Project Spotlight BUIDL

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is one of the foremost examples of the amazing innovation that can occur as a result of the nexus of TradFi and DeFi. Launched in March 2024 by BlackRock, the world's largest asset manager, and tokenized by Securitize, BUIDL is a regulated, on-chain investment vehicle designed to provide institutional investors with a compliant and stable source of U.S. dollar yield. It has had a quick ascent to a TVL of more than $2.3B and has become the backbone of multiple stablecoins and DeFi protocols.

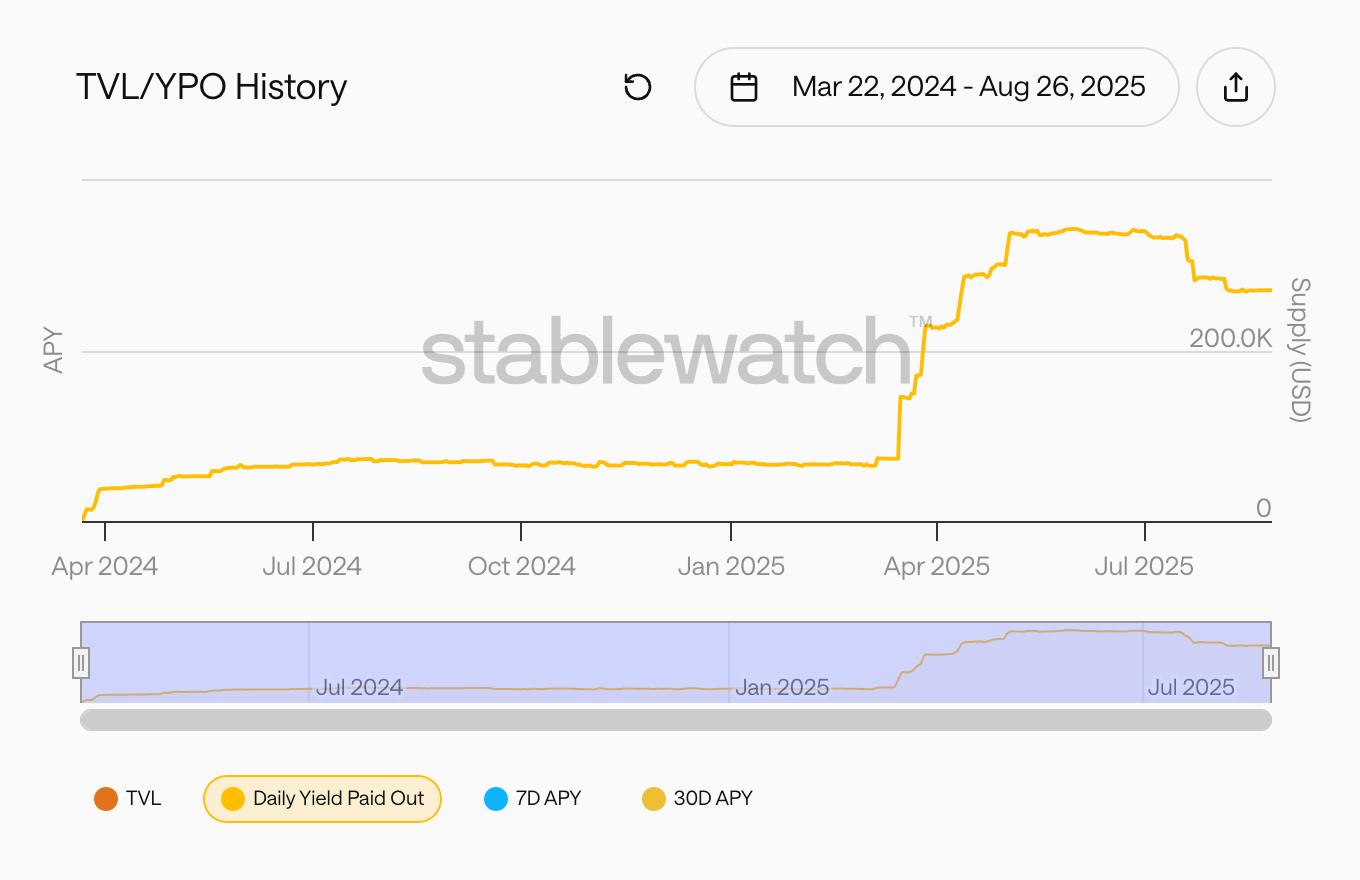

BUIDL TVL

The core purpose of BUIDL is to address the systemic inefficiencies that plague traditional markets, such as manual processes and delayed trading hours. Tokenising a money market fund, BUIDL leverages the open and permissionless nature of blockchains to offer 24/7/365 trading and settlement, near-instantaneous transfers between counterparties, and automated compliance through Securitizes DS Protocol. For DeFi BUIDL solves the key issue of accessibility of the risk free rate, seamlessly connecting the onchain actors to the federal funds rate. For Blackrock, this product has been a resounding success enhancing their reach into the onchain economy and opening a new diverse market of holders for their money market product offering. Currently the largest BlackRock Money Market Fund is the BlackRock Institutional Cash Series US Dollar Liquidity, perhaps the best TradFi analog for BUIDL.

Fund Structure

BUIDL's investment objective is to provide interest income while maintaining a stable net asset value (NAV) and ensuring a high degree of liquidity. To that extent the fund is mandated to invest 100% of its holdings into short-term, high-quality debt instruments.

These include:

- Cash

- US Treasury Bills

- Repurchase Agreements secured by US Treasury Bills or Cash

- Notes and other obligations issued or guaranteed as to principal and interest by the U.S. Treasury Bills

This is the strategic hallmark of a money market fund that offers an enhanced product over holding just US Treasury Bills (T-Bills). Cash allows the fund to meet immediate liquidity needs, as even though T-Bills are virtually risk free they do have maturities (e.g., 4, 13, or 26 weeks) which may not align with liquidity needs. Repurchase Agreements (Repos) allow for yield optimisation as they carry a premium due to the credit risk (though very minimal as they are collateralised with Cash or T Bills). Holding a mix of assets allows the fund to better perform its obligations and introduce more counterparties such as banks for repo agreements, opening for a larger breadth of partners available to manage liquidity risk.

