The Crypto Payment Card Market: An In-Depth Analysis of its Role in Bridging Digital Assets and Global Commerce

Executive Summary

The crypto payment card market represents a critical intersection between the nascent digital asset economy and the established global financial infrastructure. This sector, now at a pivotal inflection point, is rapidly evolving from a niche retention tool for cryptocurrency exchanges into a key battleground for ecosystem supremacy and user custody. The core of this transformation lies in the ability to bridge two disparate financial worlds, offering real-world utility for digital assets by leveraging the ubiquitous payment rails of traditional finance.

The market is defined by a fundamental split along a philosophical and technical fault line. On one side are the custodial incumbents, such as Crypto.com and Coinbase, who prioritize convenience and a user-friendly experience to onboard the mass market. On the other, a new wave of non-custodial innovators including MetaMask, Gnosis Pay and Holyheld are championing the core Crypto principles of self-sovereignty and user control, building products that allow users to spend directly from their personal wallets.

Further compounding this dynamic is the emergence of a sophisticated B2B infrastructure layer. "Picks and shovels" players like Rain are providing the backend technology that enables other fintechs to launch their own card programs, while vertically integrated neobanks like Plasma One are building parallel, crypto-native financial systems from the ground up. This signals a market shift from simply bridging the old system to architecting a new one.

However, the entire ecosystem remains dependent on the payment rails of traditional finance giants Visa and Mastercard. This critical reliance creates a "Decentralization Paradox," forcing even the most ideologically committed non-custodial projects to adhere to conventional compliance standards like Know Your Customer (KYC). This compromise highlights the pragmatic trade-offs required to bring the principles of decentralized finance into everyday commerce.

The market is trending toward integrated financial hubs where the payment card is just one component of a broader suite of onchain services, including staking, borrowing, and yield generation. The growing demand for self-sovereignty, the need to solve for significant tax complexities, and the battle to provide the underlying infrastructure will be the defining competitive dynamics in the years to come.

Introduction & Market Context

The confluence of institutional demand, grassroots adoption, and maturing technology has created a fertile ground for crypto-powered payments. To grasp the scale of this opportunity, one must first consider the sheer size of the total addressable market. The global financial system currently processes an estimated $148 trillion in business and consumer payments annually, an infrastructure built over decades that sustains frictions acting as a tax on global economic activity.

Within this vast market, the real-world stablecoin payments segment has emerged, distinct from trading or inter-exchange transfers. After filtering out speculative trading and bot activity, the annual volume of stablecoins used for genuine economic transfers - such as remittances, B2B cross-border settlement, and consumer purchases - is estimated to be between $100-$300 billion. This confirms that stablecoin payments are no longer a niche experiment but a validated and expanding component of global commerce.

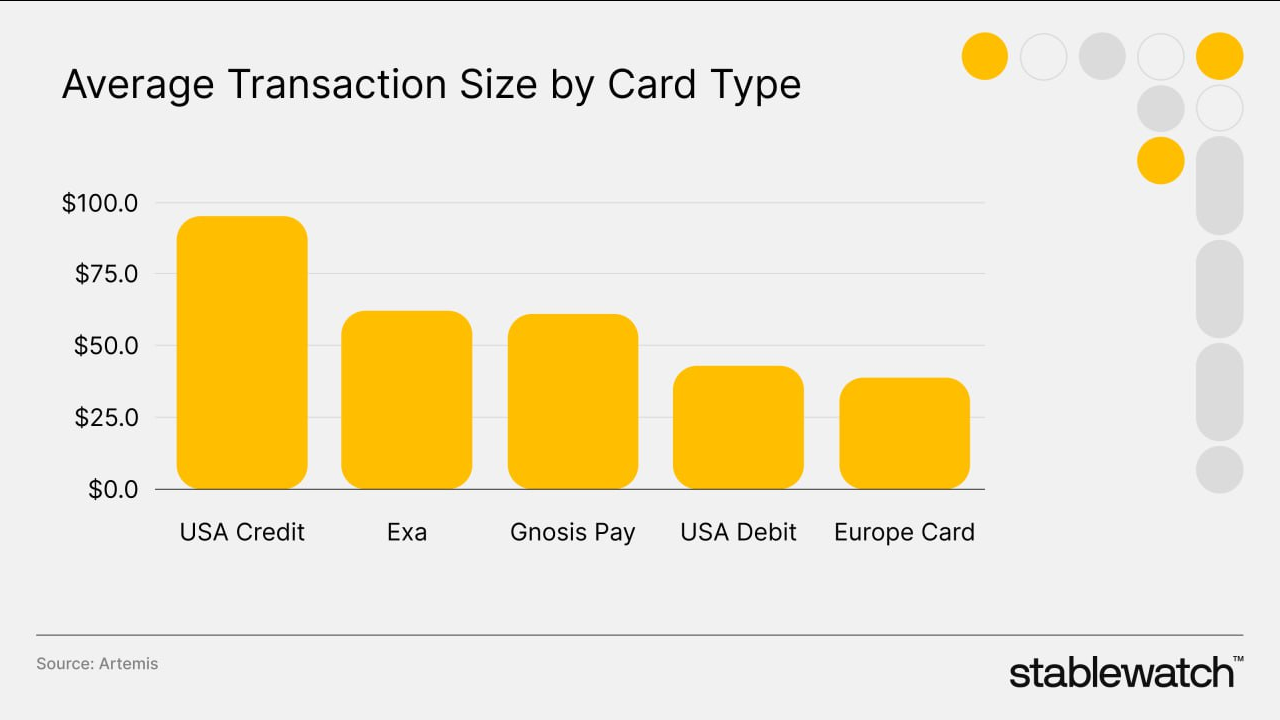

Card-based payments constitute a vital segment of this new economy. With an estimated annual run rate of $13 billion, crypto payment cards have proven their product-market fit as the primary off-ramp for converting digital assets into everyday purchasing power. They represent the most tangible and widely adopted bridge between onchain value and the physical world, leveraging existing merchant infrastructure to make crypto spending seamless.

This growth is increasingly being pulled by institutional and corporate demand, not just pushed by crypto-native supply. Recent survey data reveals tangible economic benefits are the primary motivators for corporate adoption: 52% of firms cite reduced transaction costs, while 45% are focused on faster cross-border payments. These are not marginal improvements; they represent a fundamental re-architecting of how businesses manage their finances.

The appeal for these larger entities extends beyond simple cost savings to the strategic advantage of 24/7 liquidity and real-time treasury operations. Onchain payments, particularly with stablecoins, dismantle the archaic system of "banking hours" and multi-day settlement windows. This allows a multinational corporation to move capital and settle invoices programmatically and instantaneously across time zones, unlocking working capital and solving the enduring frictions of traditional financial cut-off windows.

Robust market forecasts solidify the institutional outlook, positioning stablecoin growth as the foundational fuel for the entire ecosystem's expansion. Projections indicate that the total issuance of stablecoins is on a trajectory to reach between $1.9 trillion in a base case scenario and up to $4.0 trillion in a bull case by 2030. This projected surge in onchain liquidity will dramatically increase the capacity and relevance of all payment solutions built upon it, from B2B settlement platforms to consumer-facing cards.

While institutional demand pulls the market forward, the ecosystem's resilience is grounded in a powerful, global retail movement. This retail adoption, however, is not monolithic; it is driven by distinct regional needs and use cases. A clear geographic divergence has emerged between the developing and developed worlds, showcasing the multifaceted appeal of crypto-native finance.

In the emerging markets of Latin America, Africa, and Central & Southern Asia, crypto payments manifest as a vital tool for economic self-preservation. For millions of individuals facing high inflation and local currency devaluation, dollar-denominated stablecoins offer a crucial hedge, a way to preserve wealth outside of volatile and often restrictive domestic financial systems. Here, crypto cards are not a luxury but a critical utility, facilitating more efficient cross-border remittances and providing access to a global economic standard.

In contrast, adoption in the developed markets of North America and Europe is driven more by convenience, the "wealth effect" of crypto bull markets, and a desire for financial diversification. For users in these regions, a crypto card often serves as a seamless way to spend investment gains without the friction of off-ramping through a traditional bank account. It is less about necessity and more about integrating a new digital asset class into an existing lifestyle, providing access to innovative, DeFi-native reward structures and a more fluid financial experience.

Architecture & The Technology Stack

Core mechanics

To comprehend the competitive dynamics of the crypto payment card market, it is essential to first deconstruct its core architecture. The fundamental mechanism is a sophisticated financial process we can term the "Point-of-Sale Conversion Bridge." This system is designed to translate digital assets into fiat currency in real-time, allowing them to become a seamless medium of exchange within the existing global merchant infrastructure. Rather than requiring millions of retailers to adopt new payment systems, these cards make crypto spending invisible at the point of sale, solving the final-mile problem of adoption.

This entire process is enabled by a symbiotic, if somewhat tense, relationship with the titans of traditional finance: Visa and Mastercard. These payment networks provide the indispensable global acceptance rails, granting crypto cards access to tens of millions of merchant locations where their logos are honored. The crypto provider manages the digital asset side - custody, conversion, and funding - while the payment network handles the conventional aspects of authorization, clearing, and settlement. To the merchant, it is a standard card transaction; to the user, it is a direct payment from their crypto holdings.

Within this framework, products fall into three archetypes, each with a distinct funding mechanism. The most prevalent is the Crypto Debit Card, directly linked to a user's crypto balance, where funds are converted to fiat in real-time at the point of purchase - a model exemplified by the Coinbase Card.

In contrast, Crypto Prepaid Cards require users to proactively load funds onto the card before use. A user transfers a specific amount of cryptocurrency to the card provider, which is then typically converted into a stable fiat-equivalent balance held on the card itself. This model, employed by the Crypto.com Visa card, offers greater control over spending but introduces a preparatory step for the user.

Finally, the Crypto Credit Card model is emerging with increasing sophistication. While early versions simply offered spending rewards in cryptocurrency, innovative new products function as true DeFi-native instruments. The Ether.fi Cash card, for instance, allows users to borrow against their staked crypto assets as collateral for a line of credit, enabling them to spend without selling their underlying holdings and triggering a taxable event.

Beyond the functional differences of card types, the most profound distinction within the crypto payment card market is in the model of asset custody. This choice between a custodial and a non-custodial framework is not a technical detail but the market's defining fault line - a fundamental strategic and philosophical decision that dictates a provider's entire approach to security, user experience, and market positioning. It represents the central trade-off between the convenience of traditional finance and the sovereignty promised by Web3.

In the Custodial Model, the paradigm adopted by the first wave of major card providers, including Coinbase and Crypto.com. In this framework, a third party - the exchange or card issuer - holds and manages the user's private keys on their behalf. The primary advantage of this model is its convenience and user-friendliness. By abstracting away the technical complexities of key management, it provides a familiar user experience with safety nets like password resets and customer support, mirroring traditional banking and lowering the barrier to entry for newcomers.

This convenience, however, comes at a significant cost: the surrender of financial sovereignty. Users must trust the custodian to secure their funds, introducing significant counterparty risk. A user's assets are vulnerable to platform-level threats such as exchange hacks, corporate bankruptcy, or insolvency events. Furthermore, because the custodian controls the keys, they are subject to regulatory and legal orders, meaning user accounts can be frozen and assets seized by government authorities. This reality is succinctly captured by the enduring crypto community axiom: "not your keys, not your coins."

The Non-Custodial (Self-Custody) Model emerged in direct response, giving the user in sole possession of their private keys, typically stored in a software wallet like MetaMask. The paramount benefit of this approach, pioneered by providers like Gnosis Pay and MetaMask, is absolute user sovereignty. The user has complete and unfettered control over their funds, with no third party able to move, freeze, or seize their assets, thereby eliminating the counterparty risk associated with the provider.

With this total control comes total responsibility. The non-custodial model's primary disadvantage is that the user is solely responsible for the security of their private keys or the associated recovery phrase. If this information is lost or stolen, there is no recourse or recovery mechanism; the funds are permanently and irretrievably lost. This model demands a higher level of technical understanding and diligence, making it potentially intimidating for beginners.

