GPU-Backed Credit: How USD.AI Channels Onchain Capital for AI Compute Financing

Executive Summary

The USD.AI protocol marks a significant architectural evolution in decentralized finance, establishing the "InfraFi" paradigm to bridge onchain liquidity with the capital-intensive world of artificial intelligence compute. Its design is a direct response to a dual-sided market needs: the AI industry’s insatiable requirement for rapidly deployed capital, set against the DeFi ecosystem’s search for sustainable, non-reflexive yield sourced from tangible economic activity. USD.AI provides the solution: a transparent and efficient conduit for financing physical, cash-flow-generating assets on public blockchain rails.

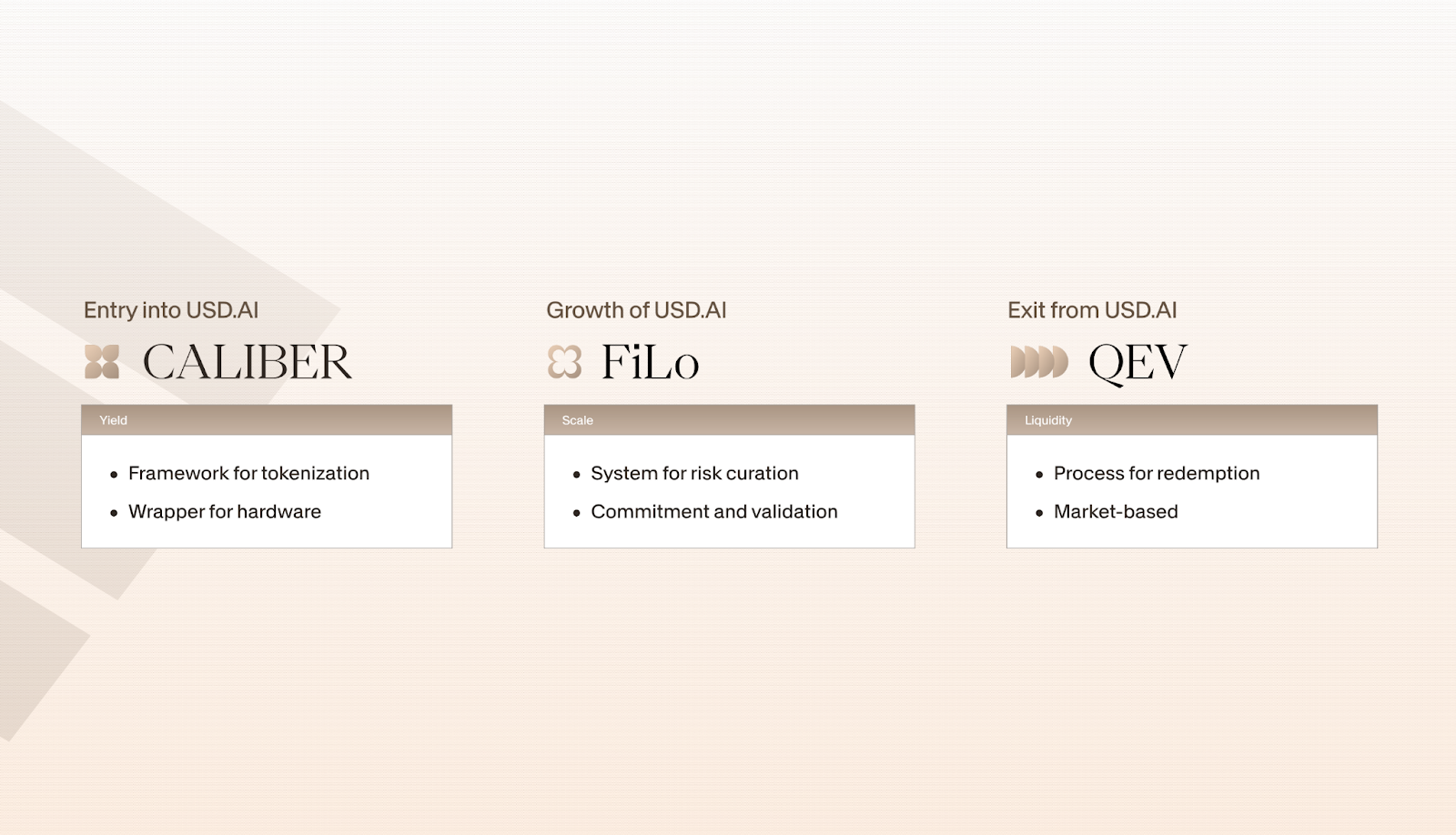

The protocol’s engine is built on three novel and interdependent primitives. First is CALIBER, which provides the standardized legal and technical framework for tokenizing physical assets. It is complemented by the FiLo Curator, a scalable, risk-isolated underwriting model that aligns incentives by mandating a first-loss position for asset originators. Finally, the system's cornerstone is QEV, an innovative auction-based mechanism for redemptions against illiquid collateral. By replacing the fragile promise of instant liquidity with a guarantee of predictable, time-priced liquidity, QEV solves the fundamental asset-liability mismatch that has plagued previous asset-backed protocols.

The viability of this architecture rests on a critical collateral thesis: the durable economic utility of NVIDIA GPUs, which gain a long-tail value from high-demand inference workloads even as they are superseded by newer generations for training, thus creating a sustainable asset class with a predictable, albeit steep, depreciation curve. This model deliberately inverts the typical DeFi risk profile. Instead of grappling with crypto-native price volatility, it imports the established risks of traditional finance: credit default, operational execution, and legal enforceability. To navigate this landscape, the protocol's underwriting framework projects the hardware's future economic value by accounting for both gradual, age-related decay and the discrete revaluation shocks triggered by new technology cycles.

Ultimately, USD.AI presents itself as more than a stablecoin protocol; it is a test case for a generalizable framework designed to finance essential, real-world infrastructure on a global, decentralized ledger. Its transition from an innovative concept to a scaled financial primitive will be defined by its ability to integrate its onchain logic with the essential offchain legal, operational, and regulatory frameworks required to manage real-world assets. This analysis deconstructs the protocol's architecture to evaluate its potential to become a new financial primitive for the emerging AI era.

Convergence of Frictions

The emergence of the USD.AI protocol is a direct consequence of two converging market forces. On one side, the artificial intelligence industry is grappling with a structural capital demand that traditional finance cannot adequately service. On the other, the decentralized finance ecosystem, having reached a state of maturity, is confronting a systemic need for sustainable, real-world yield. These parallel frictions have created a unique economic vacuum — a symbiotic opportunity for a new financial primitive designed to bridge the gap.

The core friction in the AI sector is one of explosive growth colliding with inflexible capital. The demand for compute, the foundational resource for both training and running AI models, is expanding at a staggering rate. While the development of frontier models currently represents the majority of this demand — roughly 80% according to market analysis from Brookfield — the economic landscape is poised for a dramatic inversion. By 2030, inference workloads, which involve running queries on existing models, are projected to constitute 75% of the market, and by 2034 are expected to grow to an estimated $250 billion annually. This shift signals the maturation of AI from a research-driven field into a mass-market utility embedded in global commerce.

This expansion creates a relentless demand for hardware, primarily NVIDIA GPUs, which function as the indispensable picks and shovels of the AI gold rush. However, the financing of these assets manifests as a systemic headwind for the small and mid-sized operators who constitute the long tail of the market. The industry’s rapid hardware refresh cycles, typically spanning just 12-18 months, render traditional bank loans and asset financing ill-suited for the task. The process is too slow, the underwriting models are not specialized for the asset class, and the risk profile does not fit neatly into established credit schemes. This has left the market underserved, with private credit funds attempting to fill the void but lacking the scalable infrastructure to do so efficiently. The result is a significant bottleneck, a tangible tax on innovation where viable operators are unable to acquire productive assets due to the friction of legacy finance.

