Stablecoins and the New Global Financial Rails

This research was possible thanks to our Strategic Partner - Plasma

The global financial system currently runs on decades-old infrastructure, sustaining frictions that act as a tax on economic activity - a problem particularly prevalent in the emerging markets. In response, new financial rails are organically emerging on public blockchains, utilizing stablecoins as their native medium of exchange. This article explores how stablecoins are solving the problems of cost, speed, and access. We examine the features of the technology enabling this shift and argue that it will culminate in an “Infrastructure Inversion” - a fundamental re-platforming that empowers individuals and will reshape the future of global commerce.

Smartphones Facilitate Digital Finance

Consider a software developer in Argentina working on a project for a client in San Francisco. He learned coding thanks to the resources freely available on the internet and now delivers top quality products for foreign companies. The payment arrives in seconds as a digital dollar, costs virtually nothing to transfer, and is settled directly into self-custodied wallet on his smartphone. This is not just a hypothetical future, it is the reality for a rapidly growing sector of freelancers as well as small businesses operating in an increasingly global and digital world, and it signals undergoing shifts in the financial infrastructure.

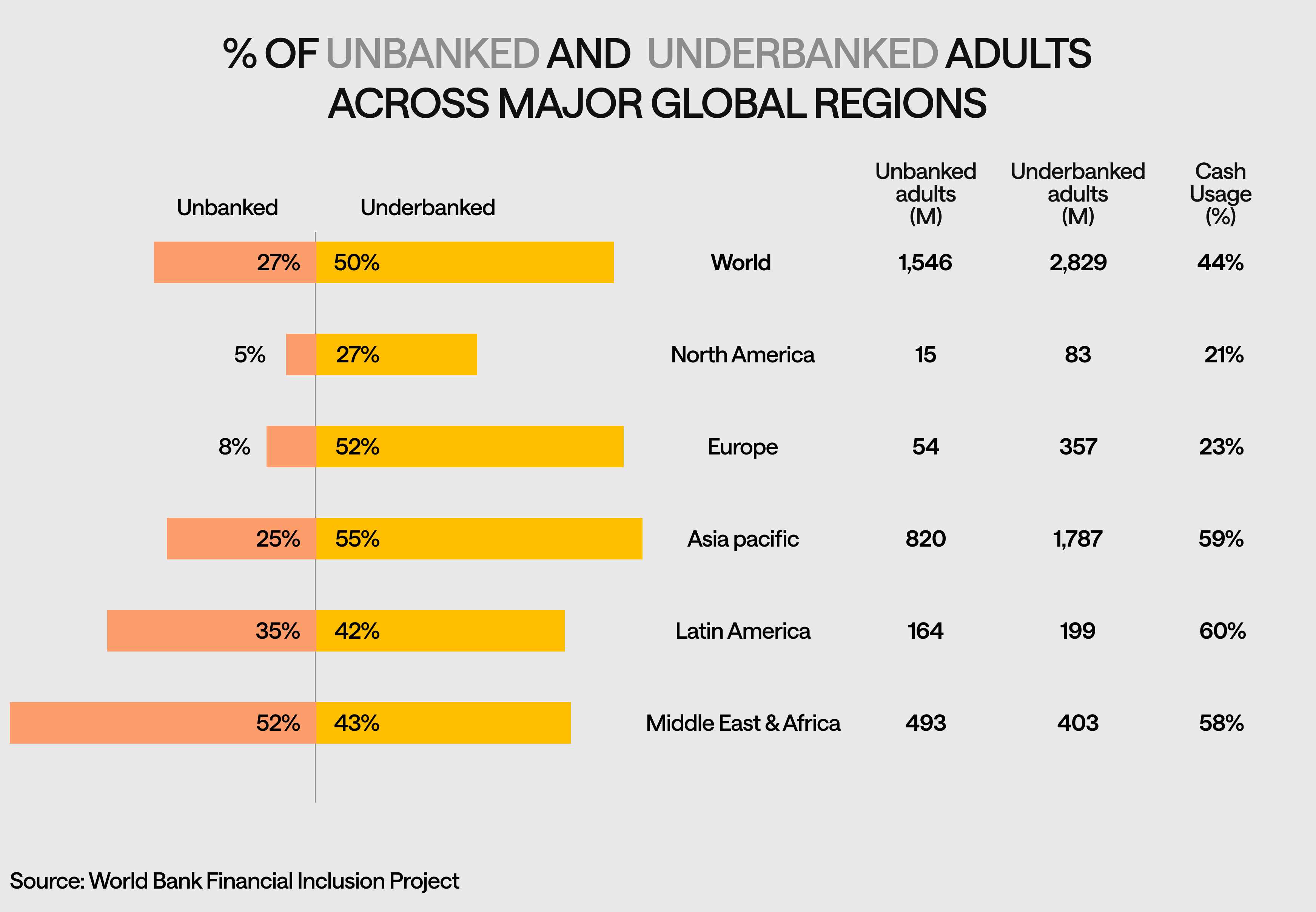

