Giza Project Spotlight

Humanity is burdened by two fundamental limitations, time and cognitive capacity. Managing capital effectively is a constant drag on both of these resources that are already in scarce supply, particularly among the most productive members of society. It is no wonder that the market size for wealth and asset management is $2 trillion+ according to McKinsey & Company. Addressing this challenge is Giza Protocol, the subject of today’s project spotlight. By democratising access to financial intelligence, it aims to empower a broader segment of humanity to benefit from effective capital allocation, preserving their wealth and purchasing power. This approach not only serves to empower individuals but also lubricates the broader market by directing capital to where it can be most productive, maximizing risk-adjusted returns.

The problem that Giza saw in today's DeFi’s landscape is a case of cognitive overload. Users are often overwhelmed by the necessity to constantly monitor returns, protocol health metrics, and other dynamic data points across a range of chains and protocols. This information deluge leads to suboptimal decision-making due to human error, cognitive biases such as fear of missing out (FOMO), or panic selling.

Giza Protocol emerged at a crossroads of two foundational innovations: Artificial Intelligence and Permissionless Finance. The protocol has caused immense discourse on the future of autonomous finance and current AI meta in onchain markets. However, Giza is not building for the short term, they aim to reimagine how finance is conducted through a paradigm shift they are calling Autonomous Financial Intelligence. This would envision onchain actions being primarily conducted through in house machine learning models tailored specifically for financial use cases. Intelligent agents built on Giza infrastructure provide continuous, 24/7 market evaluation and execution, ensuring that opportunities are captured around the clock. Sophisticated financial strategies, previously accessible only to institutional players or highly experienced users, are now available to a far broader audience. However Giza does not solely empower retail users, the project has partnered with institutional DeFi firm Re7 Capital in order to also explore an institutional case study for agent adoption.

