Ubyx - Singleness of Money for Stablecoins

Having recently launched their whitepaper (March 2025) Ubyx has made waves across the stablecoin ecosystem. This article will give you an overview of their novel approach to solving one of the industry’s most prevalent issues. Something that has played a large role in stablecoins not achieving mainstream adoption – singleness of money.

Ubyx was founded by Tony McLaughlin an ex-TradeFi executive, holding many accolades in the digital payments space, having been the originator of the Regulated Liability Network concept and one of the instigators of the Bank of International Settlement’s Project Agora. Ubyx emerges as a potential centrepiece in the future of the stablecoin landscape, ushering in an era where stablecoins have become ubiquitous, a general-purpose method for digital payment.

Ubyx recently secured a $10 million seed round led by Galaxy Ventures with participation from Coinbase Ventures, Founders Fund, Paxos, LayerZero and VanEck among others. This shows significant industry confidence in the platform's disruptive potential and Ubyx now has a sizeable amount of dry powder to build out their vision.

Mike Giampapa, General Partner at Galaxy Ventures, stressed the platform's potential:

"Stablecoins become ubiquitous when there is a shared acceptance network, just like cards. Traditional banks and fintechs should provide wallets to accept a wide range of regulated stablecoins on many public-permissionless blockchains"

Two months ago, we released the Ubyx Whitepaper. Today, we announce a $10M seed round led by Galaxy Ventures, with participation from Coinbase Ventures, Founders Fund, VanEck, and industry stakeholders to deliver the global clearing system that will unlock stablecoin ubiquity. pic.twitter.com/XT8QwSxRlL

