Sky Protocol: A Central Bank For The Open Economy

Introduction

Central banking has undergone three centuries of evolution, from the Bank of England's 1694 founding as a wartime government financier to today's sophisticated institutions managing monetary policy and nationwide financial stability. The Bank of England established the foundational public-private hybrid structure, pioneering exclusive banknote issuance and systematic capital mobilisation. The 19th century introduced the lender of last resort function in central banks, followed by the Federal Reserve's federal distribution model in 1913, which balanced centralised monetary policy with regional representation. Modern central banking achieved unprecedented macroeconomic sophistication through specific frameworks targeting inflation and employment. In addition to a comprehensive payments management system, and crisis response mechanisms. The series of financial crises in the past century however exposed critical flaws within this model where central bank authority was used to achieve political objectives at the expense of currency holders.

As inherently political entities operating within government frameworks, central banks face the agent principal problem that compromises their monetary sta

bility mandate. Political pressure during election cycles for economic accommodation and government financing needs create persistent incentives towards continuous monetary expansion and currency devaluation. The historical record demonstrates this pattern: the abandonment of the gold standard, persistent inflation above the intended target in many countries, and extraordinary monetary accommodation during crises that often extends well beyond emergency periods. These dynamics reflect not institutional failure but rather the inevitable tension between political governance structures and monetary policy objectives.

Sky Protocol represents a fundamental architectural transition that addresses these systemic limitations through a system of algorithmic policy execution and decentralised governance. Where traditional central banks operate within political frameworks that influence monetary decisions, Sky is able to achieve complete independence through transparent, rules-based governance controlled by stakeholders rather than political appointees.

While central banks coordinate monetary policy through master account holders—the privileged financial institutions that maintain accounts directly with the central bank—Sky operates through Stars (Prime Agents) that serve as the primary interface between the protocol and the broader financial ecosystem. The Risk Free Rate is replaced by the Base Rate that Prime Agents pay on Sky Loans. This agent-based structure eliminates the coordination overhead and political pressures that limit the efficacy of traditional central banks while providing 24/7 global operations and transparent auditable systems.

Through its comprehensive framework for the development of capital allocation agents, Sky Protocol establishes the foundation for a truly global monetary system owned and controlled by its participants. Beginning with USDS as a transparent alternative to traditional dollar-based systems, and sUSDS as internet native savings. Sky's architecture also provides the technical and governance framework for creating new currencies whether that be synthetic or in any other fiat denomination. Hence potentially serving as the world's first global democratic multi currency monetary authority that prioritises stability and preservation of value over political objectives.

History of Sky

Sky traces its origins back to MakerDAO, a project first introduced in the r/ethereum subreddit post “Introducing eDollar, the ultimate stablecoin built on Ethereum” in 2015 by Rune Christensen with the ambitious goal of creating a stable, decentralised digital currency. Its journey was one of innovation, crisis and finally rebirth. In 2017, following the release of the original whitepaper, “Dai (now Sai) Stablecoin System,” MakerDAO began operations with the launch of its DAI stablecoin, the decentralised dollar pegged asset, that subsequently dominated the onchain landscape. Sky trod an uneasy path. birthing a new category of protocols that used the Collateralised Debt Position (CDP), where users could lock in collateral assets, such as Ethereum, to mint DAI stablecoins.

The successful rise of Maker came to a halt during the "Black Thursday" market crash in March 2020 where Ethereum network congestion caused gas prices to soar to 200 Gwei, preventing critical price oracles from updating in a timely manner. $8.32 million in ETH was liquidated for 0 DAI, and 36% of all liquidation auctions saw no bids, leaving the protocol with $5.67 million in bad debt. MakerDAO responded through swift governance action, conducting debt auctions by minting and selling MKR to cover the shortfall. Crucially MakerDAO decided to add a centralised stablecoin, USDC in the Peg Stability Module mechanism, as an emergency collateral to provide liquidity, a measure that endures to this day. Following this crisis MakerDAO finalised the process of decentralising protocol governance from the Maker Foundation to the MKR token holders. Thereby allowing them to dictate protocol parameters and future developments.

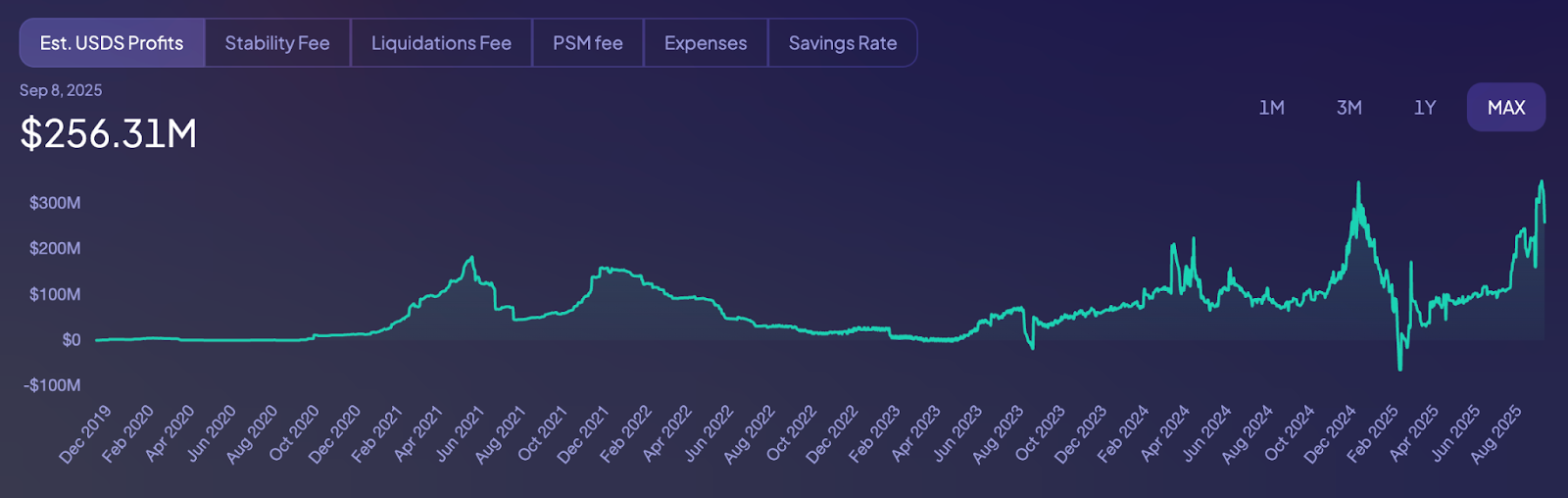

MakerDAO became one of the first DeFi protocols to integrate RWAs in the form of T Bills and private credit through Centrifuge's Tinlake protocol. In July 2021, MakerDAO became the first DeFi protocol to extend a $100 million credit line backed by RWAs to a traditional US bank (via SocGen Forge). Full rollout under MIP6 occurred in 2022, onboarding diverse RWAs like tokenized real estate and corporate debt. This was formalized through the "MIP6 Collateral Onboarding Application" proposal, accepted in early 2022. This created significant revenues for MakerDAO reaching over $100 million in 2023.

Even with DAI supply surging from $100 million to over $10 billion during this period it was inherently limited by the protocol's monetary architecture requiring significant overcollateralisation. The DAI name perplexed institutional capital which limited broad adoption. Furthermore throughout the next two years governance fatigue took its toll. There was a dire need for a change, one that was answered by the co-founder Rune Christensen’s Endgame plan. This was a decade-long roadmap that became the blueprint for a complete structural and ideological overhaul of MakerDAO. The primary objective became achieving a "self-sustainable equilibrium" and positioning the protocol for mass adoption. The plan's implementation culminated in the formal transition to the Sky Protocol identity in September 2024.

Endgame Plan

The Endgame framework represents Sky’s long-term strategic vision for merging complete decentralisation with renewed growth through economic entities first called subDAOs, then publicly known as Stars and however referred to in this article as Agents. This was an acknowledgement, that while the changes enacted in 2020 were necessary for initial decentralisation, they quickly became bottlenecks that limited protocol adaptability and growth. By transitioning to an agent driven model, Sky aims to preserve the governance structures that made MakerDAO special, while creating a system of incentives that drive agents to pursue economic opportunities for the benefit of the whole protocol.

The philosophical underpinning of the Endgame framework rests on the principle of "Universal Alignment" - ensuring that all ecosystem participants, whether human or autonomous, operate in ways that benefit the broader ecosystem. The Sky Atlas was created as the constitution for the Sky ecosystem, providing governance infrastructure that is designed to continuously evolve while maintaining its core principles.

Sky Core

Functions and Responsibilities

Sky Core is the foundational governance and operational layer for the Sky Ecosystem. It maintains direct control over critical system components while the protocol transitions to full agentic autonomy. This includes control over treasury operations, risk oversight, and the gradual transition of responsibilities to Star Agents. When it comes to the Treasury Management Function, Sky Core defines the distribution of all net revenue of the Sky Protocol among various downstream activities. This ensures that all necessary functions receive adequate funding through a structured “waterfall process”.

Sky Core’s revenue streams include:

- Stability Fees collected from Prime Agents borrowing at the Base Rate

- Peg Stability Module Fees collected when users trade in and out of collateral assets

- Liquidations Fees collected when a CDP vault becomes undercollateralised and gets liquidated

The Monthly Settlement Cycle managed by Sky Core synchronises financial operations, risk management across the ecosystem and most importantly core governance. This cycle includes:

- Calculating and allocating protocol revenues

- Settling Senior Risk Capital origination processes

- Processing conversions between different token types

- Funding Prime Agent Incentive Pools

- Executing Smart Burn Buffer operations

- Managing Core GovOps functions

Risk Oversight

Sky Core maintains direct oversight over critical stability mechanisms through the Asset Liability Management framework. During the transition period to full agent autonomy, Sky Core manages portions of the Sky Collateral Portfolio not yet deployed by Prime Agents. This activity is being continuously phased out through the The Asset Liability Management framework. This establishes universal rules requiring Prime Agents (subDAOs within the Sky Ecosystem such as Spark and Grove) to deploy Sky's Collateral Portfolio to maintain USDS (native stablecoin of Sky) peg stability through highly liquid assets such as USDC.

Sky Core additionally operates emergency response mechanisms, this includes the Governance Security Module allowing for pause delays, Emergency Spells for urgent protocol changes, and the Protego contract for canceling pending governance actions.

SKY: Sky Governance Token

SKY functions as the governance backbone of Sky Protocol, providing holders with comprehensive control over protocol operations. SKY holders can directly participate in Executive Votes for protocol changes or delegate their voting power through the Aligned Delegate system. Mimicking traditional political systems, this allows for merit-based exalted governance participants to make informed decisions while SKY holders retain full control over their tokens and can withdraw delegation at any time.