Simultaneously, the DeFi ecosystem is facing its own critical inflection point. With a market capitalization for stablecoins alone hovering around $300 billion, DeFi commands a vast pool of highly liquid, onchain capital. Yet, the primary challenge has been the generation of sustainable, non-reflexive yield. For years, the most accessible returns have been sourced from mechanisms internal to the crypto ecosystem: liquidity provision for token swaps, speculative leverage, token-based incentives, and more recently, the complex financialization of staking rewards through liquid restaking. While innovative, these yield sources are inherently reflexive, tightly coupled to the volatile sentiment and price action of the underlying crypto markets.

The quest to connect this onchain liquidity to offchain, real-world assets (RWAs) is not new, but it has been fraught with peril. Previous attempts have consistently faltered on a single, critical point of failure: the asset-liability mismatch. Protocols have tried to offer the promise of instant, on-demand liquidity — a feature native to DeFi money markets built on liquid collateral like ETH or USDC — while being backed by fundamentally illiquid, real-world assets. This structural flaw creates extreme fragility, leading to problems when even minor redemption pressure exposes the inability to liquidate underlying collateral in a timely manner. A fundamental mismatch defines this market: a massive reservoir of capital seeking durable, real-world returns, but constrained by architectures that have failed to solve the fundamental challenge of liquidity for illiquid assets.

It is at the confluence of these two frictions that the thesis for USD.AI becomes clear. The AI industry possesses a vast and growing inventory of productive, cash-flow-generating assets in need of agile financing. The DeFi ecosystem possesses a vast and growing pool of stable capital in search of productive, real-world yield. USD.AI is designed to be the conduit — a standardized, transparent, and efficient set of rails designed to channel liquidity from one ecosystem to finance the essential infrastructure of the other, creating a truly symbiotic economic loop.

Inference-Era GPUs Are a Durable Asset Class

The viability of any asset-backed lending protocol hinges on a critical prerequisite: the long-term economic durability of its collateral. For USD.AI, which underwrites multi-year loans against high-performance computing hardware, this requirement is particularly acute. The protocol's entire risk model is predicated on a specific and somewhat counter-intuitive investment thesis that refutes the common misconception that only the latest-generation GPUs hold meaningful value. This thesis argues that the AI hardware market is not monolithic, but is instead bifurcating into two distinct segments with fundamentally different economic drivers: frontier model training and mass-market inference.

The world of frontier model training is an arms race for computational supremacy. It is a domain dominated by hyperscalers like Microsoft, Google, and Amazon, who compete to build ever-larger models and require the absolute cutting edge of hardware to do so. In this segment, technological obsolescence is rapid and unforgiving. The value of a GPU is tied directly to its performance delta over the previous generation, and its economic utility fades quickly as new, more powerful architectures are released. This environment mirrors the dynamics of Bitcoin mining, where older hardware is swiftly rendered unprofitable by the relentless march of technological progress. Were this the only market for GPUs, underwriting three-year loans against them would be an untenable proposition.

The inference market, however, operates on a completely different logic. This segment, which involves running queries on already-trained models to generate outputs, is less concerned with raw computational power and more focused on throughput, reliability, and cost-efficiency. For the vast majority of commercial AI applications — from powering a chatbot to generating an image or serving real-time analytics — the crucial metric is not which specific GPU is doing the work, but the cost per token generated and the latency of the response.

This focus on economic efficiency over raw power creates a durable, long-tail market for previous-generation hardware. Chips like NVIDIA's A100 or H100 do not become worthless the moment a new generation launches; their role simply shifts. They transition from being the premier tools for training to becoming the cost-effective workhorses for inference, continuing to generate significant revenue for years after their debut.

The protocol's loan structure is explicitly engineered to harness this market reality. By structuring loans on a three-year amortization schedule, USD.AI aligns its financing model with the hardware's peak economic utility in the inference market. The financing is not a speculative bet on a rapidly depreciating piece of technology, but an underwriting of a durable, cash-flow-generating instrument during its most productive years. The model is less like a 30-year mortgage and more akin to a three-year auto lease for a high-performance vehicle: high-value, fast turnover, and continuous renewal.

Ultimately, the USD.AI model does not fear the hardware refresh cycle; it embraces it as a core feature. The rapid turnover of hardware becomes a source of strength, creating a predictable stream of new financing opportunities and ensuring the protocol's collateral pool remains modern and economically relevant. This symbiotic relationship between hardware depreciation and protocol financing allows USD.AI to provide stable, long-term yield to its lenders while simultaneously fueling the ongoing buildout of the world's critical AI infrastructure.

The Three Primitives of USD.AI

At the heart of the USD.AI protocol is an engine composed of three novel and interdependent financial primitives. Each is designed as an elegant solution to a specific, long-standing problem in asset-backed finance, and together they form a comprehensive framework for underwriting, scaling, and providing liquidity for real-world assets onchain. Whereas previous protocols have attempted to force illiquid assets into architectures designed for liquid collateral, USD.AI has built its system from first principles, creating a stack that is native to the assets it finances. This section deconstructs that engine, examining each primitive — CALIBER, FiLo Curator, and QEV — to reveal the mechanics that enable the InfraFi paradigm.