Ultimately, this custody dichotomy serves as the primary axis of market segmentation. It reveals a provider's target audience and core philosophy. Custodial providers are building a bridge for the mass market, offering a Web3 product with a familiar Web2 safety net. In contrast, non-custodial providers are building an extension of Web3 into the physical world for the crypto-native or ideologically committed user, prioritizing the foundational principles of decentralization and self-sovereignty above all else.

Crypto card payment rails

To function, a crypto payment card relies on a sophisticated technology stack comprising three foundational layers: an onchain settlement layer for processing transactions, a smart contract layer for managing funds, and an offchain issuance layer for bridging to the traditional financial world. The architectural choices made at each layer define a card's performance, security, and strategic alignment.

The transactional demands of point-of-sale payments—requiring near-instant speed and negligible cost - render the Ethereum mainnet (Layer 1) both economically and practically unviable. Consequently, all non-custodial card providers have turned to Layer 2 (L2) scaling solutions. The choice of which L2 to build upon is a defining strategic decision. ZK-Rollups like Linea (used by MetaMask) are chosen for their high throughput and fast finality, inheriting the robust security of Ethereum. In contrast, sidechains like Gnosis Chain (used by Gnosis Pay) prioritize high decentralization and predictably low transaction fees. This dependency on a specific L2 has a profound strategic implication: the payment card is transformed from a simple product into a strategic instrument in the intense competition for ecosystem liquidity and user acquisition.

Moving up the stack, the smart contract layer provides the logic for how user funds are secured and accessed. Here, different architectures enable distinct value propositions. The Gnosis Pay card, for instance, is built upon the Gnosis Safe, a battle-tested multi-signature smart contract wallet that enhances security. Other providers leverage more advanced architectures; MetaMask is transitioning its wallets to a Smart Account (ERC-4337) standard, which enables features like gas abstraction and transaction batching to streamline spending. The most complex architectures are purpose-built for novel financial products, such as the cross-layer system used by Ether.fi, where high-value collateral is secured on Ethereum L1 while high-frequency borrowing and repayment occur on an L2 (Scroll).

The final, critical layer is the one that connects the onchain world to the traditional financial system is the issuance layer. This is the offchain infrastructure that handles the conversion of a user's crypto into a fiat payment that a merchant can accept. This bridge is built upon the technology of Modern Card Issuing Platforms, which operate on a Card-as-a-Service (CaaS) model. These platforms, of which Rain is a prime example in the crypto space, provide an API-driven infrastructure that allows any company - from a global crypto exchange to a new DeFi protocol - to launch a branded payment card. The CaaS provider acts as the essential middleware, managing the complex three-way integration between the crypto company, a licensed partner bank (which is often the formal card issuer), and the payment network (Visa or Mastercard).

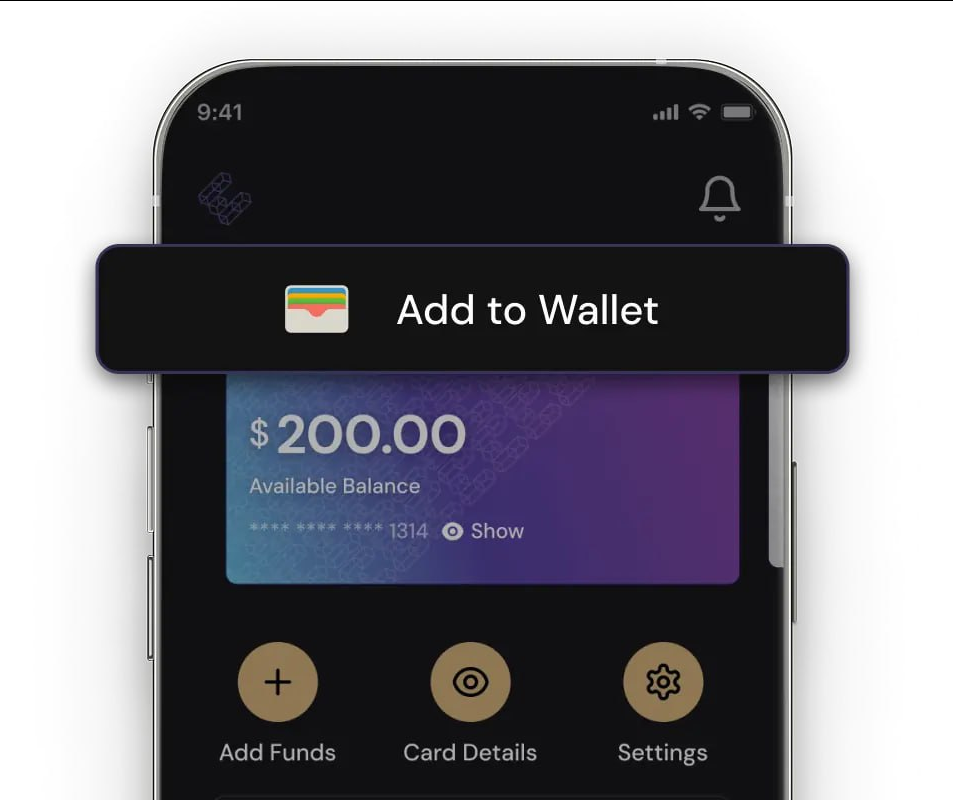

This CaaS model is what enables "Digital-First Issuance," a feature that is particularly vital for crypto payment cards. A user who completes an online KYC process for a digital product expects an immediate digital experience. Upon approval, the CaaS platform instantly provisions a virtual card directly within the crypto provider's mobile app. This virtual card can be immediately added to a mobile wallet like Apple Pay or Google Pay, allowing the user to begin spending their crypto assets within minutes. This seamless onboarding fulfills the core promise of instant utility and makes the physical card, which arrives later by mail, a secondary convenience rather than a primary necessity.

The Competitive Landscape

The incumbents (custodial card model)

Crypto.com card

The first wave of crypto payment cards was dominated by large, centralized cryptocurrency exchanges, which successfully leveraged their existing user bases and deep liquidity to introduce cards as a powerful tool for user engagement. A flagship product in this category is the Crypto.com Visa Card, which epitomizes a strategy of deep ecosystem integration and gamified user incentives. By transforming abstract portfolio balances into real-world purchasing power, it provided a crucial, tangible bridge between the nascent digital economy and the physical world of commerce.

The Crypto.com card operates on a prepaid model, requiring users to top up a fiat-equivalent balance on the card from their primary crypto wallet within the app before making a purchase. This preparatory step distinguishes it from a true debit card, but it is a foundational component of its business model, which is one of gamified loyalty, carefully designed to draw users deeper into its ecosystem and maximize their long-term value to the platform.

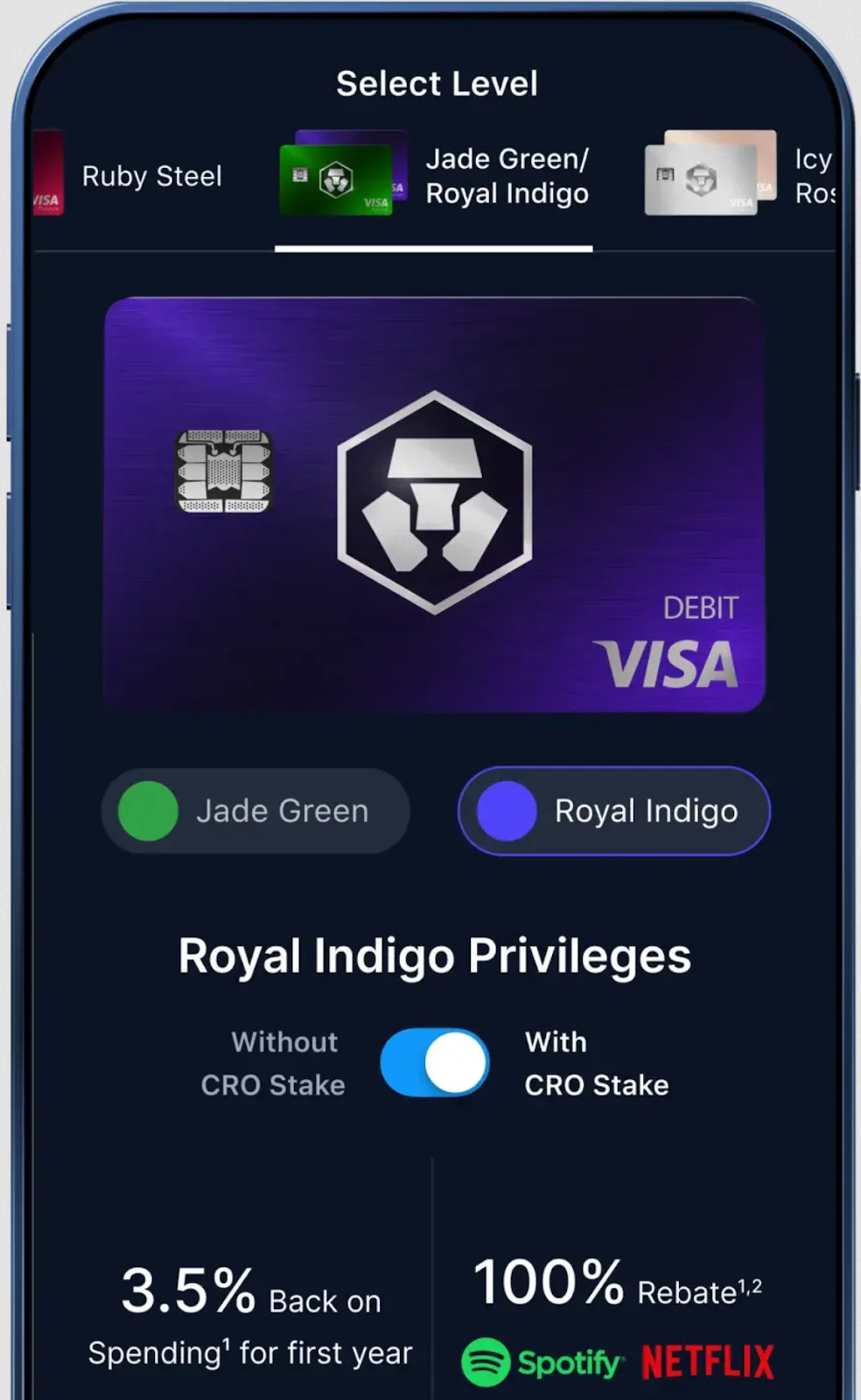

An elaborate tiered system forms the foundation of the card’s value proposition, directly correlating benefits to the amount of staked CRO, the platform's native utility token, that a user is willing to stake for an extended period. This creates a clear, aspirational ladder for users to climb. The journey begins with the free "Midnight" card, which offers no spending rewards, and ascends through tiers like "Ruby" and "Royal Indigo" all the way to the premium "Obsidian" tier, which requires a significant capital commitment.

The rewards scale aggressively with each tier. Users can earn escalating cashback rates that climb as high as 8% back on spending (paid in the CRO token). These direct rewards are complemented by a suite of lifestyle perks, most notably full monthly rebates for popular subscription services like Spotify and Netflix on mid-tier cards, and premium travel benefits such as unlimited airport lounge access for higher tiers.

This model represents a powerful incentive mechanism for fostering high user stickiness. By tying tangible, real-world benefits to the act of buying and holding the CRO token, Crypto.com effectively transforms its cardholders from simple users into long-term stakeholders in its platform's success. This creates significant switching costs and deeply entrenches the user within a single, vertically integrated financial ecosystem, maximizing their lifetime value.

Accessing these benefits, however, involves a complex fee structure. While the card has no annual fee, users face charges for ATM withdrawals above the monthly free limit (which varies by tier) incur a 2% fee. Topping up the card balance can also come with costs, including fees for using a debit or credit card. Furthermore, lower-tier cards are subject to foreign transaction fees, and an inactivity fee can be charged after 12 months of no use.

A key competitive advantage for Crypto.com has been its aggressive global rollout strategy. The card boasts one of the most extensive geographic footprints in the market, with availability across the United States, Canada, the United Kingdom, and a wide array of countries in Europe, Asia, and Latin America. This broad reach allowed it to capture a diverse, global user base early in the market's development.

Coinbase card

In contrast to the gamification of its competitor, Coinbase entered the market with a Visa debit card that pursues a strategy of trust, simplicity, and brand recognition. Rather than architecting a new suite of ecosystem-specific incentives, Coinbase chose to leverage its most powerful asset: reputation as the most recognized, well regulated, and publicly traded crypto exchange in the United States. This positions its card offering as a secure and straightforward extension of a platform that millions of users already trust with their assets.

