Head of Research at Stablewatch, focused on in-depth analysis and developing risk models for innovative stablecoin solutions. He holds a PhD in Ultrafast Spectroscopy from Politecnico di Milano, and has coauthored over 15 high-impact papers in leading scientific journals. He has worked in DeFi as an investor for venture capital firms Geometry and Synergis Capital, after which he has founded a gas derivatives startup, later merged with Luban.