CALIBER: The Tokenization Primitive

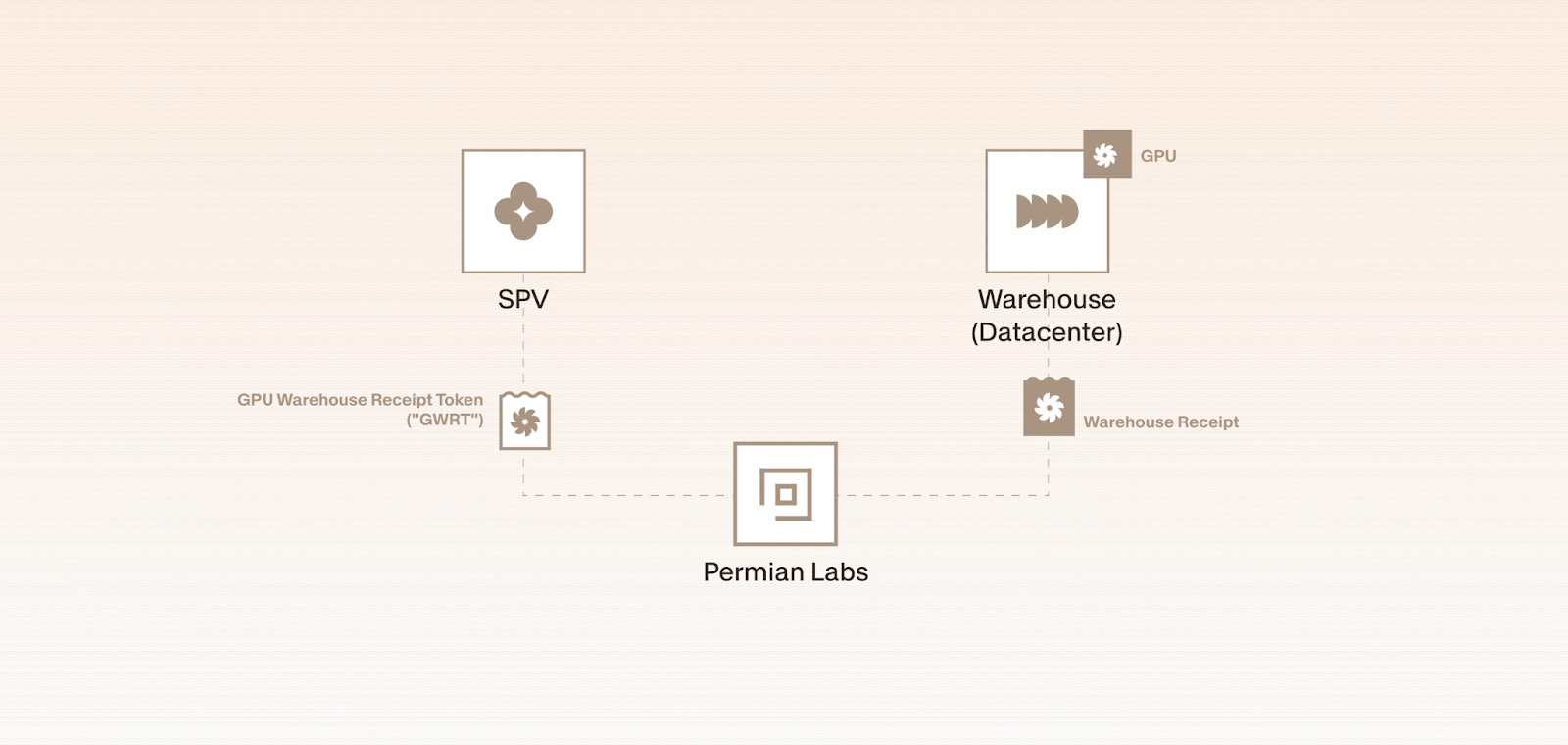

The foundational layer of the protocol is CALIBER (Collateralized Asset Ledger: Insurance, Bailment, Evaluation, and Redemption). It serves as the standardized legal and technical framework for transforming a physical, offchain asset into a fungible, onchain financial instrument. Its primary function is to solve the problem of representation and enforceability.

Each financed GPU is subject to the principles of Uniform Commercial Code Article 7, which governs bailment receipts — legal documents acknowledging the possession of goods. Adherence to this code allows a trusted, insured custodian to issue a digital receipt, tokenized as an NFT, that represents a legally recognized ownership claim over the underlying physical hardware. The resulting tokenized instrument makes the protocol's claim on the physical asset legally enforceable in an offchain context. The hardware itself is held in bailment by trusted, third-party data centers, ensuring it is physically secured and operationally monitored. The protocol mandates that all hardware must be located in an insurable, top-tier data center within a jurisdiction with strong legal protections. Fulfilling this mandate is an absolute prerequisite, as comprehensive insurance is the key that transforms a physical GPU into a bankable, onchain asset.

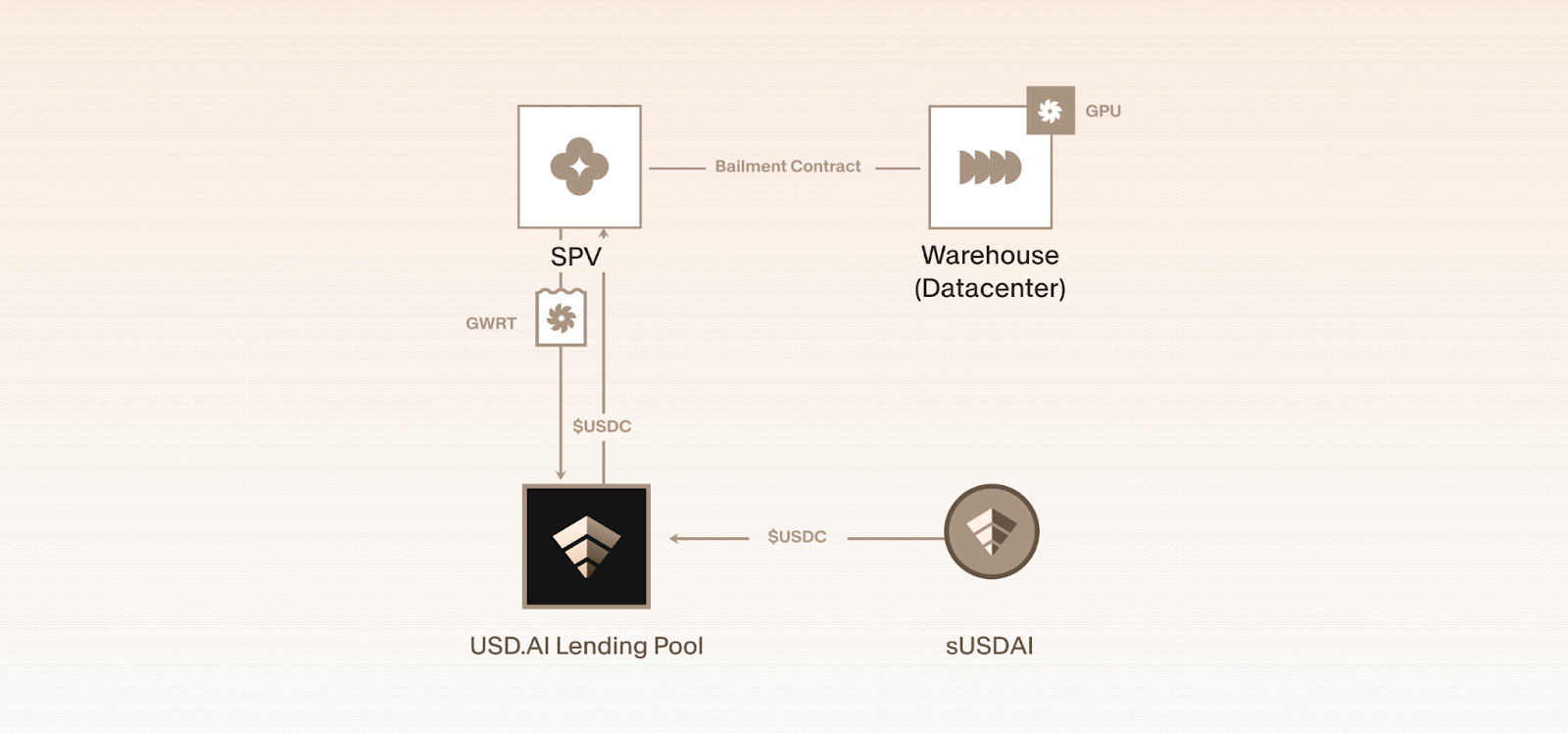

With the legal and physical reality secured, the economic value is brought onchain. A loan is issued against the hardware, and the borrower’s repayment obligation is tokenized into sUSDai. The sUSDai token is not a digital title representing a specific, serialized GPU. Such an instrument would be highly illiquid and carry concentrated risk. Instead, sUSDai represents a pro-rata claim on the aggregated cash flows generated by a diversified and constantly evolving portfolio of all loans underwritten by the protocol. This abstraction transforms thousands of distinct, illiquid credit positions into a single, fungible, yield-bearing token, creating a liquid and scalable financial primitive.