Unlike a prepaid card, the Coinbase Card functions as a true debit card, drawing funds directly from a user's account balance at the moment of purchase. This removes the friction of having to proactively top up a separate card balance, offering a more seamless spending experience. The user simply designates a specific cryptocurrency from their portfolio as the active spending asset, and the conversion happens automatically at the point of sale.

The business model reflects this focus on simplicity, monetizing primarily through a clear and direct conversion spread. For any purchase or ATM withdrawal funded by cryptocurrency (with the exception of the USDC stablecoin), the platform charges a flat 2.49% "Coinbase Wallet Currency Conversion" fee. This model forgoes complex staking requirements and tiered benefits in favor of an easy-to-understand product that integrates seamlessly with its trusted custodial platform, though the transactional cost is significant.

The card's rewards program is similarly straightforward, providing flexibility without requiring long-term capital commitment. It offers a variable percentage back on purchases, paid out in a rotating selection of cryptocurrencies that the user can choose from within the app. While not as high as the top-tier offerings from staking-based competitors, this model allows users to passively diversify their holdings or accumulate more of a favored asset simply through their daily spending.

This strategy deliberately targets a more risk-averse user base that values security and brand reputation over the potential for higher, more complex rewards. The target audience includes newcomers to the crypto space taking their first steps beyond simple trading, as well as existing Coinbase exchange customers who want a low-friction way to spend their assets. For these users, the convenience of spending directly from their primary exchange account, backed by Coinbase's institutional-grade security, outweighs the explicit transactional cost.

In line with its compliance-first approach, Coinbase has pursued a more focused geographic rollout compared to some of its rivals. The card's availability is concentrated in its core markets, primarily the United States and key Western European nations. This measured expansion strategy ensures that the product operates within well-established regulatory perimeters, reinforcing its brand identity as a trusted and reliable bridge to the digital asset economy.

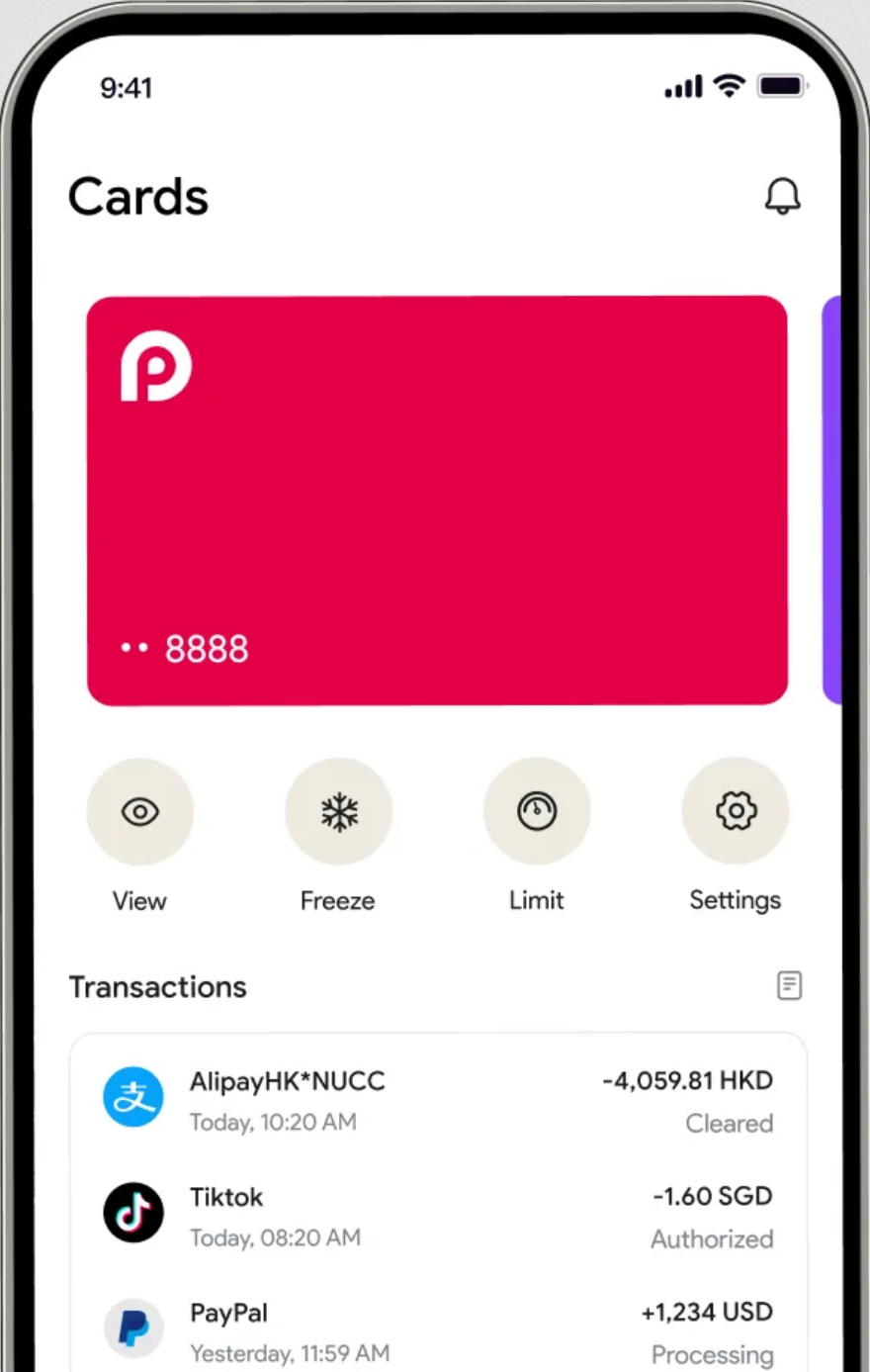

RedotPay Card

Carving out a distinct niche between the complex loyalty programs of Crypto.com and the simplicity of Coinbase is RedotPay. This provider enters the market with a utility-driven model centered on stablecoins and what can be termed "DeFi-lite" services. Its card offering is positioned not just as a spending tool, but as the front-end for a suite of accessible, yield-generating financial products, effectively creating a bridge for users who are intrigued by DeFi but not yet ready for self-custody.

RedotPay’s value proposition is to offer the functional benefits of decentralized finance - such as earning interest on holdings or borrowing against assets - within the safe and familiar environment of a simple, custodial application. The platform features an "Earn" account for generating daily interest on stablecoin deposits and a crypto-backed credit line. This allows users to experience a version of yield farming and collateralized lending without having to navigate the technical complexities and security responsibilities of interacting with onchain protocols directly.

The utility-first approach directly informs its market positioning, which includes an explicit "no staking required" policy. This is a clear competitive response to the capital-intensive model of Crypto.com, designed to target a segment of users who desire flexibility and are unwilling to lock up their capital in a platform-specific token to unlock benefits. Instead, RedotPay offers rewards and utility based on the user's direct engagement with its financial products, appealing to a more utility-focused consumer.

The business model combines one-time application fees for its virtual and physical cards and competitive transaction fees. While specific rates can vary, this structure avoids the need for long-term financial commitment from the user. This is complemented by a focus on high utility, with the company advertising high spending limits of up to $100,000 per transaction, catering to both everyday users and high-net-worth individuals.

Ultimately, RedotPay's strategic position is that of a pragmatic stepping stone into the world of more advanced crypto finance. It serves as an accessible bridge for users who have graduated beyond simple buying and selling on an exchange but are not yet prepared to take the leap into the decentralized, self-sovereign world of DeFi. By offering a centralized version of a DeFi experience, it captures a valuable and growing segment of the market that prioritizes functional utility and ease of use.

KAST card

While providers like RedotPay focus on optimizing the payment medium, others are tackling a different, yet equally significant, point of friction: the fragmented nature of a user's onchain portfolio. The modern crypto-native individual rarely holds assets on a single blockchain. Their capital is often distributed across Ethereum, various L2 solutions, and alternative L1s like Solana. KAST is engineered to resolve this very friction, positioning itself as a unified spending layer for the multi-chain user.

The core premise of KAST is to abstract away the underlying complexity of cross-chain bridging and swaps. It offers a custodial platform that aggregates a user's assets from multiple supported blockchains and presents them as a single, spendable balance. When a user transacts with the KAST card, the platform automatically selects and liquidates the necessary assets in the background to cover the fiat expense at the point of sale. This creates a deceptively simple user experience that mirrors a traditional debit card, but one that is fueled by a diverse, multi-chain portfolio.

This strategic focus makes KAST a direct competitor to custodial incumbents like Coinbase and Crypto.com, but with a nuanced distinction. Its value proposition is not primarily about ecosystem integration with a centralized exchange; rather, it is about solving a specific pain point for users who are already active across the broader onchain economy. By removing the operational burden of manually managing assets across disparate networks, KAST makes a compelling case that for a certain user segment, the ultimate convenience is not just on-ramping, but the seamless unification of a fragmented digital holdings.

Custodial Provider Comparative Analysis

To fully appreciate the strategic divergence among the custodial incumbents, a direct comparison of their core features, business models, and market positioning is essential. The following table provides a comprehensive matrix summarizing the key differentiators across these providers, offering a clear, at-a-glance view of the competitive landscape.

Table 1: Custodial Provider Comparative Analysis

This analysis reveals that the major custodial providers are not just offering slight variations of the same product but are competing based on fundamentally different value propositions. Crypto.com's strategy is one of gamified loyalty, designed to entrench users within its proprietary ecosystem through a powerful incentive structure that maximizes customer lifetime value. Coinbase, in contrast, competes on trust, brand reputation, and ease of use, appealing to a mainstream, risk-averse audience that prioritizes security and simplicity above all else. RedotPay, meanwhile, has positioned itself as the flexible utility provider, offering a taste of DeFi's functional advantages without its inherent risks and complexities. The distinct market segments carved out by these incumbents, and the inherent trade-offs of the custodial model itself, created the competitive vacuum for a new, ideologically distinct alternative to emerge: the self-custody card.

A New Wave of Non-Custodial Innovators

Metamask Card

While custodial providers successfully onboarded millions by mirroring the familiar structures of traditional finance, a new and ideologically distinct category of crypto payment cards has emerged in response. These non-custodial providers are building products that align with the core Web3 ethos of user sovereignty, financial autonomy, and decentralization. By allowing users to spend directly from their own wallets, they eliminate the intermediary risk inherent in the custodial model, appealing to a more crypto-native audience that prioritizes control over convenience.