— Ubyx (@ubyx_) June 17, 2025

The Vision: From Fragmentation to Ubiquity

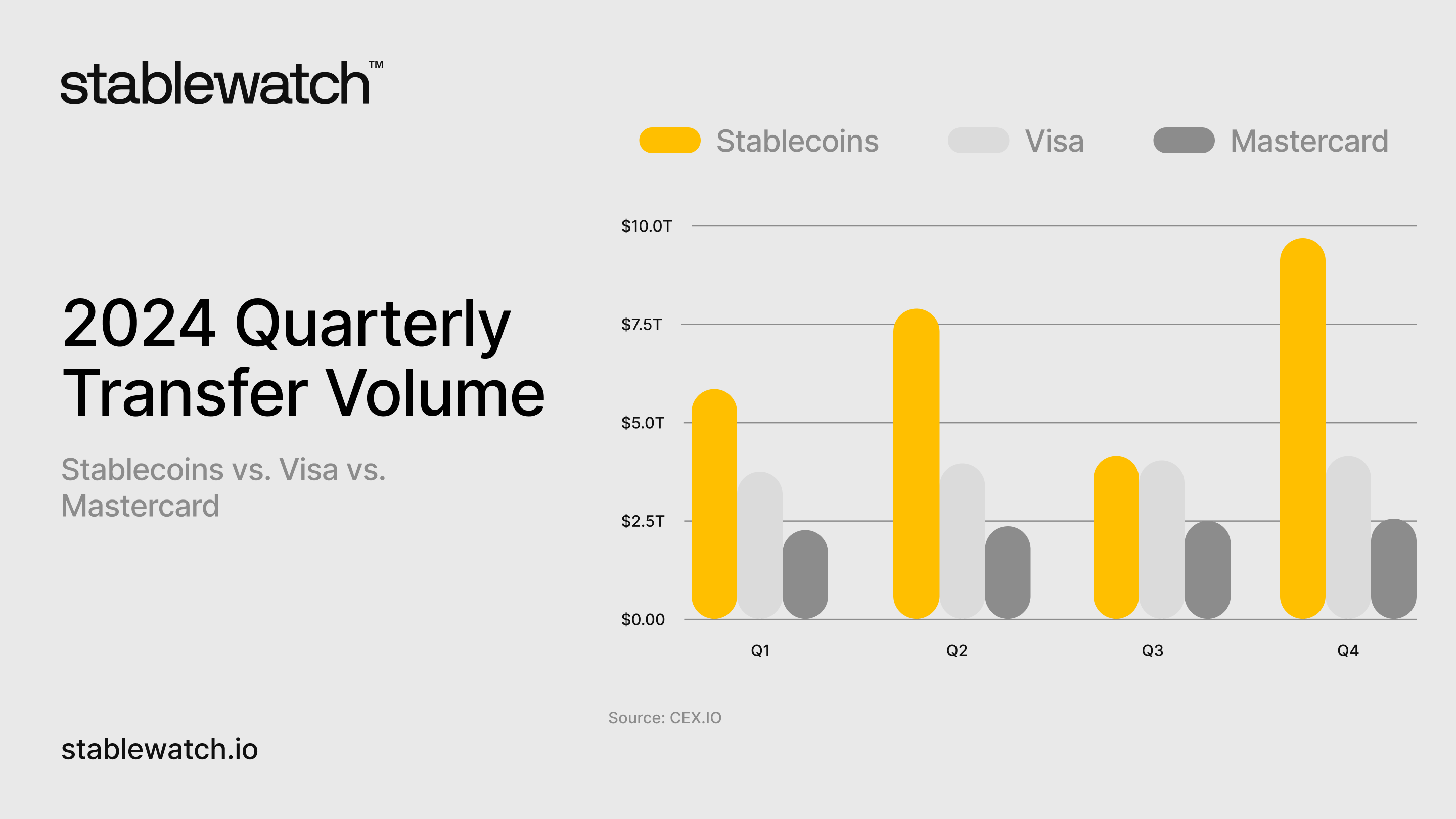

The stablecoin market has seen tremendous growth in recent years with annual transfer volumes reaching $27.6 trillion in 2024, surpassing the combined volumes of Visa and Mastercard by over 7.68%. However despite this immense scale, stablecoin payments remain siloed from the world of traditional payments resulting in significant barriers to entry for mainstream adoption. Currently redemption is limited to CEXs or a direct relationship with issuer, which is a luxury afforded only by institutions and comes with a 0.1% redemption fee (any amount with Tether, above $15M daily with Circle).

Ubyx addresses this serious bottleneck with a clearing system that enables banks and fintechs to redeem stablecoins from multiple issuers at face value directly into their deposit accounts. This fundamentally transforms stablecoins from just crypto assets into true digital cash equivalents.

Ubyx Implementation

Core Platform

In the purest sense, Ubyx is a many to many clearing house that coordinates transactions between a diverse array of counterparties including: stablecoin issuers, financial institutions, and settlement banks.

At the core of it is the Ubyx platform which serves as the orchestration layer connecting network participants and managing the redemption process across multiple stablecoin variants and issuers, handled via a standardised set of APIs.

