Piku: Yield-Optimized Stablecoin

TLDR

- Piku operates a yield-optimized stablecoin where USP appreciates in value rather than maintaining a fixed $1 peg, with backing deployed across a proprietary FX arbitrage strategy (50%) and six DeFi protocols (50%)

- The BMMF Turkey FX Arbitrage Strategy executes 2-3 delta-neutral trades daily in Turkish cryptocurrency markets, capturing crypto and traditional spreads in addition to the overnight interest rates while maintaining zero currency exposure through hedging

- USP minting requires KYC/KYB verification with a 0% minting fee, while redemptions use a queue-based system with a 0.2% fee that flows back into backing, creating a transfer from exiting to remaining holders

- Governance occurs through the PikuDAO, where PIKU token holders stake their tokens to receive sPIKU voting power, enabling community control over backing allocations, fee structures, and platform parameters through a two-stage proposal and Snapshot voting process

- The protocol has completed security audits from Omega Security, 0xMacro, Hats Finance, and Audit33, with all critical and high-severity findings addressed. Smart contracts are built on Inverter Network's modular infrastructure

1. Introduction

Piku Protocol introduces a fundamentally different approach to stablecoin design by creating a yield-optimized digital dollar that appreciates in value rather than maintaining a fixed $1.00 peg. Launched on Ethereum mainnet with plans to expand to additional EVM-compatible chains including Plasma, Piku transforms the stablecoin from a medium of exchange into a digital savings vehicle that accrues value automatically for its holders.

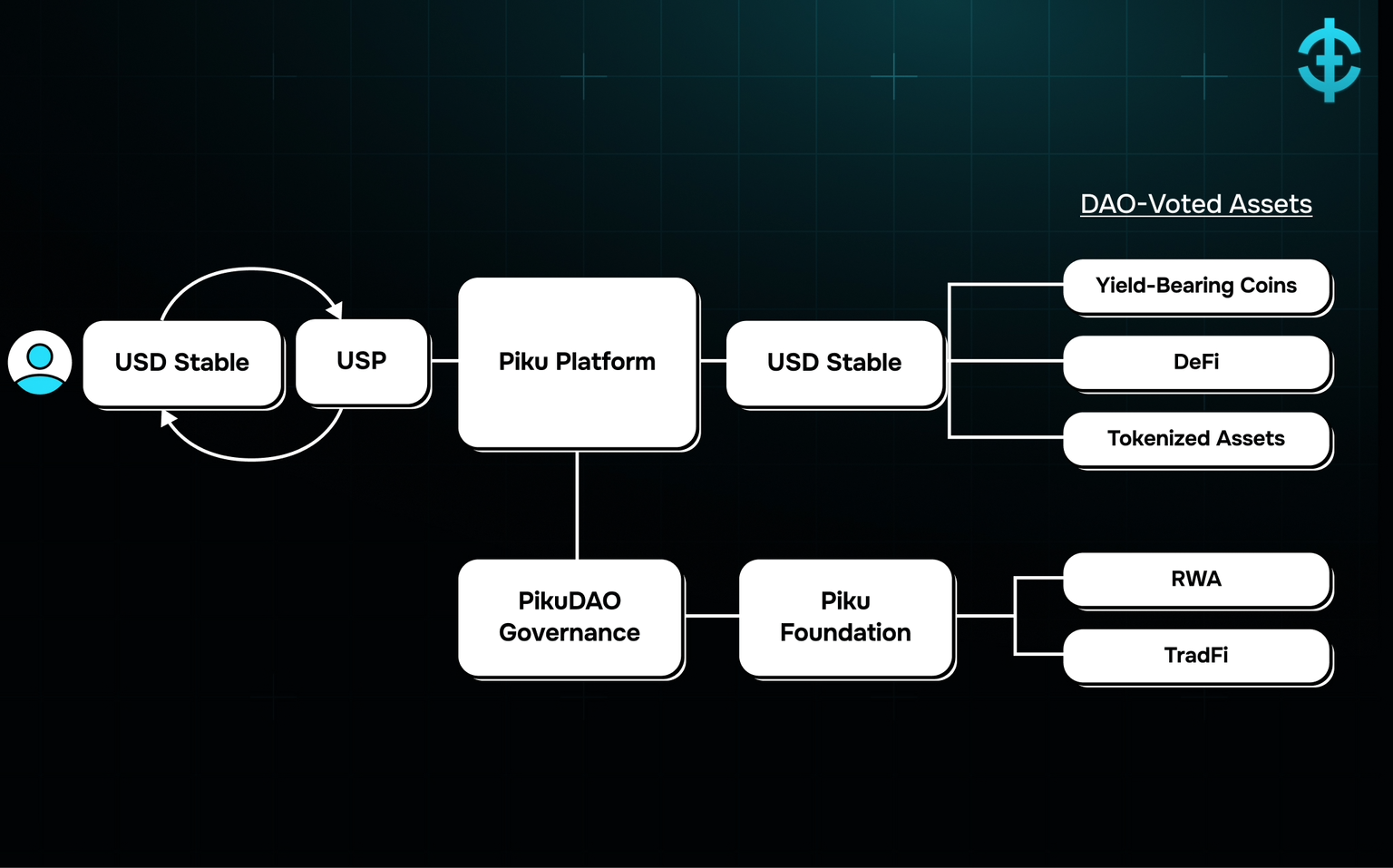

At the core of Piku's innovation is its three-token ecosystem. USP, the protocol's primary stablecoin, begins with $1.00 of backing but is designed to grow in value as yield strategies generate returns. Unlike conventional yield-bearing stablecoins that distribute earnings to holders, Piku channels 90% of all generated yield directly back into USP's backing pool, allowing each token to represent an ever-increasing claim on underlying assets. The protocol's other tokens—PIKU and sPIKU—enabe a governance delegation system where holders can either participate directly in protocol decisions or empower trusted community members with their voting power. PIKU holders control all critical parameters including backing allocations, fee structures, and protocol evolution through a transparent two-stage voting process.

Piku's yield generation strategy combines off-chain and on-chain sources to maximize returns while managing risk. The protocol currently allocates 50% of backing to the BMMF Turkey FX Arbitrage Strategy, a delta-neutral strategy arbitraging Turkish Lira USD markets, with the remaining 50% diversified across established DeFi protocols including Giza, Almanak, USD.AI, Ethena, Aave, and Cap.

As decentralized finance matures toward products serving genuine financial needs, Piku represents an attempt to create a credible alternative to traditional savings vehicles—offering a stablecoin that grows in value while having complete transparency of backing and operations, and community governance over all protocol decisions.

2. Protocol Architecture

2.1 The Three-Token System

Piku operates through a three token model, with each one serving a distinct purpose within the ecosystem. The relationships between these three tokens influence the functions behind yield generation, value accrual, and governance.

USP - The Yield-Optimised Stablecoin

Contract Address: 0x098697bA3Fee4eA76294C5d6A466a4e3b3E95FE6

USP represents the core product that Piku users interact with. The token initially launched with a 1:1 backing from Cash USD stablecoin, hence establishing a value of exactly $1.00 per token. However, unlike conventional cash stablecoins that aim to maintain this fixed peg indefinitely, USP’s design intends it to appreciate in value as backing strategies generate yield.