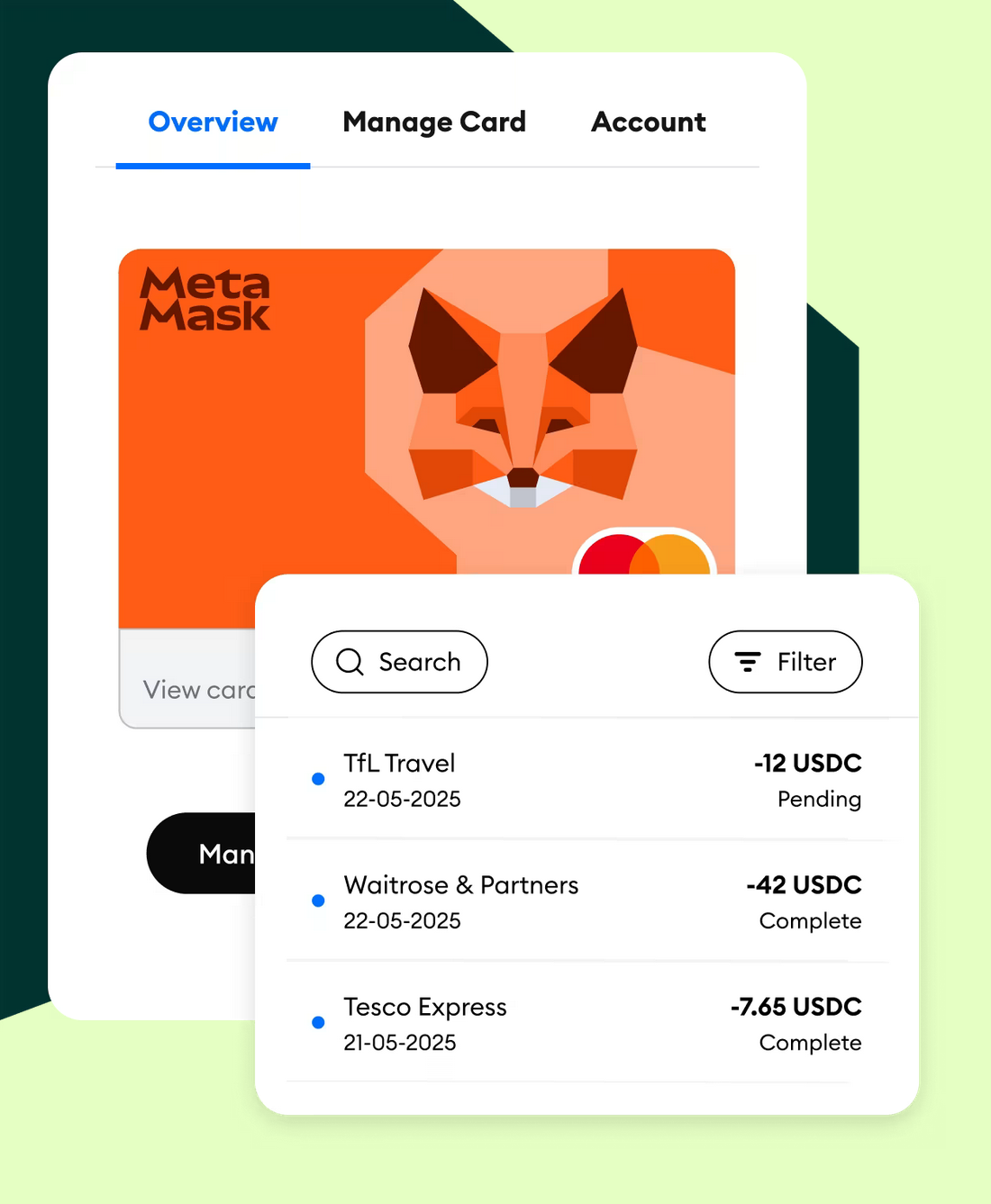

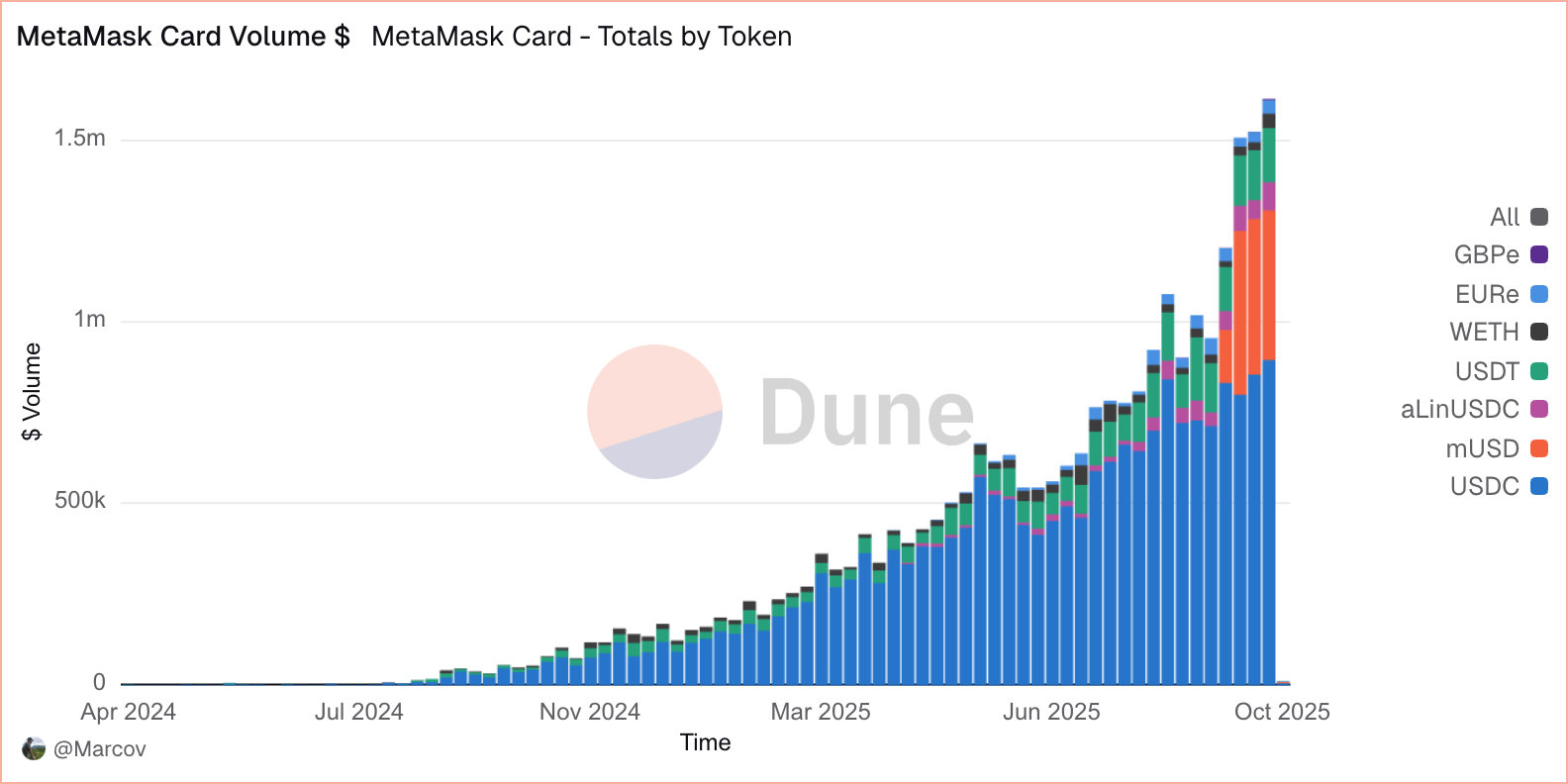

Leading the charge is the MetaMask Card, a significant market development given its origin from the world's most popular self-custody wallet. The card's core value proposition is its function as a direct, seamless extension of the user's existing MetaMask wallet, enabling real-world spending without the need to first transfer funds to a centralized exchange. This design transforms the wallet from a simple container for onchain assets into an active interface for global commerce.

The card's architecture is strictly non-custodial, meaning users retain full control of their private keys and assets within their MetaMask wallet right up to the moment of transaction. This is the paramount benefit, offering absolute financial sovereignty and eliminating the platform-level risks associated with custodial providers.

The strategic imperative behind the MetaMask Card extends beyond mere payments; it functions as a powerful on-ramp to its parent ecosystem. To achieve the necessary speed and low costs for retail transactions, the card operates exclusively on Linea, a Layer 2 scaling solution developed by Consensys, the entity behind MetaMask. This tight integration effectively requires card users to bridge their assets to the Linea network, driving user engagement, capital inflow, and liquidity to a specific onchain environment that Consensys is heavily invested in growing.

The business model is built around a standard virtual card that offers cashback on all purchases, with a premium "MetaMask Metal Card" available for an annual fee that provides enhanced rewards and zero foreign transaction fees. For the standard card, when spending stablecoins only gas fee is applied which is usually around $0.02. When spending a non-stablecoin asset there is a 0.875% swap fee in addition to the gas fee.

This ecosystem-centric approach also dictates the card's functionality. Spendable assets are limited to a curated list of tokens available on the Linea network, such as USDC, USDT, and WETH. The card's availability has been rolled out in a phased global approach, targeting the United Kingdom, Europe, and the US (excluding New York and Vermont). This transforms the payment card from a simple product into a strategic asset in the broader L2 competition as platforms compete for users and liquidity.

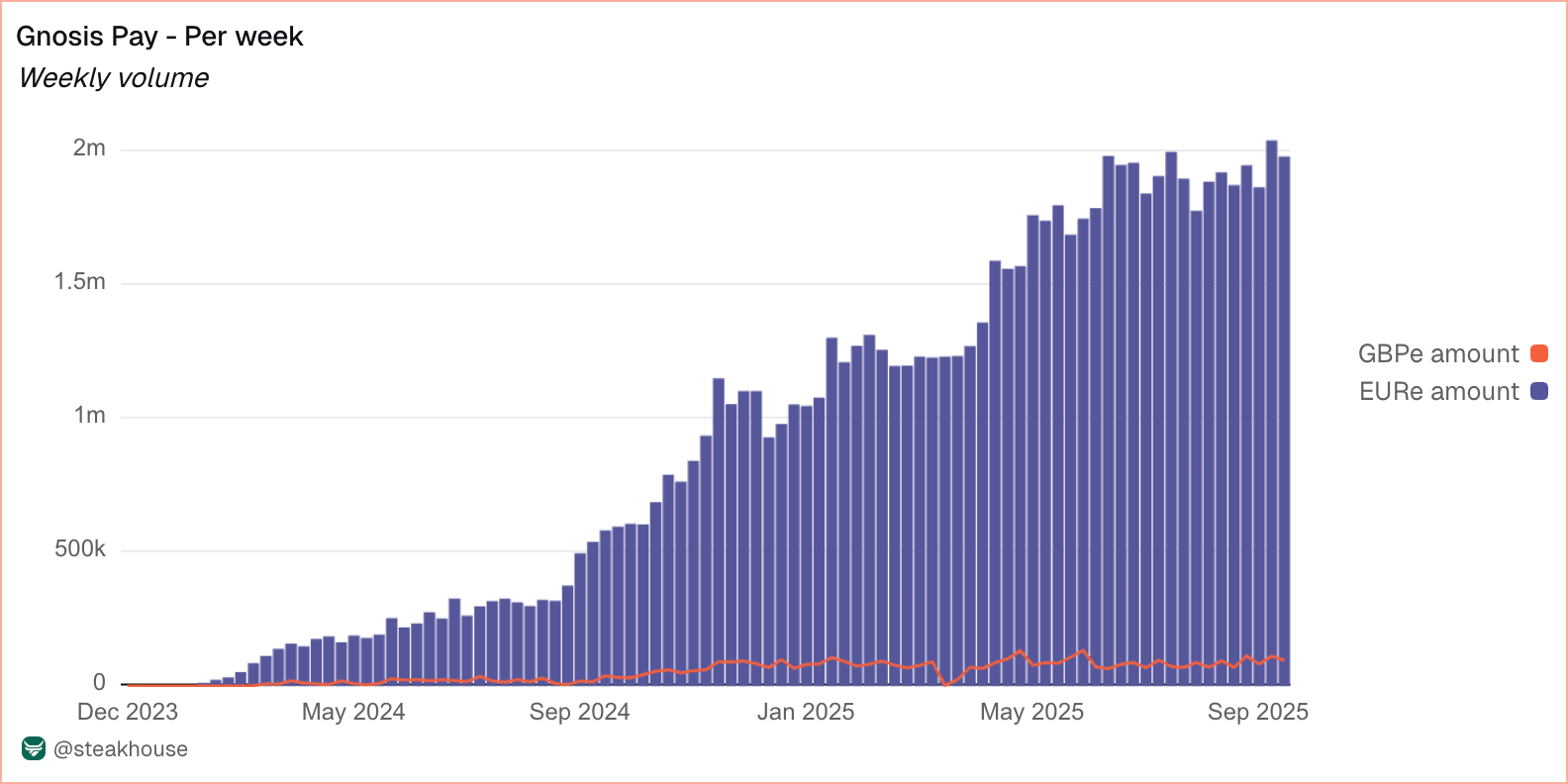

Gnosis Pay Card

Gnosis Pay enters the non-custodial arena by differentiating on institutional-grade security. Its core value proposition is its native integration with the Gnosis Safe, a highly regarded multi-signature smart contract wallet. This architecture eliminates the single point of failure associated with traditional private key wallets by requiring multiple authorizations for transactions, appealing to security-conscious users who desire robust protection for their spending funds.

The platform is fully self-custodial, with all user assets held within their personal Gnosis Safe. This smart contract wallet architecture allows for advanced, programmable security features that are not possible with standard wallets. Users can implement onchain rules such as setting daily spending limits or creating transaction delay modules to prevent unauthorized withdrawals, providing a level of granular control and risk management that is highly attractive to sophisticated users.