SKY holders control all critical protocol parameters including:

- The Sky Savings Rate

- Stability fees

- Debt ceilings for collateral types

- Risk parameters for Agent operations

- Emergency response procedures

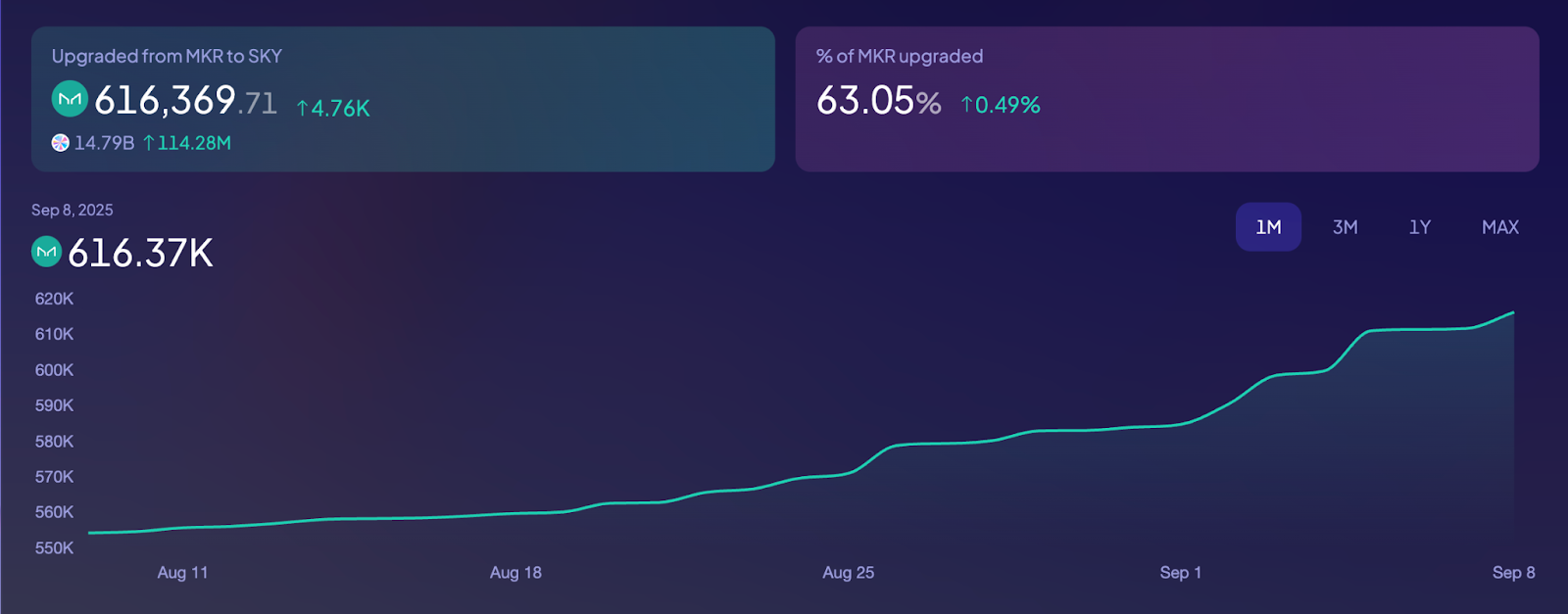

There are currently 6,257 holders of SKY with 63.05% of MKR tokens being migrated to SKY.

SKY Utility

The primary utility of the SKY token are the staking mechanisms that provide voting rewards to active governance participants. SKY stakers can choose between receiving USDS rewards sourced from the Treasury Management Function or Agent token rewards currently only available in SPK (governance token of the first Star Agent Spark). The staking system operates through two separate reward mechanisms based on wallet activity levels with Standard Activity Staking Rewards (SASR) acting as the base reward tier and High Activity Staking Rewards (HASR) for actively engaged wallets.

SKY stakers could additionally borrow USDS, through the stUSDS module currently in development. This mechanism creates capital efficiency for governance participants while maintaining their voting rights. The module would additionally serve as a debt tool for Sky Core, allowing them to raise funds without needing to sell SKY tokens.

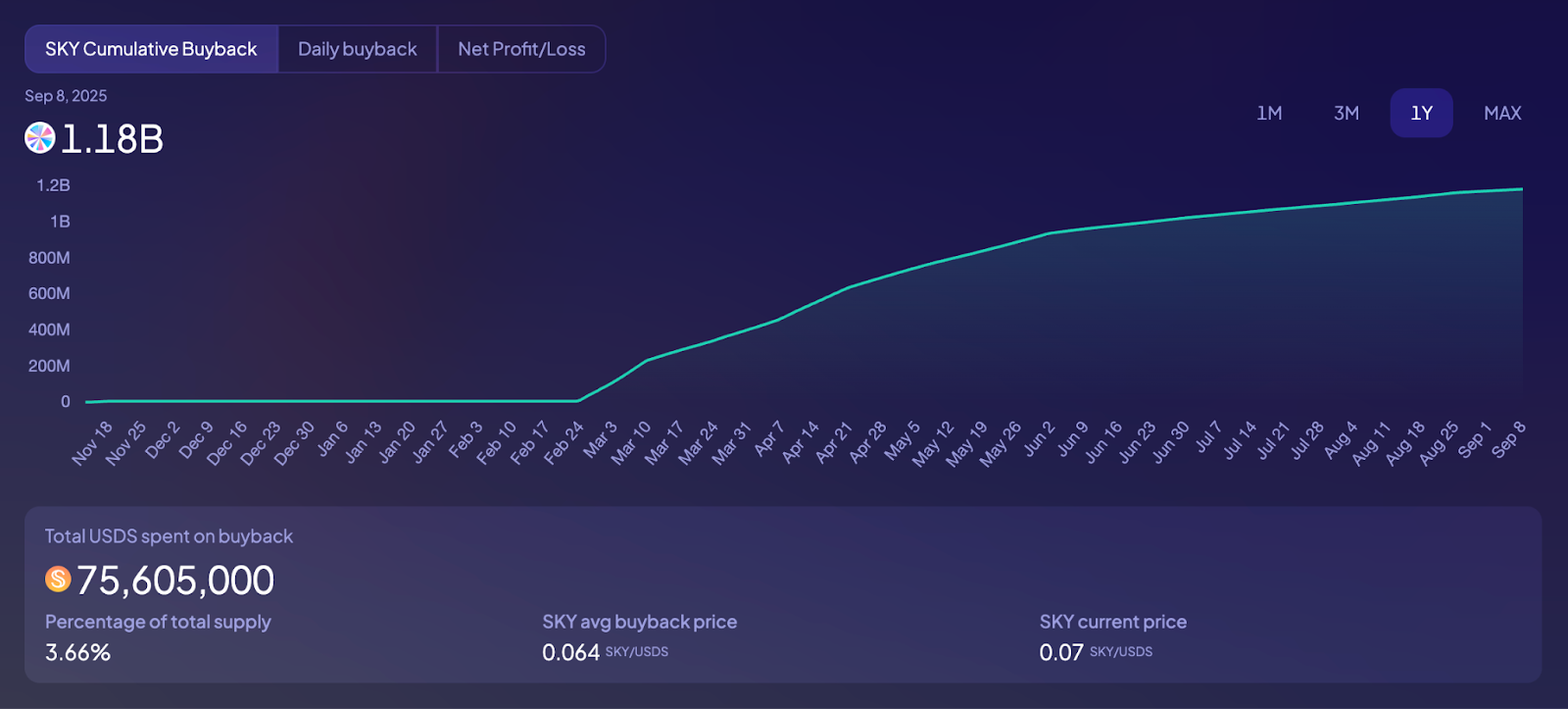

The Smart Burn Engine provides additional economic utility by systematically purchasing and burning SKY tokens using protocol revenues. Such a mechanism creates deflationary pressure on the SKY token supply, directly benefiting all SKY holders through reduced supply dynamics.

Emergency Powers

The SKY token serves as the ultimate safeguard of the Sky Protocol enhancing system stability through the SKY Backstop mechanism. If USDS ever becomes undercollateralised (with both junior and senior risk capital becoming exhausted), the protocol automatically generates and sells SKY to recapitalise the system. Controls governing the backstop system include:

- Emission rate management

- Maximum emission levels per event

- Override mechanisms for extreme scenarios

- Halt mechanisms for severe risk situations.

SKY holders possess emergency powers through calling specialised contracts that allow bypassing normal governance delays in critical situations. These include a contract for disabling parameter adjustment modules and a contract for emergency Smart Burn Engine controls.

USDS: Internet Native Dollars

USDS Minting

USDS operates as Sky Protocol's primary stablecoin, it is generated through multiple pathways including:

- Direct issuance via Peg Stability Modules

- Borrowing against approved collateral through the Native Vault Engine

- Conversion from DAI at a 1:1 ratio

The Peg Stability Module (PSM) serves as the primary mechanism for USDS generation and stability maintenance. Users can mint USDS with Cash Stablecoins at parity. Additionally swaps back into backing assets (currently just USDC and DAI) also occur at parity, creating immediate arbitrage opportunities that help maintain the peg.

The Native Vault Engine, currently controlled by Sky Core but planned for Agent ownership, allows users to borrow USDS against approved collateral types.

Accessibility Rewards provide additional incentives for Prime Agents and third-party partners who drive USDS adoption. These rewards operate as percentage-based fees calculated on USDS balances associated with specific reward codes and currently structured at 0.1% annually split between Integrator and Prime Agent Management portions.