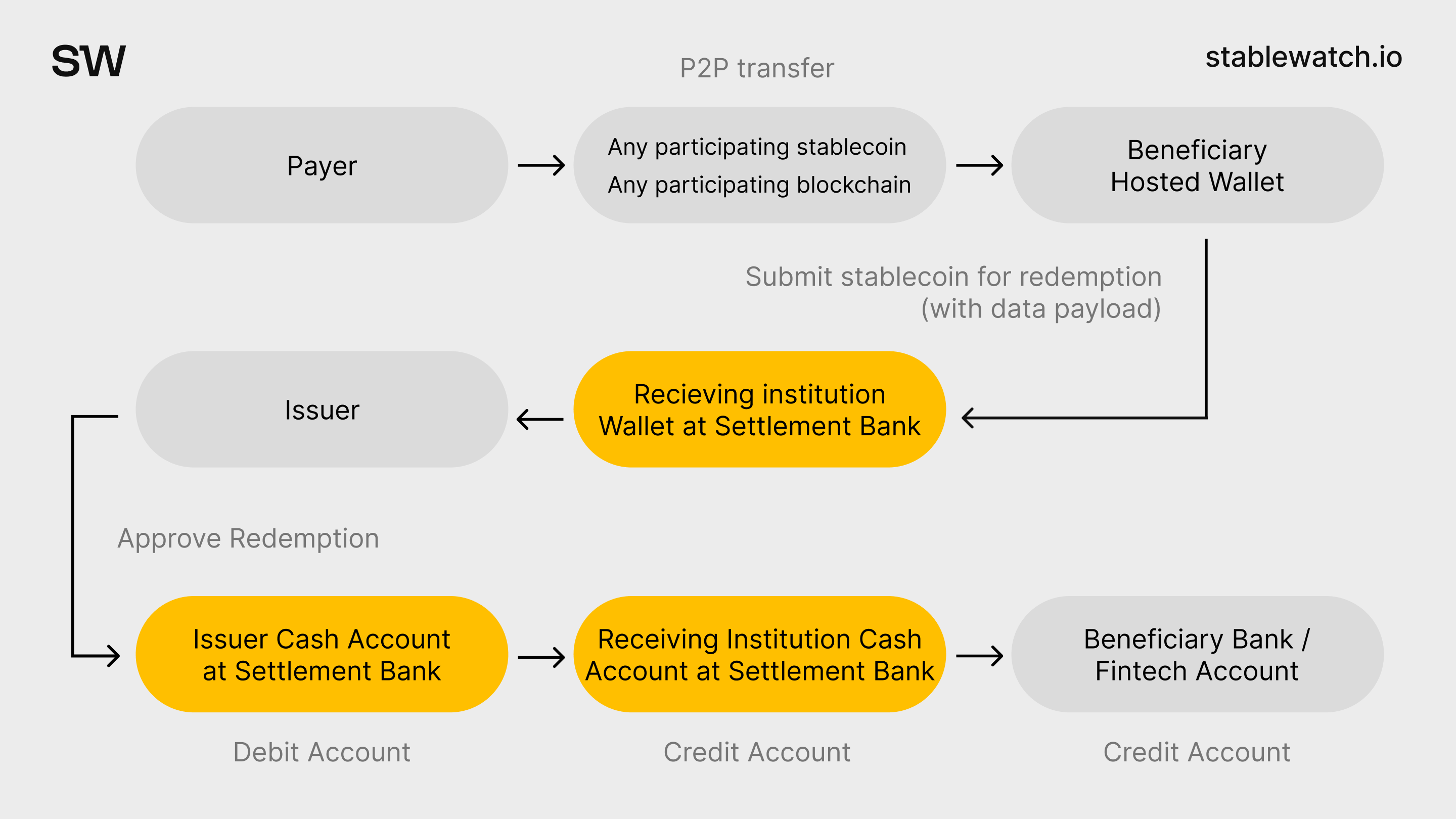

Redemptions would follow this structure:

- Send stablecoins to a wallet of a chosen financial institution. Ubyx Trust Mark on both sides of the transaction ensures payment will be accepted.

- Ubyx protocol subsequently routes the stablecoins to the relevant issuer from the institution's wallet through a settlement bank.

- Stablecoins are submitted along with a data package in order to satisfy verification requirements.

- Ubyx platform orchestrates the movement of funds from issuer pre-funded accounts to the beneficiary institutions on a 24/7 basis across the books of a settlement bank.

- Detailed redemption information is provided to receiving institutions for customer account crediting using the ISO20022 data model.