Yield Generation and Distribution

The fund generates yield through the interest earned on the held assets detailed above, this yield is then passed on directly to investors. BUIDL accrues interest daily, however yield is distributed to investors on a monthly basis. This follows a rebasing mechanism where instead of the token's price fluctuating, the value of an investor's holding grows through the issuance of additional tokens, thereby maintaining BUIDL at a net asset value (NAV) of $1. To date BUIDL has paid out a total of $70.89M in yield. The daily yield paid out (YPO) is shown below:

BUIDL Daily YPO

Legal Framework

The fund operates as a private placement, issued under specific exemptions from federal securities laws.

- Rule 506(c): This rule, part of Regulation D, provides an exemption from the registration requirements of the Securities Act of 1933. It allows an issuer to engage in general solicitation and advertising for an offering, as long as all purchasers are verified as "accredited investors". This framework allows BlackRock to promote the fund more broadly while ensuring a high level of investor sophistication and compliance with regulatory standards.

- Section 3(c)(7): This exemption from the Investment Company Act of 1940 is foundational to the fund's structure. It allows the fund to avoid the extensive regulatory burdens of a registered investment company by limiting its investors to a select group of highly sophisticated individuals and entities known as "Qualified Purchasers". This exemption grants the fund operational flexibility typically unavailable to publicly offered investment companies. A "Qualified Purchaser" is defined as an individual or family-owned business with at least $5 million in investments or an entity owning at least $25 million in investments, a far more stringent requirement than that for an "accredited investor".

As such only “Qualified Purchasers” are eligible for BUIDL, hence the fund has a minimum investment requirement of 5,000,000 USDC. The minimum redemption amount is set at 250,000 USDC. While there are no redemption fees, a 0.20-0.50% management fee is applied to the fund which is charged per year as a percentage of NAV.

The official issuer of the fund is the BlackRock USD Institutional Digital Liquidity Fund which is registered with the SEC under the Central Index Key 0002013810. The domicile (where the asset issuer is incorporated) of the fund is in the British Virgin Islands.