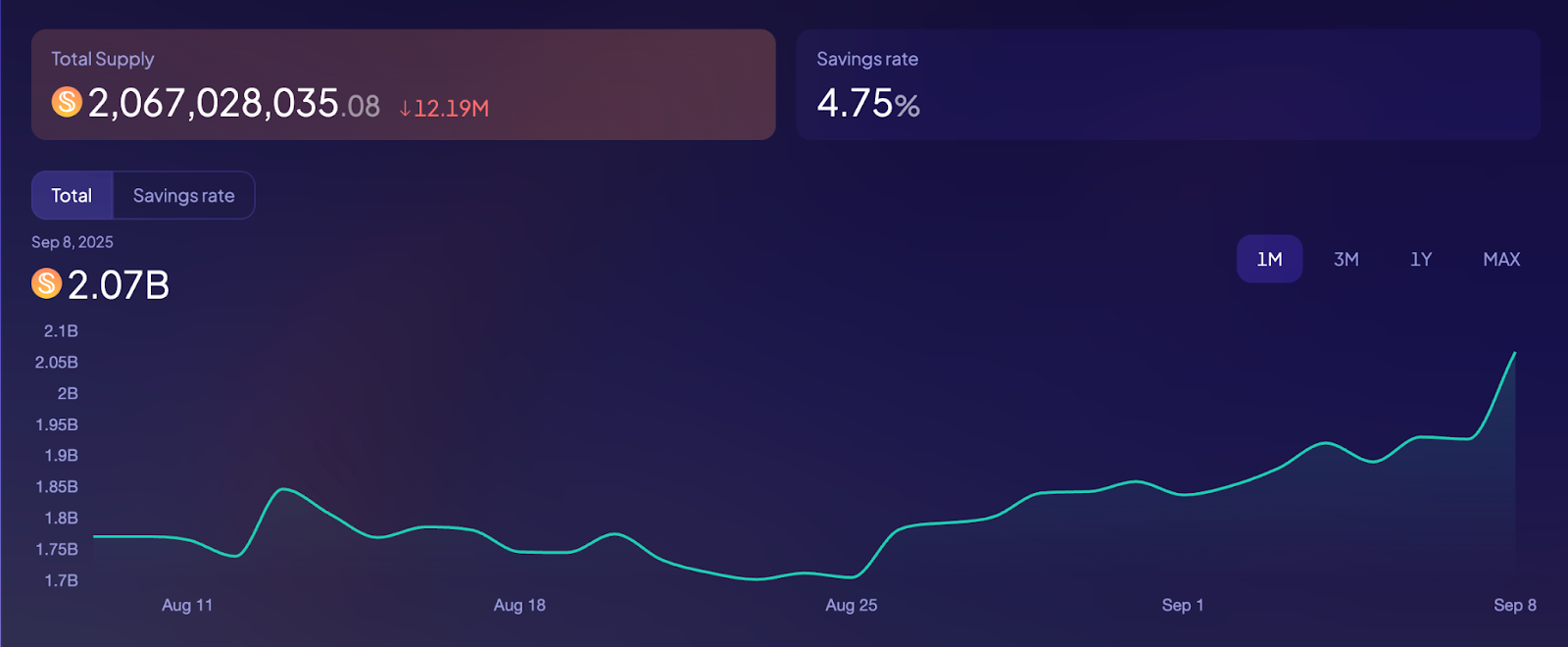

sUSDS: The Global Savings Account

sUSDS represents the native yield bearing version of USDS. Users access the token by depositing USDS into the sUSDS contract and earn the Sky Savings Rate (SSR) on their holdings. The Sky Savings rate is set at 0.3% below the base rate of the protocol and is currently at 4.75%. Rate modifications through the Bounded External Access Module enable Core Executor Agents to make adjustments within predefined parameters without initiating a full governance process. This ensures the Sky Savings Rate continuously remains competitive and aligned with market conditions.

Integration with the Token Rewards mechanism provides additional value streams for sUSDS holders where SKY and Star Agent tokens are systematically distributed to sUSDS holders, with rates calibrated at each Executive Vote (governance vote implementing technical changes to the protocol).

The Integration Boost mechanism extends Sky Savings Rate benefits to sUSDS holders within external DeFi protocols, ensuring users don't forfeit yield when utilising sUSDS in third-party applications like lending platforms or decentralised exchanges (DEX).

stUSDS: Lending to SKY Stakers

The stUSDS token currently in development serves as a risk capital token designed for more expert users who wish to engage with higher risk modules. stUSDS is structured to absorb a greater share of system risk in exchange for a larger portion of rewards. It serves a specialised function as the token providing segregated risk capital for the SKY Staking leverage system, which ensures that SKY-backed borrowing is funded by isolated capital pools. Users access stUSDS by depositing USDS into the stUSDS contract, receiving stUSDS tokens that represent their claims on the segregated risk capital used to fund SKY-backed borrowing operations.

The stUSDS Rate is calculated using the formula:

stUSDS Rate = Utilization × (SKY Borrow Rate - stUSDS Accessibility Reward) + (1 - Utilization) × Sky Savings Rate.

This formula ensures depositors earn a rate derived from the SKY Borrow Rate less the stUSDS Accessibility Reward on the utilised portion of their capital and the Sky Savings Rate on the unutilised portion.

- Utilisation represents the percentage of funds in the stUSDS contract that are actively used to fund borrowing against staked SKY, with the system targeting a 90% utilisation rate through dynamic rate adjustments.

- The SKY Borrow Rate adjusts dynamically based on utilisation levels: when stUSDS utilisation is below 90%, the rate gradually decreases; when above 90%, it gradually increases.

- The Accessibility Reward encourages Prime Agents and Integrators to promote stUSDS adoption, initially set at 0.05% for Integrator portions and 0.05% for Prime Agent Management Fees, totaling 0.1%.

The maximum amount of USDS that can be borrowed against staked SKY is dynamically determined by, and equal to, the total amount of USDS currently held within the stUSDS contract. This replaces traditional static debt ceiling mechanisms. stUSDS conversion back to USDS is subject to available unutilised liquidity in the stUSDS converter contract.

During the transition period pending full stUSDS system development, SKY-backed borrowing is temporarily funded directly by Sky.

srUSDS: Senior Risk Capital

srUSDS, also in the process of development, represents the tokenised form of External Senior Risk Capital (ESRC). This allows external investors to provide capital that would absorb losses in the case of prime agent defaults and the exhaustion of junior risk capital. Users deposit USDS into the srUSDS contract to participate in the Senior Risk Capital system, earning higher yields in exchange for assuming the senior level risks.

This risk capital would only be called upon if the Junior capital provided by Star Agents is not sufficient to cover the default. Prime agent junior capital is made up of:

- Internal Junior Risk Capital (IJRC): Capital owned directly by the Prime Agent itself.

- Prime-External Junior Risk Capital (SEJRC): Junior Risk Capital rented from another Prime Agent via the Junior Risk Capital Rental Primitive

- Tokenized External Junior Risk Capital (TEJRC): Capital provided by external investors depositing sUSDS into a specialised contract.

The srUSDS system operates through deposit and redemption queues managed during Monthly Settlement Cycles. Users can add USDS to deposit queues for conversion to srUSDS, or add srUSDS to redemption queues for conversion back. However assets in queues can be withdrawn before settlement cycles begin. Conversion rates between USDS and srUSDS reflect the compounded net returns earned by the ESRC pool, updating at each Monthly Settlement Cycle. The rate increases or decreases based on ESRC pool performance, providing market-based pricing for Senior Risk Capital participation.

Prime Agents can originate Senior Risk Capital through monthly bidding processes where they compete for access to available Total Senior Risk Capital pools. This system includes both Internal Senior Risk Capital from Sky surplus buffers and External Senior Risk Capital from the srUSDS contract.

Crosschain Interoperability

SkyLink is the Sky Protocol's multichain solution, enabling native crosschain functionality for USDS, SKY, and sUSDS across Ethereum L2s and major L1 protocols. This system supports native implementations of core Sky features including Savings Rate mechanisms, Token Rewards distribution, SKY Staking capabilities, and Integration Boost functionality across all supported chains.

Alternative L1s are currently not supported however there are plans for SkyLink to be extended to all blockchains. Outside of the Ethereum ecosystem USDS and sUSDS are available only on Solana through an implementation by bridge provider Wormhole.

Agent Framework

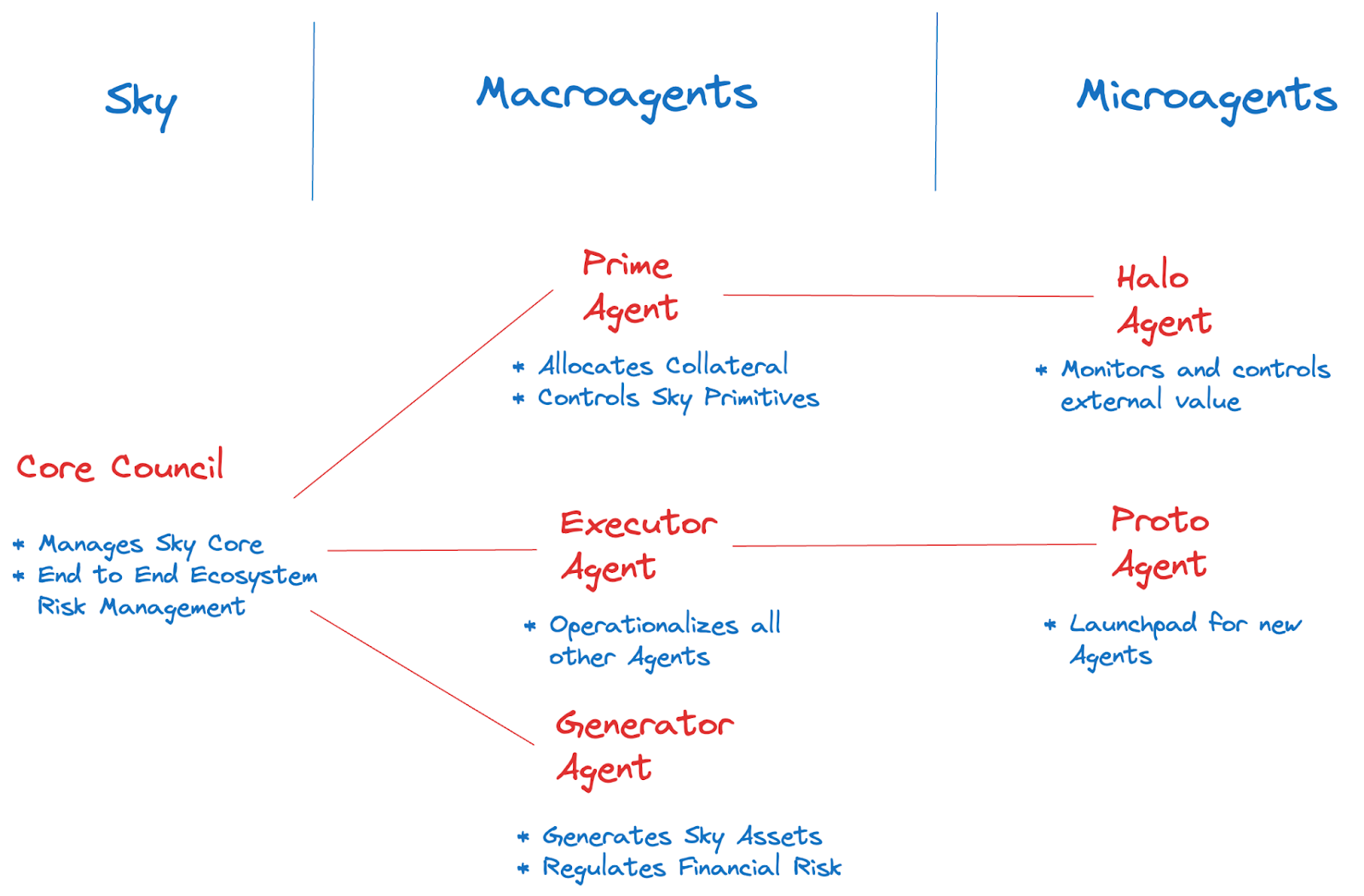

The newly introduced Sky Agent Framework which is evolving in real time serves as the backbone of how Sky manages its resources and regulates risk. This overview is very much forward looking with some of the features discussed yet to be implemented. The framework distinguishes between two broad classes of Sky Agents: Macroagents and Microagents, where Macroagents interact directly with Sky as an "L2 for governance," while Microagents interact with Macroagents as an "L3 for governance."