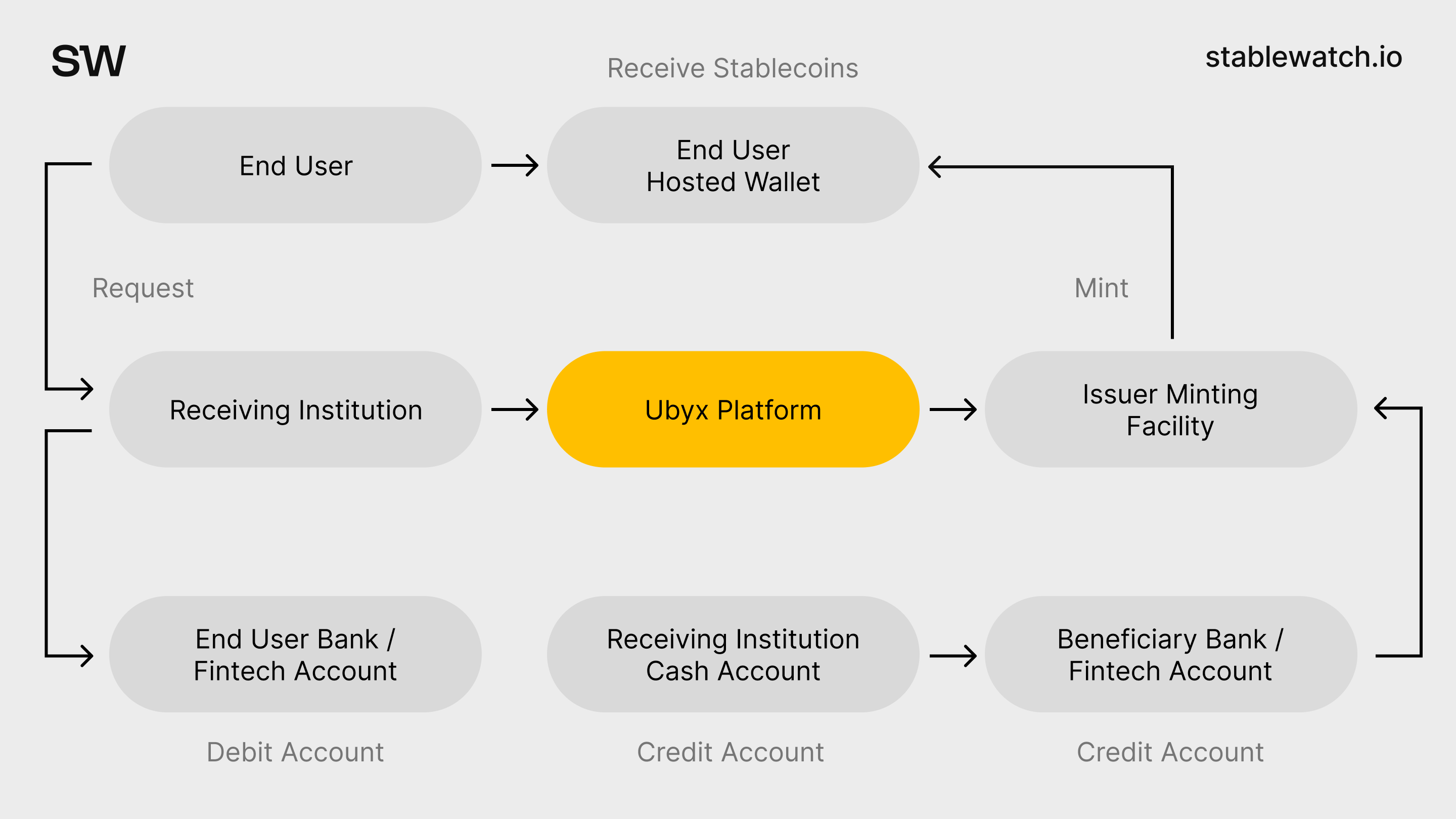

Minting would follow this structure:

- User requests to buy stablecoins through their bank or fintech

- The bank or fintech submits the minting request via Ubyx, specifying the stablecoin issuer and amount.

- Ubyx routes the request to the issuer’s minting facility, ensuring compliance with local regulations.

- The user’s bank account is debited, and the corresponding funds are credited to the stablecoin issuer’s account.

- The issuer mints the requested stablecoins and deposits them directly into the user’s hosted wallet.