The appreciation mechanism operates through a system of yield accumulation. As the strategies backing the stablecoin generate yield, 90% of these flows go back into the backing pool of USP. Differently than in conventional models where the accrued yield is distributed to token holders. This allows the total backing value to increase while the amount of outstanding USP tokens remains constant. This design allows each USP token to represent a growing claim on the underlying assets.

Lets understand it better through an example:

- We start with 100 million USP tokens backed by $100 million in assets.

- Each token would represent exactly $1.00 of backing.

- If the backing strategies generate 15% returns over one year,

- The backing pool would grow to $113.5 million (accruing 90% of returns).

- The token count would remain at 100 million (assuming no net minting or redemption).

- Each USP token now represents $1.135 of backing.

- The token's fair value would grow to reflect this increased ratio.

The token operates as an ERC-20 on Ethereum mainnet, with plans to expand to other EVM-compatible chains. However, unlike for typical ERC-20 tokens, Piku implements restrictions on who can mint and redeem USP. Existing holders are able to transfer their tokens freely, but new issuance and redemption back to Cash USD stablecoins require completing a KYC/KYB verification process.

PIKU - The Utility Token

Contract Address: 0x2E4039E8E31475d65DC00293C366FDBfBBC02DC3

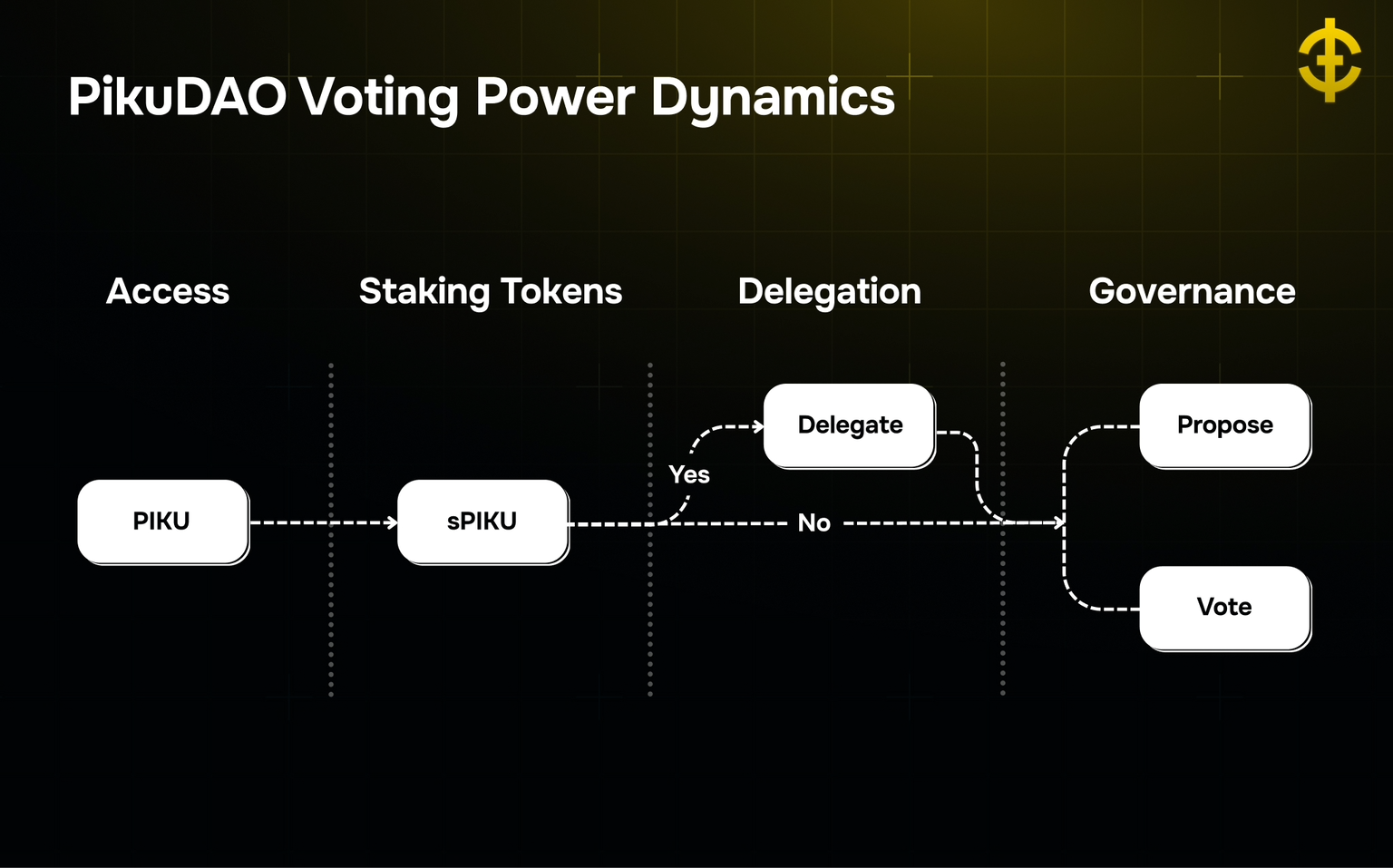

The PIKU token serves as an entryway into the PikuDAO governance process. The token itself does not directly confer voting rights. Instead, it functions as the asset that must be staked to participate in protocol governance.

The token distribution reflects the protocol's priorities and stakeholder alignment strategy:

The allocation structure makes a clear statement about protocol priorities, with forty percent allocation to USP holders representing the single largest distribution. All allocations vest linearly over their respective periods. The vesting schedules ensure that token supply increases predictably.

sPIKU - The Staked Utility Token

Contract Address: 0x5Da17CA137f1128d4be7Ce574bc61f3ac4839Df8

The sPIKU token represents actual voting power within the PikuDAO system. Users acquire sPIKU by staking their PIKU tokens through the protocol's hosted interface at app.piku.co. The staking ratio is fixed at 1:1, meaning one PIKU token staked generates one sPIKU token representing one vote in governance decisions. The staking mechanism also serves to create a commitment period that prevents governance attacks from mercenary capital.

The system is able to accommodate different levels of community engagement through delegation. Users can self-delegate their sPIKU tokens to access direct voting power, or they can delegate their voting power to other community members. As Piku grows, it intends to onboard economists, DeFi experts, risk managers and other trusted delegates to facilitate the governance process. Importantly, users who delegate their voting power still earn PIKU token rewards. This puts in place an incentive structure that encourages users to delegate rather than staking and not participating in the governance process.

2.2 Value Accrual and Distribution

The Piku protocol has implemented a dedicated system for how generated yields flow through the ecosystem and create value for different stakeholders.

Primary Yield Flow:

The strategies allocated to by Piku generate yield for the protocol, 90% of which flows back into USP backing in an automated manner. This negates any need for the user to claim rewards, manage staking positions or make decisions regarding compounding. The yield simply increases the backing and hence the token’s intrinsic value.

The remaining ten percent of generated yield flows to the DAO treasury. This treasury allocation serves several functions:

- Protocol Development: Funding UI / UX improvements and smart contract upgrades

- Security Expenses: Covering ongoing audits, bug bounties, and security infrastructure

- Governance Operations: Supporting working groups, delegate compensation, and DAO coordination

- PIKU Buyback and Burn: The team has indicated plans for revenue to be used for PIKU token buybacks, reducing circulating supply.