The framework includes multiple Agent types:

Macroagents:

- Prime (Star) Agents: focused on financial risk management and Sky Primitives utilisation

- Executor Agents: focused on operational security and risk oversight

- Generator Agents: specialised Macroagents for generating new stablecoins

Microagents:

- Halo Agents: Microagents focused on product development and external asset management

- Proto Agents: Microagents serving as launchpads for new Agents

The Core Council concept provides overall structure management for all Sky Agents and Sky Core, consisting of rotating Executor Agents elected by Sky Governance. This ensures proper oversight combined with specialised autonomy within clearly defined parameters.

Prime Agents

Prime Agents represent the evolution of Star Agents with a refined focus on allocation of Sky resources and risk management. Prime Agents access most Sky Primitives including:

- Allocation System Primitive for capital deployment

- Junior Risk Capital Rental for efficient capital utilisation

- Asset Liability Management tools for risk optimisation

- Core Governance Primitives for maintaining ecosystem infrastructure

The current Prime Agents, Spark and Grove, are an example of practical applications of the Prime Agent concept.

The Allocation System Primitive, enables Agents to deploy capital into yield-generating opportunities while maintaining appropriate risk management. The Base Rate mechanism determines the cost for Prime Agents to borrow USDS from Sky for deployment into allocation opportunities. This rate is dynamic and reflects underlying market conditions.

Success in this strategy depends on identifying opportunities that exceed the Base Rate after accounting for risk capital requirements and operational costs.

Prime Agents earn fees through various ecosystem services including:

- Accessibility Rewards for driving USDS adoption

- Integration Boost management for maintaining yield consistency across DeFi protocols

- Pioneer Chain operations for expanding USDS to new blockchain networks.

- Agent Rate on unrewarded USDS and DAI balances, typically 0.1% below the Base Rate

Prime Agents must however maintain specific percentages of Actively Stabilizing Collateral and Demand Absorption Buffers relative to their allocated capital.

Prime Agents must also maintain appropriate ratios between Internal Junior Risk Capital, External Junior Risk Capital, and Senior Risk Capital to ensure adequate risk absorption capacity. Prime Agents bid for access to Total Senior Risk Capital pools, with successful bidders paying uniform clearing prices determined by an auction mechanism.

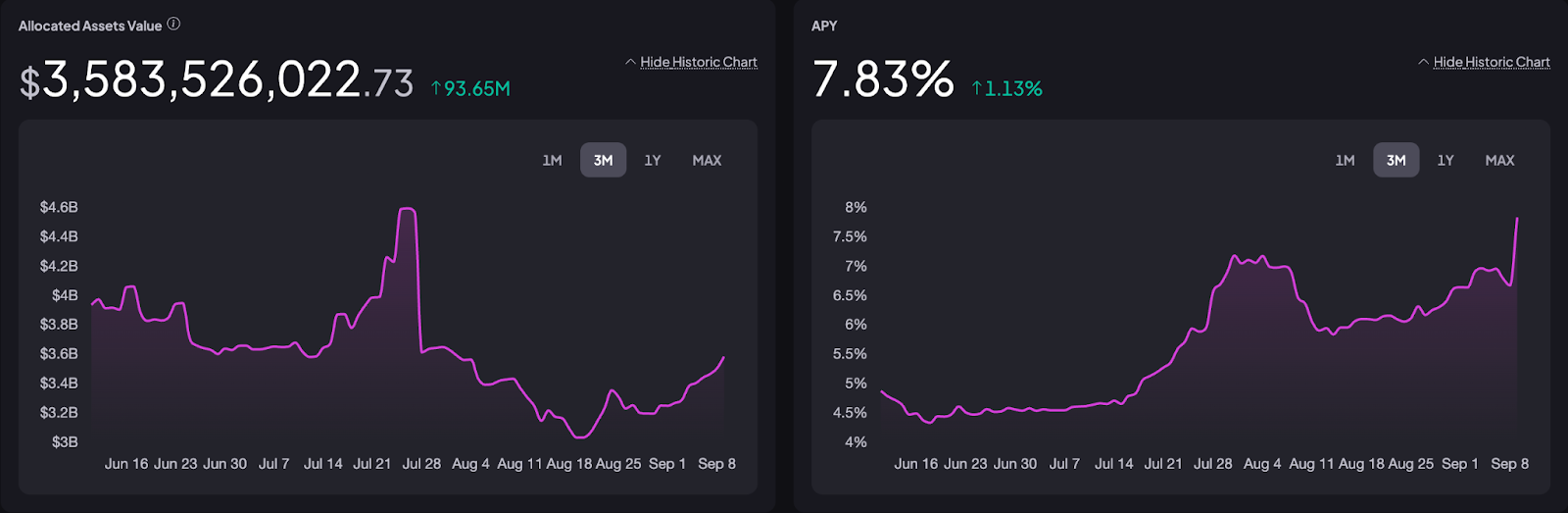

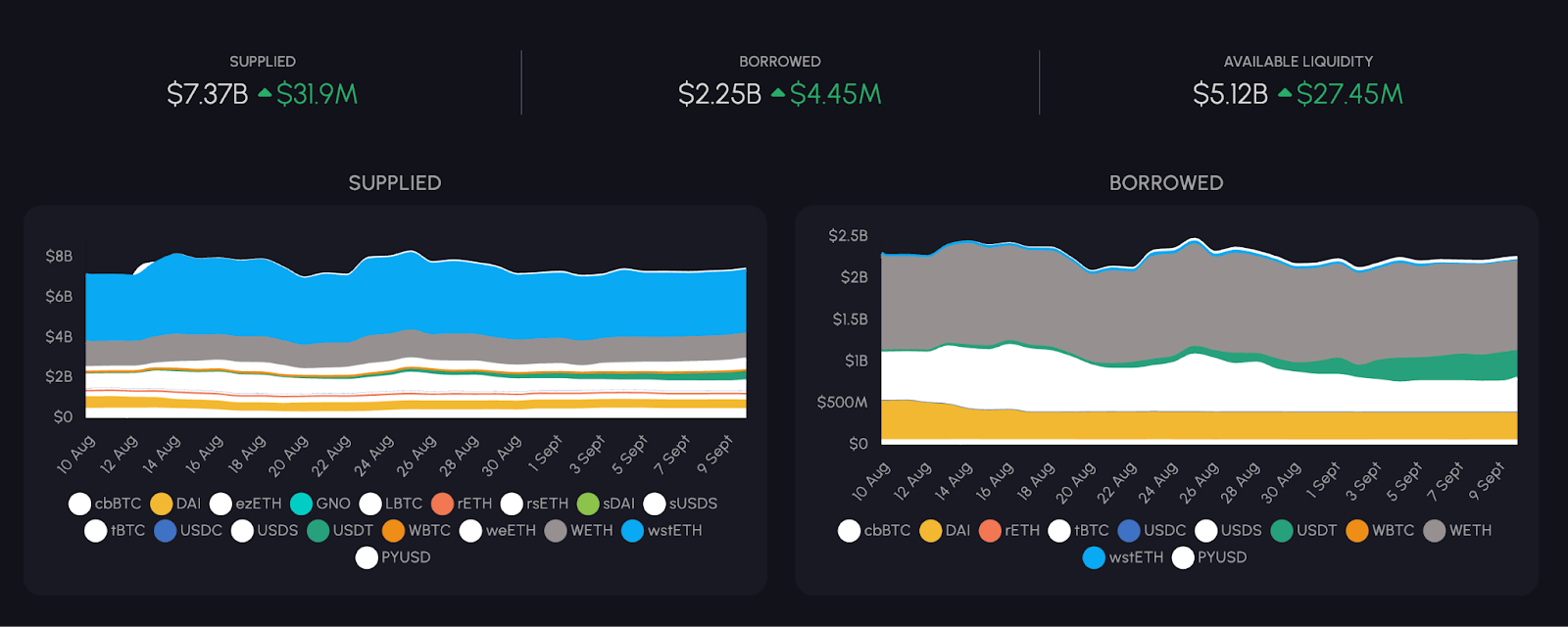

Spark

Spark operates as inaugural Star Agent, functioning as an active capital allocator, and is actively focused on building USDS adoption on Ethereum and its L2 ecosystem. Since its inception in May of 2023 within Pheonix Labs by Sam MacPherson, Spark has attained significant traction currently sitting at a TVL of just under $7.5 billion split among its product suite. Cumulatively Spark has earned over $123.6 million in protocol fees and currently has an annualised revenue of $31.8 million.

Core Architecture

Spark's architecture centers around three primary components:

- Spark Liquidity Layer (SLL) for capital allocation

- SparkLend for lending protocol operations

- Spark Savings for stablecoin yield generation

Each module optimises for specific aspects of USDS ecosystem development.

Spark Liquidity Layer (SLL):

The SLL works through minting USDS against Sky's collateral through the Sky Allocation Vaults, utilising SkyLink for native crosschain bridging of USDS and sUSDS, and leveraging the PSM for instant, slippage free swaps between USDS, sUSDS, and USDC across multiple chains.

The SLL integrates with off-chain monitoring solutions that continuously observe liquidity conditions across chains, yield performance from external DeFi protocols that Spark allocates to, and Sky's reserve levels, automatically rebalancing liquidity in real-time based on these metrics.

Current SLL deployments include over $3.5 billion allocated across diversified DeFi strategies resulting in an APY of 7.83% on protocol assets.

