What Stablecoin Users Should Know: Yield, Issuers, and the Legal Line in GENIUS vs MICA

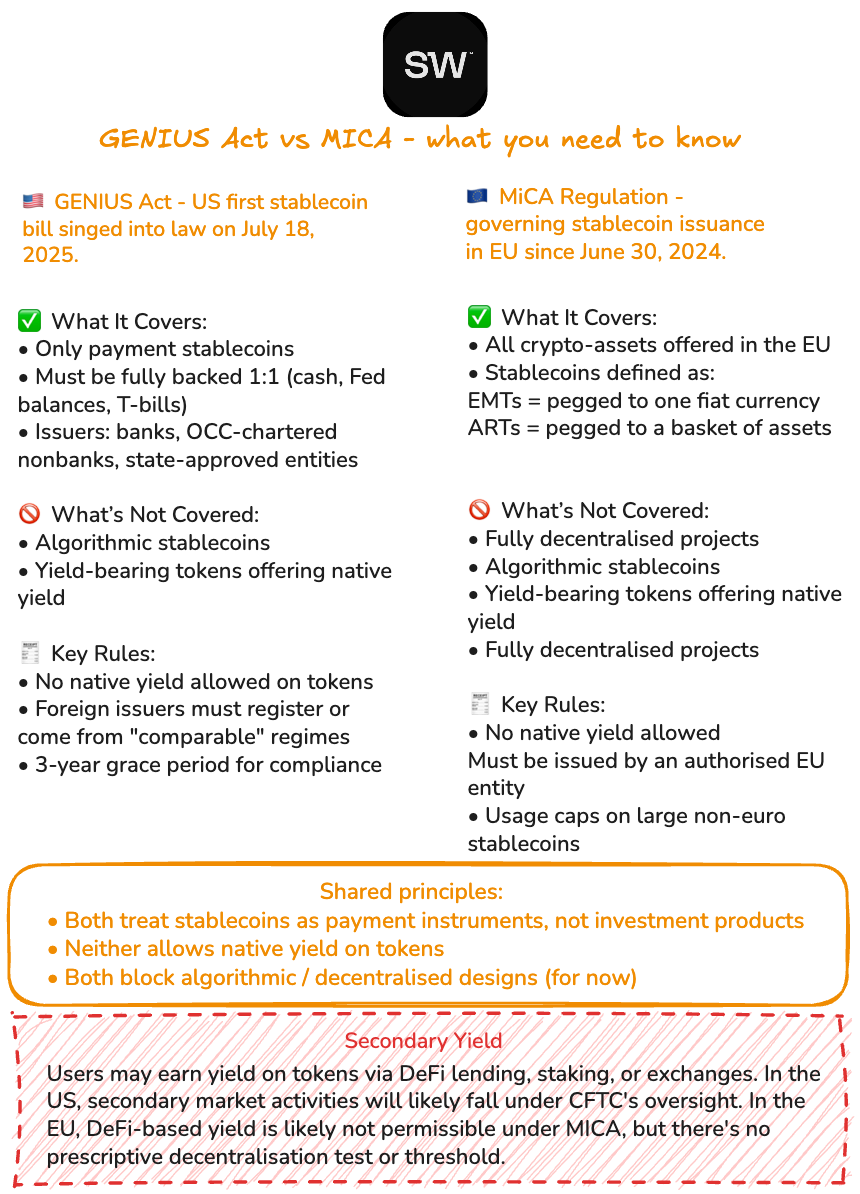

The GENIUS Act (US first stablecoin bill) was signed into law on Friday, July 18. The Act establishes the first US federal framework for payment stablecoins (read more about the Act in our blog post here). In parallel, the Congress has advanced the Crypto CLARITY Act, a broad-encompassing market structure legislation clarifying the regulatory borders of what constitutes a security, commodity, digital collectible etc, now awaiting voting in the Senate. Meanwhile, across the Atlantic, MiCA regulation takes the realm over the stablecoins market in the EU, with its stablecoin provisions (Titles III and IV) fully in force since June 30, 2024.

Scope

Both the US and EU currently sideline algorithmic and decentralised stablecoins, with focal points of regulators being payments stablecoins.

- GENIUS encompasses and permits solely the fully-backed stablecoins issued by licensed banks, OCC-approved charters, or state-approved qualifying entities, with reserves held 1:1 in cash, Fed balances, or short-term Treasuries. GENIUS establishes that payment stablecoins are neither treated as securities nor commodities, instead placing them under a new prudential regulatory regime.

