Project Spotlight: Reservoir

Reservoir has emerged as a heavyweight among DeFi yield bearing products, the protocol has to date amassed a TVL of $197m since its launch in November of 2024. It currently ranks as the 14th largest protocol on Stablewatch in terms of yield paid out (YPO) for just the ERC-20 version of their savings product, a notable feat.

In its essence Reservoir is an onchain capital allocator having no native yield generation mechanism, nevertheless at this the protocol excels. Combining crypto backed, RWA and Treasury strategies has allowed Reservoir to consistently beat the Stablewatch RWA, Crypto Backed and Managed Strategy benchmarks. Currently the Reservoir 7D APY is at 8.79%.

Reservoir has three main products with a third in active development. These give users access to yield generated through the Reservoir managed strategy using their preferred medium (dollar pegged token). These are rUSD, srUSD, wsrUSD and finally trUSD:

rUSD

The first product in the Reservoir ecosystem is rUSD which is a dollar pegged token backed by a balance sheet of real world and digital assets. rUSD aims to be a truly capital efficient asset, hence becoming a wrapper for assets generating meaningful value - returns. rUSD currently has a TVL of $65.99m.

Dollar Peg Mechanism

The dollar peg of rUSD is managed through the Peg Stability Module leveraging a chainlink price orLendingacle to monitor the price of USDC to enable seamless 1:1 conversions. The PSM is automated to maintain a minimum balance of USDC 1,200,000 at all times, automatically refilling every ten minutes.

Reservoir stresses their live proof of reserves which ensures that there is always enough USDC to redeem liquid rUSD and increases trust in the peg as users have a fully transparent view into the health of the Reservoir balance sheet.

Reservoir has also recently launched a USDT peg stability module that allows for conversions 1:1 with USDT however with this module there is a 0.1% mint and redemption fee.

Lending

rUSD is integrated into a Morpho vault curated by the prominent firm Steakhouse. This vault allows users to borrow rUSD against collateral. The vault currently has a TVL of $92.97m with the primary use case of this lending market being to loop exposure to the yield bearing rebasing version of rUSD (srUSD) at scale. With srUSD making up 61.26% of the vault and idle rUSD liquidity making up 38.58% (99.84% total) – available for more looping activity.

Most liquidity to this pool is currently being provided by the Revervoir protocol with them holding $93.13m steakRUSD on their public balance sheet (making up almost half of Reservoir TVL). The pool pays a native APY of 4.76% with no performance fee for depositors of rUSD. The borrow rate of rUSD is 8.71% providing a margin of 1.18% for loopers. $51.4m has been borrowed from the srUSD/rUSD market on Morpho.

srUSD & wsrUSD

The Savings Module of the Reservoir protocol allows users to mint srUSD or wsrUSD from USDC, USDT or rUSD. Both are redeemable for rUSD at any point in time and have the same level of yield

srUSD

This savings rUSD accrues interest on a daily basis, this is calculated using the 'currentRate' function in the Savings module and compounding it for 365 days. srUSD has a TVL of $109.4m.

srUSD operates on a cumulative compounding rate, which steadily increases it's price in rUSD. The price can never go below 1, however the rate it goes up in prices varies according to the interest rate set by governance. Starting at an initial time, the cumulative compounded value of 1 srUSD is:

Where:

ri is the interest rate applied during a specific period.

ni is the number of compounding seconds in that period.

wrsUSD

This savings rUSD is a ERC-4626 version of srUSD that accrues interest each block however to ensure standardisation the APY is calculated on a per second basis. The continuous compounding occurs over 31536000 seconds per year (equivalent to 365 days × 24 hours × 60 minutes × 60 seconds). wsrUSD has a TVL of $20.56m.

Where:

ri is the per-second interest rate during a period.

ni is the number of compounding seconds in that period.