Deployments are split up amongst a range of vehicles including:

- SparkLend $1.22 billion (33.92%)

- Morpho at $946.52 million (26.36%)

- Ethena at $714.02 million (19.93%)

- Maple at $630.77 million (17.6%)

- Peg Stability Module at $45 million (1.26%)

- Idle USDC liquidity at $17.99 million (0.5%)

- Curve at $9.55 million (0.27%)

- Aave at $3.51 million (0.1%)

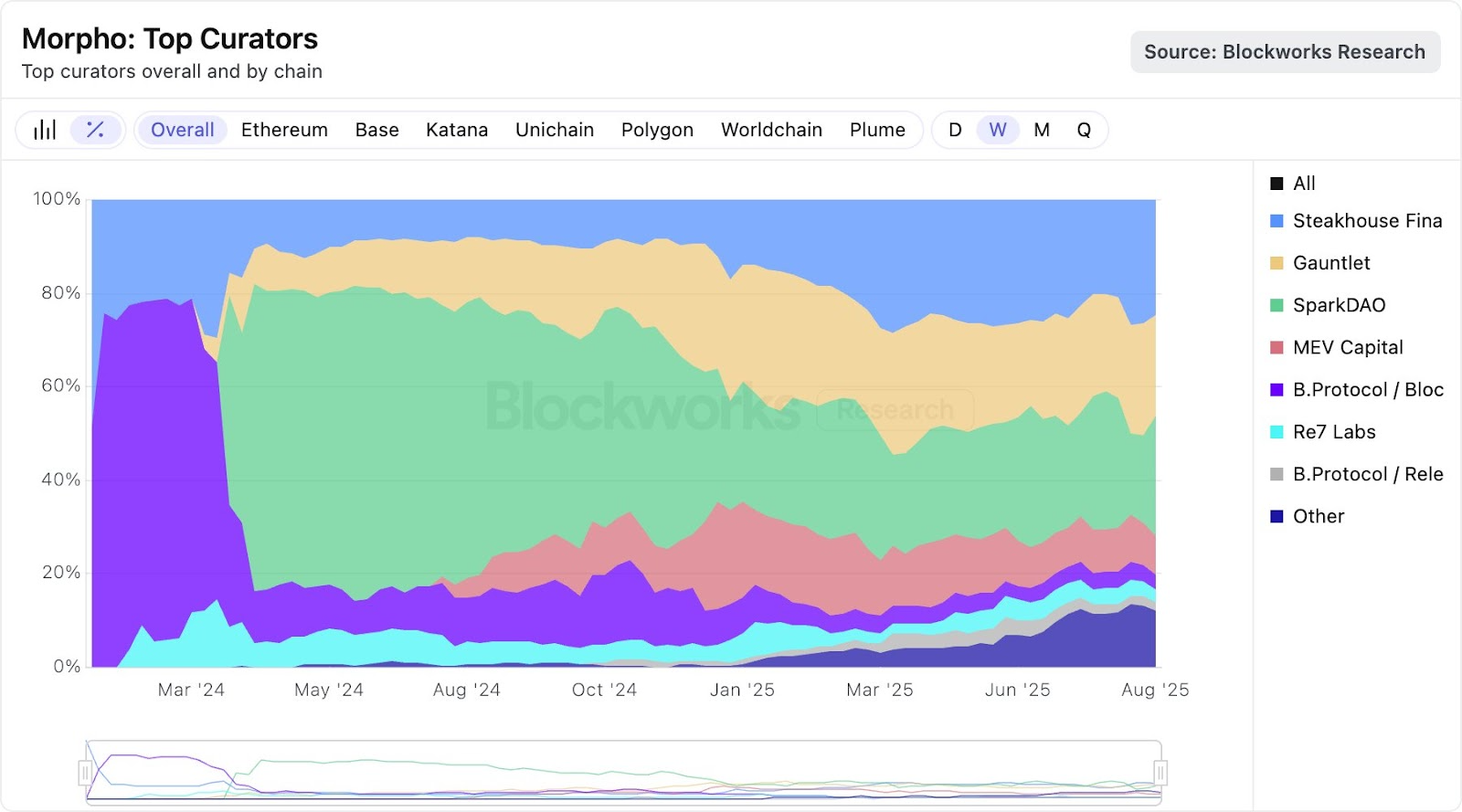

Revenue generation through SLL occurs via multiple streams including supplying liquidity to SparkLend, the basis trade capturing Perpetuals funding rates through Ethena’s USDe, funding institutional bitcoin backed loans through Maple and currently being the largest vault curator on Morpho.

The allocation of the Spark balance sheet to these protocols is what generates the aforementioned 7.83% APY. However, from this amount, Spark has to pay out the Base Rate, which is made up of:

- Sky Savings Rate (4.75%)

- Sky Spread (0.1%), which facilitates ecosystem financing

- Accessibility Reward Fee (0.2%)

The Accessibility Reward Fee itself, is made up of:

- Rewards for Integrators (0.1%)

- Prime Agent management fee (0.1%) which goes back to Prime agents like Spark

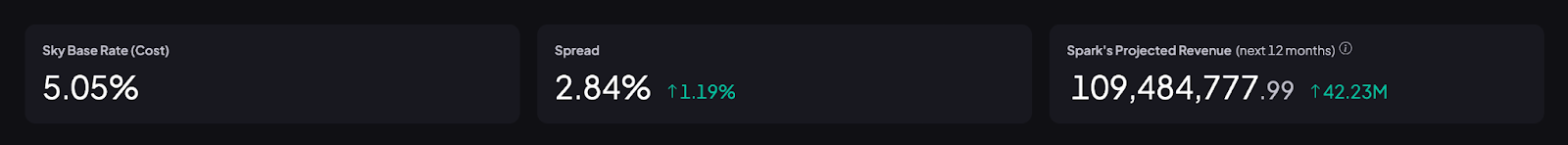

The resulting spread for Spark is currently at 2.84% which results in annualised projected revenue of over $109.4 million.

SparkLend

SparkLend was initially part of the Sky Core developed by Pheonix Labs before being spun off into the Spark Prime Agent entity. While it is a fork of Aave v3, it differentiates itself from other lending protocols including its progenitor, through a limited supported collateral model. SparkLend only supports sUSDS and ETH, BTC derivative assets.

These include:

- wstETH

- rETH

- weETH

- cbBTC

- LBTC

- tBTC

- rsETH

The protocol applies a customised rate model to the USDS market directly linked to the Sky Savings Rate, offering USDS borrowing at a fixed rate informed through the SSR which itself is controlled through governance rather than fluctuating market-driven rates, providing predictable and consistently low borrowing costs.

SparkLend receives liquidity injections from Sky's vaults through its direct integration with the SLL. USDS pools are continuously supplied with freshly minted USDS that can be dynamically withdrawn or re-supplied based on protocol demand.

SparkLend currently has a TVL of $5.1 billion, in addition to a treasury of just under a million dollars.

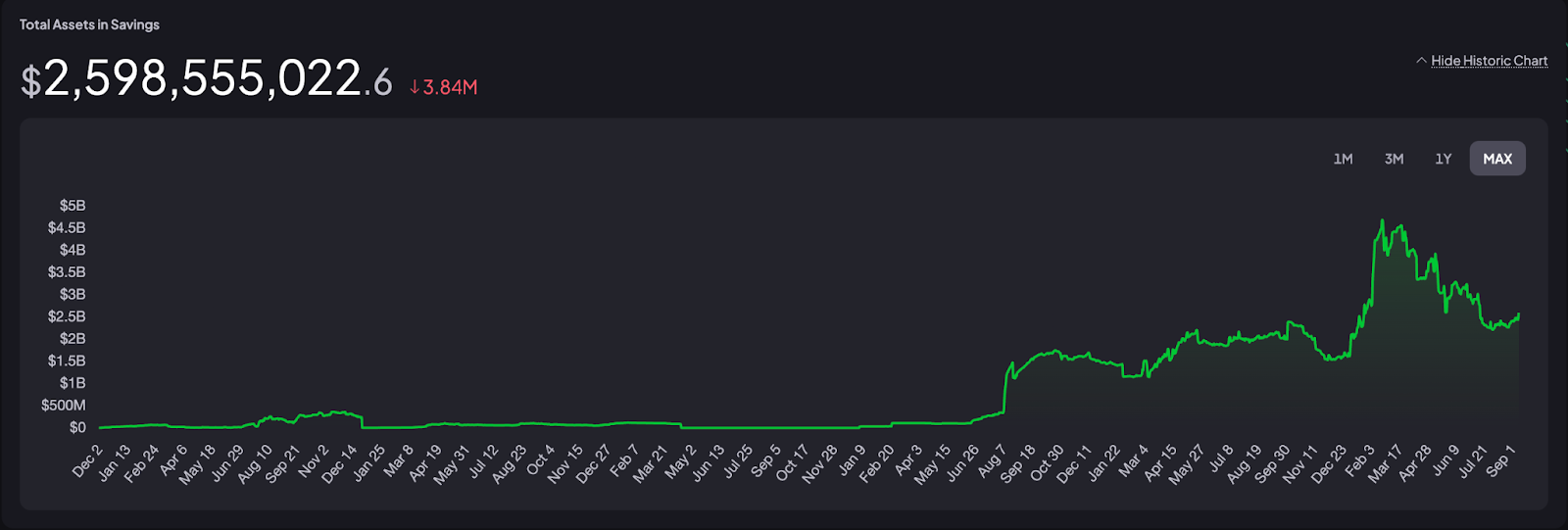

Spark Savings

Spark Savings operates as one of the primary vehicles for users to get access to the Sky Savings Rate. This is done through the Spark Savings frontend where users can deposit USDC, USDS and DAI in exchange for Sky’s sUSDS and Spark’s own savings token sUSDC at parity using the PSM. USDT may also be used however this will likely result in minor slippage.

sUSDS and sUSDC earns the Sky Savings Rate currently set at 4.75% and has a TVL of over $2.59 billion. This is split up among sUSDC with $1.25 billion in commitments and sUSDS with 260.71m in commitments.

Spark Savings creates powerful network effects by serving as both a user acquisition tool for Sky Protocol and a capital source for Spark's operations, where increased user deposits expand the available capital for Spark's allocation strategies.

Cross-Chain Operations

Spark operates across multiple chains including: Ethereum Mainnet as the primary hub, Base, Arbitrum, Optimism, and Unichain. The multi-chain expansion leverages SkyLink, Sky Protocol's native cross-chain bridge developed specifically for seamless transfer of USDS and sUSDS across supported networks,

SkyLink integration allows the Spark Liquidity Layer to automate real-time liquidity rebalancing across chains. This automatically bridges additional USDS from Ethereum mainnet or USDC using Circle's Cross-Chain Transfer Protocol (CCTP) when PSM demand increases on Layer 2 networks. In addition to reallocating excess idle capital back to mainnet for optimal capital utilisation.