Similar to its peers, Gnosis Pay utilizes its payment card as a strategic tool to drive adoption of its native blockchain ecosystem. The card operates exclusively on Gnosis Chain, requiring users to hold their spendable assets - specifically, a curated list of stablecoins like EURe and USDCe on that network. This design choice transforms the card into a compelling reason for users to bridge assets to Gnosis Chain, directly contributing to the network's user base and onchain activity.

Further strengthening its competitive position, Gnosis Pay has introduced a compelling and aggressive zero fee structure. The platform advertises zero transaction fees, zero gas fees for card spending, and zero foreign exchange fees, positioning itself as a highly cost-effective solution for global spending. The primary cost to the user is a modest one-time card issuance fee of around 30 EUR.

A rewards program complements this low-cost model, creating a circular economic incentive. The card offers up to 5% cashback on purchases, paid out weekly in the native Gnosis (GNO) token. This mechanism not only rewards users for their spending but also increases their stake in the Gnosis ecosystem, aligning the cardholder's financial interests with the long-term success of the platform.

Holyheld Card

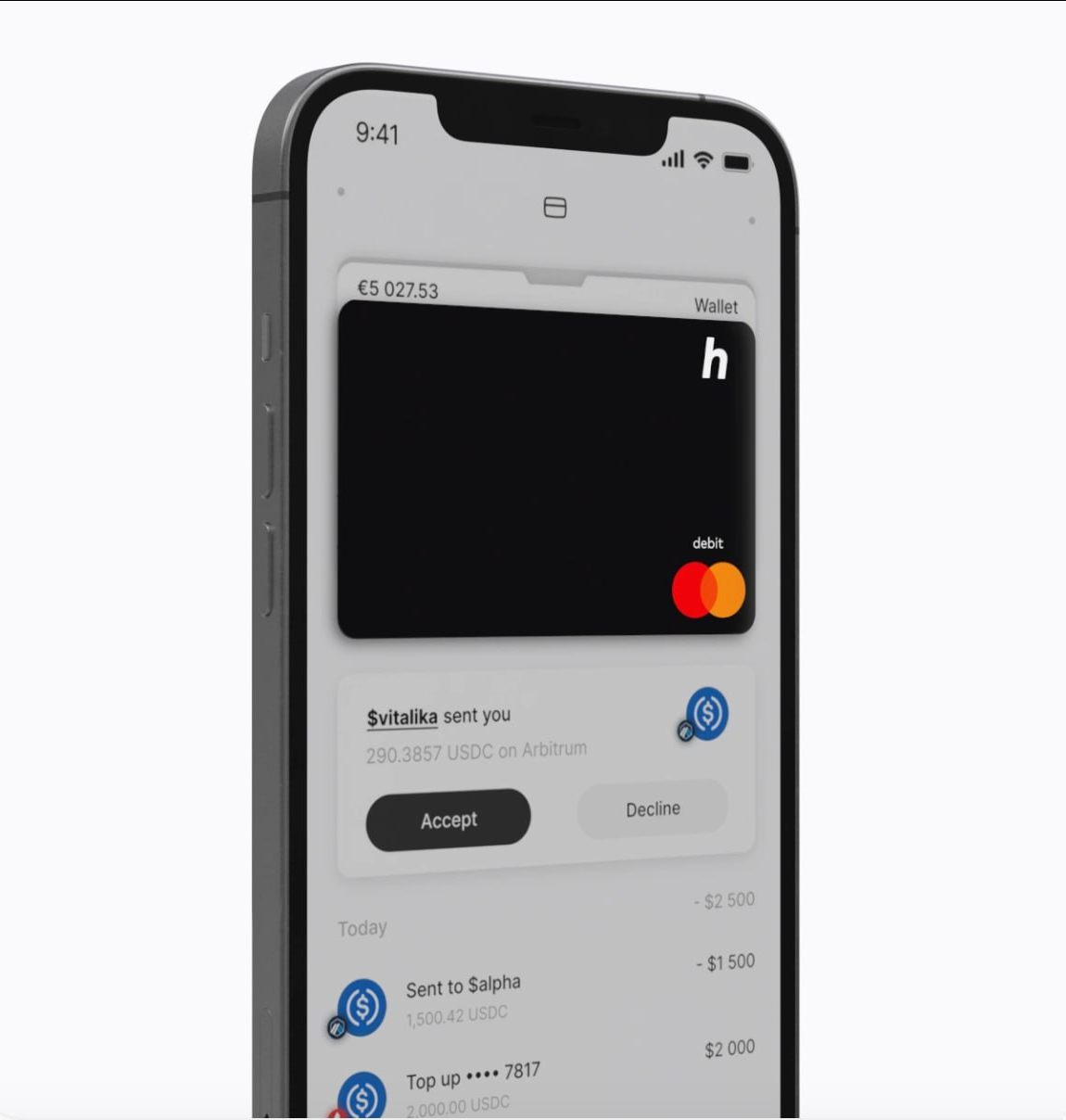

The Holyheld Card joins the non-custodial market by positioning itself not just as a payment tool, but as an "onchain cash account." Its unique value proposition is the provision of a personal International Bank Account Number (IBAN) that is controlled directly from a user's existing self-custody wallet. This feature is a significant architectural leap, fundamentally bridging the gap between decentralized assets and traditional banking infrastructure. It enables crypto-native bill payments and peer-to-peer SEPA bank transfers directly from a user's wallet, moving beyond simple point-of-sale spending to address core banking functions.

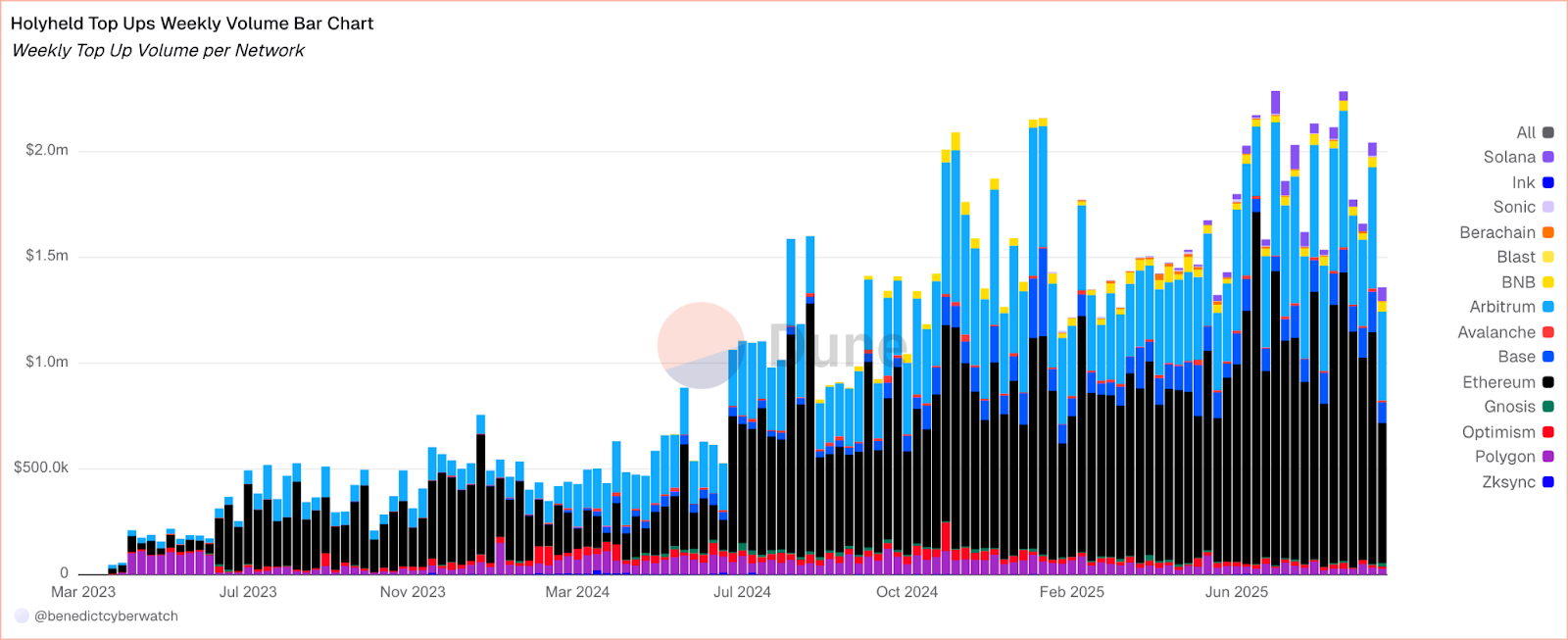

In terms of ecosystem strategy, Holyheld adopts a notably different and more flexible approach than its direct competitors. Instead of locking users into a single, proprietary blockchain, it has engineered an omnichain architecture. This allows users to top up their card balance from a wide array of popular blockchains including Ethereum, Polygon, Arbitrum, and Gnosis Chain, without performing a manual bridging operation. By abstracting away this technical complexity, Holyheld's strategy is to capture the existing segment of multi-chain users who value flexibility and a superior, lower-friction user experience, rather than attempting to build a new walled garden.

The platform's business model is built around a tiered card offering with one-time issuance fees and modest cashback rewards. Users can choose from a virtual "Classic" card, a "Limited Edition," or a physical "Metal" card, with issuance fees scaling from €29 to €199. Cashback is offered in USDC and ranges up to 1% for the highest tier, a more conservative reward structure that emphasizes the card's utility over gamified incentives. This is complemented by a clear fee structure for transactions, which includes a 2.5% fee plus a 1 EUR charge for international card payments and a 3% markup on the Mastercard exchange rate for currency conversions.

However, a critical nuance lies in its hybrid custody model. While users fund their account non-custodially from their own wallets, the topped-up balance is transferred to a custodial account by the provider at the moment of spend. This is a deliberate trade-off, sacrificing the ideological purity of a direct-from-wallet transaction (like Gnosis Pay) for the UX benefit of a seamless, omnichain funding experience. This positions Holyheld as a pragmatic bridge for users who want multi-chain flexibility and TradFi integration, and are willing to accept a degree of centralized custody to achieve it.