Yield Generation

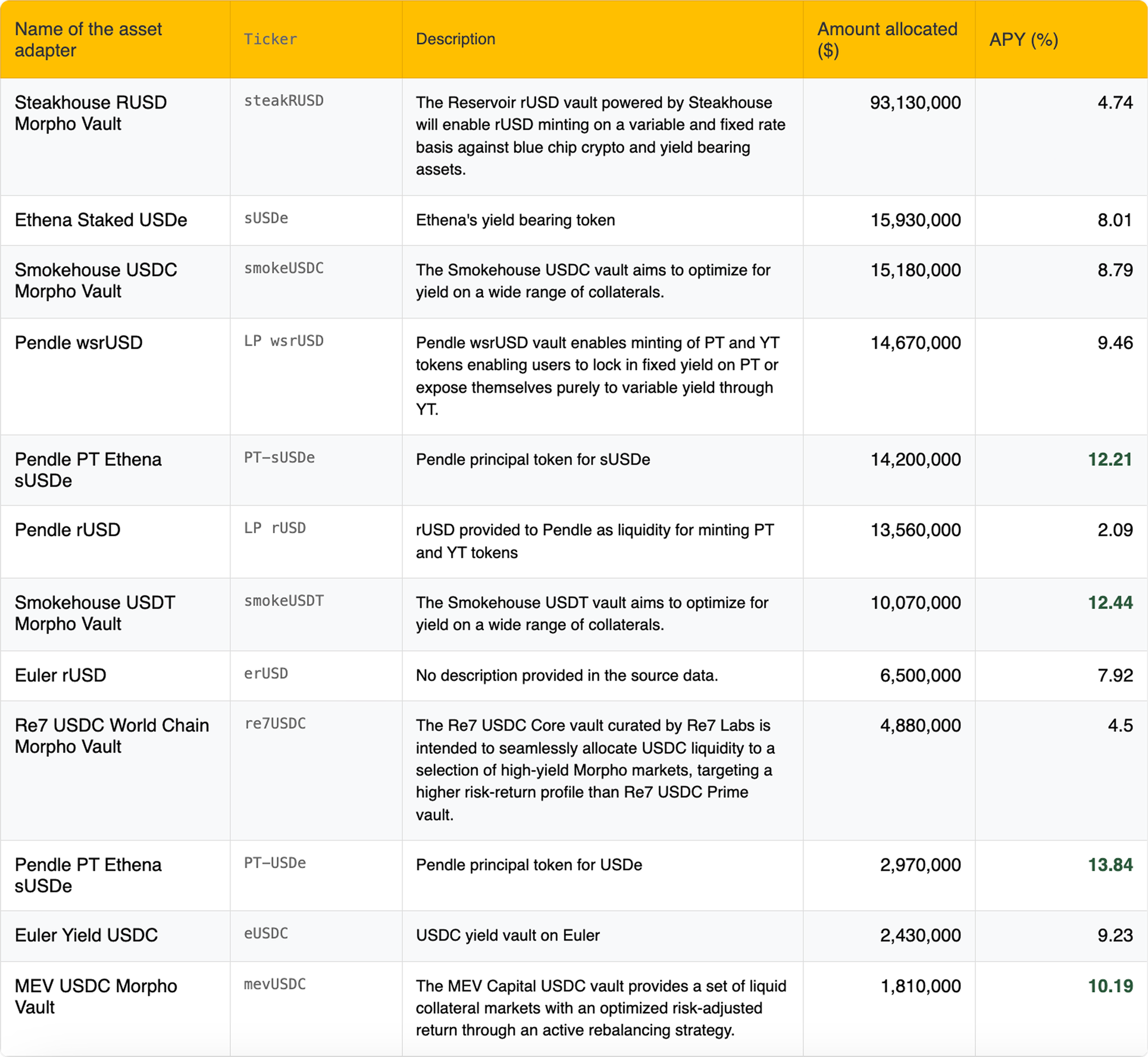

On Reservoir capital used to mint rUSD is allocated into yield generating digital and real world assets, this is done through governance approved Asset Adapters. Holdings are held by the protocol and are placed on the asset side of the balance sheet. Each asset has a unique Asset Adapter and capital allocations are determined by governance vote.

These Asset Adapters include top tier curators that have partnered with Reservoir in both Morpho and Euler vaults. Curating partners include Steakhouse, Re7, MEV, Gauntlet, Objective Labs, Hakutora, Hyperithm, Relend, Tau Labs, and others.

Current Asset Adapters are as follows (26th August 2025):

In addition to these assets Revervoir holds 1.19M USDC to meet redemptions as part of the Dollar Peg Mechanism This minimum balance will also be set as the USDT PSM continue to grow.