Flagship Product: ARMA Agents

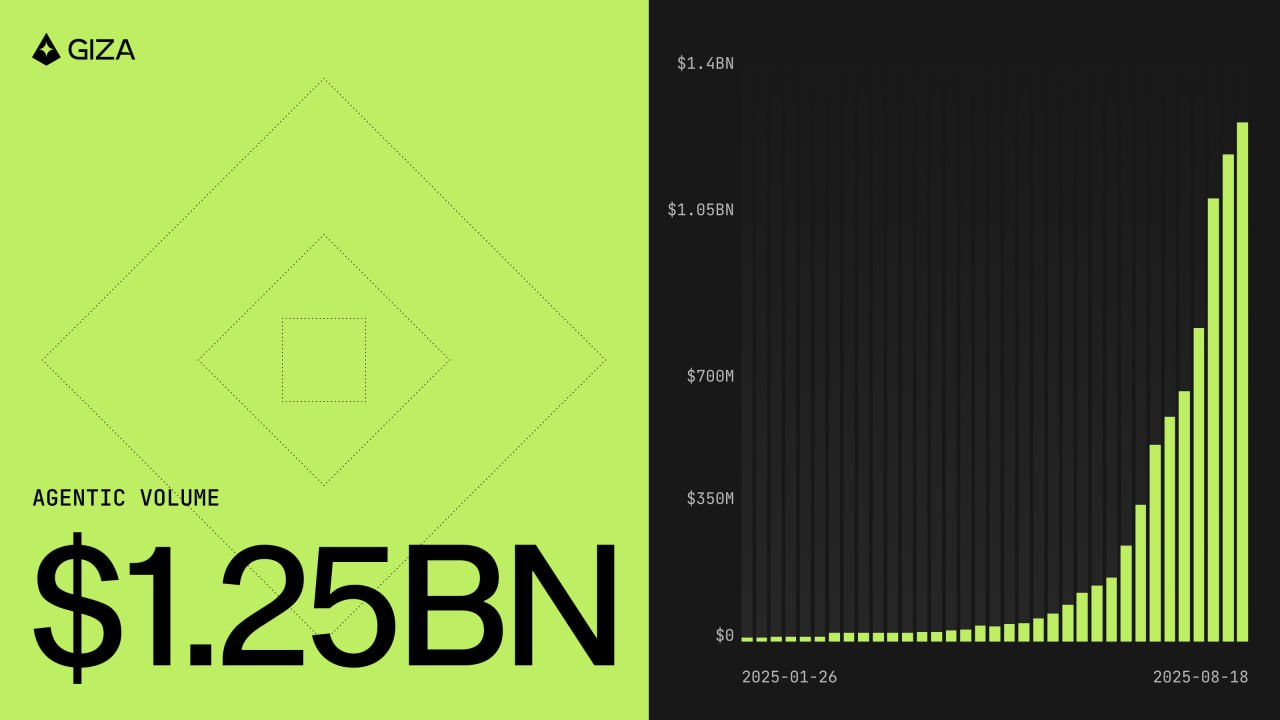

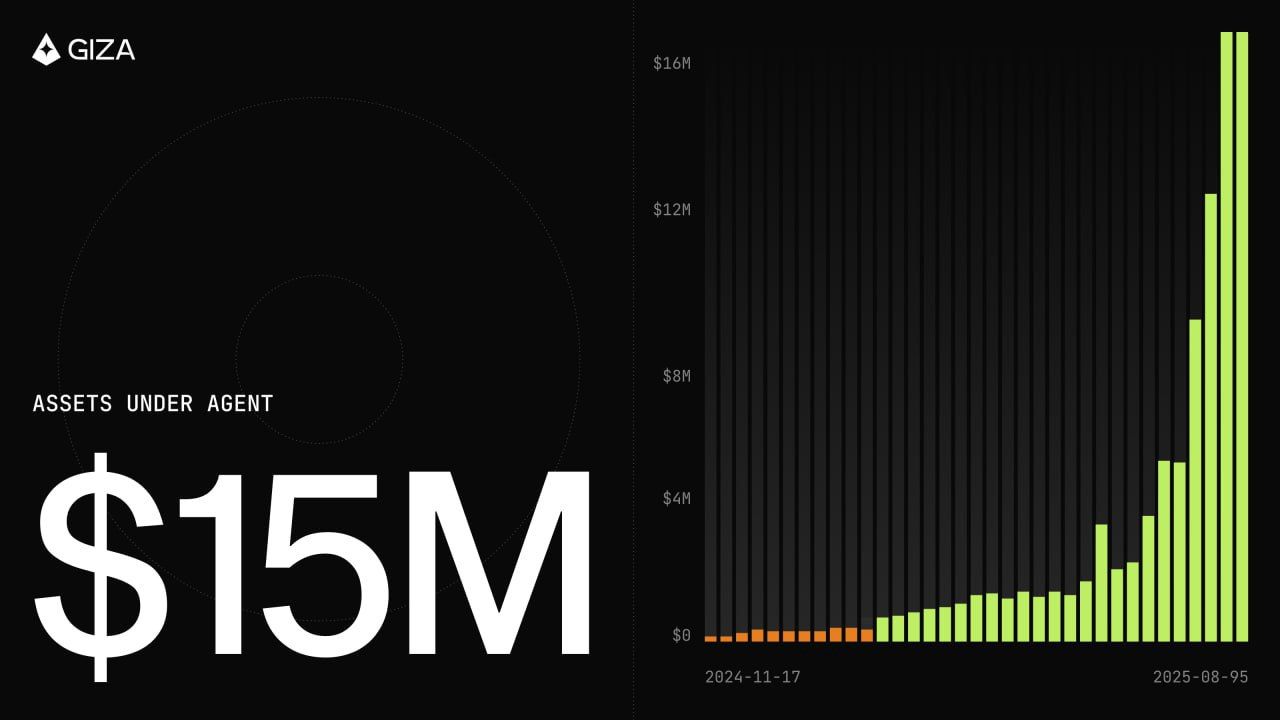

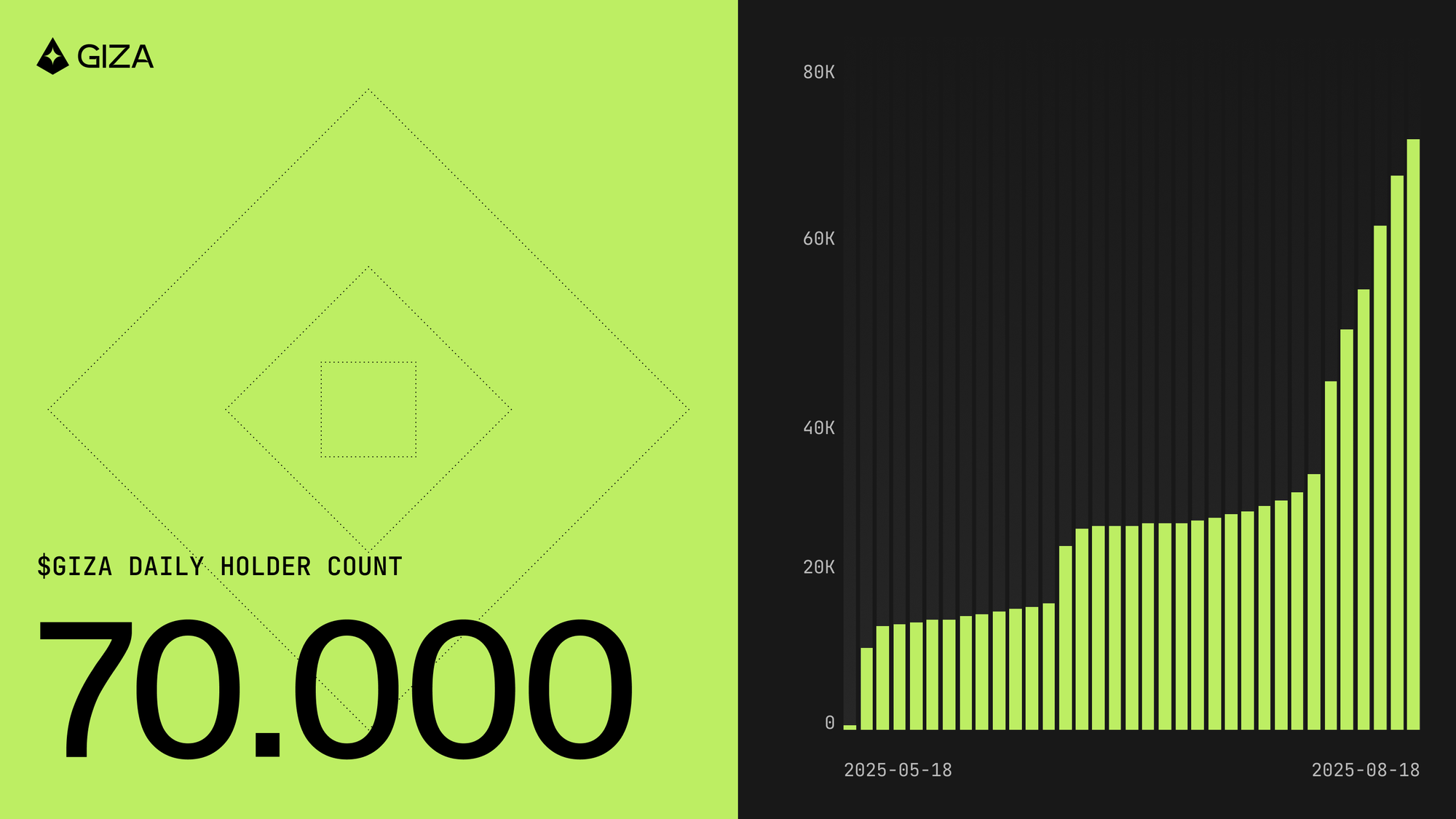

The ARMA agent is the first success story in the Giza ecosystem. Having launched in February 2025 on Base it has attained significant traction, at the time of writing boasting a TVL of over $16M with over $1.3B in agentic volume. A key driver for this traction is their very competitive advertised 15% APY. Usage numbers are also striking by DeFi standards with ~60,000 unique holders and 36,000+ deployed agents.

ARMA employs a multi-layered optimisation system that continuously monitors lending rates across integrated protocols currently spanning: Seamless, Morpho, Moonwell, Compound, AAVE, Fluid and Euler. ARMA is able to track the complete reward stack including protocol incentives, token distributions, and ecosystem rewards. The agent performs real-time standardisation of rates, accounting for supply and demand dynamics across different protocols to enable optimal positioning decisions. Risk management includes allocating solely to battletested blue chip protocols with complete transparency over the flow of funds.

ARMA’s cost benefit analysis includes the precise yield differential and factors in all transaction costs including gas fees and swap costs. Furthermore it analyses market depth to predict potential rate impacts from larger movements, and determines individual risk-adjusted returns for each potential position. Backtesting data shows ARMA achieving up to 2x yield enhancement compared to static positions.

The auto-compounding mechanism of ARMA further demonstrates the power of continuous optimisation. The agent automatically claims and reinvests accrued yields, converting reward tokens back to users' original stablecoins with compounding frequency dynamically optimised based on position size, current APR, and transaction costs. This ensures maximum efficiency while minimising unnecessary operations — a level of precision impossible for manual management.

Giza never has access to users' private keys or funds while enabling sophisticated automated operations. Each smart account is automatically created during activation and remains under complete user control, with session keys providing time-bound, protocol-specific permissions that can be revoked instantly.

Note:

The advertised 15% APR on ARMA is guaranteed by compensating wallets with $GIZA tokens if performance falls below the target. Users can choose direct wallet transfers or automatic staking.