While critical financial services remain difficult to access for many, with 50% of the population remaining underbanked and over one third of the emerging economies - unbanked, the tools for a new digital economy are already in the hands of billions. Across key emerging markets, smartphone adoption was already nearly 80% in 2023, as reported by GSMA’s “Mobile Economy 2024” report. This reality effectively turns every phone into a potential gateway for letting users access the global financial network. However, despite this digital access, the underlying financial rails remain antiquated, presenting persistent barriers of gated access, high costs, slow speeds, and the constant risk of local currency devaluation. It is this gap - between digital access and legacy infrastructure - that stablecoins are decisively closing.

This shift towards empowering individuals is a result of a convergence of powerful macro trends. First, the post-pandemic normalization of remote work has created a truly global talent pool, disconnecting earning potential from local economic constraints. Second, after many years of development, blockchain infrastructure has matured beyond speculation into a viable settlement layer technology. Finally, the established adoption of a smartphone and access to mobile internet provides a capable terminal. The confluence of these forces is the primary catalyst for the acceleration of the re-platforming of finance onto stablecoin rails.

The Anatomy of Friction in Traditional Finance

The friction imposed on users within the traditional financial system is not just a minor inconvenience, it is a tangible tax on economic activity. For individuals and businesses in emerging markets, this manifests as a systemic headwind that gradually destroys value for families and strangles growth for small enterprises. Effectively turning the simple act of moving money across into a costly and complex procedure.