Tokenisation

The partnership of BlackRock and Securitize is central to the funds’ existence and functionality. Securitize is not only the tokenization provider, but also serves as regulated issuer, digital transfer agent, and the placement agent providing the critical infrastructure needed to bring BUIDL onchain.

Securitize is registered with the SEC as a broker-dealer and digital transfer agent. In this capacity, it performs a number of critical functions that are analogous to a traditional transfer agent, but adapted to the onchain world. These responsibilities include maintaining the official registry of issued shares and their holders, ensuring secure transfer of the securities, canceling and issuing certificates, and distributing dividends.

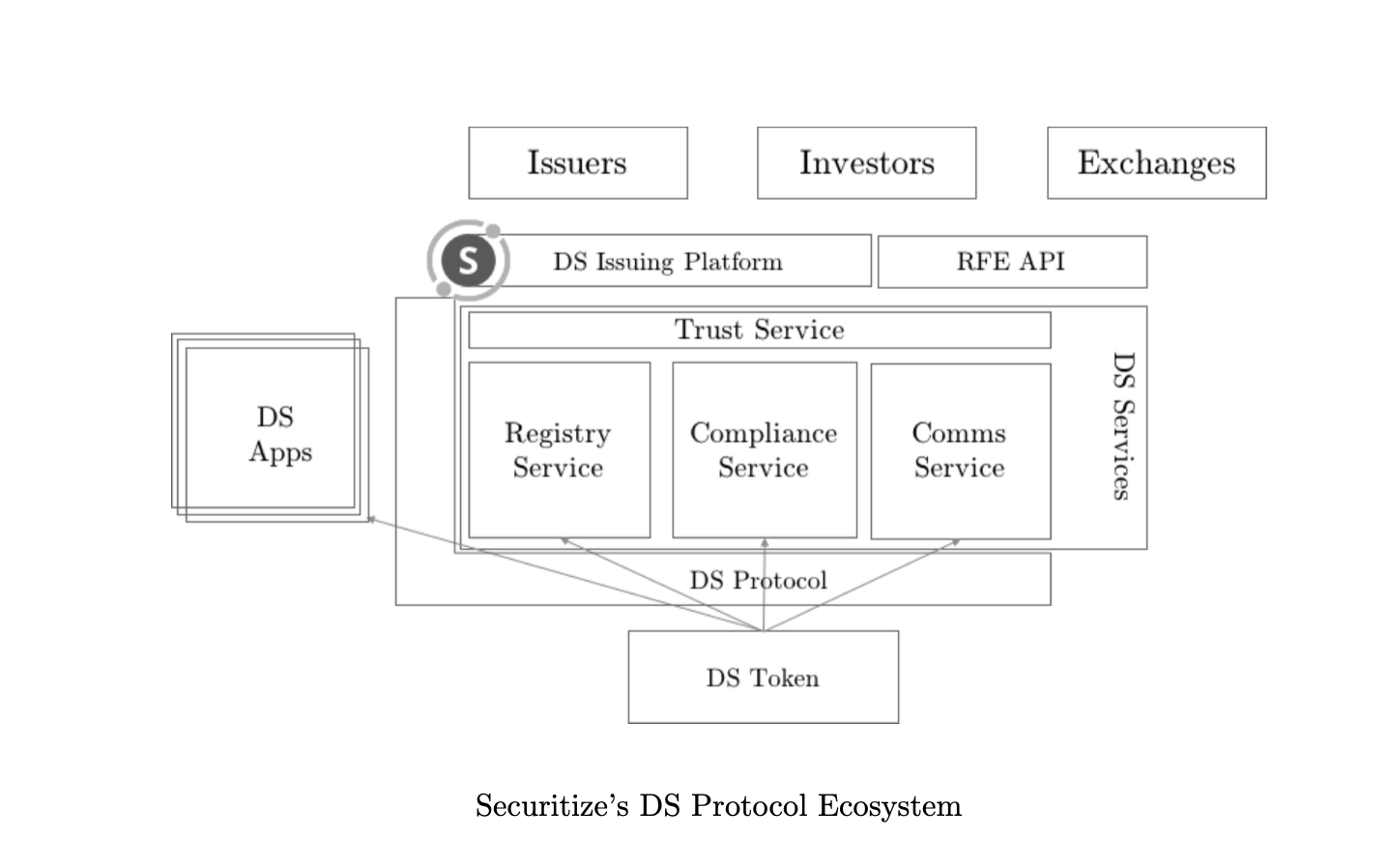

The DS Protocol

At the core of Securitize’s offering is the DS Protocol which encompasses the entire lifecycle of an RWA. This allows Securitize to provide a flexible ecosystem for issuers, investors, and exchanges to engage with RWAs in a compliant manner. The DS protocol consists of several key components:

- DS Tokens: These are ERC-20 compliant tokens that are extended with features like the ability for issuers to freeze tokens or force wallets to meet regulatory requirements.

- DS Apps: These are smart contracts that manage specific lifecycle events for RWAs, such as dividend issuance or voting rights.

- DS Services: This is the foundational infrastructure of the protocol that enables lifecycle management and compliance for DS Tokens. The services include:

- Trust Service: Manages the relationships and permissions between different stakeholders.