SPK Governance Token

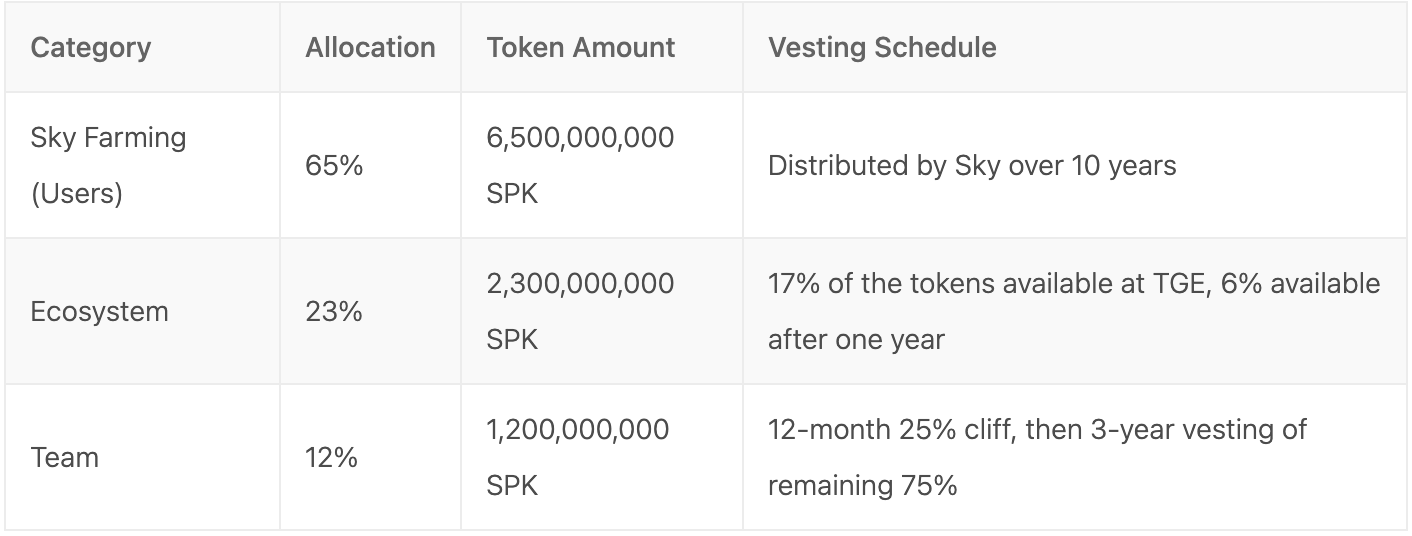

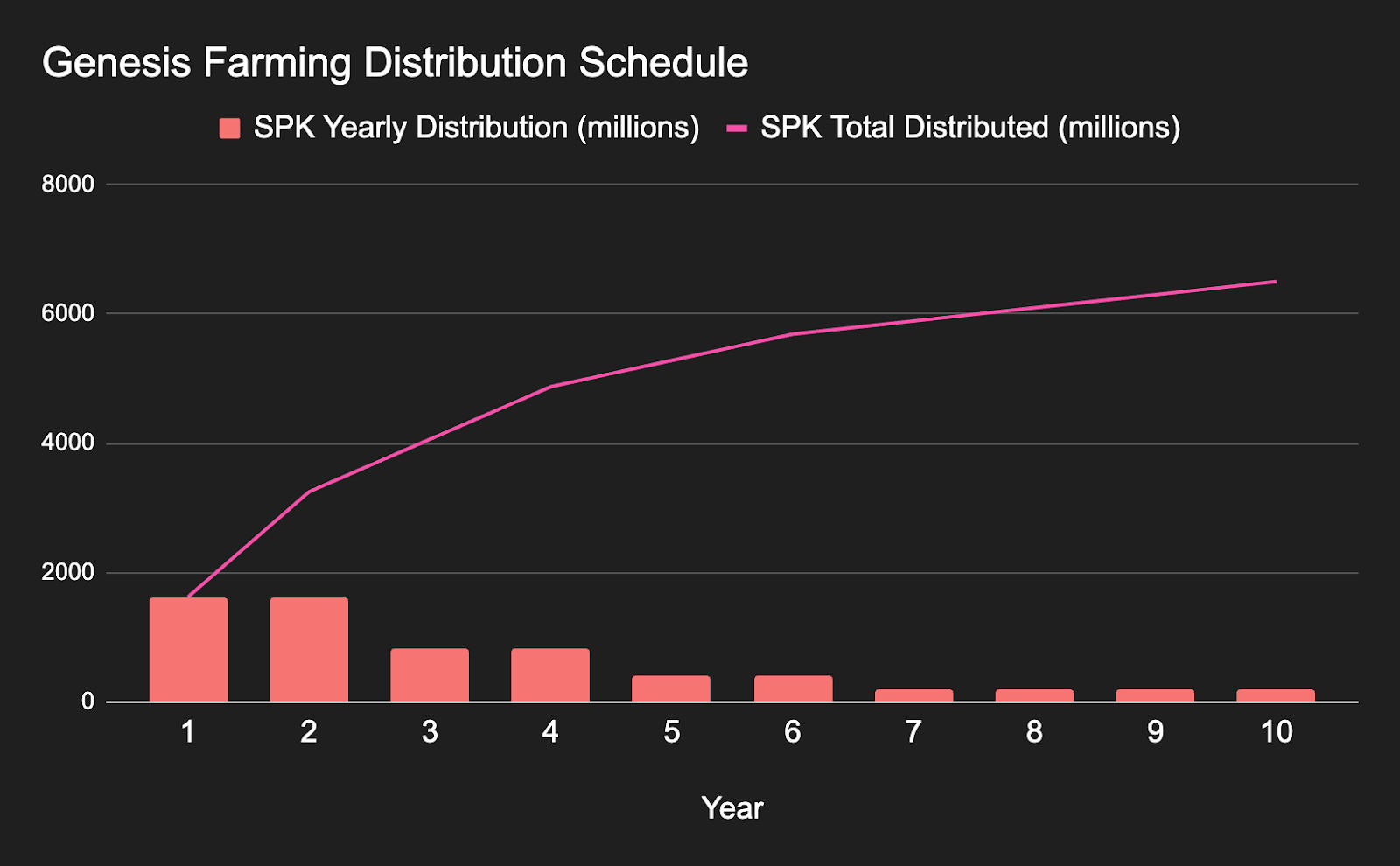

SPK serves as Spark's native governance token with a genesis supply of 10 billion tokens. The token supply is split up between the Phoenix Labs team with 12%, the ecosystem development program with 23%, and Sky Farming with 65%.

Sky Core attained 65% of the SPK token through the immense direct financial support provided in the genesis of Spark, which totaled $46.8 million in USDS. Through the Sky staking system holders of USDS and the SKY governance token can deposit their funds in order to earn SPK tokens, with a current APY of 6.08%.

Spark Staking is enabled through Symbiotic, where SPK tokens are used to provide cryptoeconomic security to other protocols. More can be learned about this on the Symbiotic site (https://symbiotic.fi/). Stakers take on the risks of their principal being slashed in case of the failure of a protocol being secured by Symbiotic. Through staking holders of SPK can earn Spark points which will entail rewards.

Finally SPK tokens can be used for governance of the Spark Prime Agent. This is done through a system of delegation in a similar manner to Sky Core governance. The two currently existing delegates are Remi and NeoNode.

Grove

Grove operates as Sky Protocol's second Star Agent and is built as an institutional-grade protocol that facilitates large-scale credit creation. Grove was designed to provide a bridge between on-chain and off-chain economies to allow Sky to seamlessly harness RWA yield opportunities. Grove addresses critical limitations in current DeFi credit markets including operational and legal complexity of tokenised credit and overcollateralisation requirements that tie up vast amounts of capital. Grove was incubated by Steakhouse Financial, a leading Morpho vault curator, and brings sophisticated credit scoring mechanisms to Sky’s backing.

Grove uses Collateralized Loan Obligations (CLO) as the primary pathway for providing Sky ecosystem exposure to higher-yielding investment-grade credit assets. This strategy establishes a scalable model for off-chain credit with on-chain governance, representing Grove's first major step toward institutional-grade asset diversification.

These provide a range of benefits:

- Access to diversified corporate credit portfolios

- Professional credit analysis and risk management

- Regulatory compliance and institutional acceptance

- Scalable framework for credit market expansion

Grove additionally has a tokenised T-Bill strategy that builds upon the successful Spark Tokenization Grand Prix, beginning with onboarding protocols that demonstrated competitive tokenised Treasury products.

Grove Liquidity Layer

The Grove Liquidity Layer (GLL) operates similarly to the Spark Liquidity Layer while introducing novel functionality for both onchain and offchain credit opportunity allocation, optimised for institutional credit applications.

Grove operates under a comprehensive Total Risk Capital management framework, maintaining a commitment to stay at or below a 90% Risk Tolerance Ratio. In addition to this the GLL enables Grove to build surplus buffers (first loss capital) that significantly increase the allocable universe of opportunities.

This is facilitated through the Grove Liquidity Layer which allocates capital from the Grove specific Sky Allocator Vault.

Allocations from the Grove Liquidity Layer include:

- BlackRock BUIDL

- Janus Henderson JTRSY (Centrifuge v2)

- Centrifuge JAAA

- Superstate USTB

While the majority of Grove’s assets are on Ethereum, Grove has expanded its operations to Avalanche through Centrifuge’s JAAA.

GROVE Governance Token

The yet to be launched GROVE token will have a 10 billion supply and will be split amongst the Grove Prime Treasury (30%) and Sky Core (70%). Similarly to SPK, due to the support that Sky provided Grove, with $25 million in USDS direct financial support, Sky will retain 70% of GROVE tokens for SKY and USDS staking rewards. Users would be able to choose to receive rewards in SPK or GROVE.

Upon its Token Generation Event (TGE) the GROVE token will be used to govern the Grove Prime Agent.

Future Development Roadmap

Grove's development roadmap includes the creation of new savings products designed as complements to sUSDS offering higher rewards through institutional credit exposure, featuring unique characteristics that differentiate them from existing stablecoin yield products. The protocol aims to significantly increase Sky's allocable universe of credit assets, particularly when it comes to tokenised offchain credit.

Keel: Sky's Pioneer Agent for Solana

Keel is the third Star to join the Sky Ecosystem and operates as Sky's designated "Pioneer" Agent for Solana with a roadmap to deploy up to $2.5 billion. As Sky's primary interface with Solana, Keel serves multiple critical functions beyond traditional capital allocation.

Pioneer Responsibilities

Keel develops core Sky infrastructure on Solana, including SVM (Solana Virtual Machine) primitives that enable native Solana access to Sky and USDS. The protocol manages relationships with ecosystem partners across the entire Solana landscape and directs comprehensive incentive programs to grow USDS adoption. Keel also develops and maintains the bridge infrastructure connecting Sky's Ethereum operations with Solana's DeFi ecosystem.

Capital Allocation Strategy

Keel deploys capital across five complementary pillars: dynamically allocating into overcollateralised stablecoin lending markets while maintaining minimum 25% liquidity; providing scalable allocation into yield-bearing RWAs and tokenised strategies; offering atomic swap liquidity for leading stablecoin pairs; warehousing assets through redemption periods to provide RWA secondary liquidity; and supporting liquidity and TVL bootstrapping for new protocols and issuances.

Ecosystem Development

Beyond capital allocation, Keel facilitates Solana ecosystem access to Sky's sUSDS savings product, providing institutional-grade yield backed by Sky's diversified collateral portfolio. The protocol generates revenue through Sky's Accessibility Reward structure based on USDS and sUSDS adoption growth.

Launch Agent 3 (sky.money)

Launch Agent 3 operates as the foundational access layer for USDS and sUSDS adoption across multiple blockchains. Serving as the primary infrastructure for delivering USDS utility and the Sky Savings Rate enabled sUSDS. The frontend of Launch Agent 3 is located at sky.money, the main Sky Protocol application.

Halo Agents

Halo Agents operate as Microagents within Prime Agents. Halo Agents would begin life as internal products incubated inside Prime Agents or other Halo Agents, growing until they warrant tokenisation and leverage capabilities. They would then spin off as independent Halo Agents within their incubating Prime Agent. Executors that operationalise Prime Agents also work with all nested Halo Agents. Prime Agents would additionally maintain proprietary service layers for all nested Halo Agents while Executor GovOps serves as backstop for any abuse or service layer failure.