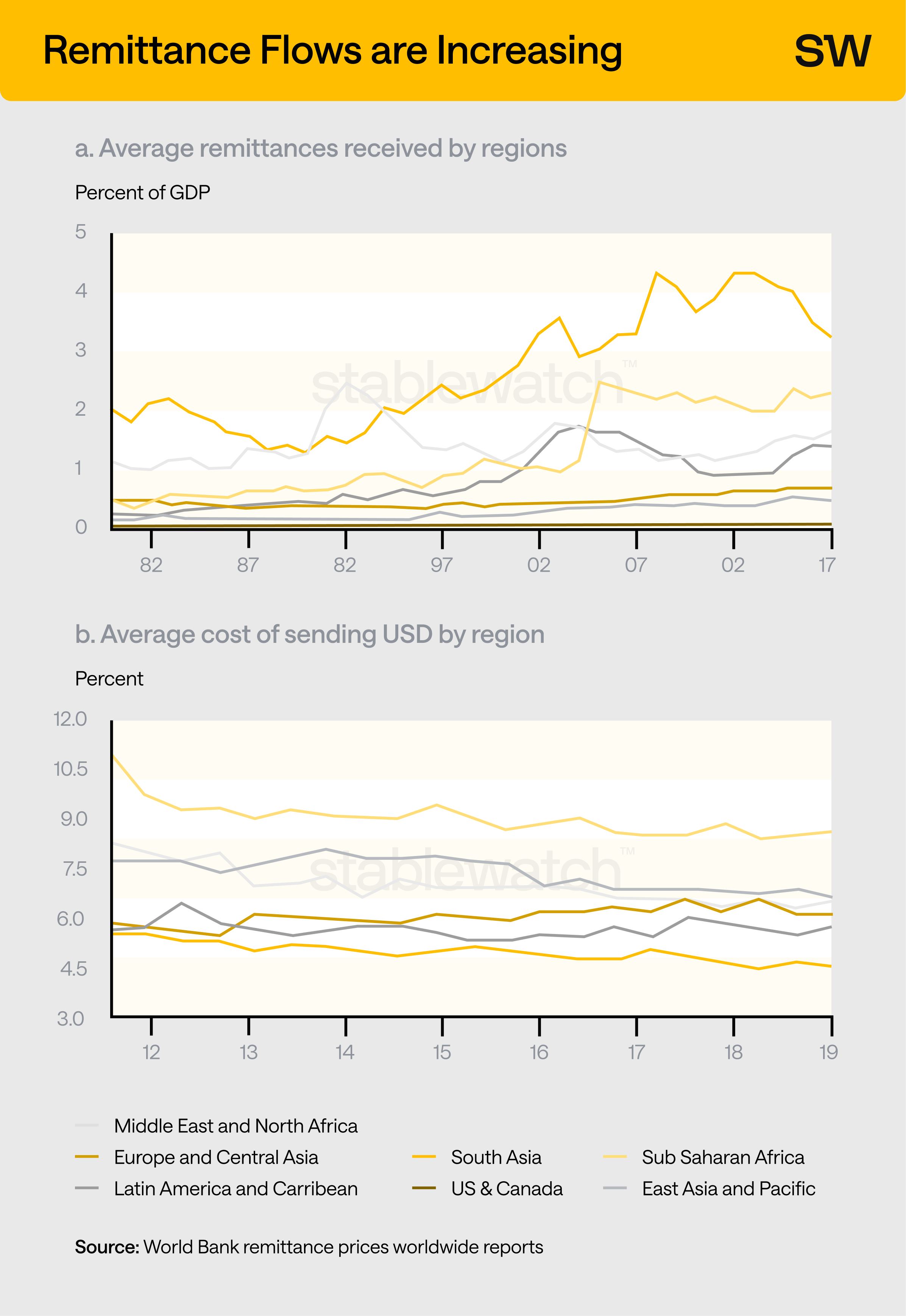

For individuals, this friction is best understood through an example of a remittance corridor. When a person sends a small, often vital, remittance to their family abroad, these funds do not travel directly to their destination. Instead, they are passed through a chain of correspondent banks, each taking a small fee for its service along the way. These fees, combined with often opaque currency conversion spreads, progressively reduce the amount that reaches the final recipient. Consider a typical $200 remittance: a $5 fee from the originating bank, a 2% hidden currency conversion spread at an intermediary, and another $5 fee from the beneficiary bank can mean the family receives only $186. That missing $14 could be a week’s worth of groceries.

Compounding on top of this loss is the time delay, often a 3-5 day settlement period, which can create anxiety for families in immediate need of funds. According to the recent World Bank’s report, the average portion of the GDP linked to the remittances received by a region has been growing in emerging economies - signalling an increased need for improving the service. Yet, the same data shows that the average cost of sending a transaction has barely improved.

For businesses, this same friction creates a working capital trap - a barrier hindering growth in capital-restricted environments. Many small enterprises rely on international suppliers and need to rapidly turn inventory into sales and sales into cash to fund their operations. In emerging markets, where access to short-term liquidity can be unreliable, the multi-day settlement delay can bring business to a standstill. While it is expected for the cross-border transfers to clear within two days, it’s often not the case.

To give an example, when a local manufacturer in Argentina pays a $5000 invoice to a supplier from Germany, that capital is effectively frozen in transit. The payment has been sent but the growth is stalled. For a small enterprise, the speed at which money moves directly impacts the speed at which it can scale. This is further compounded when the assets and liabilities are denominated in currencies such as the US dollar or Euro, introducing foreign currency exchange risk on top of the settlement delays.

The legacy finance system is full of road bumps. Intermediaries may not process the wires on time or could even reject them for minor reasons. From time to time, a wire can get lost for a week or two due to a simple clerical error on the banks’ side. Moreover, given the ancient architecture of the SWIFT system, locating the wire in real-time is nearly impossible for the customer, unthinkable for the modern cohort of blockchain-savvy users. Whenever a delay occurs, the business cannot prove the payment to release the shipment, tying up capital and compounding delays in production. This operational drag, inherent to the payment rails themselves, makes it difficult to compete with firms in better-capitalized regions of the world that have seamless access to a suite of advanced financial tools.