Based on the portfolio the yield is approximately $13,236,567.00 meaning that there is an APY per instance of srUSD ($109.24m) and wsrUSD ($20.44m) of 10.21% leaving the Reservoir DAO with a spread of 1.21% on the total of issued yield bearing tokens ($129.68m).

trUSD

This unlaunched savings version rUSD would allow users to mint a fixed yield token receiving scheduled cash flow payments. The term asset is structured so that users can always buy different terms at different maturities, and the maximum duration is configurable by the smart contract.

This is an example of how trUSD would work given in the Reservoir Documentation:

In the example above, a user on 4/10/22 can purchase one of five terms at indices: 1, 2, 3, 4, and 5, with the dates for the cash flow and redemption payments. The implementation uses ERC1155, providing a standardized indexed set to enable smart contracts to make all the necessary calculations related to the dates of maturities. When the smart contracts are first deployed, trUSD is given a genesis timestamp, from there the redemption dates and coupon dates are deterministically calculated represented by the vertical lines.

Reservoir also plans to launch a fixed rate lending product in addition to trUSD. This would allow for lending of rUSD, USDC & USDT on fixed rate basis against bluechip crypto assets, yield bearing stables, and Pendle PTs. They have cited the growth in fixed rate loans in centralized venues (Maple, August, and others) – showing a clear appetite in the market for fixed rate / maturity products, as the reason for this expansion.

Protocol Architecture

All these modules make up the Reservoir Protocol Architecture as detailed below:

Risk Management

Reservoir’s yield generation is done through a managed strategy meaning that human portfolio managers make the allocation decisions effectively replicating traditional fund management within DeFi infrastructure. Each of the assets backing the Reservoir dollar pegged tokens detailed above also has a unique risk profile that should be examined by prospective investors. However to mitigate some of this Reservoir has implemented risk management tools within its protocol:

Liquidity Ratio: set at a minimum of 105%, measures the ability to redeem rUSD within 30 days by comparing liquid assets to the maximum redeemable rUSD, with the credit enforcer smart contracts automatically selling assets to boost liquidity if the ratio falls below this threshold.

Solvency Ratio: set at a minimum of 105%, measures the protocol’s ability to cover total liabilities with total assets, and if it drops below this threshold, the credit enforcer will sell native tokens to raise cash to meet balance sheet obligations.

Capital Ratio: set at a minimum of 105%, mitigates capital risk by ensuring sufficient capital to absorb potential losses from risky assets, with the credit enforcer selling risky assets to reduce exposure if the ratio falls below this threshold.

Multichain Expansion

Revervoir is not just bound to Ethereum, they have garnered significant traction on Berachain partnering with Dolomite and USDT0 to offer vaults yielding 3.32% of rUSD and 8.26% on srUSD. This cross chain use case has resulted in rUSD growing to the 10th largest asset by LayerZero OFT volume.

Reservoir is currently live on Ethereum, Berachain and Plume however as communicated by the team their future plans include expansion to 14+ chains including lana, Worldchain, HyperEVM, Sonic, Unichain, BNB chain, Base, Arbitrum, Solana (which would come with a Kamino integration), SEI, Plasma, Katana, MegaETH and Monad. Also in their plans is launching support for World Liberty Financials USD1.

Disclaimer

This material is provided by Stablewatch and the authors for informational/educational use only. Opinions are as of publication. Content may include forward-looking statements and third-party data; accuracy, completeness, and timeliness are not guaranteed. Nothing herein is investment, legal, tax, accounting, or other professional advice, nor an offer, solicitation, recommendation, or endorsement of any asset, protocol, product, or service. Do your own research and consult qualified professionals. Stablewatch and the authors may hold positions or relationships in the mentioned projects and may change them without notice. Subject to applicable law, by accessing you agree to release and hold harmless Stablewatch, its affiliates, contributors, and the authors from any loss or damages (inclusing direct, indirect, incidental, consequential, special, or punitive) arising from use of or reliance on this content or on any projects/products described, including errors, omissions, delays, security incidents, or performance outcomes. You assume all risk. Stablewatch and/or the authors have no duty to update. If you disagree, do not access or rely on this material.