FiLo Curator: The Underwriting Primitive

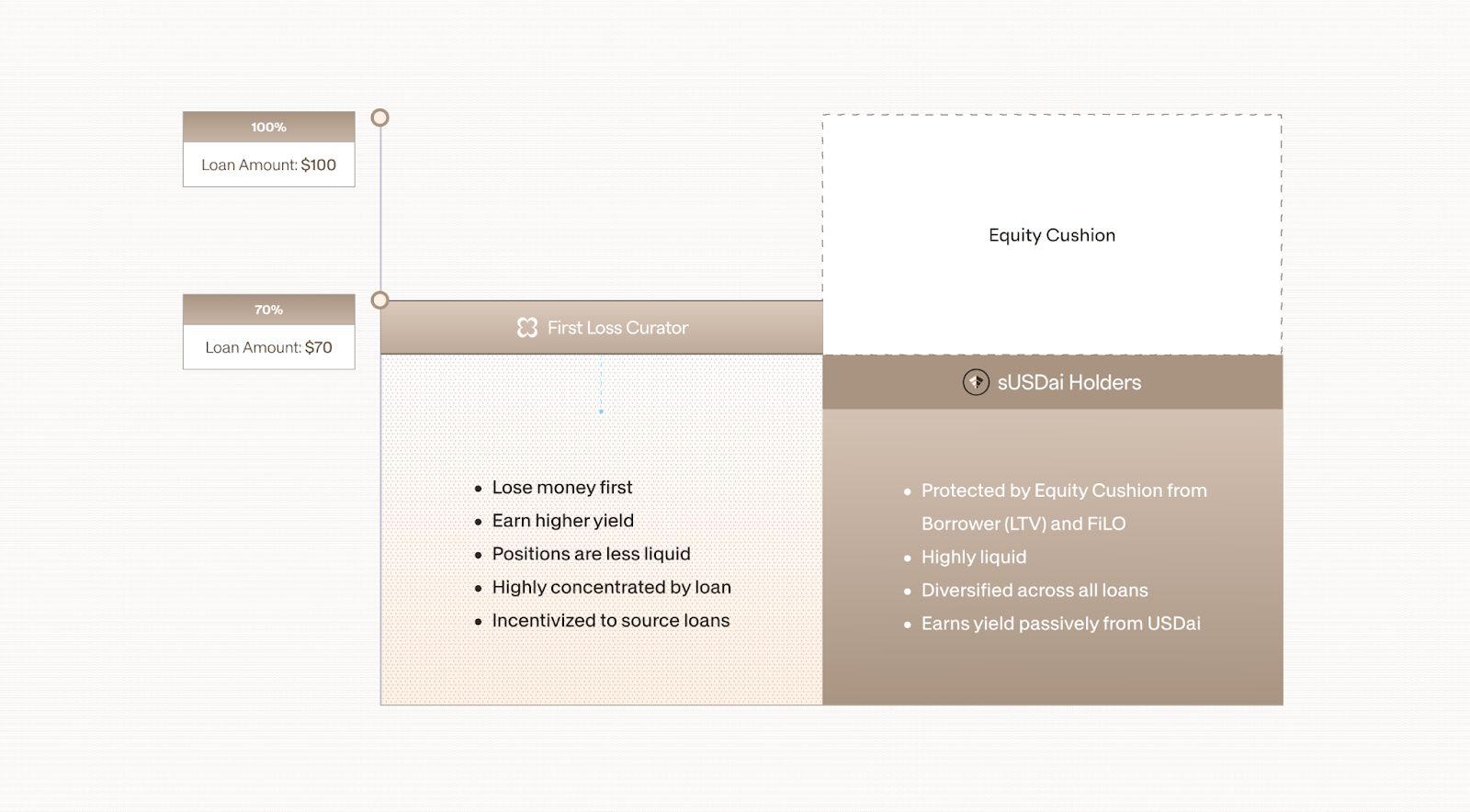

While CALIBER provides the framework for tokenizing a single asset, the FiLo Curator (First Loss Curator) primitive provides the mechanism for scaling the system by onboarding new assets in a risk-isolated manner. It is designed to solve the twin challenges of adverse selection and risk contagion that plague many pooled-risk lending models. The FiLo model allows the protocol to grow its asset base without commingling the risk of new, unproven collateral pools with the established, performing loan book.

The architecture functions like a series of curated loan stacks. When a new asset originator or Curator wishes to bring a portfolio of GPU-backed loans to the protocol, they must initiate a new, segregated stack. This Curator is required to provide the first-loss capital for their stack. This capital acts as a deductible, absorbing any initial defaults before the protocol's lenders are affected. While interest payments from performing assets are distributed concurrently to both parties, the capital stack's priority is absolute in a default: senior lenders who provide the majority of the capital must be repaid their principal in full before the Curator can recoup any of their own subordinate capital. This incentive structure is critical: it forces the Curator, who possesses the most intimate knowledge of the collateral and the borrower, to have durable skin-in-the-game. By aligning the Curator's financial success directly with the performance of the assets they originate, the FiLo model creates a powerful, decentralized, and scalable underwriting process. It allows the protocol to expand its operations through a network of specialized partners without having to underwrite every loan centrally, all while ensuring risks are contained within their respective stacks.

QEV: The Liquidity Primitive

Queue Extractable Value (QEV) is arguably the protocol's most significant innovation and the cornerstone of its long-term viability. It is a novel solution to the fundamental asset-liability mismatch — the core structural flaw that has rendered previous real-world asset protocols so fragile. Where others have failed by promising instant, on-demand liquidity against fundamentally illiquid collateral, QEV redesigns the very concept of a redemption. It replaces the fragile promise of instant liquidity with a robust guarantee of predictable, time-priced liquidity.