Secondary Revenue Source:

The 0.2% redemption fee serves as an additional channel for yield generation. When users redeem USP for Cash USD stablecoins, this fee is charged on the amount being redeemed, and is subsequently added back into the backing pool. This facilitates a transfer of value from holders who exit the protocol to those who remain.

The redemption fee fulfills both an economic and a behavioral purpose. Economically, it compensates remaining holders for the backing liquidity disruptions caused by large redemptions. Behaviorally, it imposes a mild penalty on short-term speculators while rewarding long-term holders, aligning functionality with the protocol's intended use as a savings vehicle.

2.3 Wallet Infrastructure

Piku maintains treasury operations across multiple blockchains with hot wallets for active operations, cold wallets for long term storage and a separate wallet for the PikuDAO Treasury. All wallet addresses are publicly documented and verifiable on chain.

Hot Wallets (Active Operations):

Cold Wallets (Long-term Storage):

Treasury Wallet:

3. Governance Structure

3.1 PikuDAO Governance Framework

PikuDAO is the central decision making authority for the protocol, overseeing all protocol parameters. The DAO’s mission as stated in the documentation is to ensure "a fully decentralised decision-making process, focused on determining the economics of the optimal store of value currency." The governance process is founded on a two stage model intended to balance voting efficiency

Stage 1: Discussion and Proposal Formation

Governance proposals would emerge through discussion on the community discord server, this process allows for ideas to be refined, and improved based on community feedback before moving on to official voting.

Stage 2: Snapshot Voting

After community discussion a proposal would move onto the Piku forum. Here the proposal would be formalised and become viewable by the entire community. Voting occurs through Snapshot, an offchain voting platform that has become the industry standard. Each sPIKU token held by a wallet represents one vote during the voting period.

Key characteristics of the Snapshot voting process:

- Verification: Despite being offchain, votes are cryptographically signed and verifiable

- Flexible voting periods: The DAO can set appropriate voting windows for different proposal types

- Delegate model: Users can attribute voting power to DAO delegates while the vote is active

3.2 Governance Authority Scope

The DAO’s control extends over virtually every single protocol parameter ensuring robust community authority over the evolution of the Piku protocol.

Backing Allocation Control:

DAO governance enables a two tier system for managing USP backing allocations, allowing for enhanced flexibility when facilitating allocations:

- Maximum Allocation: The DAO first votes to whitelist a protocol and set an upper bound for capital allocation. For example, the FX arbitrage strategy currently has a 60% maximum allowance. This ceiling establishes a boundary for potential exposure.

- Current Backing Distribution: The DAO separately votes on actual capital deployment within the maximum allowance limits. The FX strategy is currently deployed at 50%, providing 10% of headroom below the maximum. This separation allows tactical adjustments without requiring full re-votes on allocation ceilings.

Fee Structure Authority:

All platform fees fall under DAO control:

- Minting fees: Currently 0%, but the DAO could implement fees to manage demand or generate additional revenue

- Redemption fees: Currently 0.2%, but adjustable based on market conditions or treasury needs

- Future fee mechanisms: The DAO can introduce new fee types as the protocol evolves

Treasury Deployment Decisions:

The ten percent of yield flowing to the DAO treasury requires governance approval for expenditure.

Multisig Council Composition:

The DAO maintains authority over who serves on the multisig council that executes governance decisions. Through votes, the DAO can add or remove signers, change the threshold required for execution, or modify any aspect of the multisig structure. This ensures that the execution layer remains accountable to token holders. The DAO additionally has the power to remove the multisig council entirely to be replaced with automated smart contracts.

3.3 Delegation System and Delegate Management

The governance system recognises that not all token holders have sufficient time, expertise or inclination to evaluate each DAO proposal. The delegation system enables participants to empower trusted community members with their voting power while maintaining the economic exposure and earning potential of their held PIKU tokens.

Users who hold sPIKU tokens can delegate their voting power to another wallet address through the platform interface at app.piku.co/delegation. The delegation transferring voting authority is recorded onchain, while the underlying sPIKU tokens remain in the user's wallet. Delegators continue earning PIKU rewards even though they've delegated their voting power to someone else.

Becoming a Delegate:

The current process for becoming a recognised delegate involves manual review by the core team:

- Application submission: Prospective delegates email delegation@piku.co expressing interest

- Manual review: The core team evaluates the applicant's background and qualifications

- Interview process: Selected applicants undergo interviews to assess expertise

- Profile creation: Approved delegates receive listings on the delegation page with name, wallet address, and background information

- Community selection: sPIKU holders can then delegate to listed delegates

This is a temporary process, with Piku intending to transition towards a more decentralised delegate onboarding mechanism through DAO vote.

Self-Delegation Requirement:

Users who prefer to retain the ability to vote on governance proposals must self delegate their tokens. This one-time action through the delegation interface activates voting rights.

3.4 Security Mechanisms

Multisig Council Structure:

The multisig council exerts executive control over governance votes. Importantly the council serves purely as an execution function and does not have any influence over decision-making. Council members additionally cannot implement changes not approved by governance nor can they veto proposals made by the DAO. Council members are yet to be announced by PikuDAO, however it is intended to represent diverse stakeholder groups within the DAO.

Unstaking Cooldown:

There is a thirty-day cooldown period for unstaking sPIKU that ensures malicious actors cannot quickly accumulate voting power, push through harmful proposals, and exit before consequences materialise.

