Beyond APY: A Due Diligence Framework for Yield-Bearing Stablecoins

Evaluating the Yield Premium in a Novel Asset Class

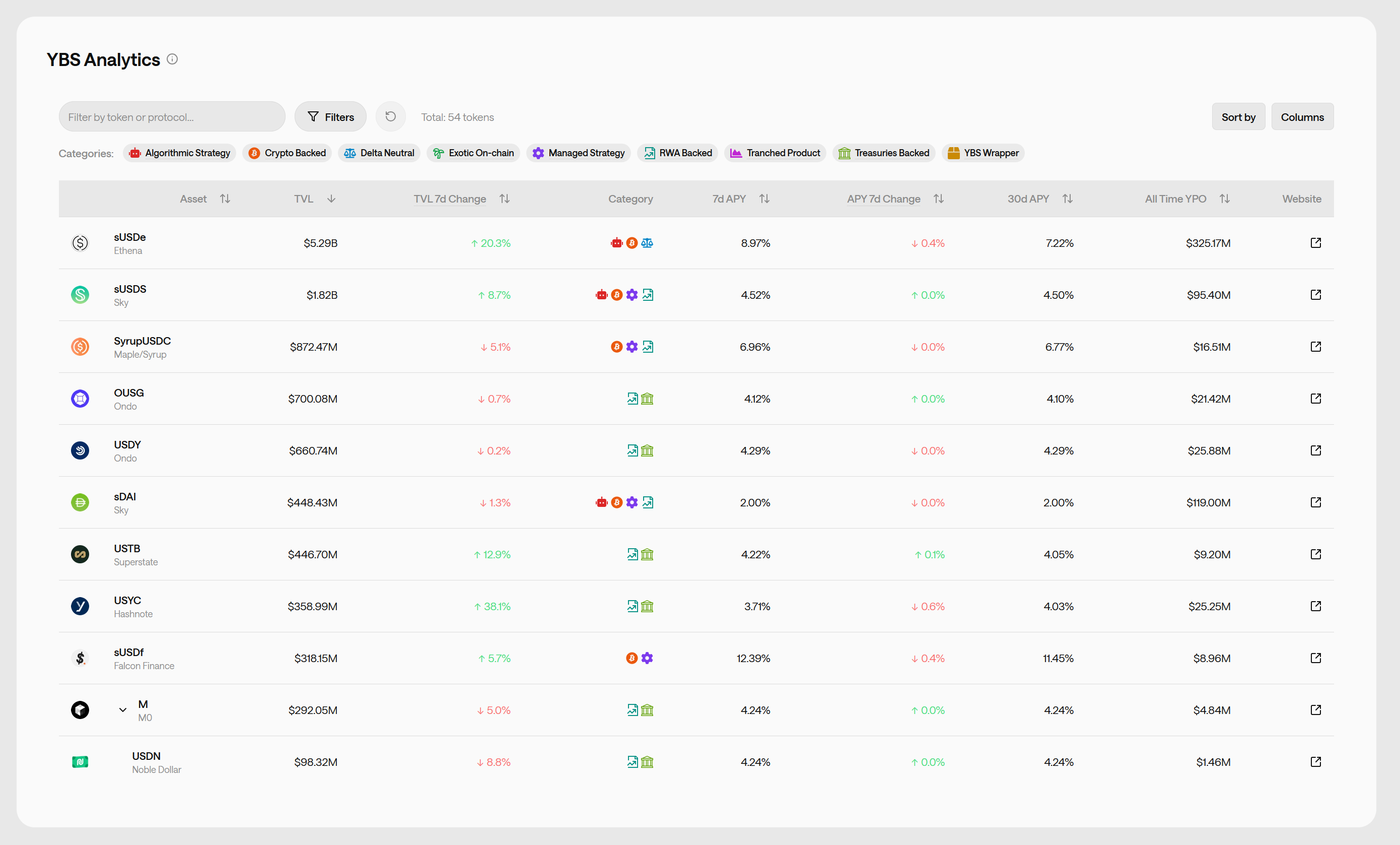

Yield-bearing stablecoins (YBS) have emerged as a prominent decentralized finance (DeFi) asset class of 2025. Combining the price stability of a fiat-pegged asset (implying there is no downside) with a native yield (essence of DeFi). This creates a compelling proposition for investors - getting paid to hold dollars. Moreover, thanks to the blockchain guarantees, you can verify everything, no risk of someone providing fake data. But is it so? The apparent simplicity of YBS may obstruct the reality of a varied, complex landscape of underlying risks.

As of right now, with the risk-free rates on US government bonds you get around 3.5-4% (which is abnormally high compared to the past 10-15 years). Yet, every day you hear about stablecoins offering 5, 10, 15, even 20%. Sounds great, right?

In an efficient market there would be enough willing investors to extract the yield, until it's arbitraged away to somewhere around 3.5-4%. However, it doesn’t happen. The premium persists, directly implying that investors are demanding higher compensation that goes beyond risk free.