Halo Agents could also migrate between Prime Agents to access better features or lower costs, creating competitive dynamics that drive innovation and efficiency improvements across the ecosystem

Halo Agents enable the creation of revenue-generating products whose value serves as collateral for Sky. A single Halo Agent can tokenise multiple assets and manage diverse external infrastructure, all while maintaining operational independence..

Halo Agents are specifically designed to serve as modular and transparent venues for large-scale leverage on advanced or exotic assets within the risk hierarchy structure (Sky → Generator → Prime → Halo).

Executor Agents

Executor Agents represent the operational backbone of Sky Protocol's Agent ecosystem. These specialised entities implement elements of Prime Agent activities that directly interface with the Sky Protocol while leaving Prime Agents free to focus on strategic business development.

The framework distinguishes between two Executor sub-types:

- Core Executor Agents: These oversee activities of Operational Executors and ensure implementation of Prime Agent strategies aligns with the Atlas

- Operational Executor Agents: These handle day-to-day execution of Prime Agent strategies that directly interface with the Sky Protocol.

Operational Executor Agents must comprise of at least one Facilitator responsible for interpreting the Atlas and Agent Artifacts (mini Atlas that contains all rules, processes, parameters, and knowledge for a specific Agent), and at least one GovOps actor who carries out corresponding actions. Operational Collateral serves as a guarantee to cover losses or damages resulting from negligence or malicious behavior.

Prime Agents cannot be active in the Sky Ecosystem without an active "Operational Executor Accord" that codifies their relationship with an Operational Executor. This system is meant to ensure proper risk management and protocol compliance.

The current system operates under transitional measures where GovOps actors and Facilitators collectively perform Executor Agent functions pending full Executor Agent deployment with independent tokens and governance structures.

Atlas Axis: Core Executor Agent

Atlas Axis operates as Sky Protocol's primary Core Executor Agent.

It is responsible for:

- Ecosystem-wide oversight

- Emergency response coordination

- Maintaining critical operational infrastructure including the Stability Parameter Bounded External Access Module operations.

The Atlas Axis Agent controls the Operator Multisig for stability parameters management with a 2/3 signing requirement across three addresses. This enables direct alteration of vault parameters and savings rates within predefined limits all while maintaining proper governance oversight.

Atlas Axis holds special privileges for embedding permissions within the Emergency Response Group (crisis management team within Sky Protocol designed to handle emergency situations that could threaten the protocol's survival or stability). This allows for assignment of more than two team members to emergency response communications and coordination activities.

As Core Executor Agent, Atlas Axis maintains alignment with the Spirit of the Atlas, monitoring Operational Executor compliance. This ensures that all ecosystem participants maintain proper alignment with protocol objectives and risk management standards.

DAOcraft: Multi Agent Operational Executor

DAOcraft operates as the primary Operational Executor Agent serving multiple Prime Agents simultaneously, including Spark, Grove, Launch Agent 2, and Launch Agent 3 through individual Executor Agent Accords. Thereby providing operational execution services across the Prime Agent ecosystem.

The entity functions in both Operational GovOps and Operational Facilitator roles, handling technical implementation of Prime Agent strategies. In addition to interpreting Atlas requirements and ensuring alignment.

DAOcraft controls multiple operational multisigs including the Core Operator Relayer Multisig with 2/3 signing requirements. This allows for execution of relayer roles for cross-chain operations and maintaining critical infrastructure for Prime Agent activities.

Moonbow: Intellectual Property Services

Moonbow operates as an Operational Executor Agent with a specialised focus on intellectual property management, requiring Prime Foundations to sign license agreements for all relevant intellectual property usage.

The licensing framework includes worldwide commercial exclusive licenses with specific terms for revocation, sublicensing permissions, quarterly reporting requirements, and monetary penalties for IP violations.

Moonbow's role extends to include ecosystem coordination, particularly in managing the relationship between proprietary financial strategies and open source protocol development.

Proto Agents

Proto Agents function as Microagents within Executor Agents, serving as incubation environments for brand-new agent artifacts that can later transform into Primes, Generators, Halos, or Executors through a specialised transformation processes. These agents provide a roadmap for the permissionless creation of new Agents, Ultimately this would enable the Sky Agent Framework to support hundreds of Agents created daily while maintaining proper oversight during development phases.

This framework addresses the challenge that new Macroagents (Generators, Primes) require active Executor Accords with Executor agents in order to be activated. By allowing new agents to incubate within Executor artifacts until ready for transformation, agent creation is combined with Executor relationship building, greatly streamlining the process.

The Proto Agent design ensures Executor Agents control the onboarding rails for new Agents entering the ecosystem. Hence providing a natural scaling mechanism which can facilitate continuous ecosystem expansion and the ability to throttle throughput via fee adjustments when capacity becomes constrained.

Generator Agents

Generator Agents represent specialised Macroagents designed to address the anticipated long term complexity of managing multiple stablecoins. Each Generator Agent creates and manages a single stablecoin, pegged asset, or synthetic asset. Sky however retains majority control through a long-term vesting structure of Generator Agent tokens

Generator Agents fine-tune and expand risk frameworks for their Generated Assets beyond Sky's baseline requirements. Their main focus encompasses financial and technical risk management and distribution strategy for their designated asset. In addition to this they have the ability to deploy capital into and manage strategically relevant Generator Agents and Prime Agents.

Most Generator Agent income would be partially shared with Sky due to Sky Core's essential role in regulating tail risk across all Generator Agents. Revenue sharing mechanisms include:

- 20% of Generator Spread (difference between Savings Rate + Accessibility Reward and Base Rate) shared with Sky

- Up to 80% of revenue from long-term dormant unrewarded stablecoin breakage (>1 year inactivity)

- The highest of 10 basis points per year or 20% of External Senior Risk Capital fee income.

- 10 bps per year of Internal Senior Risk Capital is shared with Sky

Remaining net revenue after expenses follows a structured distribution: up to 50% retained in Stability Capital Buffers targeting 1.8% of total Sky Generated Asset effective circulating supply, with remaining profits split 80% to Smart Burn Engine and 20% to Staking Rewards.

Generator Agents may own and stake Prime Tokens with staking revenue not shared with Sky, and owned Macroagent Token market cap would be subtracted when calculating Macroagent Upkeep obligations.

The first generator instance would be for the Sky native stablecoin. This would unlock USDS value through tokenisation while increasing regulatory and market flexibility, with Sky retaining majority tokens of the generator agent (approximately 90%) vested over 20-30 years.

Generator Agents are intended to bootstrap niche stablecoins for different currencies (EUR, CNY, CHF, SGD), regulated stablecoins for jurisdictional compliance, and synthetic commodity assets.

- Regulated Licensed Generator Agents can pursue GENIUS ACT/MiCA compliance and deep financial regulation integration, providing USDS with internal ecosystem on/off ramps.

- Synthetic Commodity Generator Agents create Generated Sky Assets referencing copper, silicon, rare earth minerals and other commodities, with underlying collateral consisting of Halo Agents controlling autonomous storage, shipping, mining, refining, and processing facilities.

Conclusion

Sky Protocol represents the most ambitious attempt to address the fundamental limitations of traditional central banking. The innovations brought about by the open and permissionless nature of blockchains and the maturity of the onchain economy makes Sky perfectly positioned to bring about a fourth generation for central banking. While traditional central banks must balance political objectives with monetary stability, Sky's multi-layered risk management architecture—spanning junior and senior risk capital across multiple Agent types— creates structural independence through siloed entities with the right incentives and automated risk management.

The protocol's vision however extends far beyond current central bank limitations toward serving as the monetary infrastructure for the future AI-driven economy. The Atlas reveals explicit integration plans where AI agents will become central to protocol operations. The Agent framework itself is designed for autonomous operation at scale, with Core Executor Agents tasked to "continuously improve" input methods that enable hundreds of new agents to be launched daily. This scalability is critical as the protocol positions itself to coordinate economic activity between autonomous AI systems conducting billions of microtransactions, and managing complex financial strategies without human intervention. The protocol's planned expansion to multiple currency denominations (EUR, CNY, CHF, SGD) and synthetic commodity assets positions it not merely as an alternative to traditional central banking, but as the coordinating mechanism for a global currency agnostic agent economy that transcends current financial boundaries.

The "Universal Alignment" principle in the Atlas in addition addresses one of the core challenges in AI coordination by ensuring that as AI agents proliferate and gain economic autonomy, their actions naturally benefit the broader ecosystem. In this paradigm, Sky doesn't just serve as a monetary system—it provides the governance, risk management, and value coordination systems necessary for autonomous agents to operate safely at scale. Hence allowing them to efficiently add value to the world, allocation capital to where it can achieve the best risk adjusted returns. This will be a key catalyst to allow Sky to become the central nervous system for a new era of economic coordination. One where auditable code based precision replaces the dated political decision making managing our current economies.

Sky Protocol Glossary

History of Sky

MakerDAO - Original project from 2015 that evolved into Sky Protocol

MKR - The original governance token of MakerDAO

DAI - The original decentralised stablecoin from MakerDAO

Collateralized Debt Position (CDP) - Mechanism where users lock collateral assets to mint stablecoins, pioneered by MakerDAO

Endgame Plan - Decade-long roadmap for MakerDAO's structural and ideological overhaul leading to Sky Protocol

Peg Stability Module (PSM) - Primary mechanism for USDS generation and stability maintenance through cash stablecoins

Universal Alignment - Core principle ensuring all ecosystem participants operate for the broader ecosystem's benefit

Sky Core

Agent Rate - Fee typically 0.1% below the Base Rate on unrewarded USDS and DAI balances

Asset Liability Management Framework - Universal rules requiring Prime Agents to deploy Sky's collateral to maintain USDS peg stability

Base Rate - The dynamic rate that determines the cost for Prime Agents to borrow USDS from Sky for deployment

Core GovOps - Core governance operations functions managed by Sky Core

Emergency Spells - Urgent protocol changes that can bypass normal governance delays

Governance Security Module - Emergency mechanism allowing for pause delays in governance actions

Liquidation Fees - Fees collected when CDP vaults become undercollateralised and are liquidated

Monthly Settlement Cycle - Sky Core's synchronised process for financial operations, risk management, and governance

Native Vault Engine - System allowing users to borrow USDS against approved collateral types

Protego Contract - Emergency mechanism for canceling pending governance actions

Sky Core - Foundational governance and operational layer maintaining direct control over critical system components

Sky Spread - 0.1% fee facilitating ecosystem financing as part of the Base Rate

Sky Surplus Buffer - Protocol's reserve fund for covering bad debt and funding operations

Smart Burn Buffer - Operations systematically purchasing and burning SKY tokens using protocol revenues

Stability Fees - Fees collected from Prime Agents borrowing at the Base Rate

Treasury Management Function - Sky Core function defining distribution of all net revenue among various downstream activities