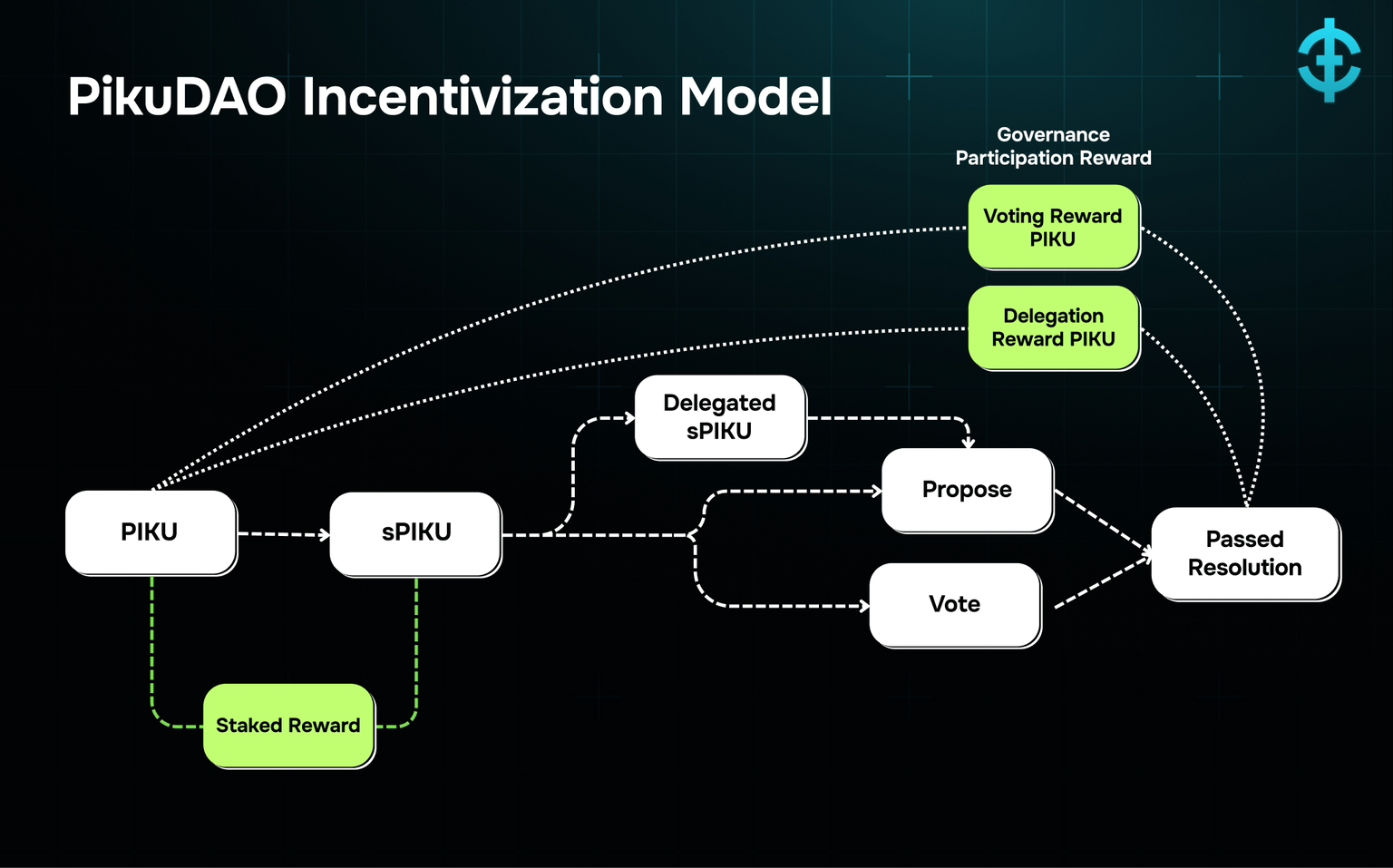

4. Governance Incentives

4.1 PIKU Token Emissions and Rewards

The protocol allocates significant token supply to incentivize active governance participation across multiple stakeholder groups.

Staking Rewards (2.5% of Total Supply)

Allocation: 12,500,000 PIKU (2.5% × 500,000,000 total supply)

Vesting: Linear over 4 years

Annual Distribution: 3,125,000 PIKU per year

Users who stake PIKU to receive sPIKU voting power earn rewards from this allocation. The rewards incentivize token locking, which:

- Reduces circulating supply

- Aligns long-term incentives

- Ensures governance participants maintain stake exposure

- Creates opportunity cost for passive token holding

Delegator and Voting Rewards (5% of Total Supply)

Allocation: 25,000,000 PIKU (5% × 500,000,000 total supply)

Vesting: Linear over 4 years

Annual Distribution: 6,250,000 PIKU per year

This larger allocation rewards both delegates who receive voting power and users who actively vote on proposals. The dual incentive structure encourages:

- Expert participation as delegates

- Active voting from engaged community members

- Delegation rather than passive token holding

- Knowledge sharing and governance discussion

USP Holder Rewards (40% of Total Supply)

Allocation: 200,000,000 PIKU (40% × 500,000,000 total supply)

Vesting: Linear over 8 years

Annual Distribution: 25,000,000 PIKU per year

The largest allocation goes to USP holders, distributed over eight years. This creates powerful incentives for long-term USP holding.

5. Minting, Redemption, and KYC Requirements

In order to facilitate future expansion of RWA asset backing, Piku has implemented a system of mandatory identity verification for all users wishing to mint or redeem USP. However once USP tokens are minted they can be freely transferred and exchanged.

Verification Requirements:

The protocol requires KYC verification for individuals and KYB verification for business entities. The verification process is handled by third party verification service Shufti. After completing verification, the user's wallet address is whitelisted in the protocol's smart contracts, hence enabling the wallet to mint and redeem USP.

Restrictions:

During Phase 1 of operations, US individuals and businesses are excluded from minting and redeeming USP due to regulatory compliance considerations.

5.1 Minting Process

The minting process converts Cash USD stablecoins into USP tokens at the current backing value. The protocol does not charge a minting fee, meaning there are no frictions for users to enter the protocol.

Accepted Stablecoins for Minting:

During Phase 1, the protocol accepts the following USD-pegged stablecoins:

- USDC (Circle)

- USDT (Tether)

- Other USD stablecoins as approved by DAO governance

Minting Process:

- Complete KYC/KYB verification through Shufti the protocol's integrated provider

- Wallet whitelisting occurs after successful verification, enabling protocol interactions

- Connect wallet to the Piku platform at app.piku.co

- Select deposit amount and choose which USD stablecoin to use

- Approve spending if first time using the selected stablecoin (standard ERC-20 approval)

- Submit minting transaction which executes onchain

- Receive USP tokens at current backing value in the same transaction

Minting Exchange Rate:

Users receive USP tokens at the current backing value per token. If USP has $1.20 of backing per token, a user depositing $1,200 in USDC would receive 1,000 USP tokens. The exchange rate adjusts continuously as the backing generates yield and the backing-per-token ratio increases.

5.2 Redemption Process

The redemption process allows users to burn USP tokens and receive Cash USD stablecoins in return. Unlike the instant minting process, redemptions require managing liquidity risk hence they use a queue-based system.

Redemption Fee Structure:

- Fee Rate: 0.2% (20 basis points)

- Fee Destination: Flows back into USP backing pool

Queue-Based Redemption System:

Redemption requests enter a smart contract queue on a first-come, first-served basis. However entries are treated differently based on size:Small Redemptions: The redemption contract maintains a buffer of USD stablecoins to immediately satisfy smaller redemption requests.

Large Redemptions: When redemption requests exceed the available stablecoin buffer, the protocol must liquidate a portion of backing assets to fulfill the request.

The queue system ensures these liquidations can occur in an orderly fashion without forcing immediate fire sales at prices unfavourable to all stakeholders.

Redemption Process:

- Connect wallet to app.piku.co (must be KYC-verified wallet)

- Select redemption amount of USP tokens to redeem

- Submit redemption request which enters the queue

- Queue processing occurs based on position in queue and available liquidity

- Receive USD stablecoin (minus 0.2% fee) after processing completes

- USP tokens are burned removing them from total supply

6. USP Asset Backing

USP's asset backing consists of a diversified portfolio split between offchain and onchain strategies. Additionally, backing may be kept in Cash Stablecoins USDC and USDT.

Current Reserve Backing Distribution:

7. The BMMF Turkey Stablecoin FX Arbitrage Strategy

The BMMF Turkey FX Arbitrage Strategy makes up for the largest portion (50% as of this publication) of Piku’s backing collateral allocation. The strategy is run by Balsa Technologies an algorithmic trading company specialised in market making. Piku plans to reduce its reliance on this offchain strategy over time. For now, however, it provides the DAO with a unique source of yield to attract depositors - one that is not easily accessible to onchain natives otherwise. The strategy exploits pricing inefficiencies in Turkish cryptocurrency markets through delta-neutral trades between USDT and Turkish lira (TRY).

Market Opportunity:

High domestic inflation in Turkey, at times exceeding 40%, creates strong demand for dollar-denominated assets to be used as a store of value. However, spreads on the traditional banking system have pushed the people of Turkey towards stablecoins as an alternative means of accessing dollar-based savings.