Ether.fi Cash

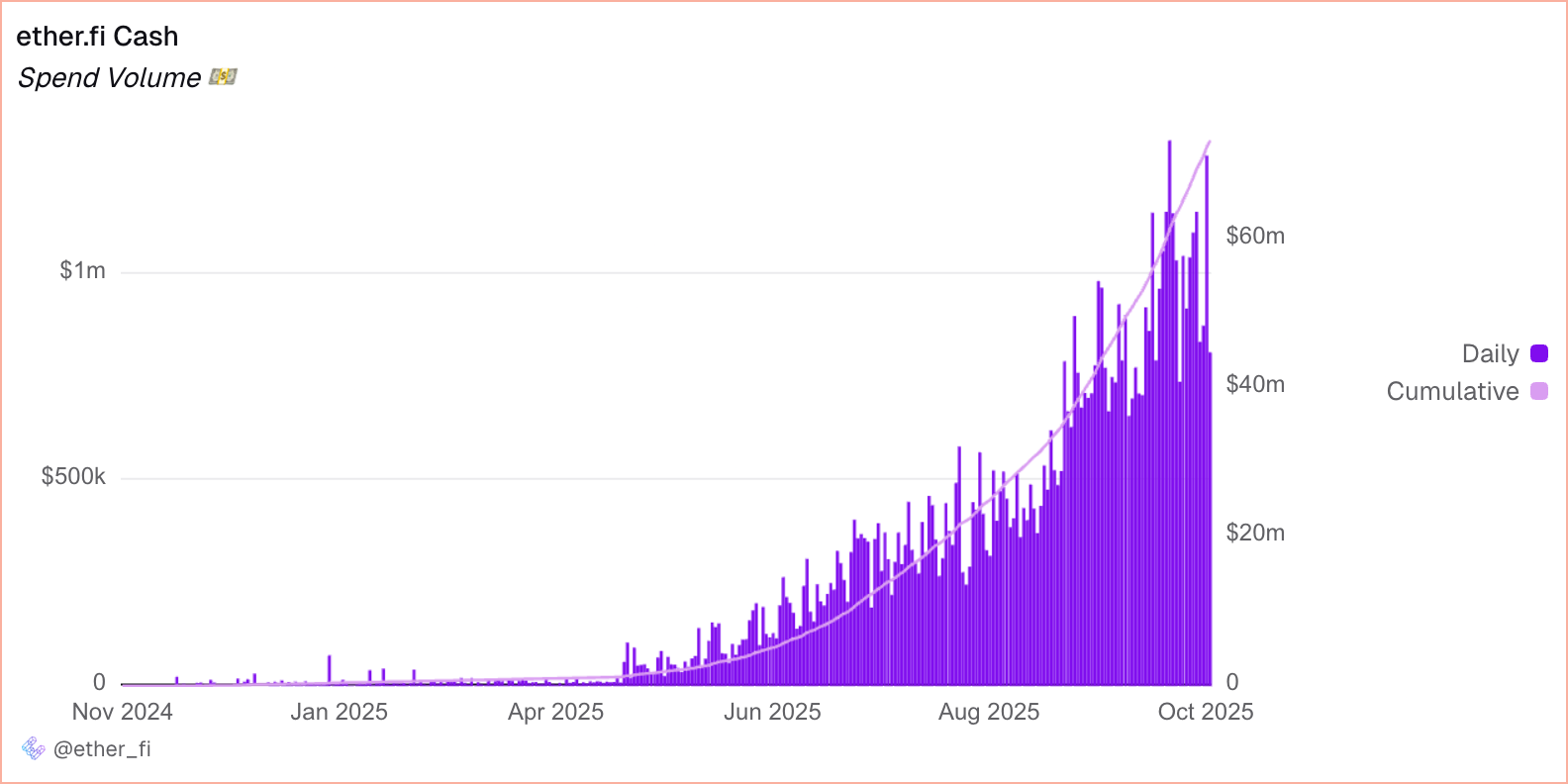

Perhaps the most architecturally distinct entry into the market is the Ether.fi Cash card, which introduces a novel DeFi-native credit model that fundamentally shifts the spending paradigm. Its core value proposition is neatly captured by the slogan, "Never Sell Your Crypto." Instead of requiring users to liquidate their assets to fund purchases, this Visa card allows them to borrow against their yield-bearing collateral held within the Ether.fi liquid restaking protocol.

This "borrow-to-spend" model is the card's defining feature. It creates a powerful, structurally elegant solution to the taxable event problem that plagues direct-spend debit cards. By borrowing rather than selling, users can unlock liquidity for real-world spending without creating a constant stream of capital gains disposals. This appeals directly to long-term crypto holders who want to use the value of their assets without sacrificing their exposure to potential future price appreciation.

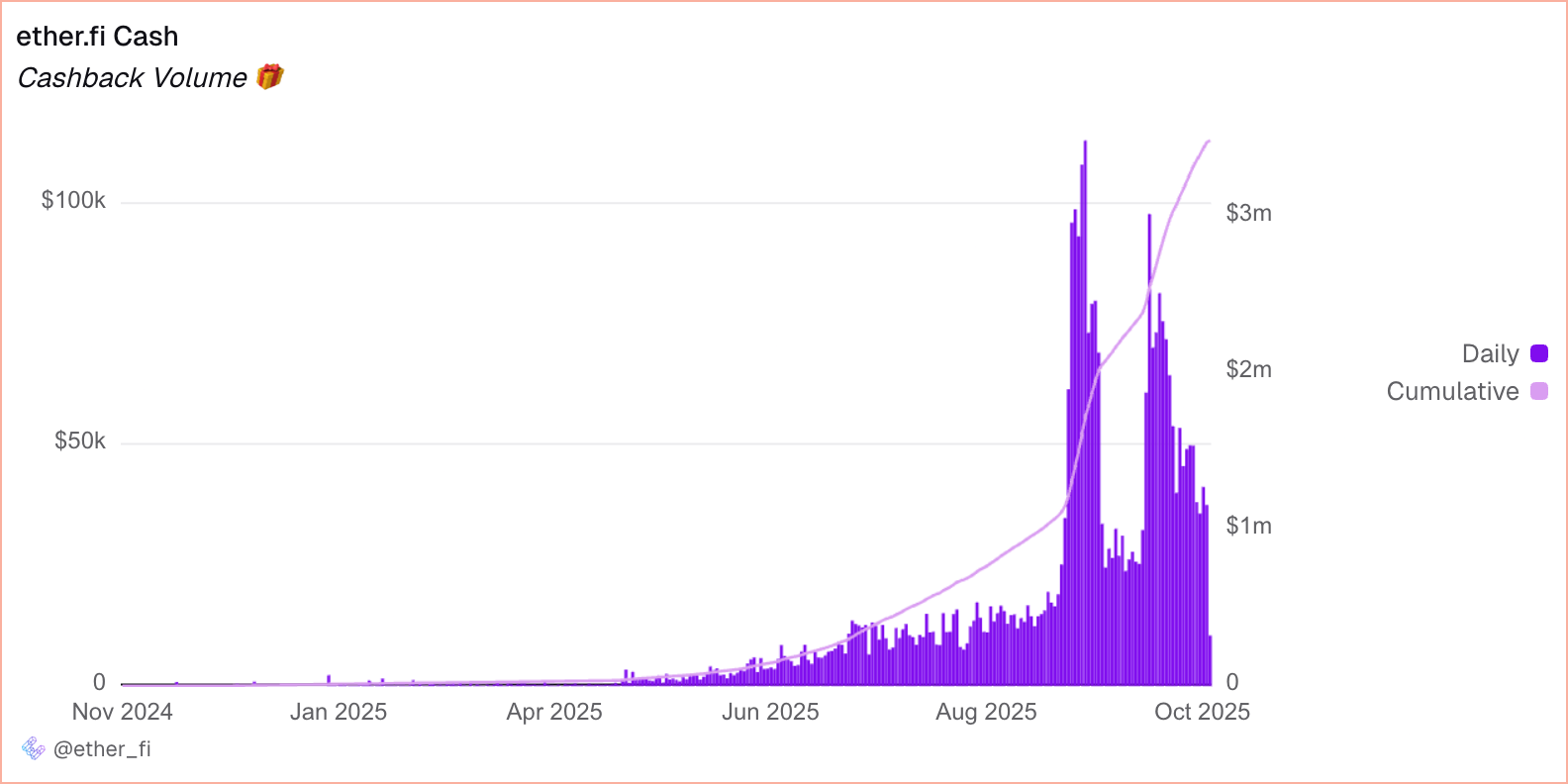

The card's ecosystem strategy is one of direct capital acquisition for its underlying protocol. To secure a line of credit, a user must first deposit assets into Ether.fi to serve as collateral, making the card a potent incentive for driving total value locked (TVL) into the protocol. This creates a deeply integrated and self-reinforcing financial loop that is unique in the market.

Such a dynamic creates a system where a user’s investments effectively subsidize their spending. The yield generated by the user's staked and restaked assets within the protocol can be programmatically used to automatically service the loan's interest or pay down the principal. This also entrenches the user within the Ether.fi ecosystem, directly aligning their day-to-day financial activities with the health and performance of the protocol.

Ether.fi's business model is structured around a tiered membership club that rewards user activity and offers competitive cashback rates of 2-3% on all purchases, paid in tokens on the Scroll network. While the card has no annual fee, it does include a 1% foreign exchange fee on international transactions. Crucially, Ether.fi has pursued an aggressive global-first strategy, marketing the card as available in over 100 countries. This positions it as a direct competitor to the more geographically restricted offerings from both custodial exchanges and other non-custodial providers, aiming to capture a global audience of crypto-native users from the outset.

Non-Custodial Provider Comparative Analysis

A broader analysis of these non-custodial providers reveals a significant evolution in the market's strategic landscape. These products are not just simple payment tools; they are mechanisms designed to serve as on-ramps to their parent ecosystems, driving user engagement and capital inflow.

Table 2: Non-Custodial Provider Comparative Analysis

The technical design of each card - whether it be MetaMask's reliance on Linea, Gnosis Pay's integration with Gnosis Chain, or Ether.fi's collateral requirements - forces a degree of ecosystem commitment from the user. This dynamic has transformed the payment card from a standalone product into a critical component of a much larger competition for platform adoption. The success of a non-custodial card is no longer just about its fees or rewards; it is inextricably linked to the value proposition, liquidity, and user experience of its underlying blockchain or DeFi protocol. Consequently, the consumer's choice of which card to use is becoming synonymous with the choice of which ecosystem they wish to engage with most deeply.

Infrastructure Enablers

Rain

Beneath the visible layer of consumer-facing cards, a foundational infrastructure is being developed. The emergence of these "picks and shovels" players signals a crucial maturation of the market, which is evolving from a collection of standalone products into a more modular ecosystem. These entities are not competing for end-users; instead, they are building the underlying rails that will power the next generation of crypto-native finance.

A prime example of this infrastructure-as-a-service (IaaS) model is Rain, a B2B provider backed by institutional investors like Galaxy Digital. Rain operates on a business model that is fundamentally enabling rather than competitive. It offers a full-stack financial platform designed to empower other fintech companies and Web3 projects, providing them with the essential backend technology to quickly launch their own branded, stablecoin-backed payment solutions without needing to build the complex underlying infrastructure from the ground up.

Rain's offering is a modular suite of APIs that covers the entire payment lifecycle. This developer-first toolkit includes services for white-label card issuance, fiat on-ramps for converting local currency into stablecoins, fiat off-ramps for enabling cross-border payouts, and embedded digital dollar accounts that can be seamlessly integrated into any application. This comprehensive approach is engineered to significantly lower the technical and regulatory barriers to entry for new market participants.

Rain’s strategic role is to act as a foundational enabler - an abstraction layer that hides the immense complexity of integrating with the traditional financial system. By handling the intricacies of card network partnerships, compliance frameworks like KYC and AML, and payment processing, Rain allows its clients to focus entirely on their core product and user experience. This model serves as a powerful catalyst for innovation across the ecosystem.

This go-to-market strategy is perfectly illustrated by its pivotal partnership with the Plasma blockchain. By serving as the infrastructure backbone for this ambitious new financial ecosystem, Rain demonstrates its core function: allowing innovators to focus on their unique value proposition, while Rain provides the commoditized, but essential, bridge to the global merchant network. This allows new financial products to be brought to market in weeks rather than months, accelerating the pace of evolution for the entire industry.

Plasma One

Beyond the enabling infrastructure layer, a new and even more ambitious archetype is emerging: the vertically integrated neobank. This model represents a fundamental strategic shift, moving beyond simply bridging crypto to the traditional financial system and instead attempting to build a parallel, more efficient system from the ground up. These projects are not just building applications; they are building the entire financial stack, from the settlement layer to the consumer interface.

The leading example of this approach is Plasma One, building a "stablecoin-native neobank" and a super-app that runs on its own purpose-built blockchain. This represents a bold attempt to re-architect the foundations of payment settlement for the digital age, rather than simply building on top of existing, general-purpose networks.

The Plasma L1 blockchain provides the technical foundation for this vision. It is a standalone, EVM-compatible network engineered from first principles to handle high-volume, low-cost, global stablecoin payments. Its architecture is highly optimized for this specific use case. It features a high-throughput consensus mechanism known as PlasmaBFT and, most notably, unique economic advantages like zero-fee USDT transfers. This design is intended to create a settlement layer that is fundamentally cheaper and more efficient for stablecoin transactions than any existing alternative.

The core value proposition of this project lies in its deep vertical integration. By controlling both the underlying settlement layer (the Plasma L1) and the consumer-facing application layer (the Plasma One app and card), the project can offer a tightly integrated and highly efficient user experience that is difficult to replicate on congested, general-purpose blockchains.

This end-to-end control enables a powerful combination of user benefits. The project's vision includes allowing users to simultaneously earn a 10%+ yield on their stablecoin balance, receive significant, 4% cashback on card purchases, and conduct peer-to-peer transfers within the app completely free of charge. These benefits are a direct result of owning the entire technological stack and eliminating the rent-seeking intermediaries present in both traditional finance and other blockchain ecosystems.