Furthermore, the term YBS encompasses a wide range of strategies and risk profiles making the APY comparison difficult or potentially misleading. One could function almost as a cash equivalent (with a small premium for the blockchain-related risk), while the other could be a tokenized hedge fund unit that actively manages strategies and could end up posting a significant loss on any trading day. A transparent framework is therefore required to look beyond the advertised yield and properly assess these innovative instruments.

A Transparent Stablecoin Risk Framework

We present a framework to help DeFi users conduct their due diligence and shed some light on the growing YBS sector. You can see it here.

Our objective is not to assign ratings or scores, as in this rapidly evolving market characterized by shifting risks, traditional rating methodologies could provide a false sense of security. Especially with fickle markets, random hacks, and other unexpected encounters, just everything would be graded as speculative or highly speculative and it would be the end of the story. Instead, we created a framework to filter the noise and figure out what’s really inside a YBS. We categorize the types of YBS, their sources of yield, collateral backing, and specific risk vectors, to prioritize transparency and equip investors with the tools to make more informed decisions.

The YBS Risk Categories and Mechanisms

We choose to classify YBS depending on how they generate returns, in the following categories expressing a diverse set of onchain and offchain activities - many of the assets belong to several categories.

- RWA-Backed: Yield is generated from real-world assets such as loans, bonds or other debt instruments held offchain.

- Treasuries-Backed: A specific subset of RWAs where yield is derived from government bonds, being more on the safe side.

- Crypto-Backed: Yield is generated by lending out the stablecoin against over-collateralized onchain assets such as BTC or ETH through DeFi protocols.

- Delta-Neutral: The yield is extracted by arbitraging the funding rates between spot and derivatives markets, aiming to remain neutral to the price direction of the underlying crypto assets.

- YBS Wrappers: These act as aggregators or indices, providing a diversified exposure to a basket of other YBS to spread the risk across several strategies.

- Exotic On-Chain: A broad category of experimental DeFi strategies that manages to extract a yield and attach it to a low-volatility asset.

- Managed Strategies: Manually managed strategies that rely on active management to deploy capital and generate yield.

- Algorithmic Strategies: Automated operations that deploy capital in a predictable manner to generate yield.

- Tranched Products: Risk is segmented into different layers. Quite often the stable layer is the insurance, first-loss-absorbing layer, which could present a highly asymmetric risk-reward profile - to the downside.

For each YBS, we’re asking the same set of questions:

- Loss Potential: How can you lose money in the “stable” strategy?

- Onchain: Crypto collateral or DeFi vault balances. We help you check the chain.

- Offchain: Real-world assets or CEX collateral. Backed by attestations, proofs-of-reserves etc.

- Liquidity: Locked-in or free to sell at will?

- Exit Plan: How do you get your funds out, and what are the costs?

- Proof: Can you verify the reserves or do you “trust the team”?

We choose to apply the following risk categories:

- DeFi Hacks: The risk of flawed code leading to a partial or total loss of funds.

- Controller’s Wallet: The degree to which your money is controlled by you in a permissionless automated contract, or controlled by some other person with admin rights? Think before sending your hard earned assets to an unregistered fund manager.

- Liquidations & Oracles: The risk of faulty price data could trigger improper liquidations causing a depeg.

- Gas & Network: For highly active onchain strategies, the risk of a few days of spiked gas could negate a month worth of returns.

- Cost Bleed: If the alpha decays and the strategy stops earning yield and starts losing, you may see your APR turn negative.

- Bridge Risk: The risk associated with asset deployment across different chains via third-party bridges, turning into bridge’s IOUs and becoming a single point of failure.

- Misallocation: Risk of mismanagement of the yield-generating strategy by its managers causing underperformance and leading to losses.

- Counterparty: Undefined intermediary holders related risk.

- Custodian: Risks related to the control over the offchain assets backing the YBS.

- Governance/DAO: Protocol’s governing body could vote to change key parameters of the system in a way negatively impacting minority holders

The Importance of a Structured Transparent Approach

The accelerating growth of YBS represents new possibilities for capital stability and returns. However, as our analysis shows, the attractive yields only present one part of the story. The diversity of underlying strategies, from holding US government promises to executing complex onchain arbitrage, means that no two yield-bearing stablecoins are alike. Consequently, a high APY should be an invitation to conduct deeper due diligence, and Stablewatch is here to help.

By systematically categorizing the sources of yield and evaluating distinct risk vectors, investors seeking stablecoin-denominated yields can move beyond surface-level metrics. Our framework is designed to facilitate this analysis, fostering more transparent and risk-aware markets. This is stage one of our hard work and we will expand our risk framework in the future. If you have any comments, suggestions, or criticism - we’re happy to hear them.

About Piotr Kabaciński

Piotr is a Senior Researcher at Stablewatch focused on in-depth research and developing risk models for innovative stablecoin solutions. He holds a PhD in Ultrafast Spectroscopy from Politecnico di Milano, and has coauthored over 15 high-impact papers in leading scientific journals. He has worked in DeFi as an investor for venture capital firms Geometry and Synergis Capital, founded a startup, and worked as a Quantitative Researcher at Luban.