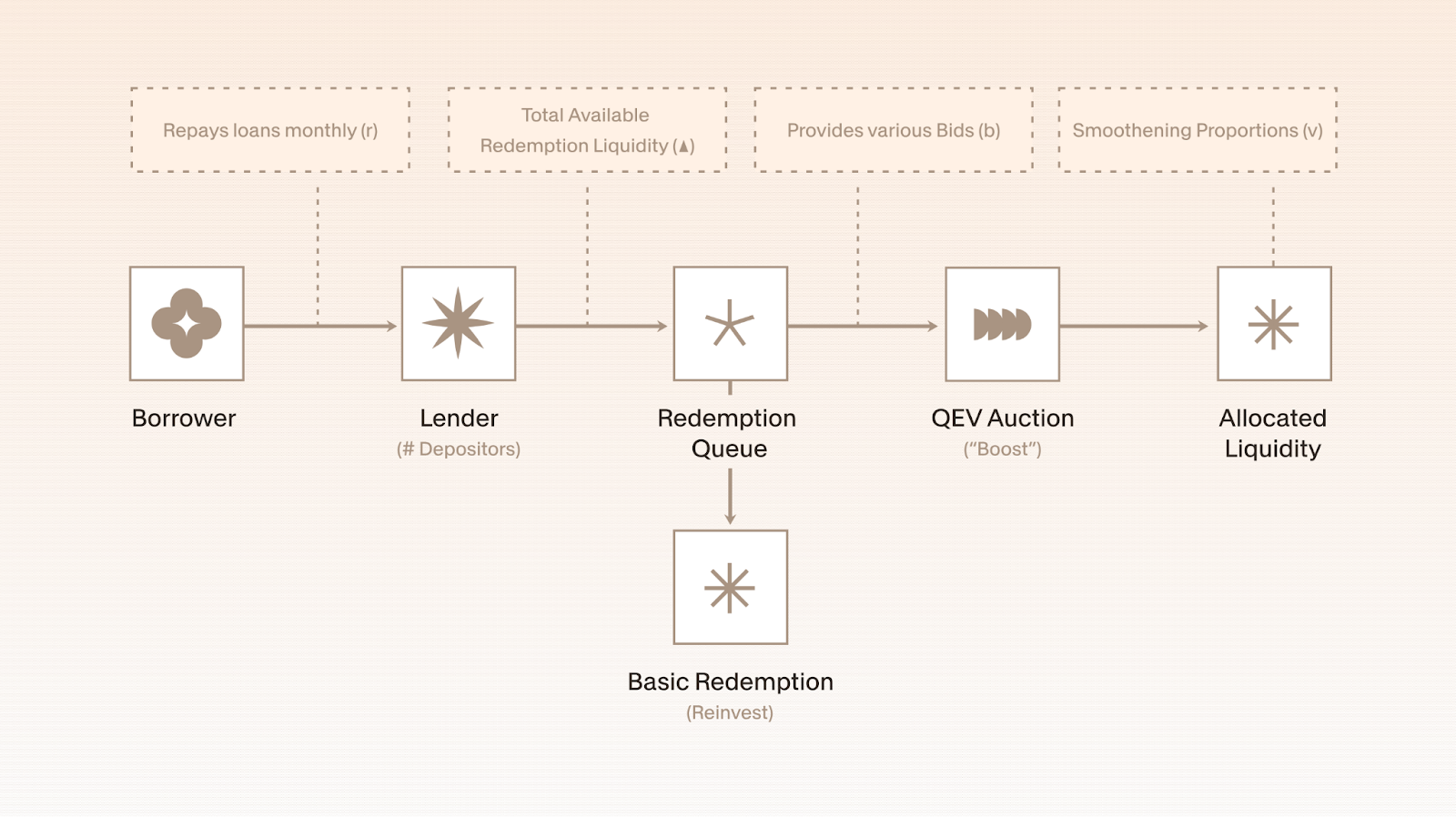

The protocol's assets are amortizing loans secured by GPUs, not liquid tokens in a smart contract. These loans generate a predictable and steady stream of cash flow as borrowers make their monthly payments, amounting to approximately 3-4% of the total outstanding principal returning to the protocol each month. This inflow is the natural source of liquidity for redemptions. The core challenge, therefore, is not one of solvency, but of sequencing: how to fairly and efficiently allocate this fixed stream of incoming capital to holders of sUSDai who wish to redeem, especially during periods of high demand.

The QEV mechanism transforms this sequencing challenge into an open and transparent market for time preference. Instead of a simple, first-come-first-served queue that can become hopelessly backlogged, QEV implements a continuous, auction-based system for priority in the redemption line. All bids are made private via zk-proofs, and the results are smoothed to facilitate distribution across the queue. When an sUSDai holder wishes to redeem, they enter the queue. By default, they can wait and redeem their tokens at par as the protocol's natural cash flows become available. However, for those who require liquidity more urgently, the system allows them to bid a small premium to move up in the queue. The premium is paid to the protocol, rewarding patience of the remaining participants.

Auctioning priority for a scarce resource shares a conceptual lineage with Maximal Extractable Value (MEV) in blockchain architectures. Just as MEV auctions allow validators to sell the right to order transactions within a block, QEV creates a transparent market for ordering redemptions against a fixed stream of capital. In both systems, value is extracted not from the underlying asset itself, but from the sequencing of access to it. This positions QEV as a sophisticated piece of financial engineering, adapting a battle-tested onchain concept to solve a novel problem in asset-backed finance.

By isolating the cost of immediacy, the QEV model diverges fundamentally from the approaches typically employed by lending protocols facing liquidity pressure. Rather than repricing the cost of capital onto the entire pool of borrowers through dynamic interest rates, or resorting to forced, fire-sale liquidations of the underlying collateral, the QEV model isolates the cost of immediacy. The financial burden is placed fully on the exiting party who demands it, ensuring that the stability of the core lending book and the terms offered to performing borrowers remain unaffected by temporary exit demand.

The result is a dynamic and fair marketplace where time preference itself becomes a tradable asset. A user with a low time preference can simply wait in line and earn the premiums paid by more urgent users, effectively being paid to wait. A user with a high time preference can pay a market-driven price to exit, compensating the patient holders for letting them cut in line. It is a mechanism that makes the cost of immediacy explicit and market-driven. By doing so, QEV elegantly solves the asset-liability mismatch, creating a durable system that can honor redemptions in a predictable manner without ever being forced to liquidate its underlying productive assets.

The Dual-Token Model

The USD.AI protocol implements a deliberate dual-token architecture to tranche risk and segment functionality between different user profiles. This system is designed around two distinct assets: USDai, a synthetic dollar, and sUSDai, its yield-bearing counterpart. USDai functions as the low-risk, liquid medium of exchange, designed for stability and trading. It is 1:1 collateralized by tokenized T-bills (wM by M0) sourced from user deposits of assets like USDC or USDT, designed for near-instant 1:1 redeemability back into those stablecoins via a liquidity pool. In contrast, sUSDai represents a staked position within the protocol. Holders of sUSDai are the ones who earn the high yield generated from the underlying GPU loan portfolio, but in exchange, they explicitly assume the protocol's core asset-liability risks, primarily managed through the QEV redemption mechanism. This unbundling allows users to self-select their exposure: one can use USDai for simple stability, or stake it to mint sUSDai and actively participate in the system's risk-reward contract.

Unlike many DeFi protocols that distribute rewards through rebasing or direct token emissions, sUSDai accrues yield through a steady increase in its intrinsic value. An sUSDai token is always a claim on a growing pool of underlying assets — the principal and accrued interest from the loan book. Therefore, as borrowers make payments, the redemption value of each sUSDai token appreciates. This non-dilutive mechanism ensures that yield is a direct reflection of the loan book's performance. Such design choice also carries potential tax savings for holders, as the gains are more likely to be characterized as capital gains realized upon redemption, rather than as income received periodically, a subtle but important distinction from rebasing models.