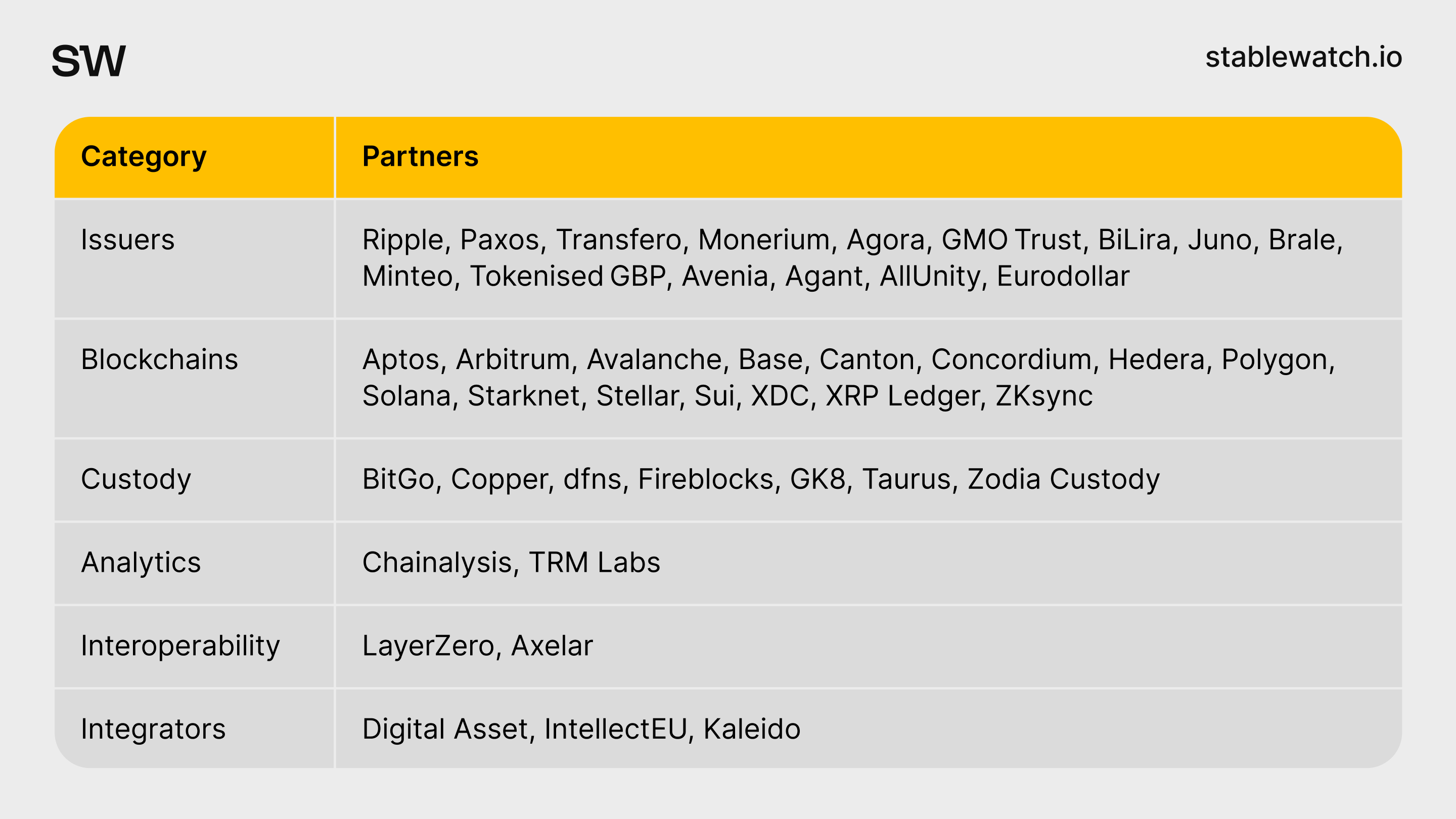

Institutional hosted wallets will be provided by Ubyx through a range of already established partners: BitGo, Copper, Dfns, Fireblocks, GK8 by Galaxy and Taurus. Creating the capability for financial institutions to accept stablecoin payments and give access to tools like Chainanalysis necessary to detect financial crime.

Supplementary Features

The Ubyx Rulebook will be developed as an open source Github project in tandem with the community. It will establish standards for issuers, receiving institutions, and participating blockchains, service-level expectations for near real-time processing, reserve and liquidity standards for reliable redemption, and processes for handling exceptions and resolving disputes.

The Ubyx Trust Mark for wallets and issuers provides a degree of trust within the industry relieving due diligence efforts and establishing a recognisable brand to ensure collective assurance from all network participants of rulebook and regulatory compliance. Just as the Visa and Mastercard logos serve as trusted signals in TradFi, Ubyx intends the Trust Mark to evolve into a symbol of credibility for stablecoins.

The Ubyx Association will serve as the ecosystem’s collaborative forum, facilitating governance of the protocol among the participating institutions, regulatory bodies and stakeholders. Association activity would cover development and amendments to the Ubyx Rulebook, regulatory and government engagement, and ecosystem expansion.

Protocol Decentralisation

Ubyx plans to democratise access to the global redemptions and payment network for stablecoins through a DAO model. Token holders would gain the ability to propose and vote on amendments to the Ubyx Rulebook. Beyond governance, the Ubyx token would serve as a means of payment for fees associated with stablecoin redemptions, membership, and transactions.

In addition to the DAO, Ubyx plans to decentralise the protocol through a phased approach. Initially the platform will begin as a largely centralised system akin to traditional clearing infrastructure, in order to build trust with regulators and TradFi institutions through already proven frameworks. However, progressive decentralisation is intended for the protocol by becoming an L1 or L2 chain (to be decided).