- Registry Service: An onchain register of investor information, including their country, KYC status, and accreditation.

- Compliance Service: Handles transfer validations and enforces specific compliance rules based on issuer requirements.

- Comms Service: Enables onchain communication of relevant events to investors.

sToken Framework

Securitize has developed a proprietary sToken framework in order to allow for their issued RWAs to attain proliferation within the wider DeFi ecosystem. The sToken Vault allows for the creation of representation tokens (sTokens), these are permissionless ERC-20 tokens that act as proxies for the regulated securities deposited in the vault. These tokens are designed to retain the composability of standard ERC-20 tokens while falling under the regulatory constraints of the underlying securities. This means that there is a separation of ownership and rights: holding an sToken does not imply ownership of the underlying securities. Instead it offers liquidity through a collateralisation mechanism (all sTokens are backed with the respective security they represent). This means that sTokens can be freely transferred and used within DeFi protocols however redemption of the underlying assets remains restricted to KYC-compliant wallets.

This logic extends to BUIDL, where the core BUIDL token represents a share in the underlying fund with compliance enforced at the point of issuance and redemption. However, through the sToken Vault users can mint sBUIDL which can be freely transferred and used within DeFi protocols.

Ecosystem and Onchain Utility

The BUIDL funds value proposition is amplified when compared to its TradFi counterpart through the extensive integration into the broader DeFi ecosystem.