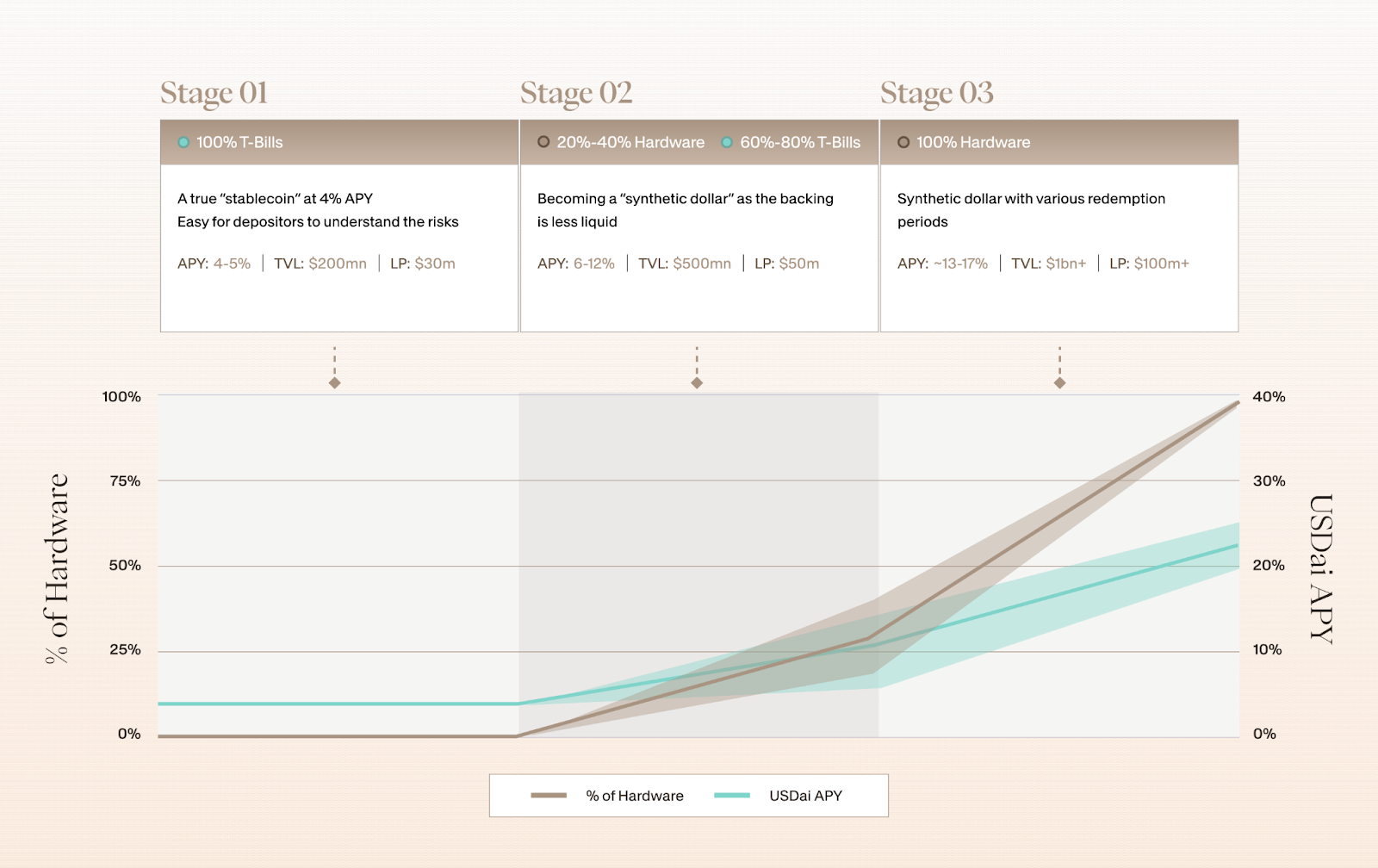

Gradual Capital Allocation

The protocol manages capital allocation across two distinct stages to optimize yield and minimize inefficiency. The first stage, the "Genesis" or idle state, addresses the natural lag between when capital is deposited and when it can be deployed into an underwritten GPU loan. To prevent this undeployed capital from creating a cash drag that would dilute overall returns, the protocol allocates these funds into U.S. Treasury Bills. This is accomplished through a dependency on the M0 protocol, which provides the onchain infrastructure to access T-Bill yields. Once a qualified loan is ready for funding, the capital transitions to the second stage: the "Sprawl" or active state. In this phase, the capital is deployed from the treasury pool to fund the GPU loan, and the high yield generated from the borrower's interest payments begins to accrue directly to sUSDai holders, marking the system's primary value-creation cycle. In its final, mature state, the protocol’s backing will be predominantly composed of hardware-backed loans. This will generate a high APY for sUSDai holders (13-17%+), but will also mean the token functions as a fully synthetic dollar with longer, variable redemption periods heavily reliant on the QEV mechanism to manage liquidity.

To solve the classic "chicken and egg problem" of attracting a critical mass of Total Value Locked (TVL) before a robust loan portfolio exists to generate yield, the protocol has introduced the "Allo" points program. This initiative is designed to bootstrap initial liquidity by rewarding early depositors with points that signal a claim on a future token launch. Holders of the liquid USDai token receive a 5x points multiplier, an allocation geared towards a traditional Initial Coin Offering (ICO) structure that will require KYC. In parallel, holders of the staked sUSDai token receive a 2x multiplier in addition to the protocol's base yield. This second track is aligned with a KYC-free airdrop, rewarding users who are willing to lock up capital and embrace the protocol's core yield-generating mechanism from the outset.

From Capital Provision to Redemption

The interactions within this dual-token economy are best understood by tracing the journey of its key participants. For a capital provider seeking to earn yield, the process is a deliberate two-step engagement. It begins by depositing a stable asset like USDT into the USD.AI protocol, which mints a corresponding amount of the liquid stablecoin, USDai. To access the protocol’s core return, the holder then stakes their USDai, receiving the yield-bearing sUSDai token in return. This newly staked capital is then allocated by the protocol into the active loan book, funding the acquisition of GPU hardware for borrowers. From this point forward, the sUSDai holder automatically accrues yield from the interest payments on these loans, with their sUSDai acting as a liquid claim on a diversified, revenue-generating portfolio of real-world infrastructure.