These frictions are not an accidental bug, but a core feature of an outdated architecture designed for the previous era. The chain of intermediary banks had to be built decades ago to connect disparate domestic banking systems. A modern digital payment today is often still routed through this multi-hop process, introducing delays, counterparty risks and intermediary fees at every step. It is a system unfit for a real-time, digital and global economy.

The Unbanked

Another source of friction in many emerging markets is the lack of access to financial services often taken for granted in modern economies. Either due to regulatory issues (local governments forcing the citizens to spend and save in local currency), lack of trust in the rule of law, or just banking infrastructure issues, the access to any form of a USD savings account is often restricted. The older generation would prefer to stash the dollars under their bed as a rainy day fund.

Holding them in a bank was often troublesome, and even when possible, would come with no interest and the risk of losing the access to funds in case of any political turbulence. The acceleration of the creation of an independent financial infrastructure that has been shaping up on-chain during the past five years is presenting a solution to this problem. The opportunity to self-custody your funds on your phone and transport them at will could become one of the biggest unlocks of the issue that citizens of many countries have been facing for years.

Stablecoins as a Solution for Enduring Financial Problems

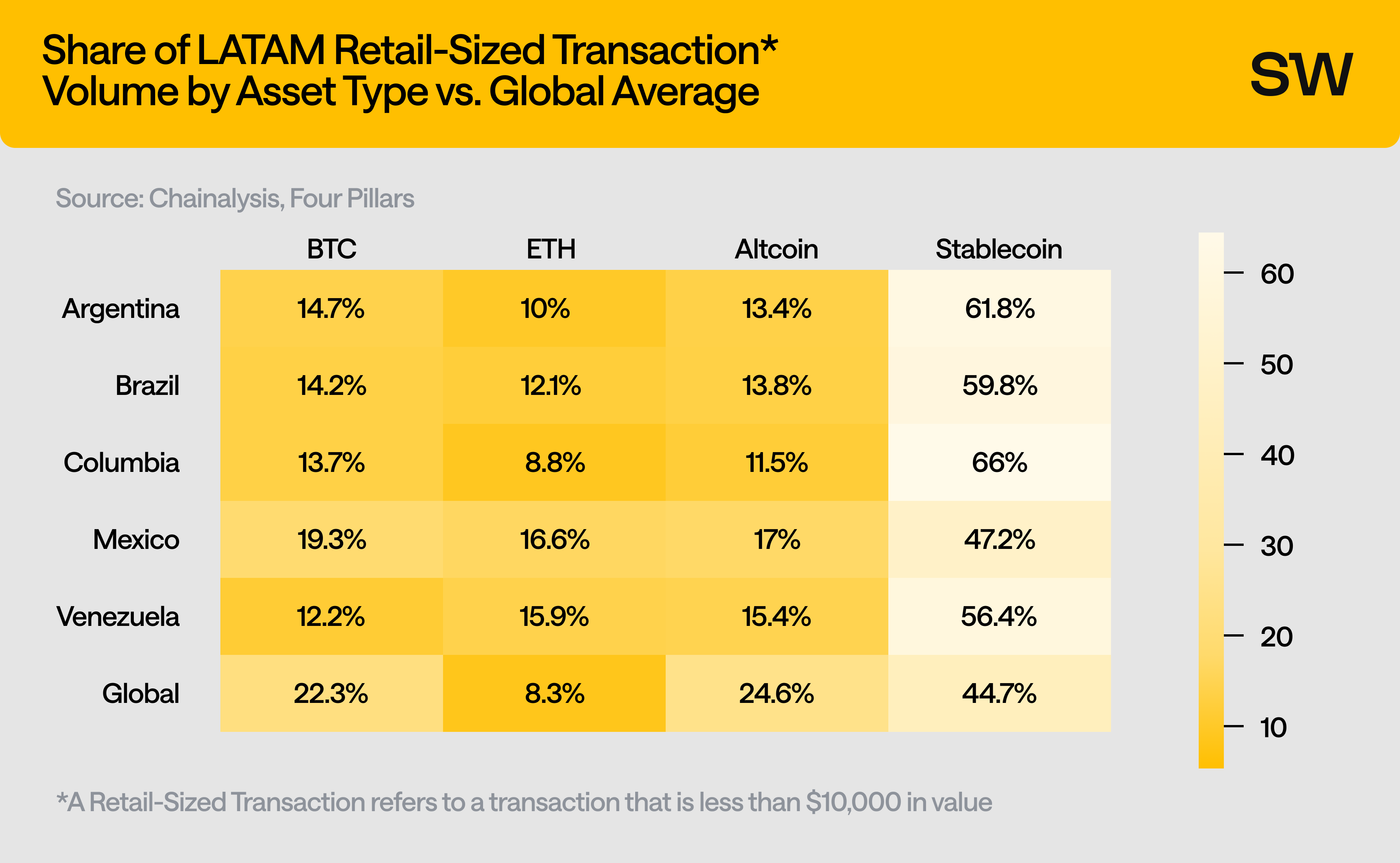

The acceleration in adoption of stablecoins is being driven not by speculation, but by the ability of this technology to solve fundamental economic problems with an efficiency that the traditional system lacks. For users in emerging markets especially, it provides direct answers to two of the most enduring challenges: how to preserve value in a volatile environment, and how to transfer it effectively.

For billions of people living in uncertain economies preserving wealth is an uphill battle against high inflation, restrictive capital controls, and various currency risks. Local currency savings can have their purchasing power melted away, while acquiring a more stable currency like the US dollar is often gated or deliberately made impractical. Stablecoins can provide individuals with the ability to hold a resilient store of value directly on their smartphone, in a self-custodied wallet that they alone have control over.

This simple upgrade insulates a portion of their accumulated wealth from the domestic monetary policy shocks and specific risks of the local banking system, offering a level of financial independence that was previously unattainable.

Beyond simply preserving value, stablecoins and their blockchain rails are also fundamentally changing how that value is moved. Operating on modern blockchain technologies lets users avoid the inefficient chains of intermediaries. Such architectures can enable near-instant settlement at a fraction of the cost, available 24/7, and with full transparency of the process for all parties involved.

The "Walled Gardens" of Existing Fintech