- MiCA is broader in scope, covering “all” crypto-assets offered in the EU. It defines two stablecoin categories: e-money tokens (EMTs), which are tokens referencing a single fiat currency, and asset-referenced tokens (ARTs), which reference multiple currencies or other assets, often referred to as peg to a basket of assets. Any entity wishing to issue a stablecoin in the EU must seek authorisation from a national regulator (with the European Banking Authority supervising significant stablecoins). MiCA’s definitions similarly carve out crypto-assets that qualify as financial instruments under MiFID II and effectively create a unified EU licensing regime for stablecoin issuers.

Yield-Bearing Stablecoins and Interest Payment

A key regulatory convergence is the treatment of stablecoins that pay interest to the holders by both EU and US regulators.

- GENIUS Act prohibits any payment of interest, dividends, or yield to stablecoin holders solely on the virtue of holding the coin (read more on the yield ban in GENIUS in our blog post here). Permitted issuers cannot offer interest on the stablecoin balance, effectively preventing stablecoins from functioning like bank deposits or investment products. Regulators concerned that yield-bearing stablecoins resembled banking and posed risks, and so that concern took the shape of prohibition of yield-bearing stablecoins in GENIUS.

- MiCA similarly bans native interest on stablecoins. Art. 45 MiCA explicitly states that no issuer of e-money tokens (or related service provider) shall grant “interest or any other benefit” tied to the length of time a holder keeps the token. This prohibition, grounded in EU e-money principles, ensures that stablecoins do not mimic bank deposits. Like in the US, the regulator reinforces here that stablecoins are payment instruments and not investment vehicles.

Important to note here is that both GENIUS and MiCA ban natively offering yield on the token itself. Interest earned through DeFi lending or staking is seen as a separate service. In the US, this means a stablecoin issuer (such as Circle for USDC) cannot directly pay interest on the coin, yet users may still earn yield via exchange reward programs or DeFi lending. Under the proposed CLARITY Act such secondary-market yield activity would likely fall under CFTC purview. As for the EU, fully decentralised or algorithmic stablecoins (with no centralised issuer and no fiat reserves) have no legal place under MiCA’s, as stated in Recital 41. EU regulators took a hard line after past failures like TerraUSD, opting to exclude these token designs entirely. This contrast in handling stablecoin yield naturally leads into the question of definition of decentralisation.

Approach to Decentralisation in Stablecoin Models

- GENIUS Act currently covers only centrally issued, fully reserved stablecoins. It excludes “endogenously collateralized” (algorithmic or crypto-backed) stablecoins from its regulatory regime, at least initially. Instead of attempting to fit decentralised stablecoins into the framework, GENIUS has mandated a Treasury-led study on such stablecoins within one year from enactment of GENIUS.

- MiCA recital 22 states clearly that any crypto-asset service provided “in a fully decentralised manner without any intermediary” lies outside MiCA’s scope. However, MiCA provides no clear test for what qualifies as “fully decentralised,” creating ambiguity around which projects actually fall outside its scope. As a result, the regulatory status of DeFi-based lending of stablecoins remains uncertain, but in practice such activities remain largely unregulated under MiCA for now, provided no identifiable intermediary is involved.

Extraterritoriality and Reciprocity

- The GENIUS Act applies to all payment stablecoins offered in the US, including those issued by foreign entities. To access US users, foreign issuers must either register with the OCC or come from a country with a regulatory regime deemed comparable by the US Treasury. After a three-year transition, unlicensed stablecoins will be banned from US platforms.

- MiCA already requires any stablecoin offered to the EU public or listed on EU exchanges to be issued by an authorised EU entity. In practice, this means foreign issuers must obtain an EMT or ART licence. Without authorisation, stablecoins risk being delisted from EU exchanges. Several exchanges have fairly quickly taken action and delisted, for example USDT due to Tether’s non-compliance with MiCA rules. MiCA also places limits on the use of large non-euro stablecoins to protect the euro, reinforcing that access to the EU market comes with strict regulatory conditions.

For regulators both in the US and EU, the north star was to position stablecoins an everyday payment tool rather than an investment entailing risk. For user, this means that stablecoins in your wallet should be fully backed by real assets and regulated, giving you more confidence that your digital dollar or euro will hold its value. But it also means you won’t earn interest just by holding a token, so any yield will have to come from separate DeFi products or exchange arrangements, likely entailing customer exposure to higher leverage and higher smart contract risks.