The arbitrage opportunity has emerged from pricing discrepancies between Turkish and global stablecoin markets. During periods of volatility in the Lira or local Turkish supply-demand imbalances, the TRY price of USDT can diverge from its theoretical value based on the USD/TRY exchange rate. These mispricings create opportunities to profit from the spread between the two values.

Delta-Neutral Structure:

While the BMMF team buys and sells Turkish lira repeatedly throughout each day, every lira of exposure is immediately hedged through forward contracts or spot trades with Turkish banks and institutional market makers. This hedging ensures that whether the Lira strengthens or weakens against the dollar has no impact on the profitability of the trade. The ability of the strategy to capture spreads regardless of currency direction means it is delta neutral.

Proprietary Nature:

The broad mechanics of the BMMF Turkey FX Arbitrage Strategy are disclosed for transparency and risk assessment, however granular execution details must remain confidential, due to their proprietary nature.

7.1 Trading Operations

The strategy operates on a multi-trade daily cadence, executing up to 3 complete rounds of trades in a single day depending on market conditions.

Operational Structure:

- Automated bots: Maintain continuous presence in exchange order books, executing trades when spreads reach programmed thresholds

- Manual traders: Handle larger clips and tactical timing decisions, particularly for T+1 overnight positioning

- Hedge coordinators: Manage relationships with banks and market makers, ensure hedge availability

Daily Trading Pattern:

A typical trading day includes two T+0 (same-day settlement) trades capturing intraday spreads, this would be followed by a one T+1 (next-day settlement) trade that combines spread capture with overnight interest rate earnings. The exact number and type of trades varies based on market conditions.

Primary Exchanges:

- Binance TR

- OKX TR

- BTC Turk

Hedge Counterparties:

- Turkish commercial banks: Traditional financial institutions offering spot and forward FX contracts

- Zodia Markets: Cryptocurrency-native institutional market maker backed by Standard Chartered

- GSR: Major institutional market maker currently in testing phase for integration

7.2 T+0 Intraday Trade Mechanics

T+0 trades capture same-day spreads between USDT sell and buy prices in Turkish markets. The strategy would normally execute these trades twice a day when spreads are attractive.

Numbers are purely illustrative

Example T+0 Trade Flow:

Trade Parameters:

Execution Sequence:

Step 1: Sell USDT

Step 2: Simultaneous Hedge

Step 3: Buy Back USDT

Profit Calculation:

Daily T+0 Revenue Estimate:

Hedging Methodology:

The hedging process varies based on whether execution is automated or manual.

Automated Bot Hedging:

- Bot detects attractive spread in order book

- Bot executes spot USDT sale

- Bot simultaneously triggers hedge with pre-connected counterparty

- Near-zero latency between trade and hedge

Manual Trader Hedging:

- Traders monitor spreads and execute larger positions

- Hedging occurs in standardised clips:

- $250,000 clips for wider spreads (lower execution risk)

- $100,000 clips for tighter spreads (manage price impact)

- Each clip is fully hedged before executing the next clip

- Prevents accumulation of unhedged exposure during large trades

Risk Management:

The critical risk management principle that dictates execution of this strategy is that hedges execute simultaneously with or immediately after spot trades. Additional spot trades are never executed before existing positions are hedged. This sequencing prevents dangerous exposure windows where adverse currency moves could eliminate multiple days of spread profits.

7.3 T+1 Overnight Trade Mechanics

T+1 trades add overnight interest rate capture to spread earnings by holding Turkish lira positions overnight with forward hedge protection.

The team decides between executing a third T+0 trade versus T+1 positioning based on:

- Current spread width (wide spreads favor T+0)

- Overnight interest rate levels (high rates favor T+1)

- Available hedge pricing for T+1 forwards

Turkish Interest Rate Context:

- Overnight Rate: Approximately 40% annualised

- Daily Rate Calculation: 40% ÷ 365 days ≈ 0.1096% per day ≈ 11 basis points

Turkey's central bank maintains high overnight rates as part of monetary policy to manage inflation and support currency stability. These elevated rates create opportunities to earn meaningful interest income on overnight TRY positions when combined with forward hedging.

Numbers are purely illustrative

Example T+1 Trade Flow:

Trade Parameters:

Sell USDT Spot

Execute T+1 Forward Hedge

The forward contract locks in the exchange rate for next-day settlement. The team knows with certainty they will deliver 414,800,000 TRY to their counterparty tomorrow morning in exchange for $10,000,000. Currency risk inherent in holding overnight TRY exposure is eliminated through hedging.

Deposit to Turkish Bank

Next Morning: Settlement

T+1 Profit Calculation:

Spread Revenue:

Combined T+1 Profit:

7.4 Revenue Aggregation

The conditions presented are purely illustrative to demonstrate the mechanisms behind the BMMF Turkey Stablecoin FX Arbitrage Strategy. The estimated 38-39% annualised return shown in the example does not guarantee similar results in practice, which may vary due to spread width, interest rate fluctuations and trade frequency.

7.5 Stablecoin Composition

Stablecoin Usage by Trade Type:

USDC (First Two Daily Trades):

- Fastest settlement times

- Team converts USDC → USDT on exchanges

USDG (Third Daily Trade):

- OKX TR's unified order book treats USDG as fungible with USDC

- Team converts USDG → USDC → USDT on exchanges

USDT (Final Conversion):

- USDT / TRY pairs offer deepest liquidity in Turkish markets

- Tighter spreads than alternative stablecoin pairs

8. DeFi Backing Allocations

Currently the remaining 40% of backing allocation is spread over six DeFi protocols, each providing differentiated exposure.