At this point, a skeptic might rightly ask: haven't modern fintech applications already solved these problems of cost and friction? It is true that a wave of innovation in recent years has dramatically improved the user experience, especially for domestic finance, wrapping cumbersome processes into a sleek user-friendly interface. However, a closer look reveals that much of the innovation happened at the interface level, while the core is still often built upon the same, decades-old foundations. This dependency on an unavoidable need to plug into the legacy system forces even the most ambitious fintech services into “walled gardens”.

This deep integration with a single country’s domestic banking system allows for hyper-efficient local transfers. However, the same architecture severely constrains potential for global reach. A payment app working great for Brazilians, cannot directly transact with a similar one in Nigeria. To move value between these two endpoints, the payment must exit the modern app and fall back onto the slow path of correspondent banks we detailed earlier. The last mile of user experience has been improved, but we have not yet managed to rebuild the primary inefficiencies of the global financial rails connecting them.

Stablecoins living on a public blockchain represent a fundamental architectural leap. They are not just an application built on the old system - they are a new financial primitive and a prime candidate for a replacement of the legacy infrastructure. From a purely technological standpoint, a transaction from a crypto wallet in Turkiye to a wallet in Indonesia is identical to one between wallets in the same city, traversing the same global protocol. While a different regulatory framework will apply in each jurisdiction, the underlying settlement layer itself is inherently borderless - a quality that the previous wave of fintech innovation fundamentally lacked.

The Technology Enabling Re-platforming

The architectural leap that stablecoins represent is supported by maturing stack of public blockchains, offering a robust infrastructure designed from the ground up to be global, fast, and resilient. To understand the current landscape, it is impossible to ignore the dominance of the Tron network, as of March 2025 hosting the largest supply of USD₮ at over 51.6b tokens, followed by Ethereum at 35.4b, together accounting for 76% of all USD₮ transactions that took place in Q1 2025. At the same time, other networks such as Polygon and Solana are showing strong growth, currently holding 3.7b and 2.2b USD₮ respectively. While the incumbents are growing, new designs are challenging their technology, such as Plasma, an upcoming stablecoin-first blockchain platform.

These networks are unified by a core principle, building for radical cost reduction as compared to traditional banking systems. The average transaction cost for a USD₮ transfer on Tron is around $1, contributing to its popularity and adoption in emerging markets. This paradigm shift transforms cross-border payments from a costly service into an accessible everyday utility, making it viable for a global user base. Plasma is even working on zero-fee USD₮ transfers that would eliminate the friction entirely.