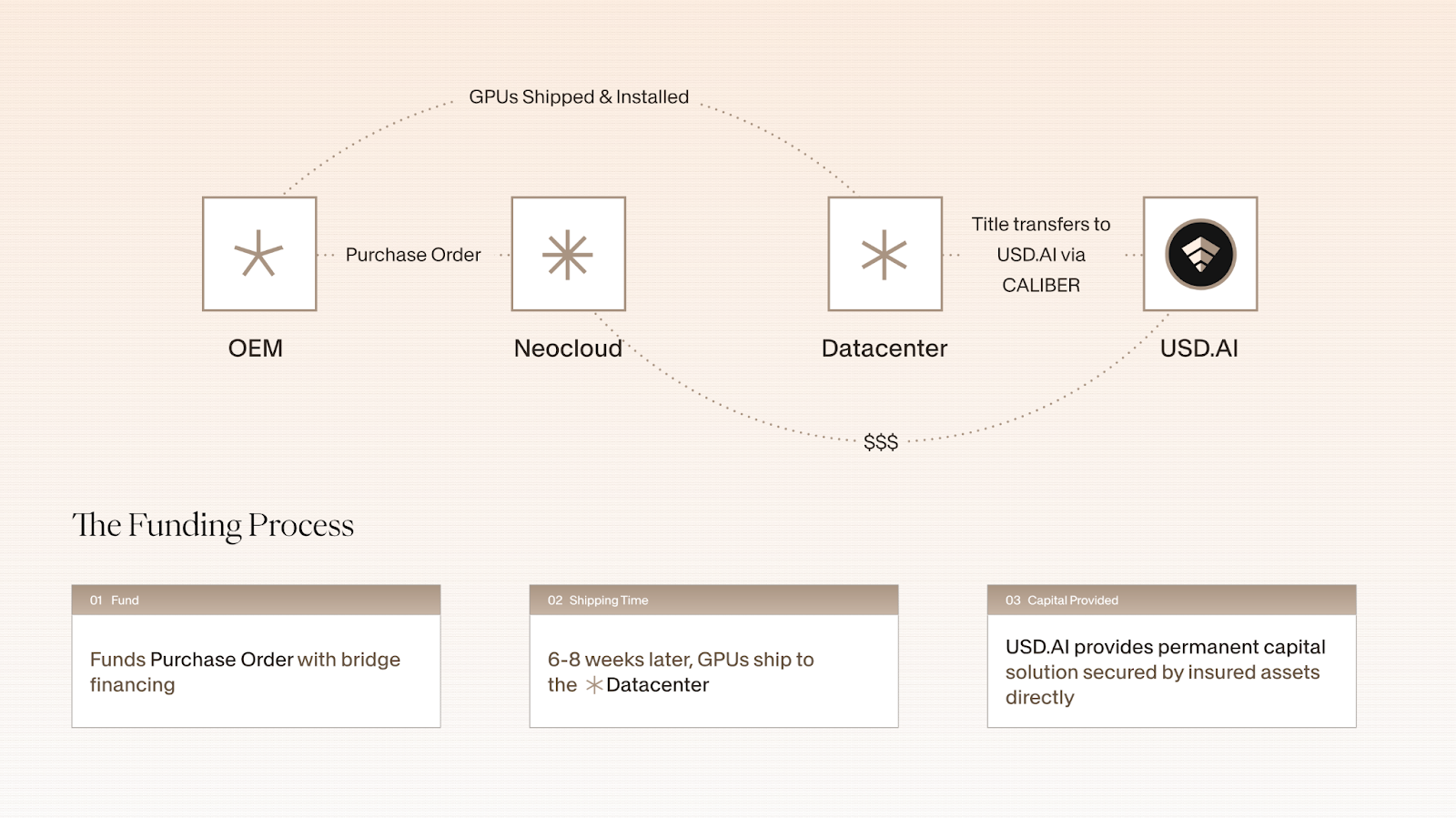

For a borrower, typically a GPU operator or data center, the journey starts offchain by working with a vetted FiLo Curator. The Curator is responsible for all aspects of due diligence, structuring the loan, and preparing the assets for collateralization under the CALIBER framework. Once approved, the loan is funded onchain by the protocol, and the borrower receives the capital — denominated in USDai — to acquire their hardware. They then begin making regular principal and interest payments back to the protocol as dictated by their loan terms. The result is the access to a global, on-demand liquidity pool that is more agile and efficiently priced than traditional financing channels, enabling them to scale their operations in lockstep with market demand.

The final stage of the lifecycle is redemption. When an sUSDai holder wishes to exit their position and reclaim their underlying USDC, they initiate a redemption request, which places them in the QEV queue. Here, they are presented with a clear choice that is a function of their time preference. They can choose to wait patiently in the queue, where their sUSDai will be redeemed at par as loan repayments naturally replenish the protocol’s liquidity reserves. Alternatively, if they require immediate liquidity, they can bid a market-driven fee to push their position in the queue above the other market participants. By making the cost of immediacy explicit, the QEV mechanism allows urgent users to exit without imposing that cost on the broader system, and rewarding patient holders who provide the exit liquidity.

Risk Mitigation Framework

Engaging with the USD.AI protocol requires a fundamental shift in risk assessment compared to typical DeFi primitives. The protocol deliberately minimizes exposure to crypto-native risks, such as the extreme price volatility of collateral assets or the manipulation of onchain oracles, which have historically been the primary failure vectors in decentralized lending. Instead, USD.AI’s risk profile is dominated by a framework imported directly from traditional finance. The primary vectors of concern are no longer market dynamics native to blockchains but the long-established challenges of credit risk, operational integrity, and the enforceability of legal contracts. This re-orientation demands a more conventional analytical lens, one focused on the quality of underwriting and the robustness of offchain execution rather than onchain market phenomena.

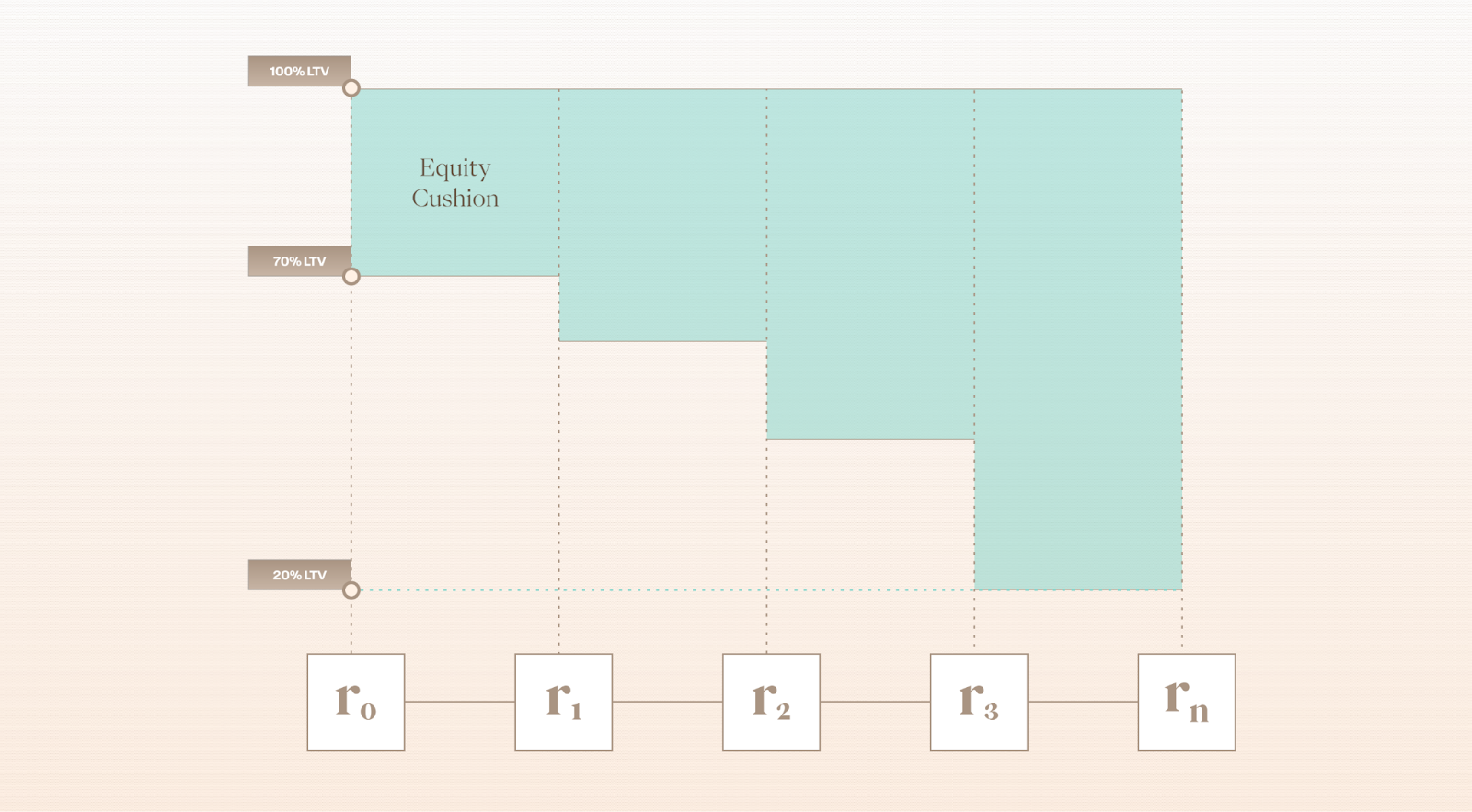

The most significant asset-specific risk facing the protocol is the accelerated depreciation of its GPU collateral. NVIDIA's aggressive, potentially even one-year, product release cycle threatens to devalue older hardware generations faster than conventional models might predict, causing the loan-to-value (LTV) ratios of outstanding loans to rise unexpectedly. The protocol employs a multi-layered strategy to mitigate this. The foundational backstop is the "Inference Will Dominate" thesis, which posits that older-generation chips retain a long tail of economic value for less demanding inference workloads, creating a durable secondary market. Structurally, loans are issued with conservative initial overcollateralization and feature aggressive amortization schedules designed to outpace the depreciation curve. Critically, the protocol forgoes a fixed algorithmic valuation model, instead relying on third-party market data and valuation experts to dynamically manage LTVs, ensuring they remain within acceptable bounds based on current, real-world conditions.

The primary liquidity risk for any lending protocol is a "bank run" scenario, typically triggered by a sudden loss of confidence that leads to a cascade of withdrawal requests. The USD.AI architecture is uniquely designed to neutralize this threat. The QEV mechanism makes a traditional, immediate bank run structurally impossible. Instead of promising instant liquidity it cannot guarantee, the protocol transforms a potential liquidity crisis into a manageable and market-priced process. By placing all redemption requests into a time-gated queue serviced by predictable loan repayments, QEV ensures the protocol's solvency is never threatened by the velocity of withdrawal demand. The cost of immediacy is borne entirely by those who demand it, who can sell their queue position to other market participants, while patient holders are shielded from the negative externality of a liquidity crunch.