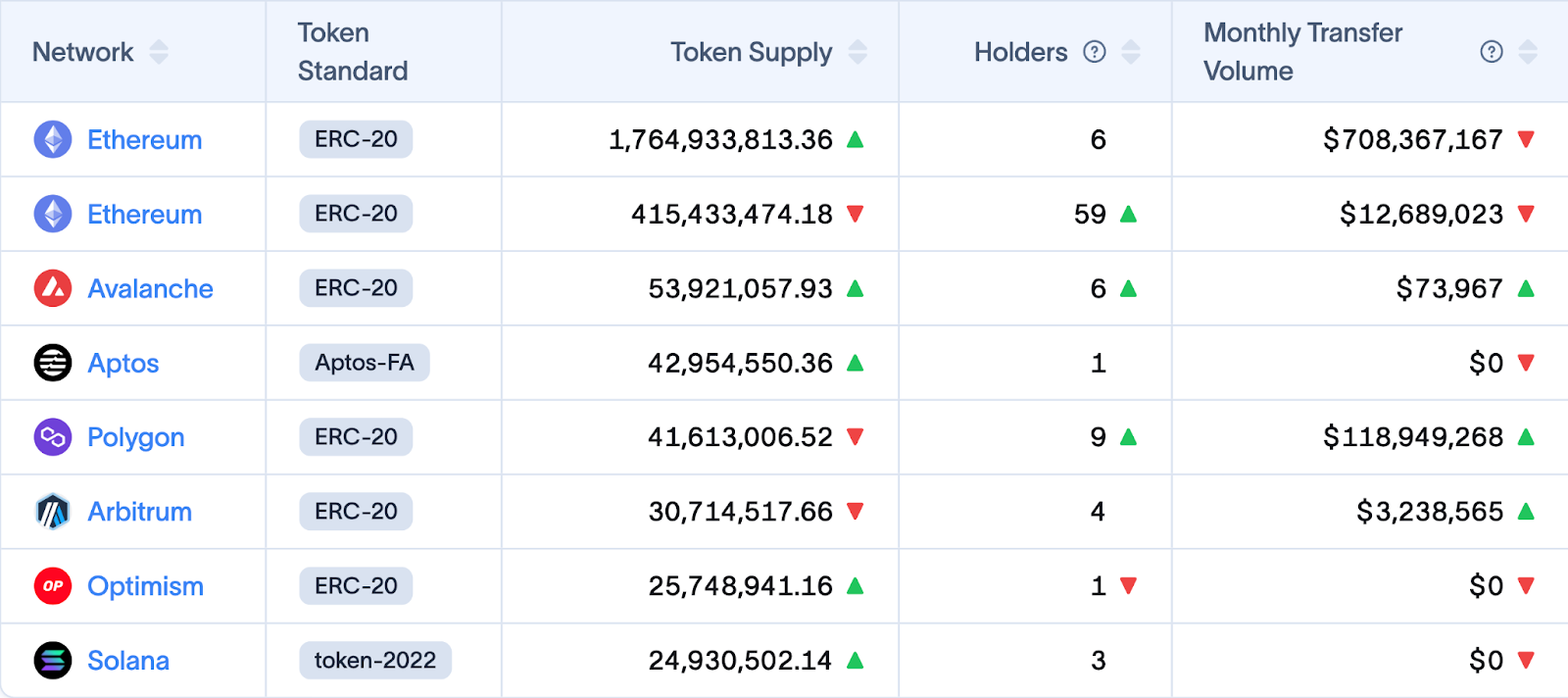

While BUIDL was initially launched on Ethereum, it has quickly expanded support for seven networks including: Ethereum, Aptos, Arbitrum, Avalanche, Optimism, Polygon, and Solana.

Stablecoin Backing

One of the most prominent use cases of BUIDL onchain has been for the backing of stablecoins. This is due to the onchain nature of BUIDL alleviating many of the hurdles that face stablecoins protocols when trying to access T-Bills. This is in addition to the ease of accessing yield through BUIDL rebasing functionality. These are Ethena, Frax Finance, and Elixir.