ARMA Institutional Adoption

While ARMA focuses on retail users, Giza's infrastructure is designed to accommodate institutional requirements from day one. The protocol's authorisation layer supports complex permission structures that can meet institutional risk management and compliance needs. Multi-signature requirements, role-based access controls, and audit trails provide the governance frameworks that institutional capital demands.

Giza’s infrastructure enables institutions to deploy specialised agents tailored to their specific investment mandates. For example, a pension fund might deploy agents focused on yield generation within strict risk parameters.

Institutional adoption of ARMA has already begun. Re7 Labs, a DeFi-centric investment firm, initiated a pilot allocation to Giza’s ARMA Agent to explore infrastructure efficiencies, without having to develop an internal bespoke solution. Giza is additionally developing a dedicated Agent suite for Re7’s broader ecosystem. This would include strategically sweeping liquidity across vaults only when the optimiser’s signal clearly surpasses the transaction-cost hurdle. The smart-account template, monitoring stack, and session-key framework are being designed with reuse in mind. This would allow each subsequent Agent to require significantly less engineering effort than the last. Back-tests conducted over the past four months, based on historical market conditions, indicate that the tailored Agents delivered up to 67% higher yield on stables and 18.5% higher yield on ETH compared to static allocation strategies.

Authors Perspective

Giza Protocol has significant implications for the future of how humans interact with financial markets. This will most prominently affect the retail user experience (UX) of financial management. No longer will complex strategies be out of reach or gated by an exuberant management fee for the majority of participants. Outsourcing financial intelligence fundamentally changes the constraints on capital allocation. The bottleneck is no longer human cognitive capacity, but rather the market’s own depth and liquidity. For the majority of people finance is not the main focus of their day to day thinking. However as such an important category of activities in our society, this causes undue hardship for many, due to lack of effective financial planning. Giza alleviates this deep rooted problem while playing a productive role of capital allocation where through achieving the best risk adjusted returns, it allows capital to be used most efficiently. This is the future of the integration of AI with finance. Other AI implementations work on providing better information to make informed decisions, but why improve the advisory function of finance when you can replace it wholly.

Markets will never be the same. Money managers play a vital role in society: in their pursuit of profit, they exploit and correct market inefficiencies. This process of arbitrage leads to fairer and more accurate pricing of assets and obligations. Essentially our world has become one large capital allocator where capital flows where it can achieve the most amount of problems solved, measured in revenue. This however is limited by the mental throughput of human actors in the system. The decision makers and capital allocaters only have 24h in each day, and in order to maintain their output, have to also rest and spend time in leisure. Agents powered by machine learning do not have this limitation and can, as is shown by the Giza implementation, monitor markets 24/7 and allocate capital to a high degree of effectiveness. Markets throughout human history have been the force that pushed us as a species, from the Greek agora which facilitated trade in olive oil and leather goods, to now global bond markets correctly pricing the risk of companies’ defaults in order to finance economic activity. Autonomous allocation is the next step in this ladder of progress, which will allow for capital to flow to where it is needed the most and achieve the highest impact - return. Welcome to the new generation of markets, welcome to Autonomous Financial Intelligence.

Technical Architecture

Giza has built a sophisticated technical stack to democratise financial intelligence for its users. This is built on the core premise that financial agents must remain non custodial with decentralised execution while maintaining cryptoeconomic security through EigenLayer's AVS framework.

Semantic Abstraction Layer

Blockchain data is communicated through bytecode and transactions while machine learning algorithm decision making is done through semantic meaning. To bridge this gap Giza's Semantic Abstraction Layer implements the Model Context Protocol (MCP) specification to create standardised, semantically rich interfaces to enable agents to interact with DeFi protocols through natural financial concepts.

MCP Server Implementation: This exposes the machine learning algorithm to protocol services through two constructs, these being resources (protocol states, market conditions, historical data) and tools (protocol operations with semantic descriptions).

Protocol Abstraction: The middle layer implements protocol specific adapters that standardise interaction patterns across DeFi protocols, with operation mapping transforming protocol specific UI into standardised operations. State transformation converts raw protocol states into contextually rich data formats with safety constraints implementing boundary conditions adapting to utilisation rates and volatility metrics.

Operation Execution Flow:

- Request Processing: AI systems submit requests through the MCP server, which validates them against service definitions and transforms them into protocol-compatible formats

- Protocol Interaction: Verified operations are executed through the Decentralized Execution Layer with appropriate protocol adapters. This involves service invocation, transactions execution, task execution validation, and session key permissions verification

- Result Transformation: Execution results are converted back into semantically rich formats for AI interpretation

Decentralized Execution Layer

The execution layer is a way for the protocol to coordinate actions with cryptoeconomic security. The architecture leverages the Othentic stack to implement EigenLayer's AVS framework. Restaked $GIZA tokens on the AVS act as a sort of insurance layer for the performance of the agent. This is what cryptoeconomic trust minimisation entails, when you can trust information, because if it is wrong then restakers will get slashed and you will be made whole in accordance with the amount that you lost.