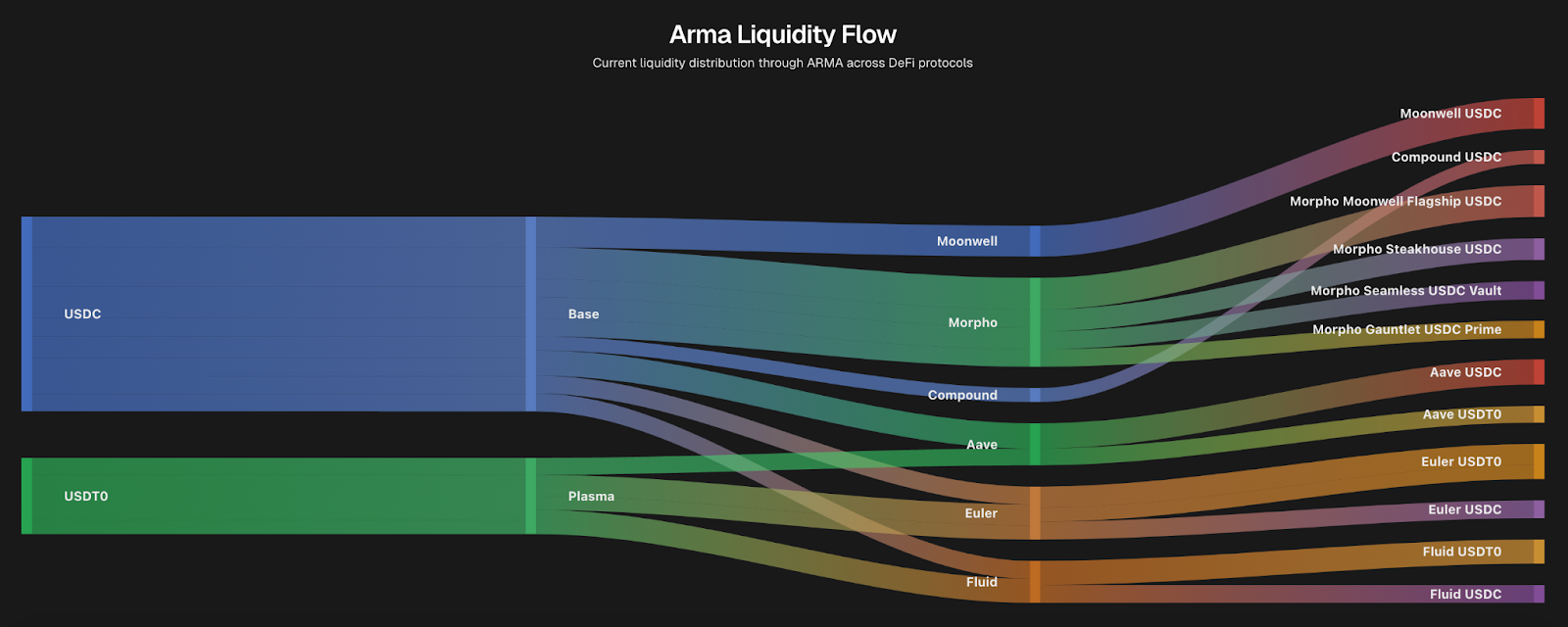

8.1 Giza Arma Agent

Allocation: 10% of total USP backing

Protocol: Giza platform, Arma Agent

Yield: 15%

Total Value Locked: $17.6 million

Giza operates a platform for deploying AI agents to execute various DeFi strategies. The Arma Agent allocated to by Piku focuses on blue chip lending protocols autonomously deploying capital to achieve the best possible risk adjusted returns. Arma continuously scans lending pools tracking real time yields and gas prices across the Base network. The agent then calculates post fee yield getting the cost or benefit of switching allocations. If the return of a change in allocation provides positive expected value the agent executes the swap. Finally the agent is also able to collect reward tokens, selling them to increase allocations.

The protocols the Arma Agent currently allocates to are:

- Morpho

- Seamless

- Aave

- Euler

- Moonwell

- Fluid

- Compound

Arma Agent Liquidity Flows

8.2 Almanak Autonomous Liquidity USD

Allocation: 10% of total USP backing

Protocol: Almanak, Autonomous Liquidity USD Vault

Yield: 9.67% (Native Yield), 18.8% (Net APY including Almanak points)

Total Value Locked: $113.4 million

Almanak operates autonomous agents that dynamically execute DeFi strategies, with real time analytics to track portfolio performance. All strategy code is verifiable which enables backtesting and risk assessment prior to strategy execution. The Autonomous Liquidity USD identifies opportunities and repositions capital to capture the highest available yields. Almanak’s AI Swarm allows for continuous rebalancing based on a cost benefit analysis.

The protocols the Almanak Autonomous Liquidity USD Vault currently allocates to are:

- Aave v3

- Compound v3

- Fluid

- Euler v2

- Morpho Blue Vaults

- Yearn v3

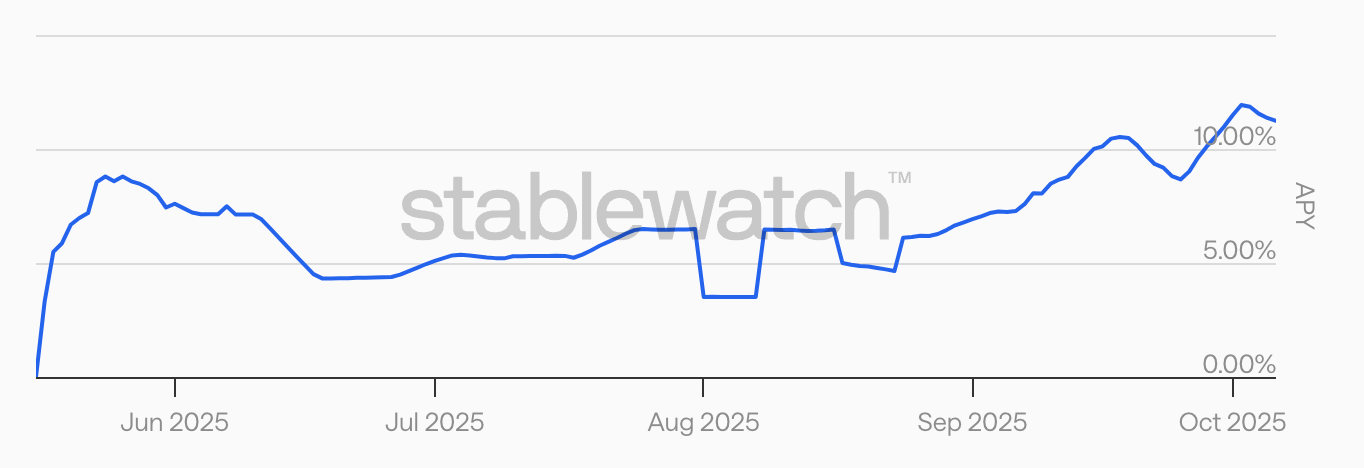

Autonomous Liquidity USD Vault APY

8.3 USD.AI

Allocation: 10% of total USP backing

Protocol: USD.AI, sUSDai token

Reported Yield: 16.1%

Total Value Locked: $505.7 million

USD.AI provides CapEx loans to long tail asset holders, namely data center operators who currently do not have access to traditional credit markets due to the short halflife of AI chips. USD.AI allows DeFi participants to provide collateralised loans to operators building the AI infrastructure without having to individually underwrite or originate loans. USD.AI provides two assets, USDai which is a synthetic liquid fully backed stablecoin and sUSDai which represents interest generating capital deployed to USD.AI clients.