Ethena

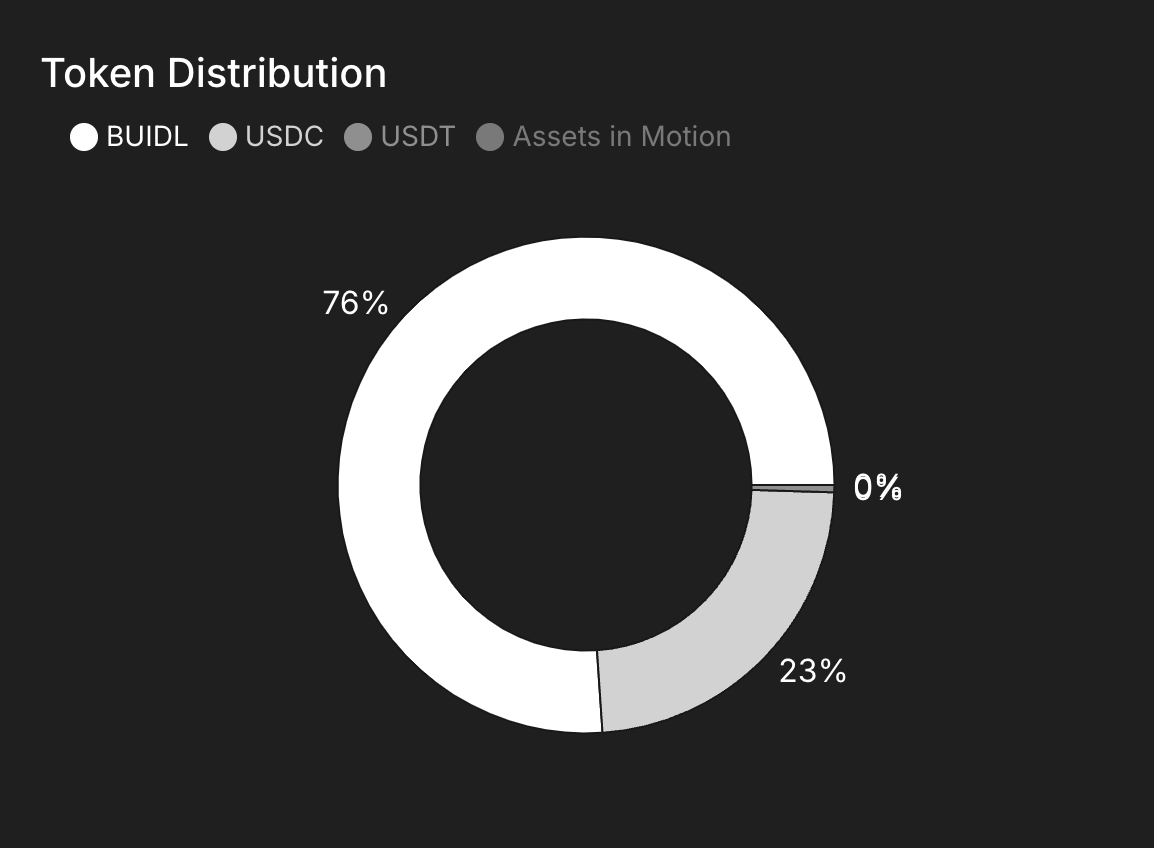

Ethena is by far the largest holder of BUIDL with it making up the majority of the backing of its secondary stablecoin USDtb. USDtb currently has a supply of $1.46b with BUIDL making up 76% of that figure ($1.1b). The rest of USDtb is backed with USDC and USDT to enable seamless redemptions.

Frax Finance

For Frax Finance’s stablecoin frxUSD BUIDL makes up 18% of the backing ($15.28M out of a total TVL of $85.12M). frxUSD is available on over 9 chains and actively passes on the yield accrued from the backing (BUIDL, USTB, WTGXX, etc) to holders taking the form of a 4.1% APY.

Elixir

Elixir’s deUSD positions itself as immediate liquidity to allow the value behind institutional assets to enter DeFi. deUSD is mintable with an array of RWAs including BUIDL thereby allowing holders to engage in DeFi through the Elixir stablecoin deUSD. Currently BUIDL makes up 4.7% of the backing of deUSD ($6.34M out of a total TVL of $132.94M) with the rest ranging from other RWA’s such as Hamilton Lanes SCOPE to crypto native assets such as ETH and staked USDS.

DeFi Integrations

The first major integration of BUIDL under the sBUIDL variant into DeFi has been on the lending platform Euler Finance. This integration was curated by Re7 Labs and allows sBUIDL to be used as collateral in order to source loans denominated in USDT, USDC, USDtb and RLUSD. The current market rate is lowest for USDtb which is priced at 5.47% borrow APY. The main use case of sBUIDL lending is to maintain exposure to the yield generated through BUIDL while additionally being exposed to a number of opportunities such as Ethena’s delta neutral funding rate yield through sUSDe, which can easily be swapped into USDTtb with minimal slippage.

Disclaimer

This material is provided by Stablewatch and the authors for informational/educational use only. Opinions are as of publication. Content may include forward-looking statements and third-party data; accuracy, completeness, and timeliness are not guaranteed. Nothing herein is investment, legal, tax, accounting, or other professional advice, nor an offer, solicitation, recommendation, or endorsement of any asset, protocol, product, or service. Do your own research and consult qualified professionals. Stablewatch and the authors may hold positions or relationships in the mentioned projects and may change them without notice. Subject to applicable law, by accessing you agree to release and hold harmless Stablewatch, its affiliates, contributors, and the authors from any loss or damages (inclusing direct, indirect, incidental, consequential, special, or punitive) arising from use of or reliance on this content or on any projects/products described, including errors, omissions, delays, security incidents, or performance outcomes. You assume all risk. Stablewatch and/or the authors have no duty to update. If you disagree, do not access or rely on this material.