Beyond the costs, trust and speed are critical for a new financial system as well, and different networks are exploring a spectrum of security models. While platforms like Tron and Solana optimize for high speed and throughput, essential for a payments-focused environment, others like Ethereum or Plasma make trade-offs to prioritize security by anchoring transactions in a strong settlement layer.

Finally, the future-proofing of the new financial stack comes from programmability. The smart contract capability common to all of the mentioned platforms, is the key that opens up applications beyond simple payments, such as on-chain lending, positioning the ecosystem to solve even more complex problems in the future. Drawing lessons from development finance, we know that unhedged foreign currency loans are a primary source of currency-induced credit risk for borrowers, hindering capital access in the emerging economies. Programmable blockchain networks could enable hedged lending protocols for the emerging markets, helping to mitigate these known risks from the ground up.

Solving for extremely low costs, security, and future growth, these stablecoin-supporting networks provide a solid foundation for a more equitable global economy.

The Coming Infrastructure Inversion

Our exploration - from the financial problems faced in emerging economies to the architecture of a new technology stack - reveals a compelling trend.

We began by diagnosing a system defined by friction that erodes value during transfer and traps the working capital of businesses. We saw how even modern fintech solutions often become walled gardens - improving the interfaces but remaining bound by the limitations of legacy rails.

Stablecoins emerge as a solution and a user-driven movement, to solve the enduring problems of the financial system. This represents a fundamental re-platforming of financial services and shows signs of an upcoming infrastructure inversion.

Currently, stablecoins are seen as a bridge between the endpoints of the traditional financial system. Connected by on-ramps and off-ramps to bank accounts and credit cards, this new technology is forced to connect to the old.

However, as we accelerate the adoption of stablecoin payment rails, we will enter the inversion - the roles will reverse. The stablecoin networks will eventually become the foundational, default rails for value transfer. At that point, traditional fintech and banking systems that are slow to adapt, will need to connect to blockchains to remain relevant, becoming the new off-ramps from a blockchain-native system. Instead of users cashing out stablecoins to pay with their bank card, merchants’ payment terminals will directly connect to the new financial rails to accept the payment.

The analysis in this article has established the foundational principles of the great re-platforming. We have introduced stablecoins as a precise solution to the problems faced by the global financial rails to serve as a foundation for the series of articles in which we will discuss stablecoin adoption and respective use cases around the world. We will explore how different countries are not merely adopting this technology, but are adapting it to solve their own unique economic challenges. Expect deep dives into the vibrant stablecoin ecosystems of Turkiye, South Korea, Argentina, and other key emerging markets around the globe in the coming months.

References:

- https://lucidityinsights.com/infobytes/over-34ths-of-adults-remain-unbanked-or-underbanked

- https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-economy/wp-content/uploads/2024/02/260224-The-Mobile-Economy-2024.pdf

- https://4pillars.io/en/articles/part3-global-stablecoins-use-cases

- https://www.bis.org/speeches/sp240827.htm

- https://castleisland.vc/wp-content/uploads/2024/09/stablecoins_the_emerging_market_story_091224.pdf

- https://a16zcrypto.com/posts/article/how-stablecoins-will-eat-payments/

- https://documents1.worldbank.org/curated/en/099736004212241389/pdf/P17300602cf6160aa094db0c3b4f5b072fc.pdf

- https://www.tcxfund.com/wp-content/uploads/2017/10/Impact-report-TCX-10Y.pdf

- https://coinlaw.io/tether-statistics/

- https://coinlaw.io/tron-statistics/

- https://4pillars.io/en/articles/plasma-everything-everywhere-all-at-once

- https://bscleaver.medium.com/illustrated-summary-notes-on-bitcoin-the-coming-infrastructure-inversion-by-andreas-121f99d6da04

About Piotr Kabaciński

Piotr is a Senior Researcher at Stablewatch focused on in-depth research and developing risk models for innovative stablecoin solutions. He holds a PhD in Ultrafast Spectroscopy from Politecnico di Milano, and has coauthored over 15 high-impact papers in leading scientific journals. He has worked in DeFi as an investor for venture capital firms Geometry and Synergis Capital, founded a startup, and worked as a Quantitative Researcher at Luban.