Currently USDAI has deployed five loans

- $2.5M NVIDIA B200s: 16.97% APY

- $840K RTX 5090s: 15.27%

- $22.2M NVIDIA B300s: 12.70%

- $2M NVIDIA B300s: 12.70%

- $4.1M NVIDIA B300s: 12.70%

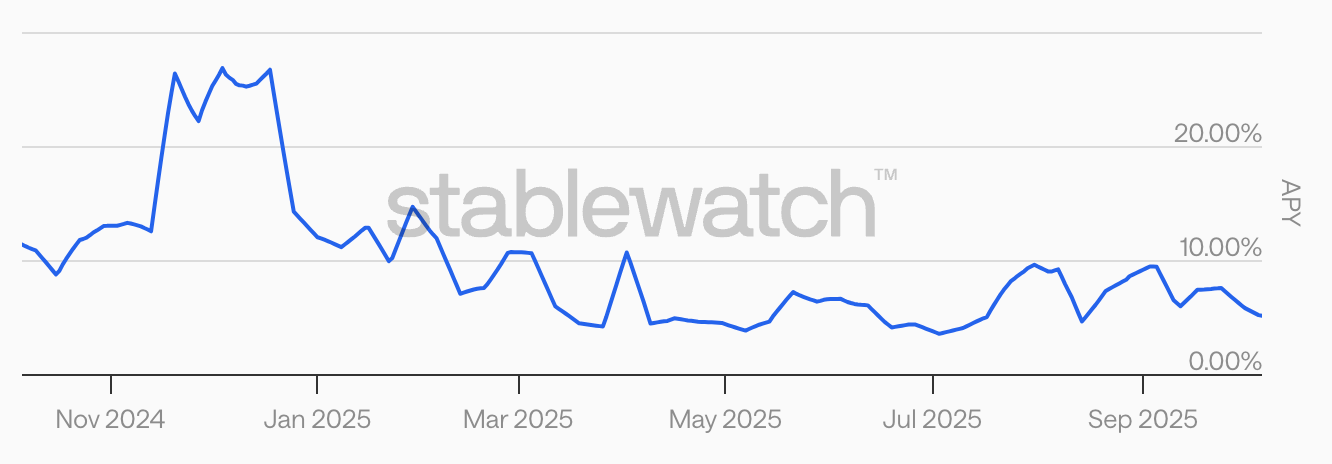

sUSDai APY

8.4 Ethena

Allocation: 10% of total USP backing

Protocol: Ethena protocol, sUSDe token

Reported Yield: 7.66%

Total Value Locked: $13.62 billion

Ethena operates a synthetic dollar achieved through delta-hedging Bitcoin, Ethereum and Solana on perpetuals exchanges. This process involves purchasing spot exposure in addition to taking out a short position to the aforementioned assets. Perpetuals exchanges balance the market by forcing the side with a higher position volume, whether that is short or long, to pay a premium for taking out the position. This is called the funding rate and as crypto markets are almost always long asset prices this means that the short positions of Ethena earn yield which it pays out to sUSDe holders. Ethena manages exchange risk by holding assets at custodians Copper.co and CEFFU.

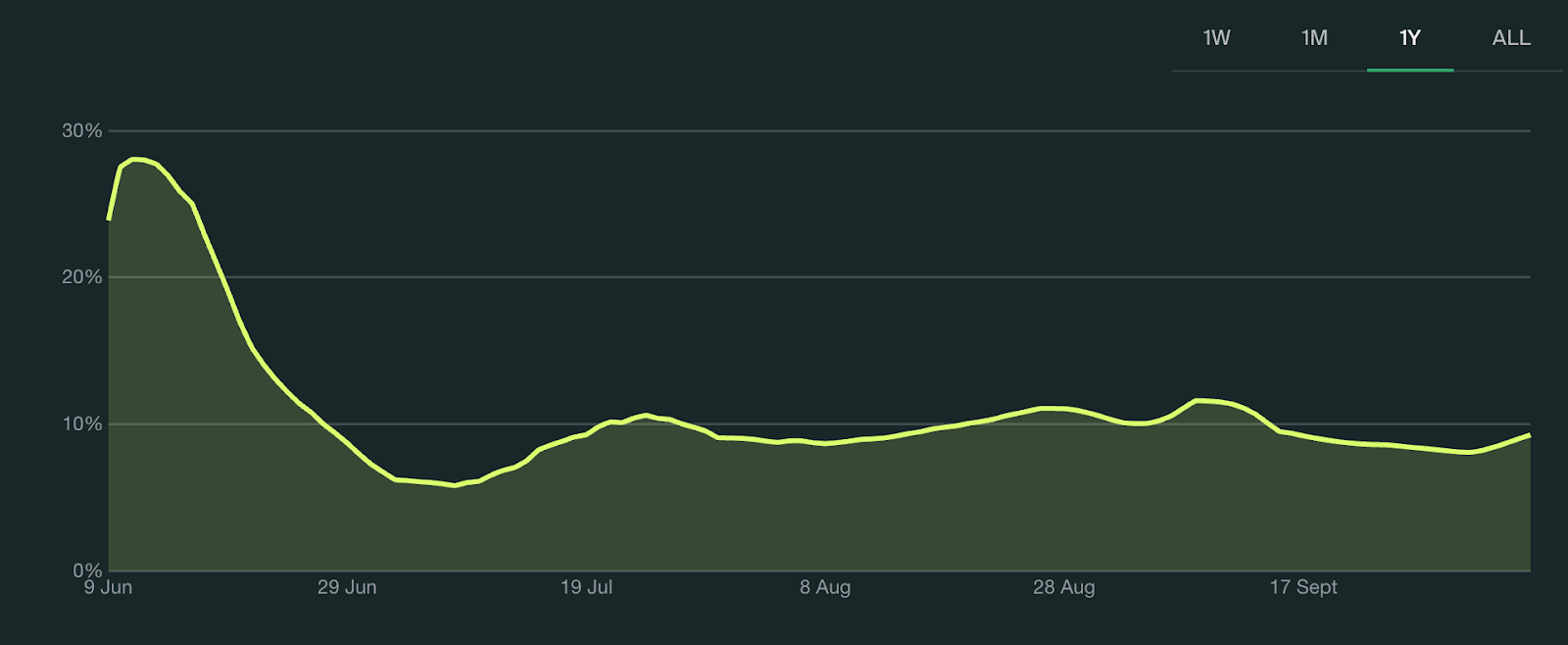

sUSDe APY

8.5 Aave

Allocation: 5% of total USP backing

Protocol: Aave, aUSDT token

Reported Yield: 4.03%

Total Value Locked: $6.68 billion

aUSDT is a yield bearing token issued by the lending protocol Aave, specifically when users of Aave deposit USDT into Aave’s lending pool. aUSDT represents the users share of the liquidity pool and accrues interest passively. Yield on aUSDT is generated through Aave lending out the underlying USDT to users through overcollateralised loans which generate interest currently set at 5.73% APY. A secondary source of yield on aUSDT is flashloans which are loans taken out and paid back in the same block, Aave charges a 0.09% fee on flash loan volumes, and suppliers receive a share of this.