Ubyx Lending Facility

Controlled by the Ubyx DAO, the Lending Facility will provide a supra-issuer liquidity mechanism – a shared pool of liquidity, designed to offer short term support during cases of market dislocation. Funded through the Ubyx Token and levies on transaction processing, it will offer a safety net to issuers. The lending facility will be enacted during periods of high redemption flows to prevent them spiraling into a crisis. An issuer would request a loan to be evaluated under a Ubyx protocol risk framework, the loan would be denominated in stablecoins and be time bound. Only the issuers with sufficient Ubyx token holdings will be given access to the short term lending facility.

Regulatory Compliance

Compliance is a core foundation of the Ubyx approach in their mission to allow stablecoins to achieve singleness of money. To that end the platform ensures that all redemptions occur through regulated financial institutions with robust KYC and ALM frameworks. Every transaction will be screened by up to four regulated entities including: the receiving institution, settlement bank, custodian and issuer.

Ubyx enables stablecoins to be treated as a true digital cash equivalent, through the IAS7 international accounting standard. This will be achieved through issuers maintaining dedicated cash reserves at Ubyx nominated settlement banks and a standardisation of redemption processes. Hence creating factual evidence necessary for accounting bodies to classify stablecoins as cash equivalents.

Innovation Pipeline

Subsequently to the launch of Ubyx there is a series of additional products planned for development by Ubyx Labs which will include:

Ubyx Auth: Direct integration with mobile wallets enabling sub-second authorisation requests from payment services providers to issuers for payment approval to support native stablecoin adoption for merchants.

ERP to ERP Data Transfer: Granting stablecoin transfers the ability to exhibit the features of wire transfers by sending associated data under the ISO20022 standard along with payments.

Confirmation of Payee (CoP): Addressing Authorised Push Payment (APP) fraud by allowing payers to verify they're making payments to the intended party.

Request to Pay: Adding functionality for payee-initiated payments, which would support stablecoin adoption for bill payments and recurring subscriptions.

Market Momentum

The value of Ubyx as a payments and redemptions network lies in their ability to secure a vast array of industry partnerships. Thus far they have been successful in this pursuit amassing a significant amount of backing. Their announced partnerships are detailed below:

Author’s Perspective

Their expansive vision to bridge stablecoins with the world of TradFi payments is as ambitious as it is necessary in order to facilitate mass adoption and usher in the stablecoin epoch. As stated by McLaughlin this would be characterised by universal acceptance across financial institutions, similar to how cash, electronic payments, and cards became ubiquitous in their respective eras.

This however will not come without its challenges.The stablecoin duopoly of Tether’s USDT and Circle’s USDC is currently noticeably absent from the list of Ubyx’s partners. This wary approach from the industry incumbents is well founded, as they have established iron clad facilities to isolate them from any redemptions based regulatory risk, endeavouring to adapt to a new unproven model brings unjustifiable risk exposure. If Ubyx attains significant traction they are likely to follow suit, however this all depends on the team of largely TradFi actors whose main work in digital assets prior to Ubyx was the development of CBDC pilot projects. Will Ubyx alongside its industry partners be able to navigate the tumultuous waters of crypto markets? Their high profile backers seem to think so.

On the TradFi side however, I believe their journey will be far less difficult, due to the background of the team and the increasingly present feeling of FOMO within TradFi over the coming wave of stablecoin adoption. Now executive teams have an easy way of establishing meaningful connections with the crypto industry and justifying their stablecoin strategy to their respective boards by joining the Ubyx Association. This, in my opinion, is the most powerful feature of the Ubyx stack. If one is to look at history, it is precisely this way that major financial revolutions occurred. One of the very incumbents that stablecoins are aiming to displace – Visa, was created by an industry insider, Dee Hock, who was able to gather significant institutional support and create a network that forever changed how we conduct payments.

In general I am very hopeful for this project. I believe all the key components to truly make it a critical inflection point in the evolution of digital money exist. Building on the capabilities of existing infrastructure and standards providers, will allow Ubyx to be easily integrated into both the TradFi and onchain technical stack. The success of this approach could have far ranging consequences in accelerating the adoption of programmable money, enhancing financial inclusion, and creating more efficient cross-border payments and settlement. As the platform moves closer towards its Q4 2025 launch, I will be watching closely for whether Ubyx can achieve its grand vision.