Core Architecture: The network consists of 4 node types, these include: the Entrypoint Nodes which coordinate task distribution and leader election, Performer Nodes which invoke registered services (action specific actions) and submit operations on-chain, Attester Nodes which validate execution through verification and finally Aggregator Nodes which establish consensus using BLS signature aggregation. This is all part of an effort to build natural security boundaries.

Security and Economics: Network operators must stake GIZA tokens as collateral to participate in validation, creating tangible costs for attacks. The system implements slashing conditions for misconduct while distributing protocol fees to reliable operators, creating an economic flywheel where increased usage rewards infrastructure maintainers.

Execution Flow

- Tasks enter through protected load balancers that prevent attack vectors.

- Leader election determines responsible execution nodes.

- Execution services invoke appropriate protocol services.

- Attesters validate results against protocol requirements.

- Aggregators establish consensus from multiple validations.

- Final results receive on-chain verification through the Attestation Center.

Agent Authorization Layer

At Giza foundation there lies an authorisation system built on smart account infrastructure. This enables wallets to be programmed with specific rules about what actions are allowed, while maintaining the non-custodial nature of traditional wallets. The implementation uses ERC-7579 compatible smart contract wallets with support for modular extensions. Users maintain complete control of the wallet while granting agents specific operational authority through session keys. For example a typical session key for ARMA would allow 30-day permission for stablecoin swaps on specific protocols with maximum transaction sizes.

Giza Agents

Agents are autonomous entities that interact with protocols and execute complex sequences of actions for users. They are able to enact multi-step strategies all while continuously monitoring protocol conditions with minimal oversight while providing auditable cryptographic proofs of their actions.

Agent Architecture: The architecture facilitates trust-minimised delegation by the protocol to agents through three processes: Agent Logic (core decision-making), Verification (integrity through zero-knowledge proofs), and On-Chain Execution (fund management and verified action execution). This powers key capabilities: autonomy, agency through session keys, verifiability through zero-knowledge proofs, intelligence through complex off-chain logic, personalisation, composability, and interoperability across chains.

The Agent Core implements multi-stage decision process through three phases:

- Data Aggregation: Information is continually sourced from on-chain data, protocol states, and market conditions, undergoing preliminary processing to normalise formats and filter noise, ensuring decisions based on clean, reliable information

- Strategic Evaluation: The Agent Core combines traditional financial algorithms with artificial intelligence to identify opportunities aligning with user objectives. The APR forecasting system exemplifies this approach, analysing historical data and market conditions to predict seven-day yield opportunities. The decision-making process considers potential returns, risks, transaction costs, and user positions, weighing factors based on preferences while learning from outcomes

- Action Planning: High-level strategic decisions translate into concrete action plans specifying exact transaction parameters, including optimal timing, size, and routing. Safety checks verify that planned actions comply with user-defined constraints and risk parameters

Specialised Modules:

Protocol Integration Module: serves as the interface to DeFi protocols through the Semantic Abstraction Layer, with protocol-specific adapters incorporating deep protocol knowledge.

Risk Management Module: Implements protection layers through comprehensive risk-scoring systems considering smart contract security, governance risks, and reliability, plus market risk analysis evaluating liquidity risk and volatility.

Accounting Module: Maintains detailed position representations across chains and protocols through double-entry bookkeeping designed for onchain operations, tracking positions and implementing performance attribution analysis.

These components create a sophisticated operational flow through four stages:

- Continuous Monitoring: The Protocol Integration module tracks on-chain opportunities, the Risk Management module maintains updated risk assessments, and the Accounting module provides real-time position data while the Agent Core processes this information stream to identify potential actions.

- Multi-Stage Evaluation: When opportunities are identified, the Agent Core develops preliminary action plans, which the Risk Management module validates against current risk parameters and market conditions, while the Accounting module verifies compliance with position limits and portfolio constraints.

- Execution Phase: The Protocol Integration module constructs necessary transactions, optimising parameters like gas prices and slippage tolerances, executing them through smart accounts, using appropriate session keys, while all components maintain active monitoring for unexpected conditions.

- Continuous Feedback Loop: After execution, the Accounting module updates all positions and performance metrics, feeding this updated state back into the monitoring process to create a continuous cycle that maintains optimal portfolio positioning while respecting user constraints.