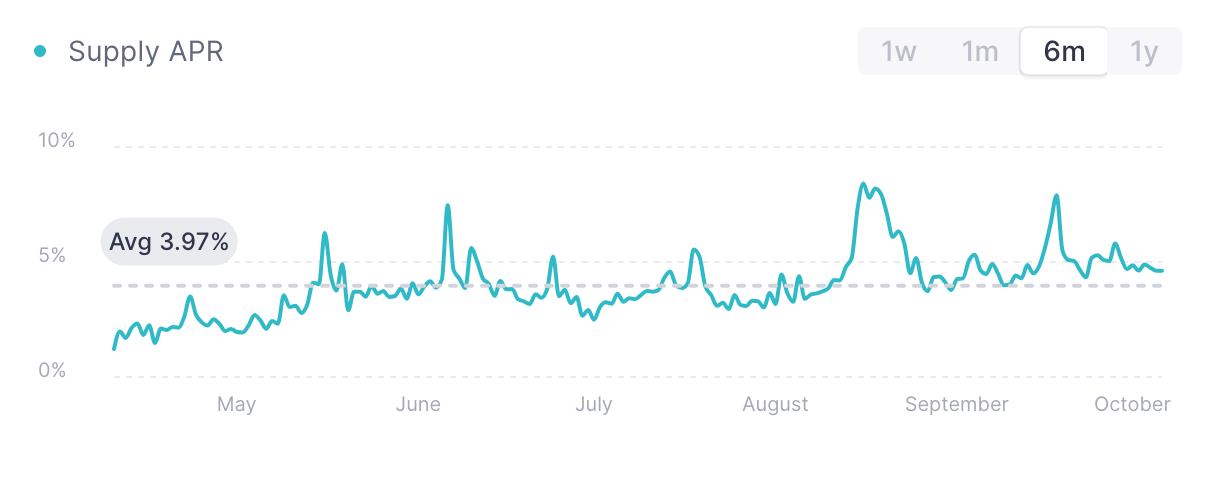

aUSDT APY

8.6 Cap

Allocation: 5% of total USP backing

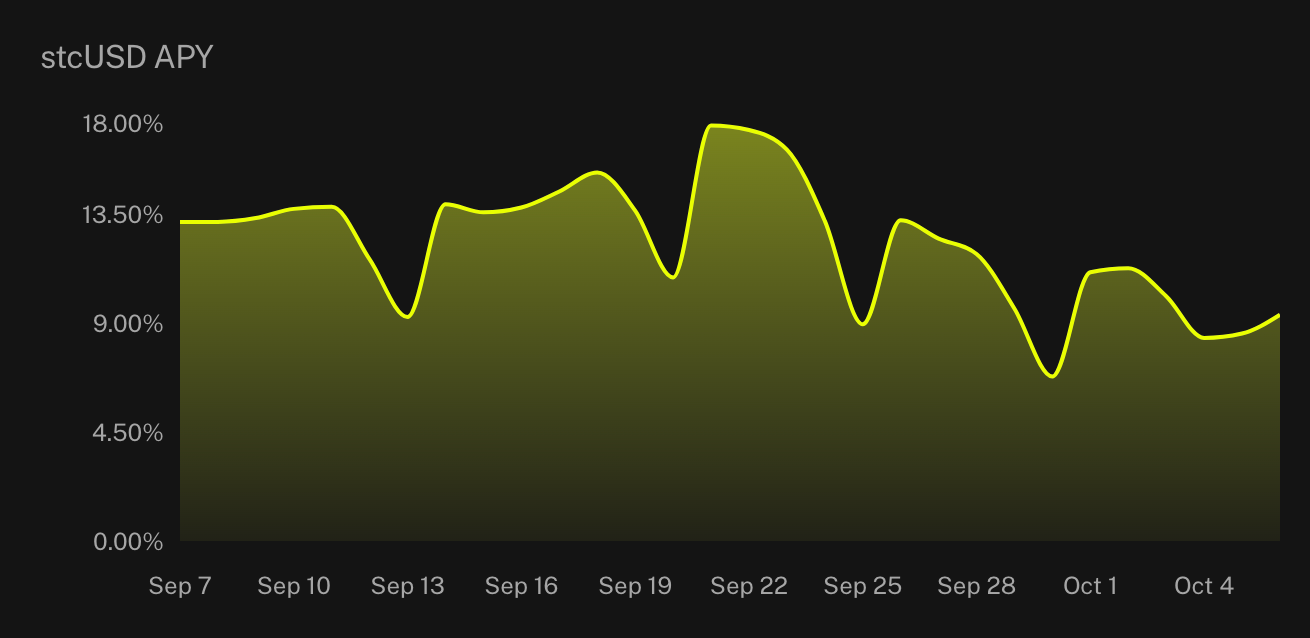

Protocol: Aave, cUSD & stcUSD token

Reported Yield: 4.03%

Total Value Locked: $250.36 million

Cap is a three sided yield marketplace built with credible financial guarantees. It involves multiple types of actors. Firstly holders of cUSD which is a standard stablecoin backed by USDC deposits. Holders of stcUSD stake cUSD in order to make their deposited USDC borrowable by operators. Operators generate yield by borrowing reserve capital to execute proprietary strategies. To be eligible to borrow, they are required to secure delegations from restakers. Restakers delegate locked assets to operators via shared security markets thereby underwriting the risk of operator default. This model allows restaked assets to form an insurance layer for undercollateralised loans to institutions. Yield from operators is split between the restakers, stcUSD holders and the protocol.

Piku allocation is currently split evenly between cUSD and stcUSD. This is due to cUSD earning double the points of stcUSD in the Cap Season 2 campaign which could encompass a higher future return.

stcUSD APY

9. Infrastructure and Audit History

9.1 Smart Contract Architecture

Piku's smart contracts are built on Inverter Network's modular infrastructure rather than developed from scratch. This architectural decision provides several advantages including the fact that it can leverage extensively audited existing code thereby reducing new code requiring independent security review. Additionally Piku benefits from Inverter's structure allowing modular updates without full system rewrites and the ongoing security maintenance that Inverter has out of the box.

The modular approach separates functionality into distinct components:

- Token logic (ERC-20 functionality with extensions)

- Oracle integration for price feeds

- Queue-based payment and redemption systems

- Governance modules for DAO operations

- Upgradeability mechanisms for protocol evolution

9.2 Audit History

Piku's infrastructure has undergone multiple independent security audits from different firms, providing a comprehensive review of the smart contract setup.

Omega Security Audit

Date: July 2025

Scope: New modules introduced to Inverter's architecture

- Queue-based funding and payment processors

- Permissioned Oracle integration

- Upgradeable ERC-20 token logic

Findings: Low-severity issues primarily related to:

- Naming conventions and code clarity

- External call handling improvements

Status: All findings acknowledged and fixed

Report: Available via GitHub PR #704

The Omega audit focused specifically on new modules added to support Piku's requirements, including the queue-based redemption system. The low-severity classification of all findings indicates no critical vulnerabilities in the new code.

0xMacro Audit

Date: April 15 – May 24, 2024 (6-week comprehensive review)

Audited Entity: Inverter Protocol (Piku's core contract architecture)

Scope: Full modular contract suite, including:

- Governance mechanisms

- Bonding curve logic

- Staking and reward systems

- Access control frameworks

- Payment routing infrastructure

- Proxy design and upgradeability patterns

Status: All critical and high-severity findings addressed and fixed

Report: https://github.com/InverterNetwork/contracts/blob/main/audits/2024-06-19-macro.pdf

The 0xMacro audit represents the most comprehensive review of Piku's underlying infrastructure, covering the entire Inverter system that powers the protocol's operations.

Hats Finance Audit Competition

Date: June 2024

Platform: Hats.Finance decentralized audit competition

Scope: Full Inverter V1 contract suite powering Piku

Reward Pool: ~$80,000 USD (24,000 UMA tokens)

Structure: On-chain submission, first-come, first-served bounty model

Outcome: Numerous edge-case issues identified, all reviewed and addressed

Report: https://github.com/hats-finance/Inverter-Network-0xe47e52c4fea05e555920f1dcdcc6fb8eca103eeb/blob/main/report.md

The Hats Finance competition represents a different audit methodology—a crowdsourced security review where multiple researchers compete to identify vulnerabilities. This approach often surfaces edge cases that traditional methods might miss because more auditors can review the code.

Audit33 Review

Date: May 2025

Auditor: 33Audits & Co.

Scope: Targeted review of specific modules

- Oracle-integrated Funding Manager

- Queue-based payment flow logic

Findings: 2 high-severity issues identified

Status: Both issues fully resolved and validated

The Audit33 review focused specifically on the oracle integration and queue-based systems critical to Piku's operations. The audit identified and resolved two high severity issues within the Piku codebase.