SKY: Sky Governance Token

Aligned Delegate System - Merit-based governance structure allowing SKY holders to delegate voting power while retaining token control

Executive Votes - Governance votes implementing technical changes to the protocol

High Activity Staking Rewards (HASR) - Enhanced reward tier for actively engaged wallet holders in SKY staking

SKY - Sky Protocol's governance token, providing voting rights and staking rewards

SKY Backstop - Emergency mechanism automatically generating and selling SKY to recapitalise undercollateralised system

SKY Staking - System allowing users to stake SKY tokens for rewards and borrow USDS against staked SKY

Smart Burn Engine - Mechanism creating deflationary pressure on SKY token supply through systematic buybacks

Standard Activity Staking Rewards (SASR) - Base reward tier for SKY stakers

Voting Power - Ability of Aligned Delegates to vote on Sky governance decisions on behalf of SKY holders

USDS: Internet Native Dollars

Accessibility Rewards - Percentage-based fees (0.1% annually) that incentivize Prime Agents and third-party partners to drive USDS adoption

Cash Stablecoins - USDC, USDT, and pyUSD that can be used to mint USDS through the PSM

Peg Stability Module (PSM) - Primary mechanism for USDS generation and stability maintenance through instant, slippage-free swaps

USDS - Sky Protocol's primary stablecoin, the successor to DAI

Unrewarded USDS - USDS balances not receiving Sky Savings Rate, Integration Boost, or Token Rewards

sUSDS: The Global Savings Account

Integration Boost - Mechanism extending Sky Savings Rate benefits to sUSDS holders in external DeFi protocols

Sky Savings Rate (SSR) - The yield rate earned by sUSDS holders, currently set 0.3% below the Base Rate

sUSDS - Native yield-bearing version of USDS that earns the Sky Savings Rate

Token Rewards - Distribution of SKY and Prime Agent tokens to sUSDS holders

stUSDS: Lending to SKY Stakers

SKY Borrow Rate - Dynamic rate for borrowing USDS against staked SKY, adjusting based on utilisation levels

stUSDS - Token providing segregated risk capital for SKY Staking leverage system

stUSDS Accessibility Reward - Reward (0.1%) encouraging Prime Agents and Integrators to promote stUSDS adoption

Utilization - Percentage of funds in stUSDS contract actively used to fund borrowing against staked SKY (targeting 90%)

srUSDS: Senior Risk Capital

External Senior Risk Capital (ESRC) - Capital provided by external investors that absorbs losses after junior capital exhaustion

Internal Junior Risk Capital (IJRC) - Capital owned directly by Prime Agents

Junior Risk Capital - First-loss capital provided by Prime Agents to cover potential defaults

Prime-External Junior Risk Capital (SEJRC) - Junior Risk Capital rented from another Prime Agent

Senior Risk Capital - External capital that absorbs losses after junior capital is exhausted

srUSDS - Tokenised form of External Senior Risk Capital for external investors

Tokenized External Junior Risk Capital (TEJRC) - Capital provided by external investors through specialised contracts

Total Risk Capital - Combined framework of junior and senior risk capital for Prime Agent operations

Total Senior Risk Capital - Combined pools of Internal and External Senior Risk Capital available through bidding

Crosschain Interoperability

Circle's Cross-Chain Transfer Protocol (CCTP) - Protocol for bridging USDC across chains that Spark utilises

SkyLink - Sky Protocol's multichain solution enabling native crosschain functionality across Ethereum L2s and major L1s

Wormhole - Bridge provider implementing USDS and sUSDS on Solana

Agent Framework

Agents - Autonomous economic entities within Sky that pursue business opportunities, each with their own token and governance structure

Agent Artifact - Documents containing all rules, processes, parameters, and knowledge for a specific Agent

Agent Scope - The codification of all Agent Artifacts within the Sky ecosystem

Core Council - Structure management for all Sky Agents and Sky Core, consisting of rotating Executor Agents

Core Executor Agents - Agents overseeing activities of Operational Executors and ensuring Atlas alignment

Star Agents:

Prime Agents - Autonomous entities focused on financial risk management and Sky Primitives utilisation

Executor Agents - Operational backbone entities implementing Prime Agent activities that interface with Sky Protocol

Generator Agents - Specialised Macroagents designed to create and manage single stablecoins or synthetic assets

Halo Agents - Microagents operating within Prime Agents, focused on product development and external asset management

Proto Agents - Microagents serving as incubation environments for new agent artifacts

Macroagents - Higher-level Agents that interact directly with Sky as an "L2 for governance"

Microagents - Lower-level Agents that interact with Macroagents as an "L3 for governance"

Sky Primitives - Core operational tools and mechanisms that Agents can access and utilise

Star Agents

Actively Stabilizing Collateral - Specific percentages of liquid collateral Prime Agents must maintain relative to allocated capital

Allocation System Primitive - Core mechanism enabling Prime Agents to deploy capital into yield-generating opportunities

Demand Absorption Buffers - Capital buffers Prime Agents must maintain to absorb market demand fluctuations

Junior Risk Capital Rental - Mechanism for Prime Agents to rent capital from each other efficiently

Pioneer Chain Operations - Services for expanding USDS to new blockchain networks

Prime Agent Management Fee - Fee (0.1%) that goes back to Prime Agents as part of Accessibility Rewards

Risk Tolerance Ratio - Maximum risk threshold (90% for Grove) that Prime Agents must maintain

Spark

Phoenix Labs - Development team led by Sam MacPherson that created Spark

Spark - Sky's inaugural Prime Agent operating as active capital allocator focused on USDS adoption

Spark Liquidity Layer (SLL) - Spark's capital allocation system utilising Sky's collateral and crosschain infrastructure

SparkLend - Lending protocol supporting sUSDS, ETH, and BTC derivatives with customised rate models

Spark Savings - Primary vehicle for users to access Sky Savings Rate through sUSDS and sUSDC

SPK - Spark's governance token with 10 billion token supply

sUSDC - Spark's savings token that earns the Sky Savings Rate

Symbiotic - Platform enabling SPK token staking to provide cryptoeconomic security to other protocols

tBTC - Threshold Bitcoin derivative supported as collateral on SparkLend

weETH - Wrapped eETH derivative supported as collateral on SparkLend

wstETH - Wrapped staked ETH derivative supported as collateral on SparkLend

cbBTC - Coinbase-wrapped Bitcoin derivative supported as collateral on SparkLend

LBTC - Liquid Bitcoin derivative supported as collateral on SparkLend

rsETH - Restaked Ethereum derivative supported as collateral on SparkLend

rETH - Rocket Pool ETH derivative supported as collateral on SparkLend

Grove

Steakhouse Financial - Leading Morpho vault curator that incubated Grove

Grove - Sky's second Prime Agent focused on institutional-grade credit creation and RWA strategies

Collateralized Loan Obligations (CLO) - Grove's primary pathway for providing Sky exposure to investment-grade credit assets

Grove Liquidity Layer (GLL) - Grove's capital allocation system optimised for institutional credit applications

GROVE Token - Governance token for the Grove Prime Agent (yet to be launched)

Keel

Keel - Sky Protocol's Pioneer Agent for Solana with a roadmap to deploy up to $2.5 billion into the ecosystem

Pioneer Agent - Designation granting unique privileges and responsibilities over an entire blockchain ecosystem, held by Keel for Solana

SVM Primitives - Solana Virtual Machine infrastructure components enabling native Solana access to Sky Protocol and USDS

RWA Redemption Liquidity - Service where Keel warehouses real-world assets through their redemption periods, providing liquidation bids for RWA lending markets

RWA Secondary Liquidity - Liquidity provision for real-world assets that typically lack liquid secondary markets

Stablecoin Swap Liquidity - Atomic swap liquidity provision for leading stablecoin pairs serving critical infrastructure needs

TVL Bootstrapping - Support for new protocols and issuances using large stablecoin reserves to help launch initiatives

Matariki Labs - Organization led contributing to Keel's development

Launch Agent 3 (sky.money)

Launch Agent 3 - Foundational access layer for USDS and sUSDS adoption across blockchains (sky.money)

sky.money - Main Sky Protocol application serving as the frontend for Launch Agent 3

Executor Agents

Atlas Axis - Sky Protocol's primary Core Executor Agent responsible for ecosystem-wide oversight

DAOcraft - Primary Operational Executor Agent serving multiple Prime Agents simultaneously

Moonbow - Operational Executor Agent specialised in intellectual property management

Emergency Response Group - Crisis management team designed to handle emergency situations threatening protocol stability

Operational Executor Accords - Required agreements codifying relationships between Prime Agents and Operational Executors

Generator Agents

Generator Spread - Difference between Savings Rate + Accessibility Reward and Base Rate for Generator Agents

Stability Capital Buffers - Generator Agent reserves targeting 1.8% of total Sky Generated Asset supply

Atlas & Governance Framework

Atlas - The constitutional framework and governance documentation for the Sky ecosystem

Spirit of the Atlas - Foundational principles of Sky Governance enshrined in Immutable Documents

Adaptive Documents - Continuously improved Atlas documents that interpret and operationalise the Spirit of the Atlas

Atlas Interpretations - Documented precedent that reflects the Spirit of the Atlas and guides future governance decisions

Budget Controller Document - Document determining rules and processes for modifying and using attached budgets

Budget Directory Document - Directory listing all Budget Documents pertaining to a Budget Controller

Budget Document - Documents containing state that can authorise payments from the Sky Surplus Buffer

Definition Directory Document - Directory for definitions of unique terms referenced in subdocuments

Definition Document - Documents that define unique concepts contained in subdocuments

Document Identifier - Unique technical name determining an Atlas Document's position in the document tree

Element Annotation Document - Document type providing expanded definitions of vague or unclear terms

Facilitator Action Precedent Document - Document type for codifying Atlas Interpretations

Governance Facilitators - Entities responsible for conducting Atlas Interpretations and governance processes

Immutable Documents - First three layers of Atlas Documents enshrining the Spirit of the Atlas

Incentive Slack - Risk arising when coded rules are not enforced or are bypassed, creating misalignment

Slippery Slope Misalignment - Risk of incremental deviations from core principles leading to significant undesirable shifts

Target Document - Immutable or Primary Document to which Supporting Documents are attached

Translation Document - Atlas documents translated into other languages while maintaining English precedence

Whole Weeks - Atlas-defined quarterly and yearly cycles counting from the first Monday of each quarter

External Protocols & Partners

Aave - Lending protocol that SparkLend is forked from

Centrifuge - Platform providing tokenised real-world assets like JAAA that Grove allocates to

Curve - DEX protocol receiving small Spark allocations for liquidity provision

Ethena - Protocol providing basis trade exposure through USDe that Spark allocates to

Maple - Platform for institutional bitcoin-backed loans that Spark allocates capital to

Morpho - Lending protocol where Spark operates as the largest vault curator