While asset and liquidity risks are structurally contained, the protocol’s most significant and opaque risk vector lies in its dependence on offchain execution. This introduces a range of counterparty and operational risks, primarily centered on the performance of its human-in-the-loop partners. The most direct threat is borrower default, where a financed entity fails to meet its repayment obligations. This is compounded by the risk of Curator failure, where a FiLo Curator could become insolvent or fail to perform its duties in underwriting and servicing the loans. Finally, there is the physical operational risk associated with the repossession and remarketing of collateral in a default scenario, which can be complex and subject to delays. The protocol’s primary mitigants are legal and structural. The CALIBER framework is designed to create bankruptcy remoteness for the assets, insulating them from the financial distress of the borrower. The FiLo Curator model directly aligns incentives by placing Curators in a first-loss capital position, while integrated insurance policies provide a further backstop against defaults.

External Risk Factors

A low-probability, high-impact tail risk to the protocol's collateral thesis is the potential erosion of NVIDIA's CUDA software moat. Currently, CUDA's deep integration and extensive developer ecosystem create a powerful lock-in effect, ensuring NVIDIA hardware retains significant value. However, the emergence of a viable software competitor, such as a mature version of AMD's ROCm or a new open-standard framework, could eventually alter this dynamic. While such a breach would not render CUDA obsolete overnight, it would bifurcate the market. This would introduce true hardware interchangeability, significantly depressing secondary market values for NVIDIA GPUs by removing the premium conferred by their exclusive software advantage and reducing the overall value stability of the collateral pool.

The secondary market for high-end GPUs is a global one, but its structure has been reshaped by geopolitical forces. U.S. export controls on advanced AI chips have effectively removed China, previously a major destination for used hardware, as a legitimate buyer in the secondary market. This has a significant second-order effect on collateral recovery values. The removal of such a large source of demand could lead to a supply glut of used hardware in non-restricted markets. This structural oversupply would depress the prices that a lender can achieve through official IT Asset Disposition (ITAD) channels, potentially lowering the recovery value of repossessed collateral below initial underwriting assumptions.

The process of repossessing and liquidating physical collateral is not frictionless; it involves material costs that can significantly erode the net recovery value. These operational costs are multifaceted and must be factored into any realistic LTV calculation. They include legal fees to enforce security interests, logistical costs for de-racking, packaging, and transporting servers, and fees for certified data destruction to comply with privacy regulations. Specialized ITAD firms that remarket the assets typically charge fees of around 30% of the gross sale price. Compounding these explicit costs is the condition modifier risk: a borrower in financial distress may neglect routine maintenance or even intentionally damage the equipment, further reducing its market value upon recovery.

USD.AI in the Financial Landscape

To fully appreciate the architectural novelty of the USD.AI protocol, it is essential to contextualize its design against the established paradigms it both borrows from and seeks to improve. The protocol does not exist in a vacuum; it is a deliberate synthesis of concepts from decentralized finance and the structured credit markets of traditional finance. By comparing its core mechanics to Asset-Backed Securitization (ABS), we can precisely identify where USD.AI innovates and the unique trade-offs it introduces.

In essence, USD.AI can be understood as an attempt to re-architect the entire ABS issuance and servicing pipeline on public blockchain rails. In a traditional ABS structure, a long chain of costly intermediaries — originators, issuers, underwriters, trustees, and servicers — are required to bundle loans and issue securities. This process is notoriously opaque, with investors receiving only summary-level data, and the resulting instruments are highly illiquid, accessible only to institutional players.

USD.AI systematically fights these inefficiencies. It replaces the chain of intermediaries with smart contracts, changing the structure of the process and reducing operational costs. It substitutes opacity with the radical transparency of an onchain ledger, where every loan's status is verifiable in real-time. Finally, it transforms an illiquid, institution-only instrument into sUSDai — a fungible, composable ERC-20 token that is globally accessible and tradable on decentralized exchanges. This represents a fundamental upgrade in the efficiency, transparency, and accessibility of structured finance.

USD.AI deliberately forgoes the crypto-native risks of DeFi money markets, but in doing so, it imports the credit and operational risks inherent to traditional structured finance. Simultaneously, it leverages the native features of public blockchains to export radical transparency and efficiency into the opaque and inefficient world of asset-backed securitization. This hybrid model creates a novel risk and return profile, one fundamentally distinct from any existing protocol in either the decentralized or traditional financial landscapes. It is neither a better crypto money market nor simply a tokenized security, but a new financial primitive built at the intersection of both worlds.

A New Primitive for the InfraFi Paradigm

The combination of the CALIBER, FiLo, and QEV primitives forms a remarkably coherent architecture for financing real-world assets onchain. The protocol’s design is not merely a collection of features but a sophisticated, interdependent system engineered to solve the specific challenges of illiquid collateral. Its primary strength lies in unlocking a new and sustainable source of non-crypto-native yield, directly tapping into the profound economic engine of the artificial intelligence industry fueled by GPUs. By creating a transparent and efficient conduit between onchain liquidity and physical infrastructure, USD.AI establishes a powerful new model for decentralized finance.

Beyond its initial focus on GPUs, the architectural stack pioneered by USD.AI presents a generalizable blueprint for a new InfraFi thesis. The same principles of legally-grounded tokenization, aligned underwriting, and time-priced liquidity could logically be extended to other classes of cash-flow-generating infrastructure, such as telecom towers, renewable energy assets, or DePIN networks. The key bottleneck to realizing this expansive vision, however, is not technological. The core challenge lies in the complex business development task of identifying, vetting, and capitalizing expert Curators in each new asset vertical. Scaling the InfraFi paradigm is ultimately a human capital problem, dependent on attracting domain-specific expertise, not simply replicating smart contracts.

For the protocol to achieve viability at scale, it must successfully navigate several formidable hurdles. The legal framework, while innovative, relies on an untested application of UCC Article 7 that has yet to be challenged in court. On the market front, USD.AI faces intense competition not only from other DeFi protocols venturing into RWAs but also from sophisticated and deeply entrenched private credit firms. The protocol will inevitably face intense regulatory scrutiny, with a high likelihood that its yield-bearing sUSDai token will be classified as a security in key jurisdictions. Ultimately, however, the entire edifice rests on the sharpest point of risk: a profound dependence on the flawless offchain execution by its trusted human partners, from Curators to legal enforcement.

The USD.AI protocol represents an ambitious experiment in the ongoing evolution of decentralized finance. It is a test of whether the native transparency and efficiency of blockchains can truly discipline the inherent complexities of real-world credit and operational risk. Scaling the GPU loan allocation will provide invaluable lessons on the true challenges and opportunities of bridging the digital asset economy with the physical world. The outcome will ultimately depend as much on the meticulous work of lawyers and operators as it does on the code of developers and smart contracts, marking a paradigm shift in how value and risk are managed at the frontier of finance.

About Piotr Kabaciński

Piotr is a Senior Researcher at Stablewatch focused on in-depth research and developing risk models for innovative stablecoin solutions. He holds a PhD in Ultrafast Spectroscopy from Politecnico di Milano, and has coauthored over 15 high-impact papers in leading scientific journals. He has worked in DeFi as an investor for venture capital firms Geometry and Synergis Capital, founded a startup, and worked as a Quantitative Researcher at Luban.