To connect its crypto-native ecosystem to the physical world, Plasma has strategically partnered with the infrastructure provider Rain to issue its payment card. This move is strategically significant, as it demonstrates a conscious decision to build a new, optimized settlement layer, while still utilizing existing infrastructure for the commoditized "last-mile" of merchant acceptance. It represents a pragmatic final bridge to the legacy financial world, allowing the project to focus its resources on its core technological differentiators and its vision of building a new, self-contained financial system.

Market Dynamics

Global Adoption Analysis

The crypto payment card market, while still nascent, is a dynamic and rapidly evolving sector whose growth is shaped by a complex interplay of regional demand, regulatory landscapes, and critical dependencies on traditional financial incumbents. Synthesizing the analysis of individual providers reveals broader market trends and provides a strategic outlook on the forces that will define its future trajectory. The global availability of these cards is far from uniform, reflecting the fragmented nature of cryptocurrency regulation and market maturity worldwide, with a clear distinction between the expansive reach of established custodial providers and the more targeted rollouts of emerging non-custodial innovators.

Table 3: Global Card Availability Matrix

Custodial cards with significant operational scale and compliance resources, such as Crypto.com and RedotPay, have achieved the broadest global reach, establishing a presence across North America, Europe, Asia, and Latin America. At the same time, non-custodial innovators are pursuing a more strategic, phased expansion, with Europe and Latin America emerging as key initial battlegrounds. This focus suggests these regions offer a potent combination of clearer regulatory pathways - such as the Markets in Crypto-Assets (MICA) framework in the EU - and strong product-market fit, where demand for stable, dollar-denominated assets is high.

Europe, in particular, represents a market driven by increasing regulatory clarity under MICA. This environment is conducive to both custodial and non-custodial providers who can offer compliant, feature-rich products. The region's mature financial infrastructure and high digital payment penetration make it a natural fit for crypto cards as a tool for spending crypto-generated wealth and accessing novel reward structures.

Adoption in Latin America presents a different narrative, one fueled by economic necessity. Persistently high inflation, local currency volatility, and the high cost of traditional remittances have created immense grassroots demand for stable, dollar-denominated assets. For millions of individuals and businesses, crypto payment cards are not a luxury but a vital financial tool for preserving wealth and accessing the global economy. This makes the region a prime market for stablecoin-centric card offerings that provide a seamless bridge between digital dollars and everyday commerce.

The North American market, particularly the United States, is defined by a different set of drivers. Here, adoption is less about immediate financial necessity and more about institutional interest and the "wealth effect" stemming from crypto trading and investment. The market is dominated by large, regulated exchanges like Coinbase, and card usage is often seen as a convenient way to spend investment gains or integrate digital assets into a broader financial portfolio. The recent introduction of spot Bitcoin ETFs has further solidified this trend, reinforcing crypto's role as a mainstream asset class and driving demand for trusted, easy-to-use spending solutions.

The high-growth frontiers of Central & Southern Asia and Oceania (CSAO) and Sub-Saharan Africa present yet another model, characterized by grassroots adoption driven by pure utility. In these mobile-first economies, crypto is often integrated directly into P2P commerce and daily financial life. With a significant portion of the population unbanked or underbanked, crypto payment cards and the stablecoins they utilize can leapfrog legacy financial infrastructure entirely. This creates a fertile ground for innovative solutions that offer not just a payment method, but a gateway to a more accessible and efficient global financial system.

From Onboarding to Point-of-Sale

The KYC Hurdle & "Decentralization Paradox"

While the underlying technology provides the foundation, it is the end-to-end user experience (UX) that ultimately dictates a product's adoption and retention. A seamless journey can mask immense technical complexity, while a clunky one can render even the most innovative technology unusable. For non-custodial cards, this journey is defined by a fundamental tension between the ethos of decentralization and the realities of regulatory compliance, beginning at the very first step.

The first interaction a user has with a non-custodial card product immediately surfaces this conflict. Despite their Web3 foundations, all providers in this category must enforce a mandatory Know Your Customer (KYC) process. This is not a voluntary design choice but a strict requirement to comply with global anti-money laundering (AML) regulations and, crucially, to satisfy the stringent partnership terms of the payment networks like Visa and Mastercard. This creates what can be termed the "Decentralization Paradox": a user drawn to the promise of a permissionless, pseudonymous financial future is immediately confronted with a permissioned, document-heavy onboarding process identical to that of a conventional bank.

This critical onboarding step is typically handed off to specialized third-party services. The user flow involves being redirected from the crypto-native application to a partner like Sumsub (for Gnosis Pay Card) or Crypto Life (for MetaMask card), where they must submit a government-issued identity document and often a proof of address. Although these providers aim to streamline the process to a matter of minutes, it represents an unavoidable compliance hurdle. User reports indicate that this process can sometimes be a point of friction, with applications occasionally facing delays while "being reviewed" for an extended period.

This initial friction point has significant strategic implications. In a competitive market where user acquisition is paramount, the quality of the onboarding experience is a critical differentiator. The provider that can most effectively abstract, streamline, or innovate upon this mandatory compliance step - whether through superior partner integration, clearer communication, or faster processing times - will gain a significant competitive advantage. For the non-custodial ecosystem, the challenge is to make this centralized checkpoint feel as seamless and unobtrusive as possible.

The bridging experience

Once a user's identity is verified, the next challenge is funding the card, a multi-step process that introduces further complexity compared to their custodial counterparts. The journey typically begins with acquiring cryptocurrency, often via a third-party fiat on-ramp like MoonPay or Transak, which charges processing fees for converting fiat currency into digital assets. For users new to the ecosystem, this is the first of several hurdles.

For non-custodial cards tied to specific Layer 2 networks, the requirement to bridge these assets from one blockchain to another presents the most significant technical and time-consuming challenge. An example of this process is as follows: a user holding USDC on the Ethereum mainnet must first navigate to a dedicated bridge website. They then connect their wallet, execute a transaction to approve the bridge's smart contract to access their tokens (paying a gas fee), and then execute a second transaction to initiate the actual transfer (paying another, larger gas fee). They must then wait for the transaction to be confirmed on both the source and destination chains, a process that can take anywhere from a few minutes to several hours. In some cases, they may also need to acquire the L2's native gas token to perform any further actions.

The superior user experience offered by omnichain solutions like Holyheld provides a clear solution to this high-friction process. By designing a system that abstracts away this complexity, Holyheld allows users to top up their card balance directly from various supported L2s without performing a manual bridging operation themselves. The intricate cross-chain mechanics are handled in the background, presenting the user with a simple, intuitive funding process that more closely resembles a traditional financial application.

At the heart of the non-custodial card market, this dynamic reveals an important strategic trade-off. While the technical friction of bridging is a significant UX problem, it also serves a strategic purpose for ecosystem-centric providers like MetaMask and Gnosis Pay. The process, however cumbersome, effectively locks both users and their capital into a specific L2 ecosystem. Each successful bridge transaction adds to the network's Total Value Locked (TVL) and user metrics, reinforcing the platform's value. The challenge for these providers is to balance the strategic goal of ecosystem growth against the user's demand for a frictionless financial experience.

Point-of-Sale Reliability & User Sentiment

The ultimate test of any payment card - crypto-native or traditional - is its reliability at the moment of truth: the point of sale. A seamless tap-to-pay experience is the absolute baseline expectation of modern commerce. Any deviation from this, such as a declined transaction, a PIN synchronization error, or a processing delay, can lead to significant user frustration and an immediate, often permanent, loss of trust in the product.

A qualitative synthesis of user feedback from online forums and app store reviews reveals the dual nature of the current experience. On one hand, there is a clear sense of "magic" when a transaction works as intended. Users frequently describe a successful payment from a self-custody wallet as "incredibly normal and uneventful" - a profound compliment for a product bridging two disparate and complex financial systems. This moment validates the entire promise of Web3 utility. On the other hand, the frustration of a failed transaction is acute. Technical glitches, while infrequent, are a recurring theme, highlighting the ongoing engineering challenges of ensuring flawless execution across a global network of disparate merchant terminals and payment processors.

Beyond simple technical reliability, there is a psychological overhead that is unique to non-custodial users. The very nature of self-custody and direct smart contract interaction creates a pervasive apprehension about making irreversible errors. Users often express a fear of accidentally approving a malicious contract or sending funds to the wrong address - a level of caution that doesn't exist when using a traditional bank card. This can create a hesitation to rely on a non-custodial card for critical or high-value purchases, relegating it to a secondary or experimental spending tool rather than a primary one.

For non-custodial cards to achieve mainstream adoption, they must not only be technically flawless but also feel completely reliable. Overcoming the final engineering hurdles to ensure near-100% transaction success is paramount. However, an equally important challenge is to build user trust through intuitive interfaces and security features that abstract away the perceived risks of onchain interactions. The long-term success of this market segment will depend on making the revolutionary act of spending from a self-custody wallet feel utterly and predictably mundane.

Critical Challenges

The Tax & Accounting Burden

A critical, yet frequently underestimated, aspect of utilizing crypto payment cards is the significant tax and accounting complexity they introduce. In most major jurisdictions, cryptocurrencies are treated as property for tax purposes, not as currency. This classification has profound implications for daily spending, transforming mundane purchases into a series of complex financial transactions and creating a substantial compliance burden that innovative providers are now beginning to address as a core feature.

For the majority of crypto debit and prepaid cards operating on a direct-spend model, every single purchase constitutes a taxable event. When a user buys a coffee or pays for groceries, they are not simply spending money; from a tax perspective, they are "disposing" of a capital asset. This disposal triggers a capital gain or loss, calculated as the difference between the fair market value of the crypto at the time of purchase and its original cost basis. For an active cardholder, this creates a daunting accounting task, potentially generating thousands of discrete taxable events that must be meticulously tracked and reported annually.

The "borrow-to-spend" model, pioneered by Ether.fi Cash, is explicitly engineered to mitigate this tax burden. The act of taking out a loan against crypto collateral is generally not considered a taxable event, as the user is not selling their assets. This allows users to unlock liquidity from their holdings without creating a constant stream of taxable transactions, a structural advantage. This model defers the tax liability, allows the user to retain exposure to the asset's potential appreciation, and enables them to continue earning staking yield that can be used to service the loan. A taxable event is only triggered if the collateral is liquidated or the loan is repaid with an appreciated asset.

The inherent complexity of direct-spend models has spurred a robust ecosystem of specialized tax software. Platforms like Koinly and CoinLedger are essential tools for compliance, integrating directly with public blockchains to automatically aggregate transaction data, calculate gains and losses, and generate the necessary tax forms. The necessity of these third-party tools underscores the significant friction point that the tax burden represents and highlights the powerful competitive advantage held by card models that are structurally designed to avoid it.

The Role of TradFi Gatekeepers

Despite the disruptive, decentralized ethos of cryptocurrency, the practical utility of every single card analyzed in this report hinges on foundational partnerships with two traditional finance behemoths: Visa and Mastercard. This dependence creates a symbiotic yet fundamentally constrained relationship that shapes the entire market, forcing even the most ardent Web3 projects to integrate with the very system they aim to innovate upon. The relationship is symbiotic because it solves a critical "last-mile" problem for merchant acceptance, while the payment giants position themselves at the forefront of financial innovation.

This dependency, however, establishes a clear power dynamic where Visa and Mastercard function as critical gatekeepers. They wield the unilateral authority to set the rules of engagement, define the compliance standards that all partners must meet, and could choose to de-platform a card program at their discretion. This introduces a significant, systemic risk for the entire crypto card ecosystem, as a change in the networks' risk tolerance, strategic priorities, or fee structures could have immediate and far-reaching consequences for every provider who relies on their rails.

This raises a fundamental long-term strategic question for the digital asset industry: is the reliance on traditional finance rails a permanent feature, or can the crypto ecosystem ever build a viable alternative merchant network? While projects have experimented with direct crypto payments at the point of sale, the ubiquity of the existing card infrastructure presents a nearly insurmountable network effect. For the foreseeable future, it appears that the most pragmatic path to mass adoption is to continue leveraging the existing system, accepting the strategic trade-offs and the gatekeeper risk as the necessary cost of bringing onchain assets into real-world commerce.

Evolving Regulatory Landscape

The global regulatory landscape for crypto-assets is in a period of rapid and highly sensitive transition, moving from an era of ambiguity to one of active framework development. This evolution is creating a complex, fragmented patchwork of rules that presents both opportunities and challenges for crypto card providers. A clear regulatory environment can foster trust and accelerate adoption, while uncertainty can stifle innovation and create significant compliance burdens.

Europe is at the forefront of this shift with its comprehensive Markets in Crypto-Assets (MICA) framework. MICA provides a harmonized set of rules for crypto-asset service providers across the European Union, creating a single, predictable market. It imposes specific, bank-like requirements on stablecoin issuers concerning the management of reserve assets and minimum capital holdings. While demanding, this clarity is a powerful catalyst for the region, making it an attractive target market for card issuers who can design compliant products with a clear understanding of their long-term obligations.

The situation in the United States is more complex, characterized by a persistent tension between the desire for overarching federal legislation, such as the proposed GENIUS Act, and the current reality of navigating a complex web of state-level money transmission laws. This creates a challenging and costly operating environment where compliance can vary significantly across jurisdictions, forcing many providers to roll out their services on a state-by-state basis or avoid the US market altogether.

In contrast, key hubs in the Asia-Pacific region have adopted a more agile, pro-innovation stance. Jurisdictions like Hong Kong and Singapore have utilized regulatory sandboxes, allowing them to work closely with innovators to test new products and develop bespoke rules in a controlled environment. This collaborative approach fosters a more dynamic ecosystem, attracting talent and capital. For global card providers, successfully navigating this multi-jurisdictional maze is a critical strategic imperative that requires significant legal and compliance resources.

Security & Risk Management

Security remains a paramount concern across the digital asset ecosystem, and the crypto payment card market presents a unique duality of risk based on the underlying custody model. The choice between a custodial and non-custodial framework fundamentally alters the security burden, shifting the locus of risk between the platform and the individual user.

For custodial card providers, the primary vulnerability lies at the platform level. Users' funds are subject to the same risks as any centralized exchange, including external hacks, internal fraud, or catastrophic business failure and insolvency. While major players like Coinbase invest heavily in institutional-grade security, the user must ultimately trust the custodian to safeguard their assets. In contrast, the non-custodial model eliminates this third-party risk but transfers the security responsibility entirely to the user. In this paradigm, the greatest threat is the loss or theft of the user's private keys or seed phrase, an irreversible event for which there is no recourse.

Beyond the specific risks associated with either custody model, the entire non-custodial ecosystem shares a reliance on the security of the underlying blockchain technology itself. The integrity of smart contracts governing DeFi protocols and, crucially, the cross-chain bridges used to move assets between networks, are all potential points of failure. A vulnerability in a bridge's code could lead to a catastrophic loss of funds for all users who have trusted it with their assets, representing a systemic risk that transcends any single card product.

Future Outlook

Looking ahead, the crypto payment card market is poised for a period of rapid evolution and strategic realignment. The foundational technologies and competitive frameworks established today will serve as the launchpad for a more integrated and sophisticated financial future. The trajectory of this market over the next five years will be defined by four key trends: the convergence with broader financial platforms, the rise of new forms of onchain money, innovation in user incentives, and the structural tension between market consolidation and proliferation.

The most significant shift will be the evolution of the payment card from a standalone product into a core feature of comprehensive, crypto-native neobanks. As the market matures, the value proposition will move beyond simply spending crypto to offering a fully integrated suite of financial services. Non-custodial providers, in particular, will leverage their direct wallet integration to bundle card spending with other DeFi primitives like staking, lending, and yield generation. This convergence will transform the card into the primary real-world interface for a user's entire onchain financial life, creating a seamless experience where assets can earn yield until the moment they are spent.

Concurrently, the next wave of innovation is being driven by challengers carving out defensible niches through the deep integration of traditional banking infrastructure with non-custodial crypto principles. This signals a market evolution towards more comprehensive solutions that aim to replace a user's primary bank relationship, rather than merely supplementing it. UR, as part of Mantle’s ecosystem, exemplifies this pioneering approach. While supporting established networks like Ethereum and Arbitrum, its core differentiator is the provision of a personal Swiss IBAN—a feature typically siloed within the legacy financial world. By positioning itself against other non-custodial wallets while offering robust TradFi rails like SEPA and SWIFT, UR is creating a powerful hybrid model that bridges the gap between the two financial paradigms.

The rise of new, bank-backed forms of onchain money will further catalyze this evolution. As detailed in Citi's forward-looking analysis—Stablecoins 2030, "bank tokens" - such as tokenized deposits issued by traditional financial institutions - are set to emerge as a major competitive force to privately issued stablecoins. These instruments will appeal strongly to risk-averse corporates and institutional users, offering the efficiency of blockchain-based settlement combined with the regulatory trust and familiarity of the established banking system. The competition between these regulated bank tokens and the existing, more agile stablecoin ecosystem will become a central dynamic, shaping liquidity and adoption across different market segments.

Concurrently, the model for user rewards and loyalty will undergo significant innovation. The current paradigm, largely based on simple cashback in a native token, will give way to more dynamic, onchain, and personalized incentive models. Leveraging the programmability of smart contracts, providers will be able to create sophisticated loyalty programs that reward specific onchain behaviors, offer tiered benefits based on a user's full ecosystem engagement, or even issue rewards in the form of NFTs that unlock exclusive experiences. This will allow for a much deeper and more compelling user relationship that extends far beyond the point of sale.

The market's very structure will be defined by the tension between two competing forces: consolidation and proliferation. On one hand, the "walled garden" effect of non-custodial cards tied to specific L2 ecosystems suggests a trend toward consolidation, where a few dominant platforms could capture the majority of users and liquidity. On the other hand, the increasing accessibility of Card-as-a-Service platforms dramatically lowers the barrier to entry, potentially leading to a proliferation of niche card offerings tailored to specific communities or use cases. The interplay between these two forces will determine whether the future of crypto spending is dominated by a few major players or characterized by a vibrant, fragmented ecosystem of specialized solutions.

Conclusion

The crypto payment card market stands at a critical juncture, having evolved from a niche product for early adopters into a sophisticated and strategically vital bridge connecting the digital asset economy and global commerce. Our analysis reveals a market fundamentally bifurcated between the convenience-oriented custodial model and the sovereignty-focused non-custodial paradigm, with each path representing a distinct vision for the future of finance. Built upon a complex stack of onchain settlement layers and traditional payment infrastructure, this ecosystem is a testament to both the innovative potential of blockchain and its current dependence on the established financial world. As the market accelerates, its trajectory will be defined by the resolution of key challenges, including the immense tax complexity of direct spending, the ever-present constraints of regulatory compliance, and the strategic choices made by its key stakeholders.

This evolving landscape presents a clear set of strategic imperatives. Card providers face the primary challenge of committing to a clear strategy - either as a seamless bridge for the mass market or as a sovereign extension of a Web3 ecosystem - and to innovate on the critical friction points of user experience, particularly the tax burden. For traditional financial institutions, the rise of this market is not a threat but a significant opportunity; they are uniquely positioned to provide the trusted, regulated infrastructure for card issuance and stablecoin reserves that the industry needs to scale.

For investors and end-users, this report provides a framework for navigating the market's inherent trade-offs. The choice of a crypto payment card is no longer a simple matter of fees and rewards; it is a decision that involves a calculated balance between convenience and control, third-party trust and personal responsibility, and short-term utility versus long-term ecosystem alignment. Understanding these fundamental trade-offs is the key to making informed decisions in a market that is not just changing how we spend, but redefining the very architecture of personal finance.

Sources

- The Future of Spending: Understanding Crypto Cards - RedotPay,

https://www.redotpay.com/news/understanding-crypto-cards

- Stablecoin Payments from the Ground Up - Artemis,

- Stablecoins 2030: Web3 to Wall Street - citi,

https://www.citigroup.com/global/insights/stablecoins-2030

- Crypto Cards: How Do They Work? - Built In,

https://builtin.com/blockchain/crypto-card

- Mastercard lets consumers make everyday purchases with Crypto Cards, https://www.mastercard.com/us/en/business/payments/consumer-payments/next-gen-payments/digital-asset-solutions/crypto-card-program.html

- Where can I use the Crypto.com Prepaid Card?, https://help.crypto.com/en/articles/2500716-where-can-i-use-the-crypto-com-prepaid-card

- Top 10 Crypto Cards for 2025 (Updated) | CoinGecko, https://www.coingecko.com/learn/top-crypto-cards

- Swipe to spend crypto: What is Coinbase Card? - CoinTracker, https://www.cointracker.io/blog/coinbase-card

- Crypto.com Prepaid Card - Rewards & Benefits, https://help.crypto.com/en/articles/2742447-crypto-com-prepaid-card-rewards-benefits

- The DeFi-Native Crypto Credit Card | Spend & Earn Cashback with Cash | ether.fi, https://www.ether.fi/cash

- Can You Spend Crypto Without Selling It? Inside The ether.fi Cash Card's “Never Sell” Revolution | HackerNoon, https://hackernoon.com/can-you-spend-crypto-without-selling-it-inside-the-etherfi-cash-cards-never-sell-revolution

- Crypto Life | Empowering Self-Custody Crypto Spending,

- Crypto.com Visa Card: Earn Up to 5% back on your daily spending, https://crypto.com/en/cards

- Crypto.com Prepaid Visa Cards are available in which European countries?, https://help.crypto.com/en/articles/3966346-crypto-com-prepaid-visa-cards-are-available-in-which-european-countries

- Coinbase Card - Overview, https://help.coinbase.com/coinbase/trading-and-funding/coinbase-card/coinbase-card-for-the-us

- Coinbase Card for the EU, https://help.coinbase.com/en/coinbase/trading-and-funding/other/coinbase-card-faq

- The Easiest Crypto Credit Card to Apply for in 2025 - RedotPay, https://www.redotpay.com/news/the-easiest-crypto-credit-card-to-apply-for-in-2025

- Unparalleled Crypto Payment Experience - RedotPay, https://www.redotpay.com/sg

- KAST: Why bank with, when you can bank on

- MetaMask Card: spend crypto anywhere, https://metamask.io/news/introducing-metamask-card-upgrade-your-crypto-spending

- Spend crypto for everyday purchases with MetaMask Card, https://metamask.io/card

- FAQs | MetaMask Help Center, https://support.metamask.io/manage-crypto/metamask-card/card-faq/

- What is Gnosis Pay?, https://help.gnosispay.com/hc/en-us/articles/39388201965332-What-is-Gnosis-Pay

- Understanding Self-Custody with Gnosis Pay, https://help.gnosispay.com/hc/en-us/articles/39400375822484-Understanding-Self-Custody-with-Gnosis-Pay

- Gnosis Pay Documentation: Introduction,

- Understanding Your Card's Fees and Limits – Gnosis Pay, https://help.gnosispay.com/hc/en-us/articles/39533569163284-Understanding-Your-Card-s-Fees-and-Limits

- FAQ - Search anything Holyheld,

- Best Crypto Debit Cards from Centralized Crypto Exchanges | by Najah - Medium, https://medium.com/@najahghani786/best-crypto-debit-cards-from-centralized-crypto-exchanges-d5c318323248

- Cash | ether.fi Help Center,

https://help.ether.fi/en/collections/592872-cash

- ether.fi Cash: Crypto-Native Banking Built on Scroll

https://scroll.io/blog/etherfi-cash

- Backing Rain & RedotPay: Expanding the Frontiers of Stablecoin, https://www.galaxy.com/insights/perspectives/backing-rain-and-redotpay-expanding-the-frontiers-of-stablecoin-payments

- Rain | Stablecoin-Powered Cards & Payments Infrastructure,

- Plasma Partners with Rain Cards to Launch Cryptocurrency Payment Card, https://x.com/PlasmaFDN/status/1968307448542077105

- It’s Not Just a Smart Money App–It’s Who UR

https://ur.app/blog/announcements/ur-one-app-one-account-all-assets

- Crypto Debit Card Taxes | Expert Guide - Koinly, https://koinly.io/blog/crypto-debit-cards-tax/

- Visa Onchain Analytics Dashboard

https://visaonchainanalytics.com/

- Scaling and securing crypto payments

- Crypto Life | Empowering Self-Custody Crypto Spending

- Are Stablecoin Payments a Threat to Banks and Card Networks?

https://x.com/FourPillarsFP/status/1945658296511381789

- Plasma partnership with Rain